Sasol (SOL): A Deep Dive Into The 2023 Strategy Update For Investors

Table of Contents

Revised Strategic Priorities and Operational Efficiency

Sasol's 2023 strategy update emphasizes a renewed commitment to operational efficiency and cost reduction as key strategic priorities for Sasol. This involves a multi-pronged approach aimed at streamlining processes, optimizing production, and improving overall profitability. The success of this strategy is vital for the long-term health of Sasol stock.

-

Specific Cost-Cutting Measures: Sasol has implemented various cost-cutting measures, including streamlining administrative processes, negotiating better deals with suppliers, and optimizing energy consumption across its operations. These initiatives aim to significantly reduce operating expenses and boost Sasol's profit margins.

-

Efficiency Improvements in Production Processes: The company is focusing on improving the efficiency of its production processes through technological upgrades, process optimization, and improved asset utilization. This includes leveraging data analytics to identify bottlenecks and areas for improvement. These improvements directly impact Sasol's operational efficiency.

-

Restructuring Initiatives: Sasol's restructuring initiatives involve streamlining organizational structures, consolidating operations where possible, and divesting from non-core assets. These actions aim to reduce operational complexity and enhance efficiency. The impact of these restructuring efforts on Sasol's overall performance will be closely monitored by investors.

-

Progress Towards Efficiency Goals: Sasol has set ambitious targets for improving its operational efficiency. Tracking its progress towards achieving these goals will be crucial for assessing the success of its 2023 strategy. Regular monitoring of key performance indicators (KPIs) related to cost reduction and productivity will be essential for evaluating the long-term impact on Sasol stock.

Financial Performance and Outlook: Analyzing Sasol's 2023 Projections

Sasol's 2023 financial performance and outlook are critical factors for investors considering a Sasol investment. The company's recent update provides insights into its financial health and growth prospects. Analyzing Sasol's revenue growth, profit margins, and earnings per share (EPS) is key to understanding its financial trajectory.

-

Key Financial Metrics: Investors should closely examine Sasol's key financial metrics, including revenue, gross profit, operating income, net income, and earnings per share (EPS). Comparing these metrics to previous years' performance will reveal trends and highlight areas of strength and weakness.

-

Comparison to Industry Benchmarks: A comparative analysis against industry benchmarks is crucial. This helps to understand Sasol's financial performance relative to its competitors. This comparison provides valuable context for evaluating Sasol's financial outlook.

-

Reliability and Risks Associated with Projections: It is vital to critically evaluate the reliability of Sasol's financial projections. Understanding the assumptions underlying these projections and identifying potential risks is crucial for investors. Factors such as commodity price volatility and geopolitical events can significantly impact the accuracy of these projections.

-

Dividend Payouts and Future Expectations: Dividend payouts are a key consideration for many investors. Sasol's dividend policy and future dividend expectations should be analyzed carefully as part of any investment decision. The sustainability of Sasol's dividend policy is a critical factor for investors seeking income.

Addressing Environmental, Social, and Governance (ESG) Concerns

Sasol's commitment to Environmental, Social, and Governance (ESG) factors is increasingly important for investors. The company's approach to sustainability, carbon emissions reduction, and social responsibility directly impacts its long-term value and its appeal to environmentally conscious investors. A thorough understanding of Sasol's ESG performance is crucial for evaluating its Sasol investment potential.

-

Carbon Footprint Reduction: Sasol's efforts to reduce its carbon footprint are a key aspect of its ESG performance. Investors need to assess the effectiveness of these efforts and evaluate the company's progress toward achieving its stated sustainability goals. The transition to a lower-carbon economy is a significant challenge and opportunity for Sasol.

-

Sustainability Goals and Progress: Regular monitoring of Sasol's progress toward its sustainability goals is essential. This includes evaluating the company's performance against key sustainability indicators. Transparency and accountability regarding Sasol's ESG performance are critical for attracting responsible investments.

-

Impact of ESG Factors on Profitability: The long-term impact of ESG factors on Sasol's profitability should be considered. Meeting ESG expectations can lead to long-term cost savings and increased brand reputation, but it may also involve short-term investments.

-

Investor Sentiment Regarding ESG Performance: Understanding investor sentiment concerning Sasol's ESG performance is important. This will impact the overall perception of Sasol stock within the investment community.

Risks and Opportunities for Sasol (SOL) Investors

Investing in Sasol (SOL) stock presents both risks and opportunities. A thorough risk assessment is crucial before making any investment decisions. This section examines the factors that could positively or negatively affect Sasol's future performance and its attractiveness as an investment.

-

Key Risks Facing Sasol: Several key risks could impact Sasol's performance, including commodity price fluctuations, geopolitical uncertainty, regulatory changes, and operational disruptions. Careful consideration of these risks is vital.

-

Growth Potential in Energy and Chemicals: Sasol operates in dynamic energy and chemicals sectors. Analyzing the company's growth potential within these sectors is essential for understanding its future prospects. Opportunities for growth may exist in specific markets or product segments.

-

Impact of Geopolitical Events: Geopolitical events can significantly impact Sasol's operations and financial performance. It is crucial to consider the potential impact of these events. Global events influence commodity prices, supply chains, and overall market stability.

-

Sasol Compared to Competitors: Comparing Sasol's performance and prospects to its competitors is essential for assessing its relative attractiveness as an investment. This comparison helps to understand Sasol's competitive positioning within the industry.

Conclusion

Sasol's 2023 strategy update provides investors with a clearer picture of the company's future direction. While challenges remain, particularly regarding ESG concerns and market volatility, the company's focus on operational efficiency and cost reduction presents potential for future growth and profitability. Investors should carefully consider the information presented before making any investment decisions.

Call to Action: Ready to delve deeper into the implications of Sasol's (SOL) 2023 strategy update for your investment portfolio? Conduct thorough research and consult with a financial advisor before making any decisions regarding Sasol stock. Learn more about Sasol (SOL) and its evolving strategy by visiting the company's investor relations website.

Featured Posts

-

Gospodin Savrsen Vanja I Sime Nove Fotografije I Reakcije Obozavatelja

May 21, 2025

Gospodin Savrsen Vanja I Sime Nove Fotografije I Reakcije Obozavatelja

May 21, 2025 -

Uk Luxury Brands Navigating Brexits Challenges In The Eu Market

May 21, 2025

Uk Luxury Brands Navigating Brexits Challenges In The Eu Market

May 21, 2025 -

Arda Gueler Ve Real Madrid In Yeni Teknik Direktoerue Bir Baglanti Var Mi

May 21, 2025

Arda Gueler Ve Real Madrid In Yeni Teknik Direktoerue Bir Baglanti Var Mi

May 21, 2025 -

How Michael Strahan Secured A Key Interview During A Ratings Battle

May 21, 2025

How Michael Strahan Secured A Key Interview During A Ratings Battle

May 21, 2025 -

Announced Dexter Original Sin Steelbook Blu Ray Prepare For Dexter New Blood

May 21, 2025

Announced Dexter Original Sin Steelbook Blu Ray Prepare For Dexter New Blood

May 21, 2025

Latest Posts

-

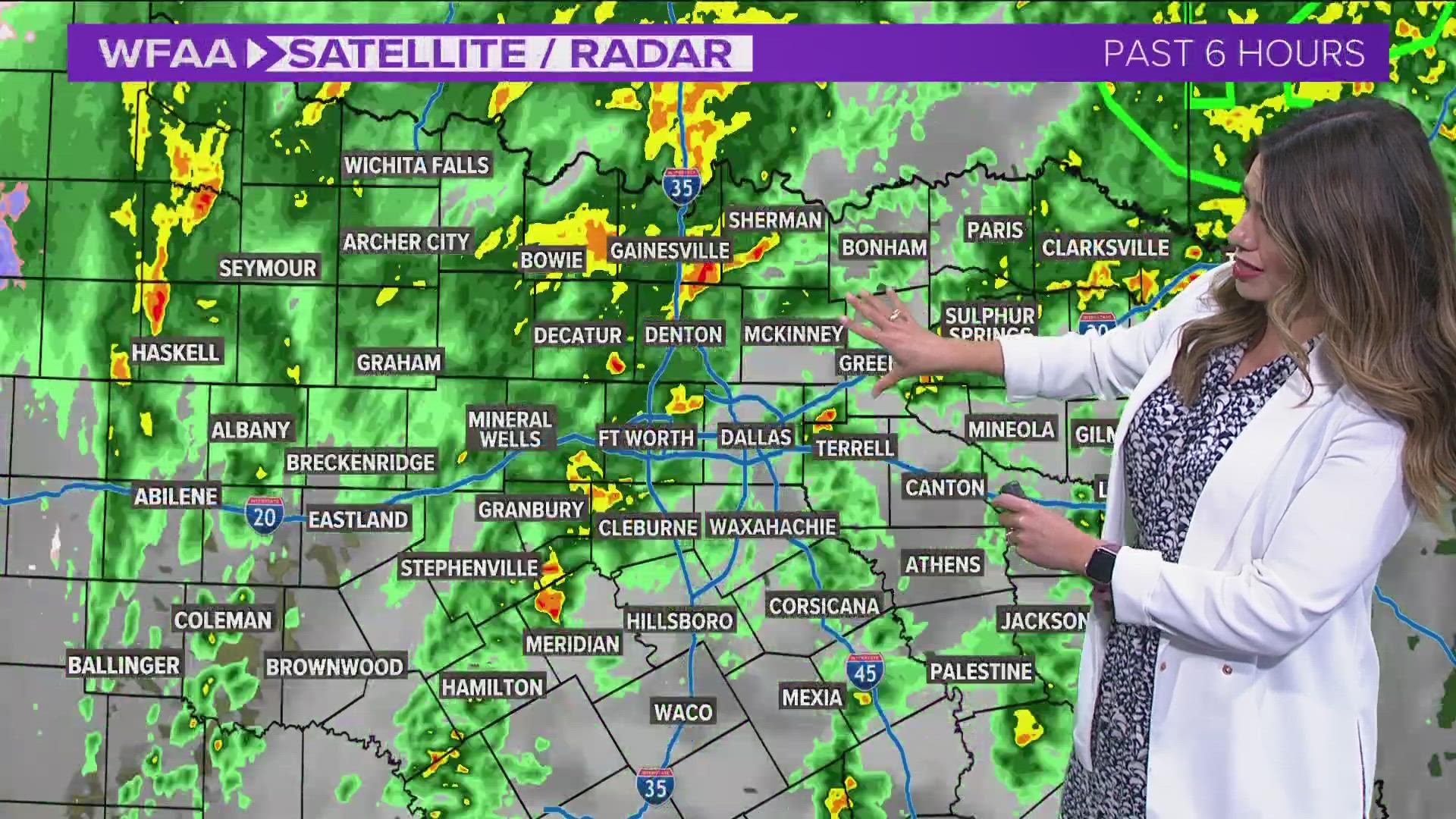

When Will It Rain Precise Timing And Chances Of Precipitation

May 21, 2025

When Will It Rain Precise Timing And Chances Of Precipitation

May 21, 2025 -

Checking For Rain Get The Latest Timing And Forecast Updates

May 21, 2025

Checking For Rain Get The Latest Timing And Forecast Updates

May 21, 2025 -

Current Rain Predictions Accurate Timing Of On And Off Showers

May 21, 2025

Current Rain Predictions Accurate Timing Of On And Off Showers

May 21, 2025 -

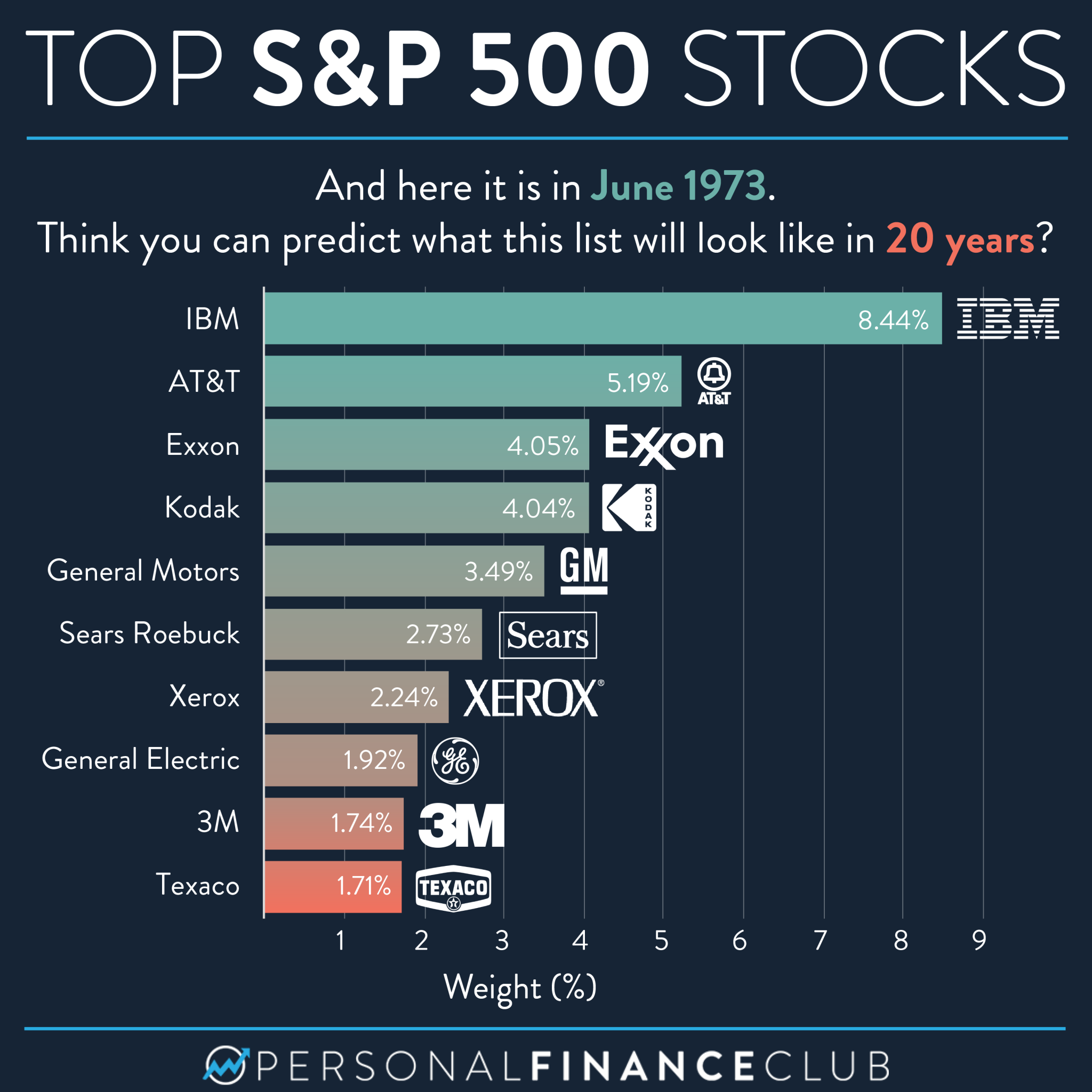

Reddits 12 Hottest Ai Stocks Should You Invest

May 21, 2025

Reddits 12 Hottest Ai Stocks Should You Invest

May 21, 2025 -

Big Bear Ai Stock Risks And Rewards For Investors

May 21, 2025

Big Bear Ai Stock Risks And Rewards For Investors

May 21, 2025