Sasol (SOL) Investor Concerns Highlighted In First Strategy Update Since 2021

Table of Contents

Debt Burden and Financial Health of Sasol (SOL)

Sasol's significant debt levels remain a primary concern for investors. The company's financial health is intrinsically linked to its ability to manage and reduce this debt burden, particularly in the face of fluctuating commodity prices. The strategy update offered a glimpse into Sasol's debt reduction strategy, outlining a timeline for achieving financial stability. However, the feasibility of this plan remains a subject of debate among analysts.

- Current debt-to-equity ratio: [Insert current debt-to-equity ratio from Sasol's financial reports – needs factual data]. A high ratio indicates a higher level of financial risk.

- Projected debt reduction timeline: [Insert details from the strategy update regarding the projected timeline for debt reduction – needs factual data]. The success of this timeline hinges on several factors, including commodity price stability and operational efficiency improvements.

- Impact of fluctuating commodity prices on debt servicing: Fluctuations in oil, gas, and chemical prices directly impact Sasol's revenue and its ability to service its debt. Periods of low commodity prices can strain the company's finances.

- Credit rating agency outlook: [Insert current credit rating and outlook from reputable agencies like Moody's or S&P – needs factual data]. Any downgrades in credit rating could increase borrowing costs and further complicate debt reduction efforts.

The ability of Sasol to successfully navigate its debt situation will be crucial for regaining investor confidence and ensuring long-term financial stability. The success of their debt reduction strategy will be a key factor in the future performance of SOL.

Operational Efficiency and Cost Reduction Initiatives

Another key area of investor concern is Sasol's operational efficiency and its ability to implement effective cost-reduction measures. The strategy update highlighted several initiatives aimed at improving operational performance and reducing production costs. However, the effectiveness of these initiatives and their impact on profitability remain to be seen.

- Key performance indicators (KPIs) related to operational efficiency: [Insert relevant KPIs from the strategy update, such as production output, operating costs, and asset utilization – needs factual data]. Monitoring these KPIs will be vital in assessing the success of Sasol's operational improvements.

- Specific cost-reduction initiatives implemented: [Detail specific cost-cutting measures outlined in the strategy update – needs factual data. Examples could include streamlining processes, optimizing energy consumption, or workforce adjustments.]

- Impact of these initiatives on production costs and profitability: The successful implementation of cost-reduction measures should lead to lower production costs and improved profitability. However, the extent of these improvements remains uncertain.

- Potential challenges in achieving cost reductions: Challenges might include unforeseen operational disruptions, resistance to change, or difficulties in achieving synergies across different business units.

The success of Sasol's cost reduction and operational efficiency initiatives will directly influence its profitability and its ability to service its debt obligations, ultimately impacting investor sentiment.

Future Growth Prospects and Strategic Direction

Sasol's strategy update also addressed its future growth prospects and strategic direction. Investors are keenly interested in the company's plans for expansion and diversification, as well as the associated risks and opportunities.

- Key strategic initiatives outlined in the strategy update: [Summarize the key strategic initiatives mentioned in the update, such as investments in new technologies, expansion into new markets, or diversification into new product lines – needs factual data].

- Projected growth in key markets: [Detail any projected growth figures for key markets – needs factual data]. Realistic projections are essential to assess the potential for future returns.

- Potential risks associated with the strategic direction: These risks could include competition, regulatory changes, geopolitical instability, or unforeseen technological challenges.

- Opportunities for growth and innovation: Exploring new technologies, expanding into higher-growth markets, and developing innovative products can create significant growth opportunities for Sasol.

The long-term success of Sasol hinges on its ability to execute its strategic plan effectively and capitalize on emerging opportunities while mitigating potential risks. This is vital for attracting and retaining investor confidence.

Investor Sentiment and Stock Performance

The market's reaction to Sasol's strategy update has been mixed, with the stock price showing [Insert information about stock price movement after the update – needs factual data]. Investor sentiment reflects a combination of concerns about debt levels, operational challenges, and uncertainty about the company's future growth prospects.

- Stock price movement following the strategy update: [Provide details on the stock price movement – needs factual data].

- Analyst ratings and price targets: [Summarize analyst ratings and price targets following the update – needs factual data]. These provide insights into market expectations.

- Investor concerns reflected in market activity: [Discuss how investor concerns are manifested in trading volumes, volatility, and investor behavior – needs factual data].

- Potential catalysts for future stock price movement: Positive catalysts could include successful debt reduction, improved operational efficiency, or exceeding growth projections. Negative catalysts could include further downgrades in credit ratings or unexpected operational disruptions.

Careful monitoring of investor sentiment and stock performance is essential for understanding the market's perception of Sasol and its strategic direction.

Conclusion

Sasol's (SOL) strategy update has shed light on several key investor concerns, including its high debt levels, the need for improved operational efficiency, and the importance of its future growth strategy. While the company has outlined plans to address these issues, the success of these plans remains to be seen. The market's reaction has been mixed, reflecting the inherent uncertainties associated with Sasol's transformation. To make informed investment decisions, it is crucial to stay updated on Sasol (SOL) developments and thoroughly analyze the information provided in the strategy update and subsequent financial reports. Learn more about Sasol's investor relations on their website [Insert link to Sasol's investor relations website]. Stay informed on Sasol (SOL) to make sound investment choices.

Featured Posts

-

Grocery Bargains 2000 Found And Doge Poll This Week In Gbr

May 21, 2025

Grocery Bargains 2000 Found And Doge Poll This Week In Gbr

May 21, 2025 -

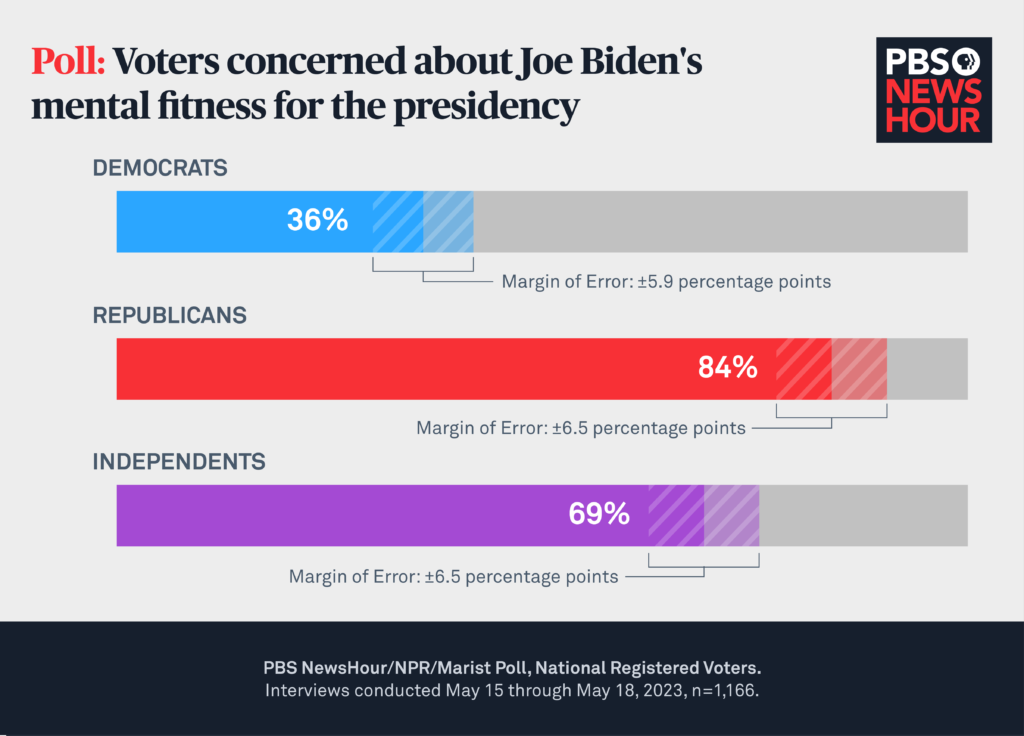

Hunter Biden Recordings Assessing Joe Bidens Mental Fitness

May 21, 2025

Hunter Biden Recordings Assessing Joe Bidens Mental Fitness

May 21, 2025 -

Gross Law Firm Representing Big Bear Ai Bbai Investors Deadline June 10 2025

May 21, 2025

Gross Law Firm Representing Big Bear Ai Bbai Investors Deadline June 10 2025

May 21, 2025 -

Effectief Verkoop Van Abn Amro Kamerbrief Certificaten Uw Handleiding

May 21, 2025

Effectief Verkoop Van Abn Amro Kamerbrief Certificaten Uw Handleiding

May 21, 2025 -

Space Based Supercomputing Chinas Technological Leap Forward

May 21, 2025

Space Based Supercomputing Chinas Technological Leap Forward

May 21, 2025

Latest Posts

-

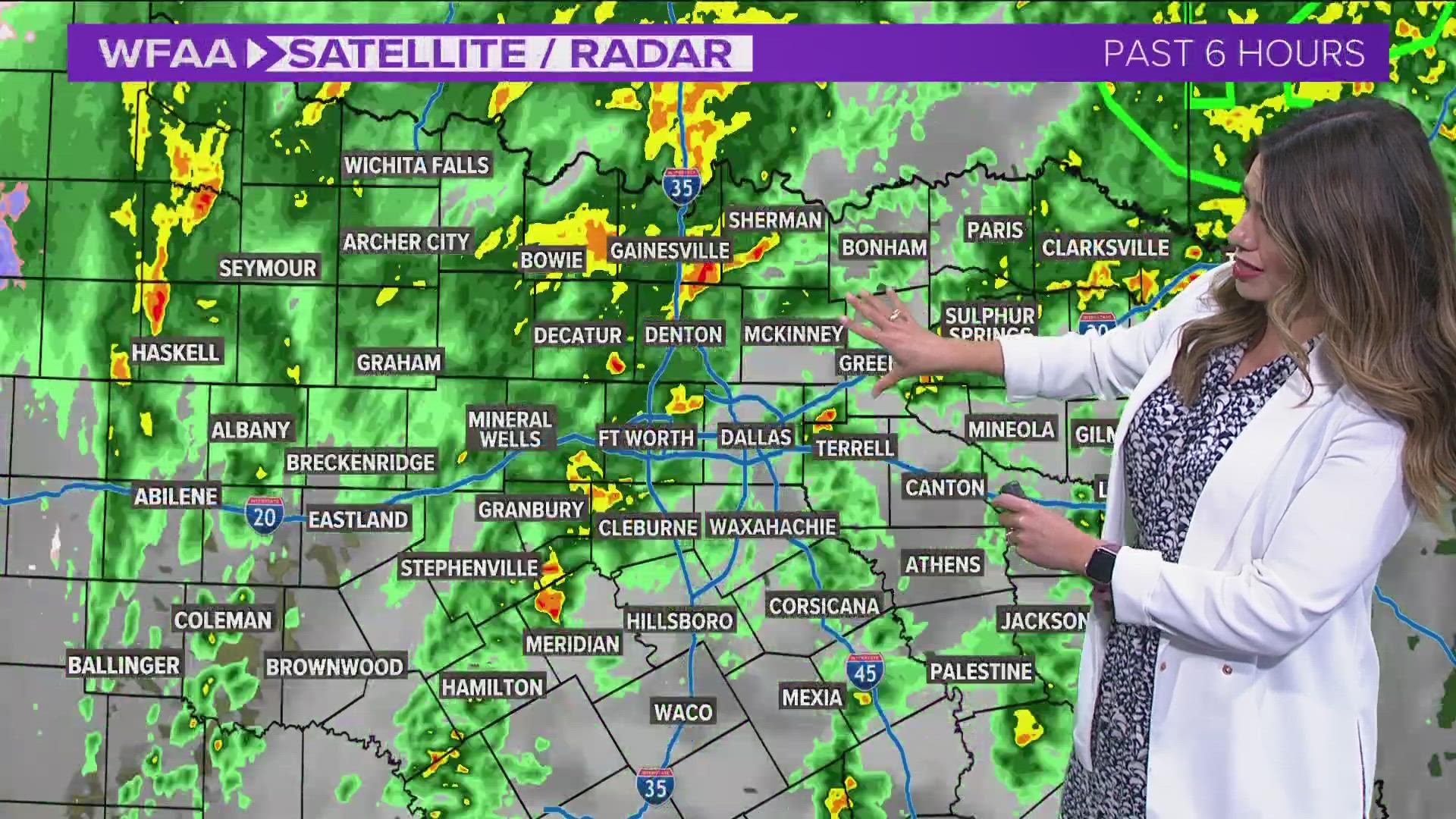

When Will It Rain Precise Timing And Chances Of Precipitation

May 21, 2025

When Will It Rain Precise Timing And Chances Of Precipitation

May 21, 2025 -

Checking For Rain Get The Latest Timing And Forecast Updates

May 21, 2025

Checking For Rain Get The Latest Timing And Forecast Updates

May 21, 2025 -

Current Rain Predictions Accurate Timing Of On And Off Showers

May 21, 2025

Current Rain Predictions Accurate Timing Of On And Off Showers

May 21, 2025 -

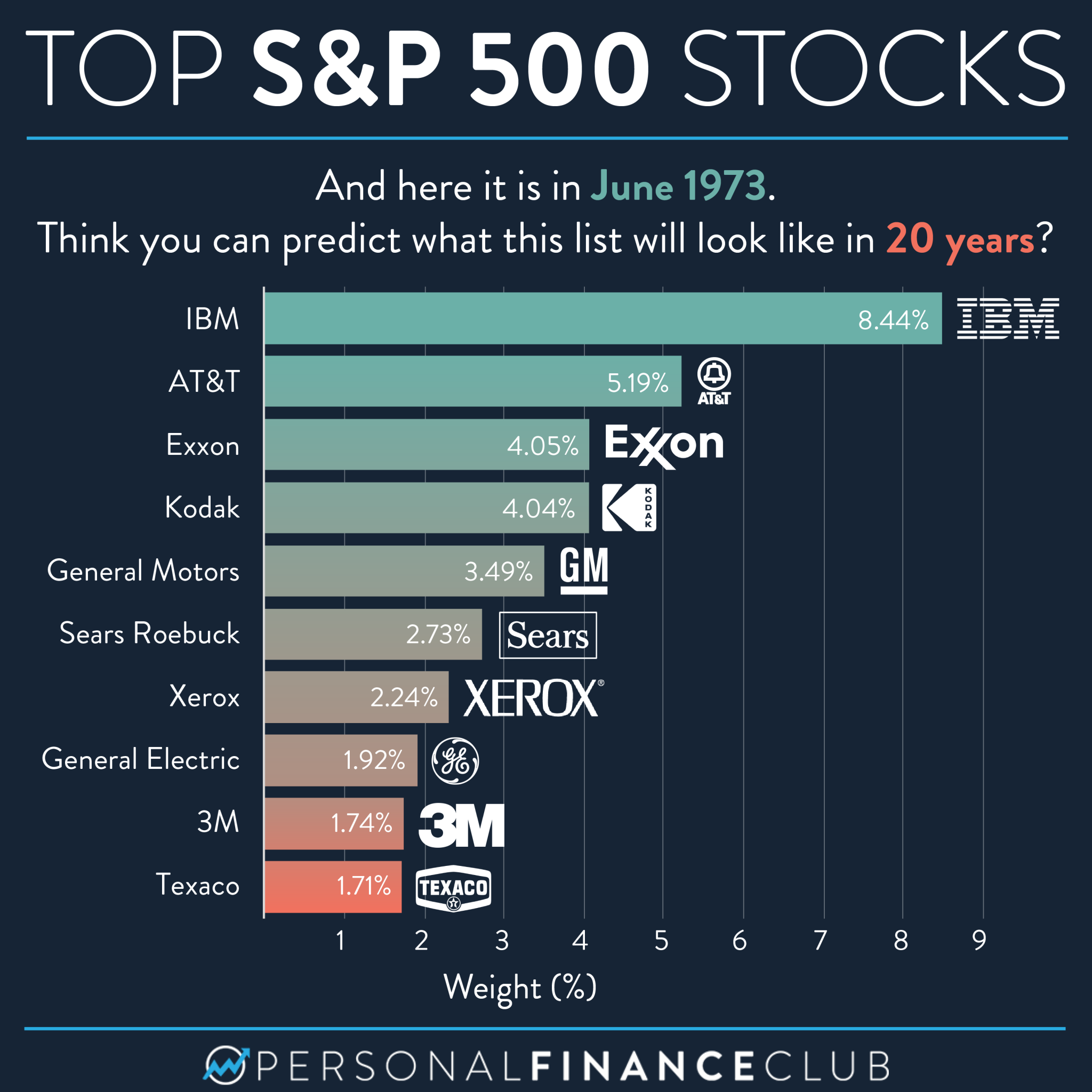

Reddits 12 Hottest Ai Stocks Should You Invest

May 21, 2025

Reddits 12 Hottest Ai Stocks Should You Invest

May 21, 2025 -

Big Bear Ai Stock Risks And Rewards For Investors

May 21, 2025

Big Bear Ai Stock Risks And Rewards For Investors

May 21, 2025