SEC Acknowledges Grayscale XRP ETF Filing: XRP Price Surges Past Bitcoin And Other Cryptos

Table of Contents

The SEC's Acknowledgment: A Turning Point for XRP

The SEC's acknowledgment of Grayscale's XRP ETF application marks a pivotal moment for XRP and the broader cryptocurrency market. This signifies that the SEC is at least considering the application seriously, a stark contrast to previous rejections of similar filings. This practical implication could pave the way for the first-ever XRP exchange-traded fund (ETF), making XRP significantly more accessible to institutional and retail investors alike.

- Grayscale's History with ETF Applications: Grayscale, a prominent digital currency asset manager, has a history of submitting ETF applications to the SEC, many of which were previously rejected due to regulatory concerns surrounding cryptocurrencies. These rejections highlighted the SEC's cautious approach towards approving crypto-based investment products.

- A Shift in SEC Stance?: The difference between this XRP ETF filing and previous attempts remains unclear, but speculation points towards a possible softening of the SEC's stance on cryptocurrencies. This could be attributed to increasing institutional interest in crypto assets and a growing understanding of the technology. The specific reasons behind the SEC's change in approach (if any) are yet to be fully disclosed, but it's undeniably a positive development for XRP.

- Potential Implications for Other Crypto ETFs: The SEC's acknowledgment could set a precedent for future ETF applications for other cryptocurrencies, potentially opening the floodgates for increased institutional investment across the entire sector.

XRP Price Surge: Outperforming Bitcoin and Other Cryptos

Following the SEC's acknowledgment, XRP experienced a remarkable price surge, significantly outperforming Bitcoin and many other altcoins. The price increase was dramatic, illustrating the market's positive reaction to the news. This demonstrates the considerable market anticipation for an XRP ETF.

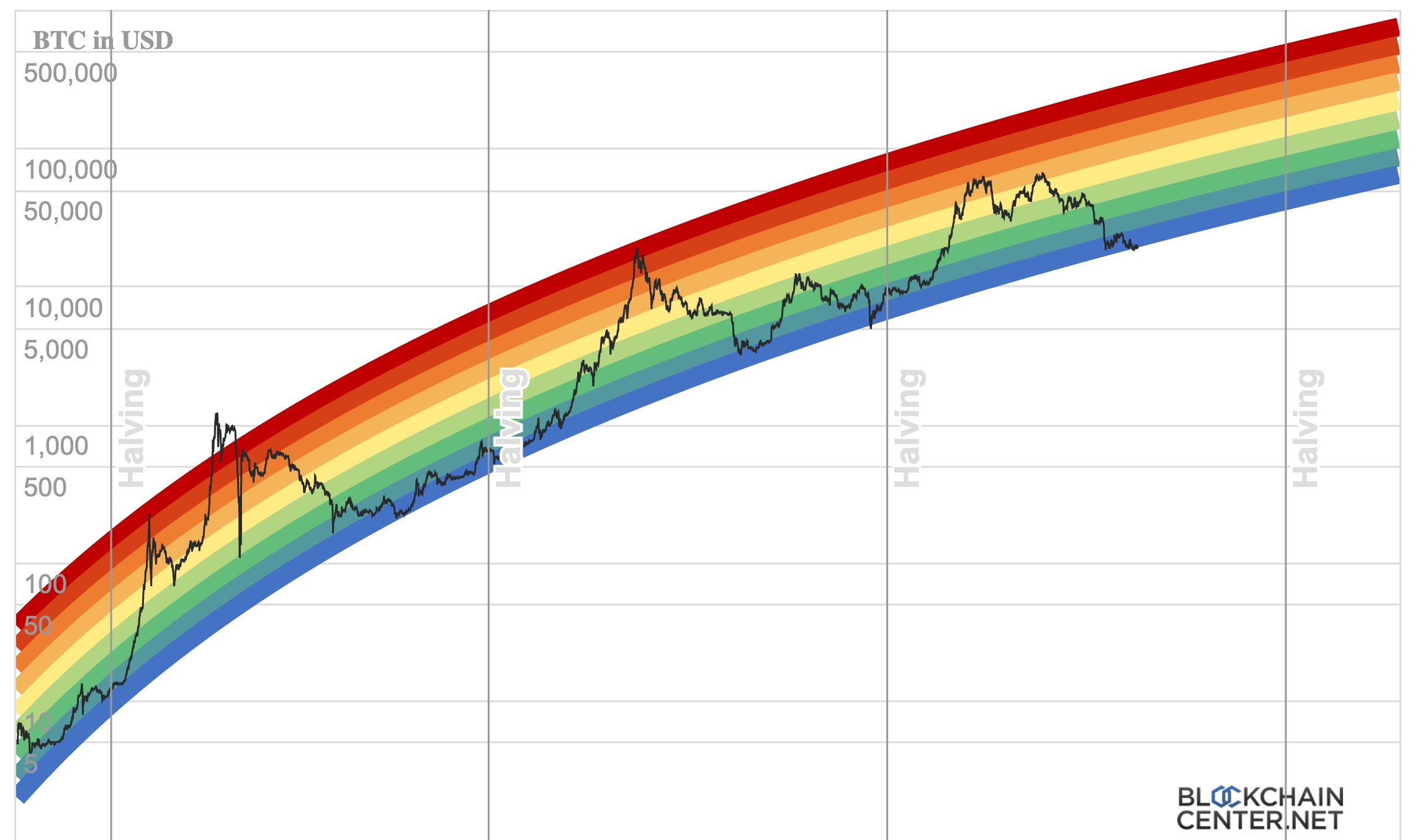

- Price Chart and Percentage Increase: [Insert a chart here showcasing XRP's price surge against Bitcoin and other major cryptocurrencies. Include specific percentage increases.] The price of XRP increased by X% in the 24 hours following the announcement.

- Market Sentiment and Trading Volume: Market sentiment towards XRP shifted dramatically to overwhelmingly bullish, with trading volume spiking significantly, reflecting the increased investor interest and excitement. This surge highlights the considerable market anticipation for an approved XRP ETF.

Implications for the Cryptocurrency Market and XRP Investors

The SEC's acknowledgment of the Grayscale XRP ETF filing has far-reaching implications for both the cryptocurrency market and individual XRP investors.

- Increased Institutional Investment: The approval of an XRP ETF would likely attract substantial institutional investment, boosting XRP's market capitalization and legitimizing it further within the financial world.

- Regulatory Clarity and Market Stability: The potential approval of the XRP ETF could contribute to increased regulatory clarity within the crypto space, potentially leading to greater market stability and attracting more mainstream investors.

- Risks and Rewards: While the potential for significant gains is high, investors should be aware of the inherent risks associated with any cryptocurrency investment. The regulatory landscape is still evolving, and market volatility remains a significant factor.

Understanding the XRP ETF and its Potential Benefits

An XRP ETF is an exchange-traded fund that tracks the price of XRP. Unlike holding XRP directly, an XRP ETF offers several advantages for investors:

- Ease of Access and Trading Convenience: ETFs trade on major exchanges just like stocks, providing easy access and convenient trading for investors.

- Increased Liquidity and Price Stability: ETFs typically offer greater liquidity compared to holding XRP directly, potentially leading to more price stability.

- Regulatory Oversight and Investor Protections: ETFs are subject to stricter regulatory oversight and investor protections than many other investment vehicles, offering investors added security.

Conclusion

The SEC's acknowledgment of Grayscale's XRP ETF filing is a landmark event for the cryptocurrency market. The significant price surge of XRP, its outperformance against Bitcoin and other cryptos, and the potential for increased institutional investment highlight the significance of this development. For XRP investors, this signifies a potential turning point, potentially offering increased accessibility, liquidity, and regulatory clarity through the approval of an XRP ETF. Stay informed about the latest developments regarding the XRP ETF and its impact on the cryptocurrency market. Learn more about investing in XRP and explore the potential benefits of an XRP ETF. Don't miss out on this potentially groundbreaking opportunity – research the XRP ETF today!

Featured Posts

-

Bitcoin In Buguenkue Durumu Fiyat Haberler Ve Gelecegi

May 08, 2025

Bitcoin In Buguenkue Durumu Fiyat Haberler Ve Gelecegi

May 08, 2025 -

Rogues Unexpected Rise To Power In The X Men

May 08, 2025

Rogues Unexpected Rise To Power In The X Men

May 08, 2025 -

India Pakistan Conflict Understanding The Importance Of Kashmir And The Risk Of War

May 08, 2025

India Pakistan Conflict Understanding The Importance Of Kashmir And The Risk Of War

May 08, 2025 -

Bitcoin Price Forecast Evaluating The Impact Of Trumps 100 Day Speech

May 08, 2025

Bitcoin Price Forecast Evaluating The Impact Of Trumps 100 Day Speech

May 08, 2025 -

Micro Strategy Vs Bitcoin Predicting The Better Investment For 2025

May 08, 2025

Micro Strategy Vs Bitcoin Predicting The Better Investment For 2025

May 08, 2025