Second-Order Effects Of Reciprocal Tariffs On Indian Industries

Table of Contents

Reciprocal tariffs, a key feature of trade wars, have far-reaching consequences that extend beyond the immediate impact on targeted goods. This article delves into the second-order effects of reciprocal tariffs on Indian industries, exploring the ripple effects that extend across various sectors and the broader economy. We will analyze how these indirect consequences affect businesses, consumers, and the overall economic landscape of India, examining the multifaceted challenges and opportunities arising from these complex trade dynamics.

Disruption of Supply Chains and Increased Input Costs

Keywords: Supply chain, input costs, raw materials, intermediate goods, production costs, price increases.

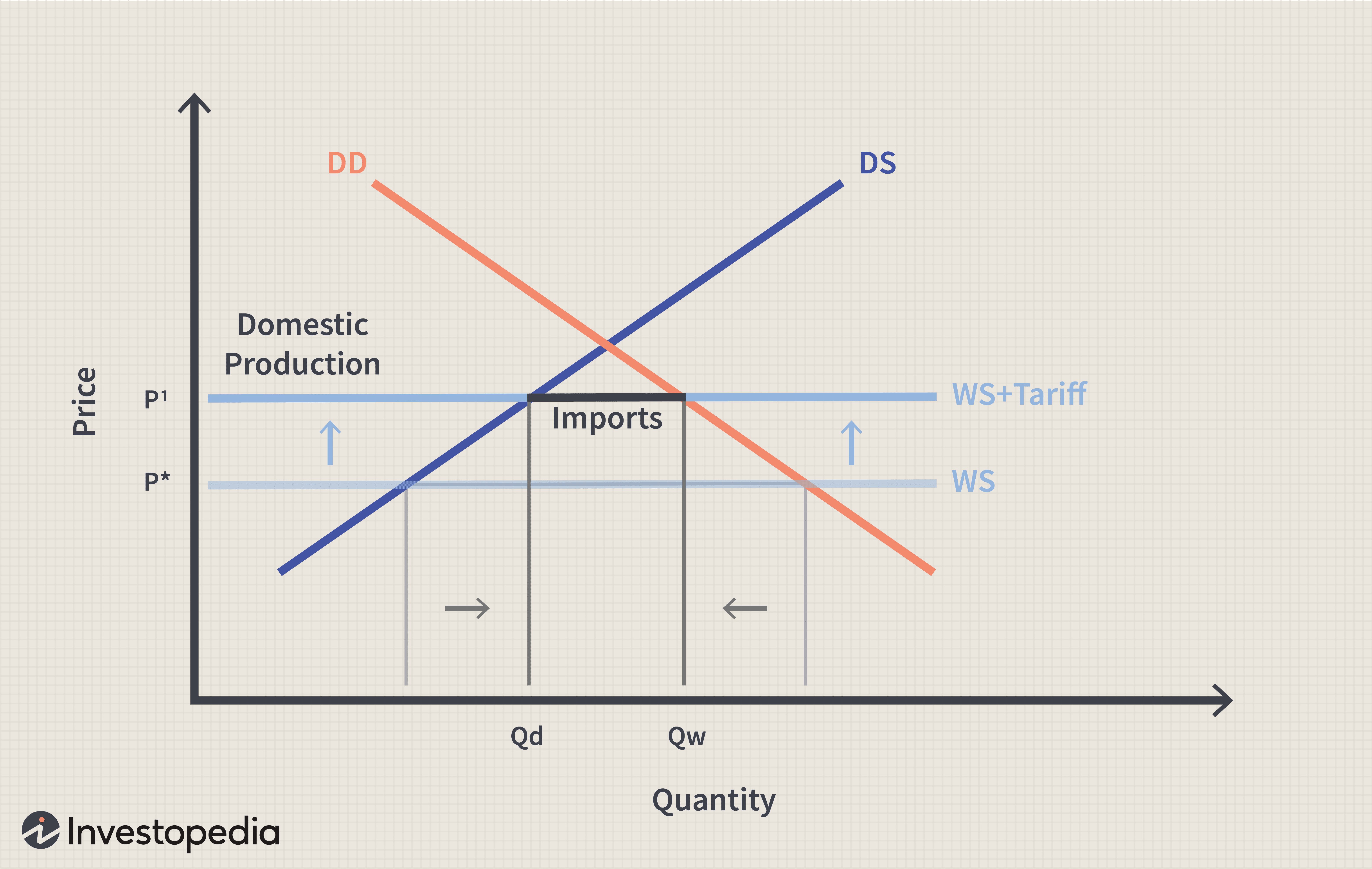

Increased input costs are a significant second-order effect of reciprocal tariffs. Tariffs on imported raw materials and intermediate goods directly increase production costs for Indian industries. This is particularly problematic for sectors heavily reliant on imported components, leading to several challenges:

- Increased costs of imported raw materials and intermediate goods due to tariffs: The added tariff burden translates directly into higher prices for businesses, squeezing profit margins and potentially impacting competitiveness.

- Difficulty in sourcing alternative suppliers: Finding alternative suppliers can be time-consuming and costly, leading to production delays and shortages. This is further complicated by geopolitical factors and potential reliability concerns with new suppliers.

- Impact on industries heavily reliant on imported components (e.g., electronics, automobiles): Sectors like electronics and automobiles, which rely on a global network for components, are particularly vulnerable to supply chain disruptions caused by tariffs. Production slowdowns and price hikes can follow.

- Case studies illustrating specific examples of supply chain disruptions in Indian industries: For instance, increased tariffs on specific electronic components could lead to delays in the production of smartphones and other electronics, affecting both manufacturers and consumers. Similarly, the automobile industry could face challenges due to higher prices for imported steel or specialized parts.

Bullet Points:

- Higher transportation costs due to trade restrictions and rerouting of goods.

- Reduced availability of crucial components, potentially forcing production cutbacks.

- Increased lead times for procuring materials, impacting production schedules and delivery timelines.

Inflationary Pressures and Reduced Consumer Spending

Keywords: Inflation, consumer spending, price hikes, demand reduction, cost-push inflation.

The increased input costs discussed above directly contribute to cost-push inflation. This occurs when the increased cost of production is passed on to consumers in the form of higher prices for goods and services. The resulting inflationary pressures lead to several negative consequences:

- Tariffs contribute to cost-push inflation, increasing the price of goods and services: As businesses absorb increased costs from tariffs, they raise prices to maintain profitability, leading to a rise in the overall price level.

- Reduced purchasing power of consumers due to rising prices: Higher prices reduce the purchasing power of consumers, leading to decreased consumer spending and potentially impacting overall economic growth.

- Impact on various consumer segments and their spending patterns: Lower-income households are disproportionately affected by inflation as a larger portion of their income is spent on essential goods and services.

- Correlation between tariff increases and inflation rates in India: Empirical studies can demonstrate the statistical relationship between increases in tariffs and subsequent increases in consumer price indices (CPI).

Bullet Points:

- Decreased consumer confidence due to economic uncertainty and rising prices.

- Reduced demand for non-essential goods as consumers tighten their budgets.

- Potential for a slowdown in economic growth due to reduced aggregate demand.

Impact on Specific Sectors: A Case Study Approach

Keywords: Textile industry, automobile industry, pharmaceutical industry, agricultural sector, specific examples.

The impact of reciprocal tariffs is not uniform across all Indian industries. Some sectors are more vulnerable than others due to their dependence on imported inputs or export markets. A detailed analysis of specific sectors is crucial:

- Textile Industry: The textile industry, reliant on imported raw materials like cotton and specialized dyes, could face significant challenges from increased input costs and reduced competitiveness in global markets.

- Automobile Industry: The automobile industry, requiring numerous imported components, would be severely impacted by higher input costs and supply chain disruptions.

- Pharmaceutical Industry: The pharmaceutical industry, depending on imported active pharmaceutical ingredients (APIs), could see increased drug prices and potential shortages.

- Agricultural Sector: While potentially benefiting from reduced competition from imports in some cases, the agricultural sector could also suffer from higher prices for fertilizers and other imported inputs.

Job Losses and Unemployment in Affected Industries

Keywords: Job Losses, unemployment, workforce displacement, economic downturn, social consequences.

The economic consequences of reciprocal tariffs often translate into job losses and unemployment. These effects can be both direct and indirect:

- Direct job losses in industries directly targeted by tariffs: Industries facing reduced competitiveness due to higher costs may resort to downsizing or factory closures, leading to direct job losses for workers.

- Indirect job losses in related industries due to reduced demand and production cuts: Reduced production in one sector can create a domino effect, impacting related industries and resulting in further job losses.

- Regional disparities in job losses and their social implications: Job losses are not evenly distributed geographically, leading to heightened social and economic challenges in certain regions.

- Government policies aimed at mitigating job losses: The government might implement retraining programs or offer financial assistance to affected workers, although the effectiveness of such measures can vary.

Bullet Points:

- Increased competition from domestic producers may lead to job displacement.

- Reduced export competitiveness may result in factory closures and layoffs.

- Potential for social unrest and economic hardship in affected communities.

Policy Implications and Mitigation Strategies

Keywords: Trade policy, government intervention, diversification, free trade agreements, economic stimulus.

Navigating the negative second-order effects of reciprocal tariffs requires proactive policy interventions:

- Government responses to mitigate the negative second-order effects: The Indian government could implement policies to support affected industries, including financial assistance, tax breaks, and investment incentives.

- Policy recommendations for promoting diversification and resilience: Diversifying supply chains and reducing reliance on specific import sources is crucial for mitigating future disruptions.

- The role of free trade agreements in reducing tariff barriers: Negotiating and participating in free trade agreements can help reduce reliance on countries imposing tariffs.

- Exploring alternative trade partnerships to reduce reliance on specific countries: Seeking alternative trading partners can create a more resilient and diversified supply chain.

Bullet Points:

- Investment in domestic industries to reduce reliance on imports.

- Skill development programs for workers to facilitate transitions to new industries.

- Incentives for import substitution to promote domestic production of essential goods.

Conclusion

This article has explored the significant second-order effects of reciprocal tariffs on Indian industries, encompassing supply chain disruptions, inflationary pressures, job losses, and policy implications. The indirect consequences extend far beyond the initially targeted sectors, highlighting the interconnected nature of the Indian economy. Understanding the complex web of these second-order effects is crucial for policymakers and businesses alike. Further research and analysis of the second-order effects of reciprocal tariffs on specific Indian industries are essential for developing effective mitigation strategies and promoting sustainable economic growth. Therefore, continued monitoring and proactive policy adjustments are vital to navigate the challenges and opportunities presented by global trade dynamics. Ignoring the ripple effects of reciprocal tariffs risks undermining India's economic stability and prosperity.

Featured Posts

-

Stock Market Valuation Concerns Bof As Perspective And Guidance For Investors

May 15, 2025

Stock Market Valuation Concerns Bof As Perspective And Guidance For Investors

May 15, 2025 -

Sensex Soars Top Bse Stocks That Gained Over 10

May 15, 2025

Sensex Soars Top Bse Stocks That Gained Over 10

May 15, 2025 -

Dimereis Sxeseis Kyproy Oyggarias Syzitiseis Kompoy Sigiarto Gia To Kypriako Kai Tin Proedria Tis Ee

May 15, 2025

Dimereis Sxeseis Kyproy Oyggarias Syzitiseis Kompoy Sigiarto Gia To Kypriako Kai Tin Proedria Tis Ee

May 15, 2025 -

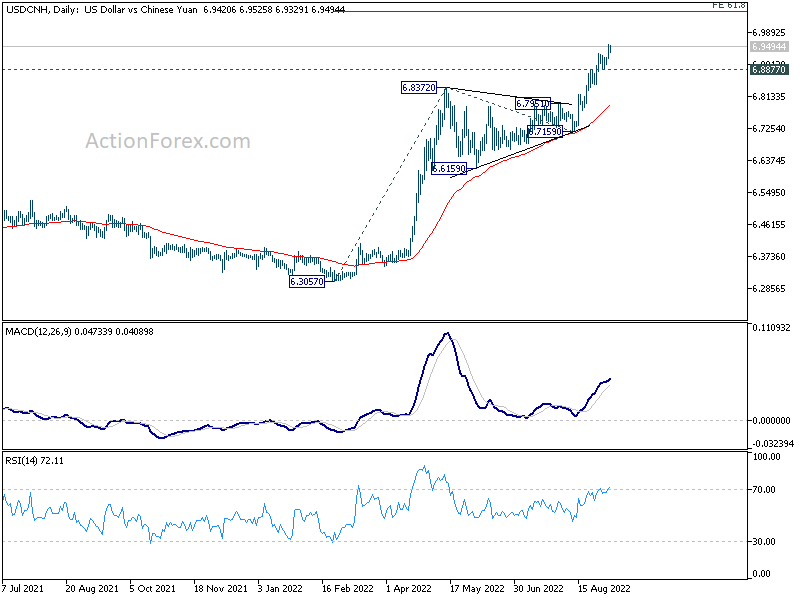

Yuan Support Measures Pbocs Actions And Market Impact

May 15, 2025

Yuan Support Measures Pbocs Actions And Market Impact

May 15, 2025 -

Npo Baas Onder Vuur Beschuldigingen Van Angstcultuur Door Medewerkers

May 15, 2025

Npo Baas Onder Vuur Beschuldigingen Van Angstcultuur Door Medewerkers

May 15, 2025

Latest Posts

-

Stock Market Valuation Concerns Bof As Perspective And Guidance For Investors

May 15, 2025

Stock Market Valuation Concerns Bof As Perspective And Guidance For Investors

May 15, 2025 -

Xi Jinpings Calculated Move Expert Led Us Deal Negotiations

May 15, 2025

Xi Jinpings Calculated Move Expert Led Us Deal Negotiations

May 15, 2025 -

The U S And Greenland The Untold Story Of A Hidden Nuclear Base

May 15, 2025

The U S And Greenland The Untold Story Of A Hidden Nuclear Base

May 15, 2025 -

16 Billion At Stake How Trumps Tariffs Affect Californias Revenue

May 15, 2025

16 Billion At Stake How Trumps Tariffs Affect Californias Revenue

May 15, 2025 -

Goldman Sachs Deciphers Trumps Preferred Oil Price Range

May 15, 2025

Goldman Sachs Deciphers Trumps Preferred Oil Price Range

May 15, 2025