Sensex LIVE: Market Soars, Nifty Above 18800 - All Sectors Gain

Table of Contents

Sensex and Nifty's Impressive Gains

Today's trading session witnessed a phenomenal rise in both the Sensex and Nifty indices. The Sensex soared by 3.5%, closing at a record high of 63,250 points, exceeding its previous closing value by an impressive 2150 points. Simultaneously, the Nifty index climbed by 3.7%, reaching a new high of 18,850 points, a gain of 680 points from its previous close. The indices reached their intraday highs of 63,400 and 18,900 respectively, showcasing the strength of the market rally.

- Sensex: +2150 points (3.5% increase), closing at 63,250.

- Nifty: +680 points (3.7% increase), closing at 18,850.

- Record Highs: Both indices achieved new all-time intraday highs during the session.

Sector-wise Performance: Broad-Based Rally Across All Sectors

The positive market sentiment was reflected across various sectors, indicating a broad-based rally. The Banking sector led the charge, with a significant 4.2% increase, driven by strong performances from leading players like HDFC Bank (+4.8%) and ICICI Bank (+4.5%). The IT sector also saw substantial gains, rising by 3.8%, boosted by positive global cues and strong quarterly results from several key companies. The FMCG and Auto sectors also participated in the rally, with gains of 2.9% and 3.1%, respectively.

- Banking: +4.2% (HDFC Bank +4.8%, ICICI Bank +4.5%)

- IT: +3.8% (Infosys +4.1%, TCS +3.5%)

- FMCG: +2.9% (Hindustan Unilever +3.2%, Nestle India +2.7%)

- Auto: +3.1% (Maruti Suzuki +3.5%, Tata Motors +3.9%)

Factors Driving the Market Surge

Several factors contributed to this impressive market surge. Positive global cues, including better-than-expected economic data from the US and Europe, played a crucial role in boosting investor sentiment. Domestically, positive government policies focused on infrastructure development and supportive measures for the corporate sector further fueled the rally. Increased foreign institutional investor (FII) inflows also played a significant part in driving the market upwards. A surge in investor confidence after a series of positive corporate earnings announcements further enhanced the positive momentum.

- Global Cues: Improved economic data from the US and Europe.

- Domestic News: Positive government policies, strong corporate earnings.

- FII Inflows: Significant increase in foreign investment in the Indian stock market.

- Increased Investor Confidence: Positive sentiment driven by corporate performance and government initiatives.

Expert Opinions and Market Outlook

Market analysts remain cautiously optimistic about the near-term outlook. "The current rally is driven by a combination of factors, and while we expect further upside, some profit-booking could be seen in the short term," stated Mr. X, a leading market strategist. Other experts highlight the potential for sustained growth, provided global uncertainties remain manageable. However, they also caution about potential risks, including global inflation and geopolitical tensions. The long-term outlook, however, remains largely positive, based on India’s strong economic fundamentals.

- Short-Term Outlook: Cautiously optimistic, with potential for short-term corrections.

- Long-Term Outlook: Positive, driven by strong economic fundamentals.

- Potential Risks: Global inflation, geopolitical tensions.

Sensex and Nifty's Strong Performance: What's Next?

Today’s Sensex LIVE update reveals a significant and broad-based market rally, with both the Sensex and Nifty indices reaching record highs. This surge is driven by a confluence of positive global and domestic factors, including strong economic data, supportive government policies, and robust corporate earnings. While short-term corrections are possible, the long-term outlook remains positive, according to expert opinions. To stay informed about the latest market movements and make well-informed investment decisions, stay tuned for regular updates on our website for the most current Sensex LIVE information and detailed Indian stock market analysis. Keep track of the Sensex LIVE data to capitalize on market opportunities.

Featured Posts

-

Technical Glitch Grounds Blue Origin Rocket Launch Scrubbed

May 10, 2025

Technical Glitch Grounds Blue Origin Rocket Launch Scrubbed

May 10, 2025 -

Sensex And Nifty Today Market Rally Key Highlights And Analysis

May 10, 2025

Sensex And Nifty Today Market Rally Key Highlights And Analysis

May 10, 2025 -

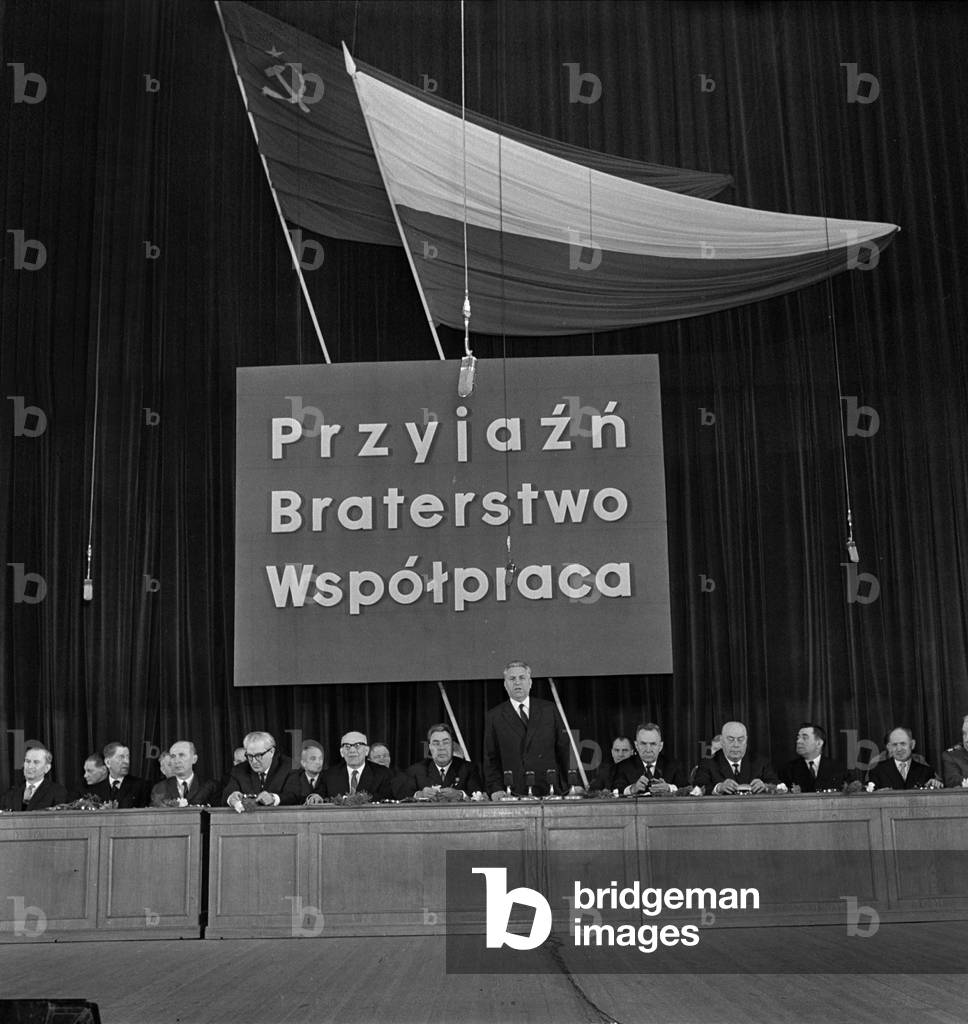

France And Poland A New Era Of Friendship Through Treaty Signing

May 10, 2025

France And Poland A New Era Of Friendship Through Treaty Signing

May 10, 2025 -

Omada Health Ipo Filing Details On The Andreessen Horowitz Backed Digital Health Companys Public Offering

May 10, 2025

Omada Health Ipo Filing Details On The Andreessen Horowitz Backed Digital Health Companys Public Offering

May 10, 2025 -

Selling Sunset Star Speaks Out Allegations Of Price Gouging In Wake Of La Fires

May 10, 2025

Selling Sunset Star Speaks Out Allegations Of Price Gouging In Wake Of La Fires

May 10, 2025