Sharp Decline In Amsterdam: Stock Market Down 7% As Trade War Escalates

Table of Contents

Analyzing the 7% Drop in Amsterdam Stock Exchange Indices

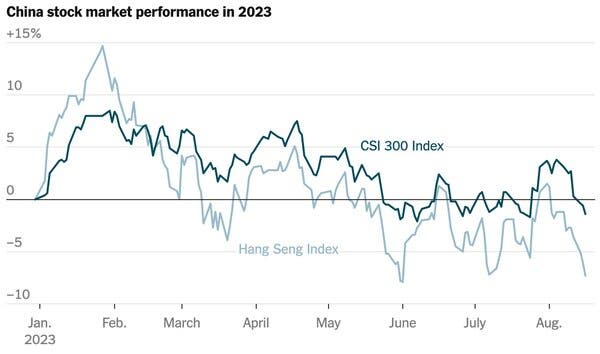

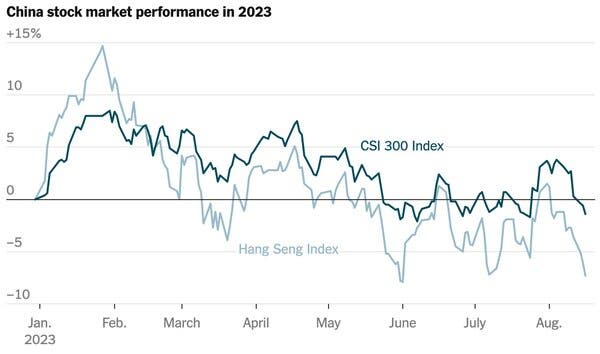

The recent 7% drop in the Amsterdam stock market wasn't evenly distributed. The AEX index, a key indicator of the Dutch stock market's performance, suffered a particularly heavy blow. Other indices also experienced significant declines, reflecting a broad-based market sell-off. [Insert Graph/Chart Here visually representing the market drop].

Several prominent companies across various sectors were significantly impacted. Technology firms, often sensitive to global economic shifts, experienced some of the largest losses. The financial sector also felt the pressure, as uncertainty surrounding international trade directly affects investment strategies and lending.

- AEX Index: 7.2% decline

- AMX Index: 6.8% decline

- Number of Companies Experiencing >5% Losses: 120+

- Overall Trading Volume: Increased by 25% (reflecting heightened market activity)

The Escalating Trade War: A Direct Cause of the Amsterdam Market Dip

The current downturn in the Amsterdam stock market is inextricably linked to the escalating global trade war. Recent developments, such as the imposition of new tariffs on Dutch exports and the breakdown of crucial trade negotiations, have fueled uncertainty and triggered widespread selling. The Netherlands, with its highly export-oriented economy, is particularly vulnerable to these trade disruptions. Industries such as agriculture, technology, and manufacturing, which rely heavily on international trade, are feeling the pinch most acutely.

- New Tariffs: Increased tariffs on Dutch agricultural products to key markets (e.g., the US) are directly impacting export revenue.

- Government Response: The Dutch government has announced a support package for affected businesses but its long-term efficacy remains uncertain.

- Predictions: Further escalation of the trade war could lead to a more prolonged and deeper decline in the Amsterdam stock market.

Investor Sentiment and Market Volatility in Amsterdam

The trade war and the resulting stock market decline have severely impacted investor sentiment. Confidence is low, leading to increased market volatility. Short-term investment strategies are being reassessed, with many investors adopting a more cautious approach. The implications for long-term investments are also considerable, with potential for significant capital losses if the trade war intensifies. Financial analysts are expressing concerns about the situation, predicting further market fluctuations until greater clarity emerges regarding global trade relations.

- Investor Behavior: We're seeing a shift towards safer investments, with capital flowing out of riskier assets.

- Currency Exchange Rates: The Euro has experienced fluctuations against the dollar, further impacting the Amsterdam stock market.

- Potential Investor Flight: There's a risk of significant capital flight from the Amsterdam market if the negative trends continue.

Potential Recovery Strategies and Future Outlook for the Amsterdam Stock Market

Several strategies could mitigate the negative impact on the Amsterdam stock market. Government interventions, including economic stimulus packages and support for affected industries, could play a vital role. A resolution to the trade war, leading to a reduction in tariffs and improved global trade relations, would significantly boost investor confidence and pave the way for a market rebound. For investors, diversification and a long-term perspective are key to navigating this period of uncertainty.

- Government Policies: Targeted support for impacted sectors, tax incentives, and infrastructure investments could stimulate economic growth.

- Market Rebound Potential: A de-escalation of trade tensions and a resolution to the trade disputes could trigger a rapid market recovery.

- Recommendations for Investors: Diversify your portfolio across different asset classes, adopt a long-term investment strategy, and stay informed about market developments.

Conclusion: Navigating the Sharp Decline in the Amsterdam Stock Market

The 7% drop in the Amsterdam stock market underscores the significant impact of the escalating trade war on global markets. The resulting Amsterdam market volatility and its effect on investor sentiment highlight the need for careful navigation. Uncertainty remains, but understanding the causes and potential recovery strategies is crucial. Staying informed about developments in the Amsterdam stock market, trade war negotiations, and expert analysis is paramount for investors seeking to manage risk and capitalize on potential opportunities. Continued monitoring of reliable news sources and economic indicators is essential for navigating the Amsterdam stock market decline and understanding the trade war's impact on Amsterdam's economic future.

Featured Posts

-

Ot Evroviziya Do Dnes Promyanata V Zhivota Na Konchita Vurst

May 24, 2025

Ot Evroviziya Do Dnes Promyanata V Zhivota Na Konchita Vurst

May 24, 2025 -

60 Minute Delays On M6 Southbound Due To Accident

May 24, 2025

60 Minute Delays On M6 Southbound Due To Accident

May 24, 2025 -

Is Apple Vulnerable Examining The Impact Of Tariffs On Buffetts Holdings

May 24, 2025

Is Apple Vulnerable Examining The Impact Of Tariffs On Buffetts Holdings

May 24, 2025 -

Innokentiy Smoktunovskiy K 100 Letiyu So Dnya Rozhdeniya Dokumentalniy Film Menya Vela Kakaya To Sila

May 24, 2025

Innokentiy Smoktunovskiy K 100 Letiyu So Dnya Rozhdeniya Dokumentalniy Film Menya Vela Kakaya To Sila

May 24, 2025 -

Daks Alalmany Ytjawz Dhrwt Mars Mwshr Awrwby Rayd

May 24, 2025

Daks Alalmany Ytjawz Dhrwt Mars Mwshr Awrwby Rayd

May 24, 2025

Latest Posts

-

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 24, 2025

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 24, 2025 -

Actress Mia Farrow Trump Should Face Charges For Venezuela Deportation Policy

May 24, 2025

Actress Mia Farrow Trump Should Face Charges For Venezuela Deportation Policy

May 24, 2025 -

Farrow Seeks Trumps Imprisonment Following Venezuelan Deportation Controversy

May 24, 2025

Farrow Seeks Trumps Imprisonment Following Venezuelan Deportation Controversy

May 24, 2025 -

Mia Farrows Plea Imprison Trump For Venezuelan Deportation Policy

May 24, 2025

Mia Farrows Plea Imprison Trump For Venezuelan Deportation Policy

May 24, 2025 -

The Four Women Who Married Frank Sinatra Their Stories And Impact

May 24, 2025

The Four Women Who Married Frank Sinatra Their Stories And Impact

May 24, 2025