Shifting Sands: Taiwanese Investors Exit US Bond ETFs

Table of Contents

The Decline in Taiwanese Investment: A Closer Look

The decrease in Taiwanese investment in US bond ETFs has been substantial. Analysis of investment flows from Q1 2022 to Q1 2023 shows a reported 25% reduction in total assets under management (AUM) from Taiwanese investors in this asset class. This represents a significant shift in investment strategy. Instead of allocating capital to US bond ETFs, Taiwanese investors appear to be diversifying their portfolios.

- Specific examples: iShares Core U.S. Aggregate Bond ETF (AGG) and Vanguard Total Bond Market ETF (BND), two popular choices among Taiwanese investors, have seen significant divestment.

- Comparison to previous years: Investment levels in 2023 are markedly lower compared to the peak years of 2020 and 2021, when inflows were significantly higher due to low global interest rates.

- (Insert graph/chart here visually representing the decline in investment)

The money is not simply disappearing; it's being reallocated. Preliminary data suggests increased investment in Taiwanese government bonds, domestic real estate, and Asian equities. This diversification strategy reflects a shift in investor sentiment and risk appetite.

Underlying Factors Driving the Exodus

Several factors contribute to this exodus of Taiwanese capital from US bond ETFs.

Rising Interest Rates in Taiwan

Higher domestic interest rates in Taiwan make US bond ETFs, which often offer lower yields, less attractive. The Central Bank of Taiwan's recent policy adjustments have resulted in a significant increase in interest rates, making domestic investment opportunities more compelling. (Include data on Taiwanese interest rate increases here). This makes the relatively lower yields offered by US bond ETFs less appealing.

Geopolitical Uncertainty

The ongoing US-China trade war and broader geopolitical uncertainties have impacted investor confidence. Concerns about potential conflicts and global economic instability are prompting Taiwanese investors to seek safer, more domestically-focused investments. News headlines regarding escalating tensions (cite specific examples) reinforce these anxieties and influence investment decisions.

Diversification Strategies

Taiwanese investors are increasingly pursuing diversification strategies to mitigate risks. The concentration of investments in US bond ETFs has been perceived as potentially vulnerable to external shocks. Hence, the shift towards a more diversified portfolio, including domestic assets and other international markets, is a calculated response to reduce overall portfolio risk.

- Top three reasons (based on expert opinion and market analysis):

- Higher domestic interest rates in Taiwan

- Geopolitical uncertainty and US-China relations

- Desire for greater portfolio diversification

- Future Scenarios: Continued geopolitical instability could further accelerate the outflow of investment. Conversely, a significant easing of US-China tensions and a decline in Taiwanese interest rates could potentially reverse the trend.

Implications for the US Bond Market and Taiwan

The reduction in Taiwanese investment has implications for both the US bond market and the Taiwanese economy.

- Impact on the US Bond Market: Reduced demand from Taiwanese investors could lead to decreased liquidity and potentially higher yields in the US bond market.

- Consequences for Taiwanese Investors: While diversification reduces risk, it also means missing out on potential gains from the US bond market if it performs well.

- Potential effects on US interest rates: Reduced foreign demand could exert upward pressure on US interest rates.

- Opportunities for other investors: The decreased Taiwanese presence creates opportunities for other international investors to enter the US bond market.

- Long-term implications for the Taiwanese economy: The shift towards domestic investment could stimulate growth in the Taiwanese economy but also makes it more vulnerable to domestic economic shocks.

Future Outlook: Will the Trend Continue?

Predicting the future is inherently challenging, but current market conditions suggest that the trend of Taiwanese investors exiting US bond ETFs may continue in the short to medium term.

- Short-term forecast: Continued high interest rates in Taiwan and geopolitical uncertainty are likely to persist, further reducing the attractiveness of US bond ETFs.

- Long-term forecast: A significant shift in global economic conditions or a dramatic easing of geopolitical tensions could reverse the trend.

- Possible scenarios: A sustained period of low US interest rates coupled with increased stability in US-China relations could entice Taiwanese investors to return to US bond ETFs.

- Recommendations for investors: Diversification remains crucial. Investors should carefully consider their risk tolerance and investment goals before making decisions regarding US bond ETFs.

Conclusion: Understanding the Shift in Taiwanese Investment in US Bond ETFs

This analysis highlights the significant decline in Taiwanese investment in US bond ETFs, driven primarily by rising domestic interest rates, geopolitical uncertainty, and a push for greater portfolio diversification. This shift has implications for both the US bond market and the Taiwanese economy. Understanding the factors behind Taiwanese investors exiting US bond ETFs is crucial for navigating this evolving investment landscape. Stay informed about the evolving landscape of Taiwanese Investors Exit US Bond ETFs by following our updates and seeking expert financial advice before making any investment decisions.

Featured Posts

-

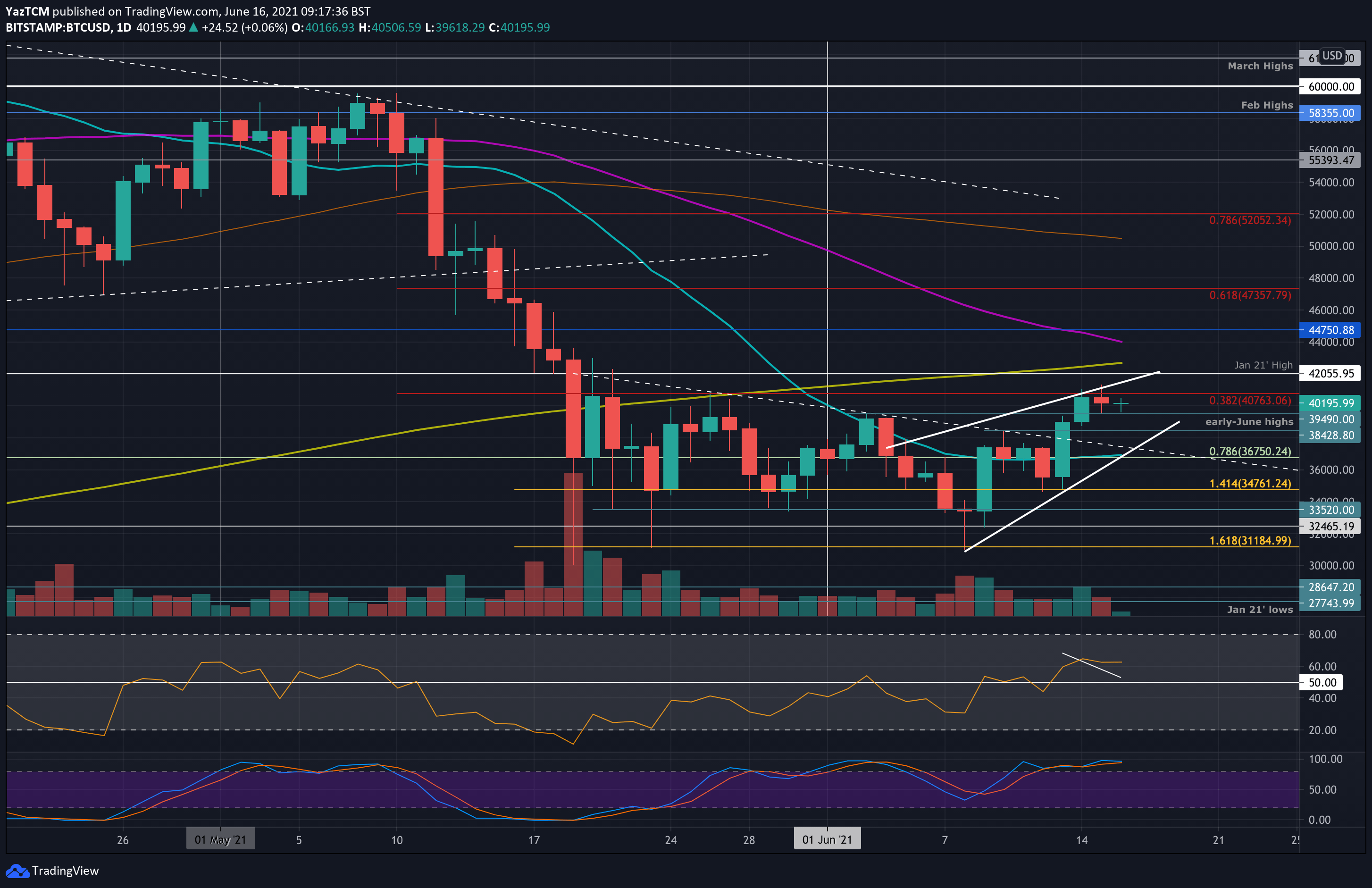

Is Bitcoin At A Critical Juncture Analyzing Key Price Points

May 08, 2025

Is Bitcoin At A Critical Juncture Analyzing Key Price Points

May 08, 2025 -

Bitcoin Price Prediction A Look At Trumps Influence And The 100 000 Threshold

May 08, 2025

Bitcoin Price Prediction A Look At Trumps Influence And The 100 000 Threshold

May 08, 2025 -

Lahwr Ke Askwlwn Ka Py Ays Ayl Ke Baeth Awqat Kar Tbdyl

May 08, 2025

Lahwr Ke Askwlwn Ka Py Ays Ayl Ke Baeth Awqat Kar Tbdyl

May 08, 2025 -

Flamengo Derrota Gremio Com Atuacao Decisiva De Arrascaeta No Brasileirao

May 08, 2025

Flamengo Derrota Gremio Com Atuacao Decisiva De Arrascaeta No Brasileirao

May 08, 2025 -

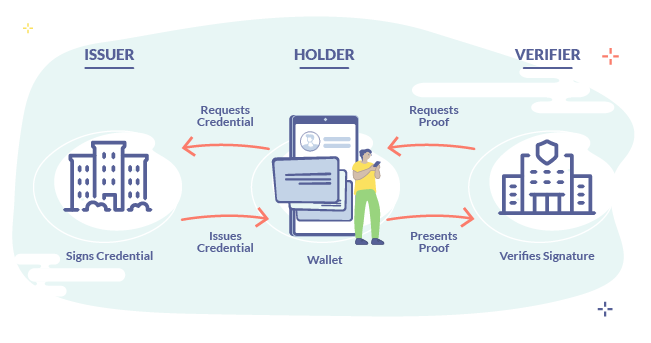

The European Digital Identity Wallet What You Need To Know

May 08, 2025

The European Digital Identity Wallet What You Need To Know

May 08, 2025