Should I Buy Palantir Stock Now? A 2025 Growth Projection Analysis

Table of Contents

The tech sector is notoriously volatile, a rollercoaster of exhilarating highs and stomach-churning lows. Amidst this turbulence, Palantir Technologies, a data analytics powerhouse, presents a compelling, albeit risky, investment opportunity. The burning question on many investors' minds is: Should I buy Palantir stock now? This article aims to analyze Palantir's projected growth trajectory until 2025, examining key factors – revenue growth, government contracts, commercial adoption, competition, and market sentiment – to assess its investment viability in 2024.

2. Palantir's Current Financial Performance and Market Position

H3: Revenue Growth and Profitability: Palantir has demonstrated consistent revenue growth in recent years, though profitability remains a focus. Analyzing their quarterly and annual reports reveals fluctuating growth rates, influenced by the mix of government and commercial contracts.

- Data Point Example: A chart visualizing year-over-year revenue growth from 2020-2023 could be included here. Highlight key trends, including periods of accelerated growth and any potential slowdowns.

- Impact of Contracts: Government contracts provide a significant portion of Palantir's revenue, providing stability but also limiting diversification. Commercial wins are crucial for sustained long-term growth and reduced reliance on government spending.

- Profitability: Investors should examine gross and operating margins to understand Palantir's efficiency and cost structure. Any shifts in operating expenses or changes in profitability should be noted.

H3: Government Contracts and their Future: Government contracts are currently a cornerstone of Palantir's business model. However, dependence on government spending presents inherent risks.

- Potential for Growth: The ongoing need for advanced data analytics in national security and intelligence suggests a continued demand for Palantir's services. However, fluctuations in government budgets and shifts in political priorities could impact future contract awards.

- Risk Mitigation: Palantir’s efforts to diversify its clientele base beyond government agencies are critical for long-term stability. Analyzing the success of this strategy is essential for evaluating risk.

- Geopolitical Factors: International relations and global events can significantly influence government spending on defense and intelligence, impacting Palantir’s revenue streams.

H3: Commercial Market Penetration: Palantir’s expansion into the commercial sector is a crucial factor for future growth. Success here will determine whether Palantir can reach its full potential.

- Case Studies: Examining successful commercial partnerships and their impact on Palantir's revenue and brand reputation is important. Highlight specific wins and quantify their contribution to growth.

- Competitive Analysis: Palantir faces competition from established tech giants and agile startups. Analyzing their strengths and weaknesses relative to Palantir will help determine their competitive advantage and market share.

- Growth Potential: The vast potential for data analytics applications across diverse industries (finance, healthcare, etc.) suggests significant growth opportunities for Palantir in the commercial market.

3. Palantir's Growth Projections for 2025

H3: Analyst Predictions and Consensus Estimates: A range of analyst predictions for Palantir's stock price and revenue by 2025 exists. These projections vary widely, reflecting differing views on the company's potential. Reviewing predictions from reputable sources like Bloomberg, Yahoo Finance, and others can provide a range of perspectives.

- High/Low Estimates: Clearly outline the highest and lowest projections, explaining the reasoning behind these differing assessments.

- Consensus Estimate: If a consensus estimate exists, it should be noted and its underlying assumptions examined.

H3: Key Growth Drivers and Potential Challenges: Palantir's future growth hinges on several factors.

- Growth Drivers: New product launches, successful expansion into new markets, and technological advancements are key drivers. Highlight specific products and market segments with high growth potential.

- Potential Challenges: Competition from other data analytics firms, an economic slowdown, and regulatory hurdles could hinder Palantir's progress. Analyze these challenges and assess their potential impact on growth.

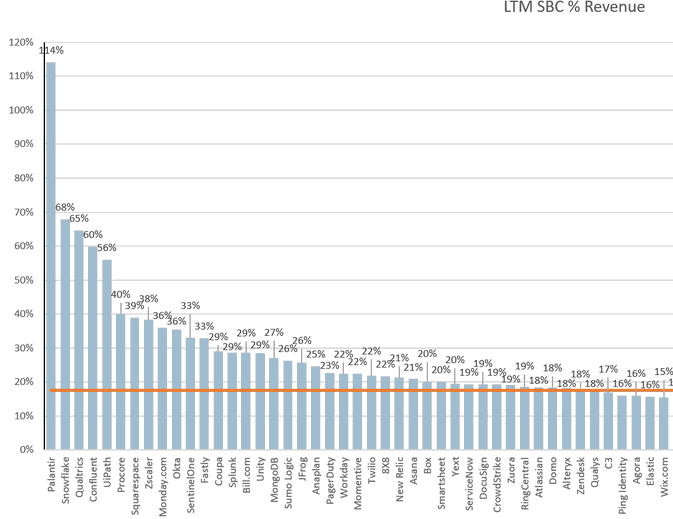

H3: Valuation and Stock Price Analysis: Analyzing Palantir's current valuation using metrics such as the Price-to-Sales (P/S) ratio and Price-to-Earnings (P/E) ratio is crucial.

- Valuation Metrics: Compare Palantir's valuation to its competitors and industry benchmarks.

- Future Price Movements: Relate the valuation metrics to the growth projections to estimate potential future stock price movements.

4. Risks and Considerations

H3: Competitive Landscape: The data analytics market is highly competitive. Key competitors include established players like Microsoft and Salesforce, as well as agile startups innovating in specific niche areas. Analyzing their strengths and weaknesses relative to Palantir is crucial.

H3: Technological Disruption: Rapid technological advancements pose a risk to Palantir. The emergence of new technologies could render Palantir's current offerings obsolete. This necessitates continuous innovation and adaptation.

H3: Economic and Geopolitical Risks: Macroeconomic factors (recessions, inflation) and geopolitical instability can negatively impact Palantir's business and stock price. Assessing the potential impact of such events is vital.

5. Conclusion: Should You Invest in Palantir Stock Now?

Analyzing Palantir’s projected growth until 2025 reveals a company with significant potential but also considerable risks. The reliance on government contracts and the competitive landscape pose challenges, while the potential for commercial market expansion and technological advancements offer growth opportunities. Ultimately, the question of Should I buy Palantir stock now? is complex and depends on individual risk tolerance and investment strategy. While the potential for high rewards is there, so is the possibility of significant losses. Before investing in Palantir stock, conduct thorough due diligence and consider seeking advice from a qualified financial advisor. Is Palantir a good long-term investment? Only careful research and a well-defined investment strategy can answer that question for you. This analysis provides a framework for your decision-making process, but remember that this is not financial advice.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Featured Posts

-

Nhl Playoffs Oilers Vs Kings Game 1 Prediction And Betting Preview

May 09, 2025

Nhl Playoffs Oilers Vs Kings Game 1 Prediction And Betting Preview

May 09, 2025 -

Wynne Evans Health Update Really Nasty Illness And Showbiz Return Hints

May 09, 2025

Wynne Evans Health Update Really Nasty Illness And Showbiz Return Hints

May 09, 2025 -

Ochakvan Rimeyk Na Stivn King Ot Netflix

May 09, 2025

Ochakvan Rimeyk Na Stivn King Ot Netflix

May 09, 2025 -

Indian Stock Market Update Sensex Nifty Close Higher Today

May 09, 2025

Indian Stock Market Update Sensex Nifty Close Higher Today

May 09, 2025 -

Analyzing Palantir Stock Before Its May 5th Earnings Report

May 09, 2025

Analyzing Palantir Stock Before Its May 5th Earnings Report

May 09, 2025