Should Investors Worry About Elevated Stock Market Valuations? BofA's Take

Table of Contents

BofA's Current Assessment of Stock Market Valuations

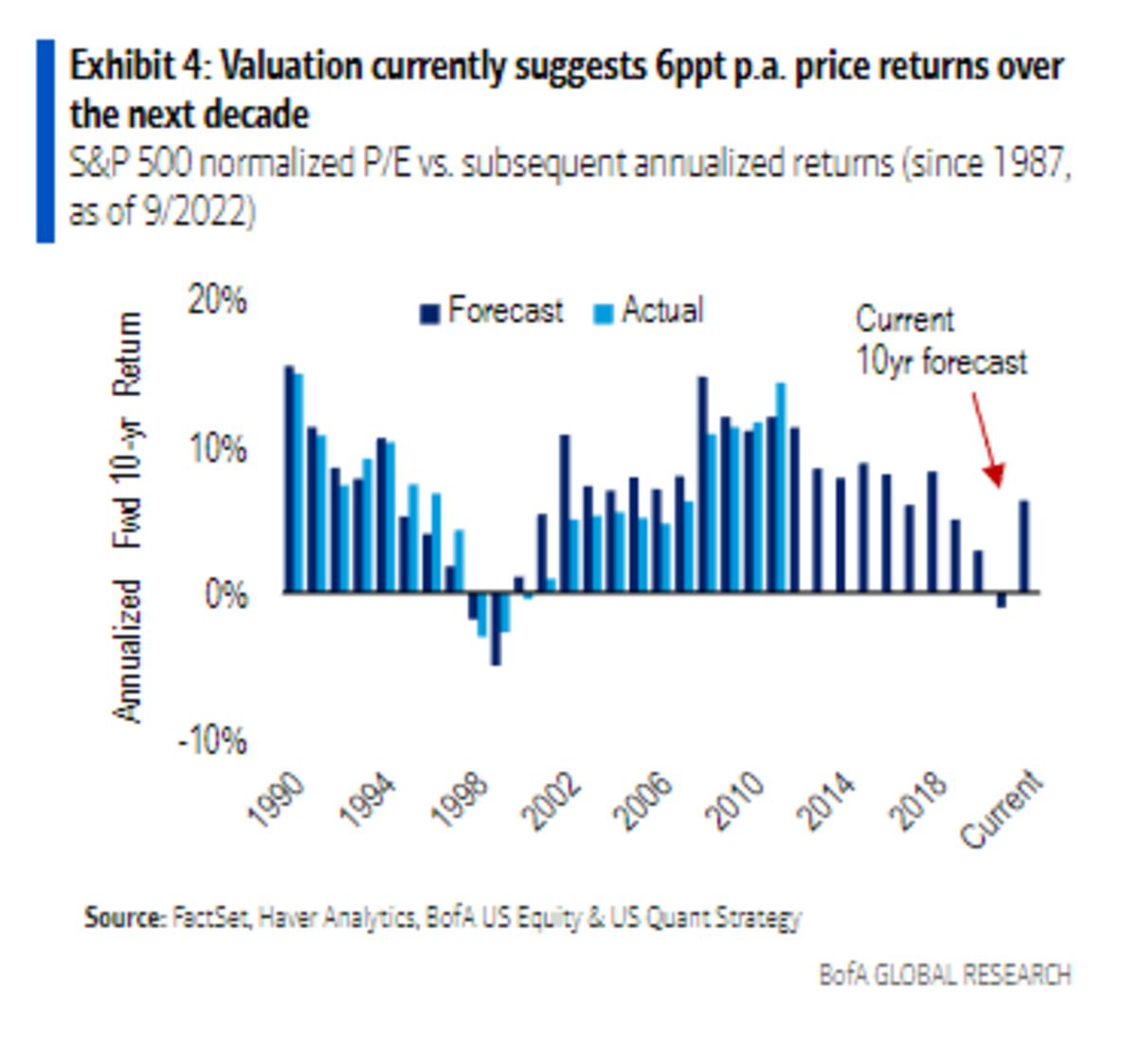

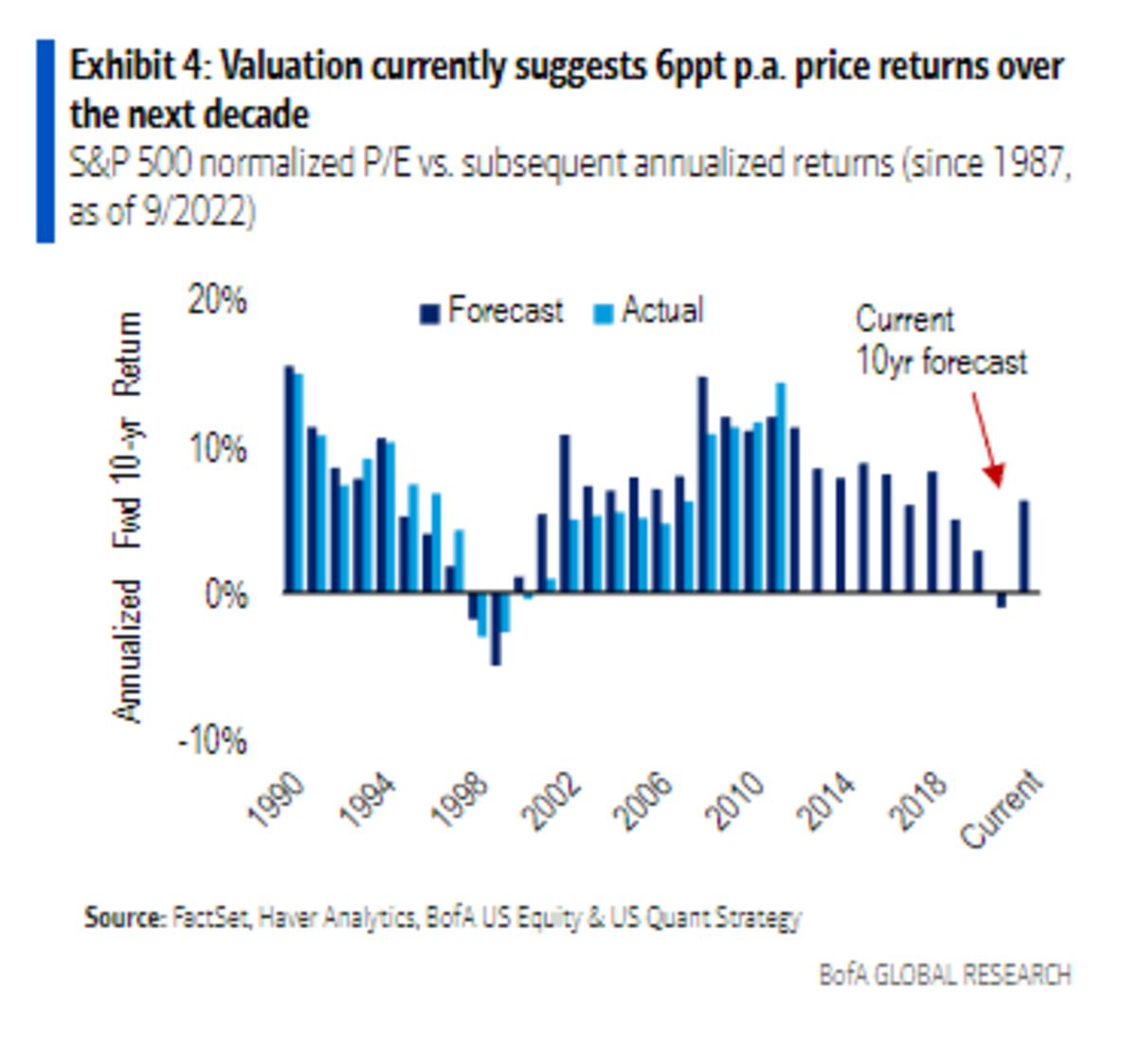

BofA's recent reports paint a complex picture of current stock market valuations. While acknowledging the historically high Price-to-Earnings (P/E) ratios across various sectors, their analysis doesn't necessarily signal immediate alarm. Specific data points from their reports (which should be referenced with links to the actual reports for accuracy and credibility) would be included here, for example, "BofA analysts cite a median P/E ratio of X for the S&P 500, compared to a historical average of Y." This comparison provides context and avoids oversimplification.

Factors Contributing to Elevated Valuations

Several factors have contributed to the current elevated valuations, including:

- Low Interest Rate Environment: Historically low interest rates have made borrowing cheaper for corporations, fueling investments and driving up stock prices. Lower interest rates also make bonds less attractive, pushing investors towards equities.

- Strong Corporate Earnings: Many companies have reported robust earnings growth, boosting investor confidence and justifying higher valuations based on future earnings potential. This positive trend supports higher price multiples.

- Technological Advancements: Breakthroughs in technology, particularly in areas like artificial intelligence and cloud computing, have fueled optimism about long-term growth prospects and are priced into the market. These innovations drive higher valuations in associated sectors.

- Inflationary Pressures: While inflation erodes purchasing power, it also can lead to increased corporate pricing power, potentially justifying higher valuations if earnings growth outpaces inflation. However, this is a double-edged sword and requires careful monitoring.

- Government Stimulus: Government stimulus packages, both domestically and globally, have injected significant liquidity into the market, further boosting asset prices, including stocks. This extra capital can inflate asset bubbles if not managed properly.

BofA's View on the Sustainability of Current Valuations

BofA's outlook on the sustainability of these elevated valuations is nuanced. While they acknowledge the risks associated with high valuations, particularly the potential for a market correction, they don't necessarily predict an imminent crash. Their analysis considers several factors including long-term growth prospects, and the potential impact of rising interest rates. They might suggest a scenario where some sectors or individual stocks experience corrections while others continue to grow. Specific quotes and analysis from their reports (with appropriate citations) are crucial here to enhance credibility. This section also needs to present counterarguments from within BofA's own analysis to show a balanced perspective, for instance, acknowledging the possibility of a “bubble” in certain sectors.

Investment Strategies in a High-Valuation Market

BofA's Recommended Portfolio Adjustments

Given the elevated valuations, BofA likely recommends several portfolio adjustments:

- Portfolio Diversification: Spreading investments across various asset classes (stocks, bonds, real estate) and sectors reduces overall portfolio risk. This is a fundamental strategy for managing volatility.

- Sector Rotation Strategies: Shifting investments from overvalued sectors to undervalued ones can enhance returns. This active management requires careful analysis of market trends.

- Defensive Investing: Allocating a portion of the portfolio to defensive stocks (utilities, consumer staples) which tend to perform relatively well during economic downturns. This reduces the impact of market corrections.

Risk Mitigation Strategies for Investors

Investors can mitigate risks associated with high valuations through:

- Dollar-Cost Averaging: Investing a fixed amount of money at regular intervals regardless of market fluctuations, reducing the impact of buying high. This strategy smooths out volatility over time.

- Value Investing: Focusing on undervalued stocks with strong fundamentals but relatively low market prices, offering potential for significant upside. This requires in-depth company analysis.

- Adjusting Risk Tolerance: Investors should carefully assess their risk tolerance and adjust their portfolios accordingly. Reducing equity exposure and increasing defensive positions may be prudent.

Alternative Perspectives and Expert Opinions

It's important to acknowledge that not all financial experts share BofA's perspective. Some analysts may express more significant concerns about the current valuations, predicting a sharper market correction. Including these differing viewpoints (with citations) provides a comprehensive picture and demonstrates balanced reporting. For example, contrasting views on the sustainability of the current low-interest-rate environment can add depth and complexity to the analysis.

Conclusion: Should You Worry About Elevated Stock Market Valuations? BofA's Take, Summarized

BofA's assessment of elevated stock market valuations is cautious but not necessarily alarmist. While acknowledging the risks, they highlight contributing factors like low interest rates and strong corporate earnings. Their recommended investment strategies emphasize diversification, risk mitigation, and a careful consideration of individual risk tolerance. Other expert opinions offer alternative perspectives, underscoring the need for thorough research and personalized investment planning. Understanding and managing elevated stock market valuations require a proactive approach. Conduct further research, consult with a qualified financial advisor to tailor an investment strategy aligned with your risk profile and financial goals. Don't hesitate to explore diverse opinions on high stock market valuations before making any investment decisions.

Featured Posts

-

Agam Berger And Daniel Weiss March Of The Living Performance After Hostage Release

May 26, 2025

Agam Berger And Daniel Weiss March Of The Living Performance After Hostage Release

May 26, 2025 -

Alternative Delivery Services Thrive Amidst Canada Post Challenges

May 26, 2025

Alternative Delivery Services Thrive Amidst Canada Post Challenges

May 26, 2025 -

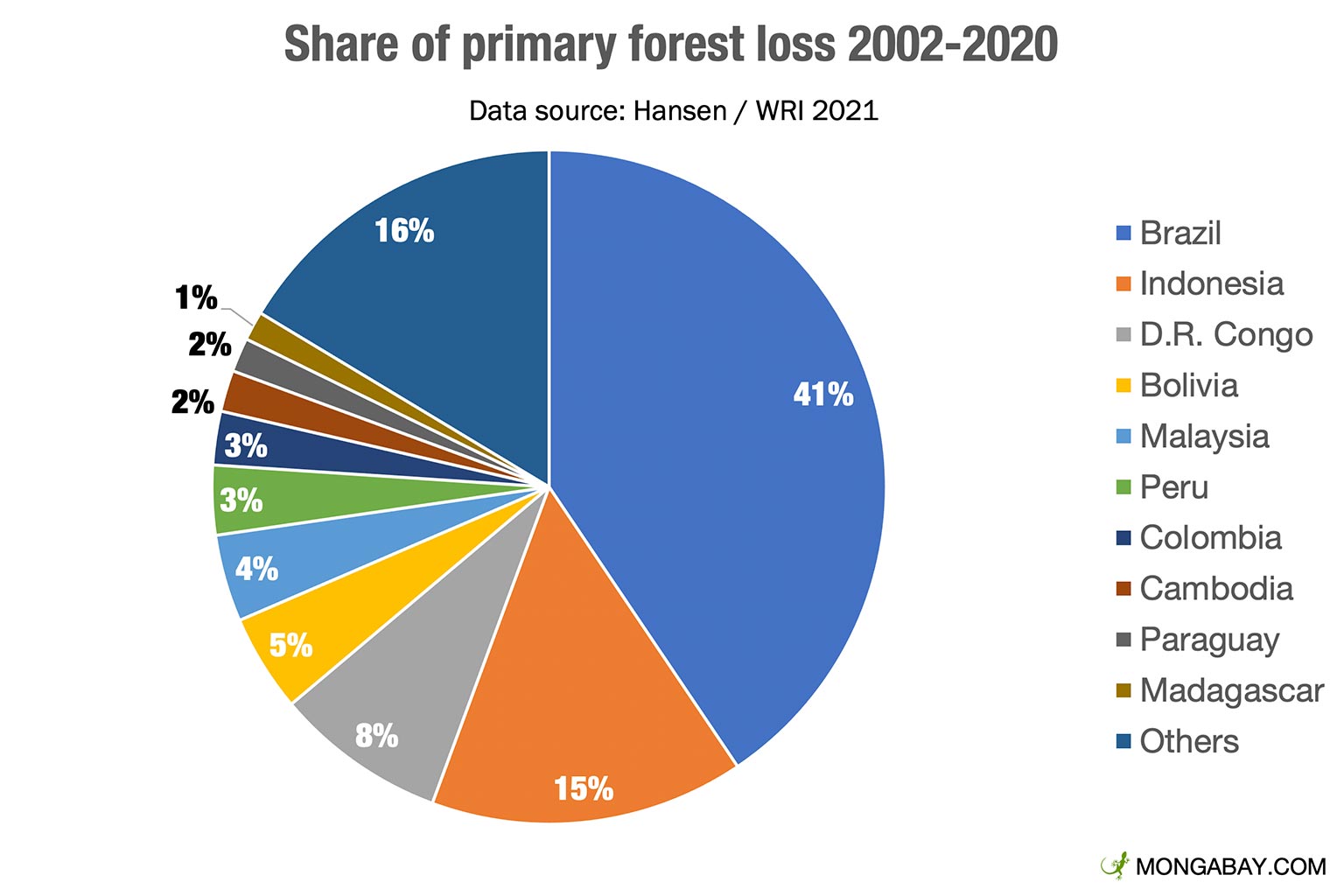

Rising Wildfires Contributing To Record Breaking Global Forest Loss

May 26, 2025

Rising Wildfires Contributing To Record Breaking Global Forest Loss

May 26, 2025 -

L Impact De La Rtbf Sur La Dynamique Des Diables Rouges

May 26, 2025

L Impact De La Rtbf Sur La Dynamique Des Diables Rouges

May 26, 2025 -

Combattre La Desinformation Le Role De La Rtbf Lors De La Journee Mondiale Du Fact Checking

May 26, 2025

Combattre La Desinformation Le Role De La Rtbf Lors De La Journee Mondiale Du Fact Checking

May 26, 2025

Latest Posts

-

Lainaa Viisaasti Vertaile Ja Saeaestae Korkokuluissa

May 28, 2025

Lainaa Viisaasti Vertaile Ja Saeaestae Korkokuluissa

May 28, 2025 -

Understanding Guaranteed Approval For No Credit Check Loans From Direct Lenders

May 28, 2025

Understanding Guaranteed Approval For No Credit Check Loans From Direct Lenders

May 28, 2025 -

Edullisempi Laina Vertaile Ja Loeydae Paras Vaihtoehto

May 28, 2025

Edullisempi Laina Vertaile Ja Loeydae Paras Vaihtoehto

May 28, 2025 -

Direct Tribal Loans Options For Borrowers With Bad Credit

May 28, 2025

Direct Tribal Loans Options For Borrowers With Bad Credit

May 28, 2025 -

Securing A Loan No Credit Check Guaranteed Approval From A Direct Lender

May 28, 2025

Securing A Loan No Credit Check Guaranteed Approval From A Direct Lender

May 28, 2025