Should You Buy Palantir Stock Before Its Projected 40% Jump In 2025?

Table of Contents

Palantir's Growth Potential and Future Projections

Palantir Technologies, a prominent player in the big data analytics market, provides cutting-edge software solutions to government and commercial clients. Its current market position is strong, but the predicted 40% surge in Palantir stock warrants closer examination.

Analyzing the 40% Projection

The 40% projection for Palantir stock by 2025 originates from a confluence of analyst reports and market trend analyses. These forecasts anticipate substantial growth driven by several key factors:

- Increased Government Contracts: Palantir's sophisticated data analytics are highly sought after by government agencies worldwide, leading to a pipeline of lucrative contracts.

- Commercial Market Expansion: Palantir is aggressively expanding its commercial client base, tapping into diverse sectors such as finance, healthcare, and manufacturing.

- New Product Launches: Continuous innovation and the launch of new products and services will further fuel revenue growth and attract new investors to Palantir shares.

However, it's crucial to acknowledge potential downsides:

- Intense Competition: The big data analytics market is highly competitive, with established players and emerging startups vying for market share.

- Economic Downturn: A global economic recession could significantly impact government and commercial spending, affecting Palantir's revenue streams.

- Regulatory Changes: Changes in data privacy regulations could impact Palantir's operations and its ability to secure new contracts.

Key Financial Indicators and Performance

Analyzing Palantir's financial health is paramount for assessing the viability of investing in Palantir stock. Key indicators include:

- Revenue Growth: Examine year-over-year revenue growth to gauge the company's expansion trajectory. (Include a chart or graph showing revenue growth over the past few years).

- Profitability: Assess profitability through metrics like net income margin and operating income to understand Palantir's ability to generate profits. (Include relevant data points).

- Debt Levels: Analyze Palantir's debt-to-equity ratio to gauge its financial leverage and risk profile. (Include relevant data points).

Comparing Palantir's performance to competitors like Snowflake, Databricks, and Tableau reveals its strengths and weaknesses in the competitive landscape. (Include a comparative table highlighting key metrics).

Risks and Challenges Associated with Palantir Stock

While the potential for growth is significant, several risks and challenges must be carefully considered before investing in Palantir stock.

Competition and Market Saturation

The big data analytics market is increasingly crowded. Key competitors include:

- Snowflake: A cloud-based data warehousing company.

- Databricks: A unified analytics platform.

- Tableau: A business intelligence and data visualization platform.

Palantir's competitive advantages lie in its advanced data integration capabilities and its strong relationships with government agencies. However, market saturation poses a threat to future growth.

Dependence on Government Contracts

A substantial portion of Palantir's revenue comes from government contracts. This reliance presents risks:

- Political Shifts: Changes in government priorities and policies can impact funding for data analytics projects.

- Budgetary Constraints: Government budget cuts could significantly reduce demand for Palantir's services.

Palantir is actively diversifying its client base, expanding into commercial sectors to mitigate this risk.

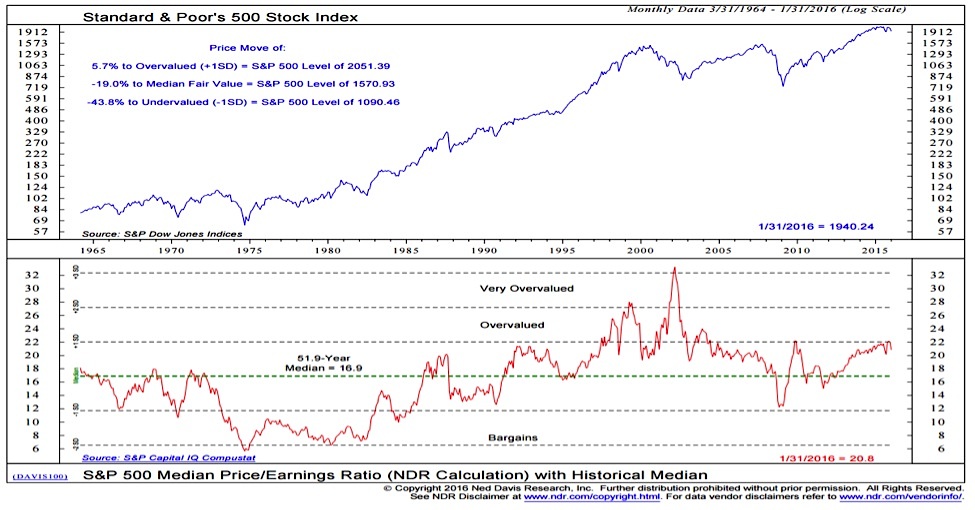

Valuation and Stock Price Volatility

Palantir's current valuation and its historical stock price volatility are key factors to assess. Compare Palantir's price-to-earnings ratio (P/E) and other valuation metrics to its peers. Analyze past stock price fluctuations to gauge its volatility and potential for significant price swings. (Include charts and graphs showing historical stock performance).

Alternative Investment Opportunities

Before committing to Palantir stock, explore alternative investment options.

Comparing Palantir to Similar Tech Stocks

Compare Palantir to other companies in the data analytics or software sector, considering their potential returns, risks, and valuation. (Provide a table comparing key metrics and growth prospects of several similar companies).

Diversification Strategies

Diversifying your investment portfolio is crucial to mitigate risk. Consider investing in a mix of assets, including stocks, bonds, and real estate, rather than concentrating solely on Palantir stock.

Conclusion: Should You Buy Palantir Stock Now?

Investing in Palantir stock presents both significant opportunities and substantial risks. The projected 40% increase by 2025 is enticing, but the competitive landscape, dependence on government contracts, and stock price volatility cannot be ignored. While Palantir's growth potential is undeniable, its success hinges on its ability to navigate these challenges successfully.

Weighing the risks and rewards, the decision to buy Palantir stock requires careful consideration. While the potential for significant returns exists, the inherent volatility demands a cautious approach.

Final Recommendation: Investing in Palantir stock should be part of a diversified portfolio and based on your individual risk tolerance. The potential 40% increase is not guaranteed.

Call to Action: Learn more about Palantir stock, research Palantir investments thoroughly, and analyze Palantir's future prospects before making any investment decisions. Remember, this analysis is for informational purposes only and is not financial advice.

Featured Posts

-

Edmonton Oilers Leon Draisaitl A Case For The Hart Trophy

May 10, 2025

Edmonton Oilers Leon Draisaitl A Case For The Hart Trophy

May 10, 2025 -

Edmonton Oilers Star Leon Draisaitls Injury Update Playoffs Possible

May 10, 2025

Edmonton Oilers Star Leon Draisaitls Injury Update Playoffs Possible

May 10, 2025 -

Bert Kreischer And His Wife Navigating The Comedy Of Sex Jokes On Netflix

May 10, 2025

Bert Kreischer And His Wife Navigating The Comedy Of Sex Jokes On Netflix

May 10, 2025 -

Why Current Stock Market Valuations Are Not A Threat Bof As Viewpoint

May 10, 2025

Why Current Stock Market Valuations Are Not A Threat Bof As Viewpoint

May 10, 2025 -

Stock Market Valuations Bof As Reassuring View For Investors

May 10, 2025

Stock Market Valuations Bof As Reassuring View For Investors

May 10, 2025