Why Current Stock Market Valuations Are Not A Threat: BofA's Viewpoint

Table of Contents

Recent market volatility has led many investors to question current stock market valuations. Concerns about inflation, geopolitical instability, and rising interest rates have fueled anxieties about a potential market downturn. However, Bank of America (BofA), a leading financial institution, offers a contrasting viewpoint, arguing that these valuations aren't necessarily a harbinger of an imminent crash. This article delves into BofA's reasoning, examining the key factors they believe mitigate the perceived risk and provide a more nuanced perspective on market valuation analysis. We'll explore their investment strategy insights and offer a clearer picture of the stock market predictions for the coming period.

BofA's Rationale: Why Current Valuations Aren't Overvalued

BofA's analysts base their optimistic outlook on several key factors that, when considered together, paint a more balanced picture of the current market landscape. Their market valuation analysis goes beyond simple price-to-earnings ratios, incorporating a broader assessment of economic fundamentals and long-term growth prospects.

Strong Corporate Earnings Growth

BofA points to robust corporate earnings as a primary justification for their relatively positive assessment of current stock market valuations. This strong earnings growth provides a solid foundation for supporting current price levels.

- Sustained growth in key sectors: Many key sectors continue to demonstrate significant growth, particularly in technology, healthcare, and consumer staples. This broad-based growth is a key indicator of economic resilience.

- Positive profit margins despite inflationary pressures: While inflationary pressures have undeniably impacted businesses, many companies have successfully managed to maintain positive profit margins through efficient cost management and price adjustments.

- Resilience of consumer spending: Despite inflation, consumer spending remains relatively resilient, indicating continued demand for goods and services. This sustained consumer confidence underpins the positive earnings outlook for many companies.

- Strong future earnings projections: Analysts at BofA project continued strong earnings growth in the coming years, further reinforcing their confidence in current valuations. These projections are based on a detailed analysis of macroeconomic indicators and sector-specific forecasts.

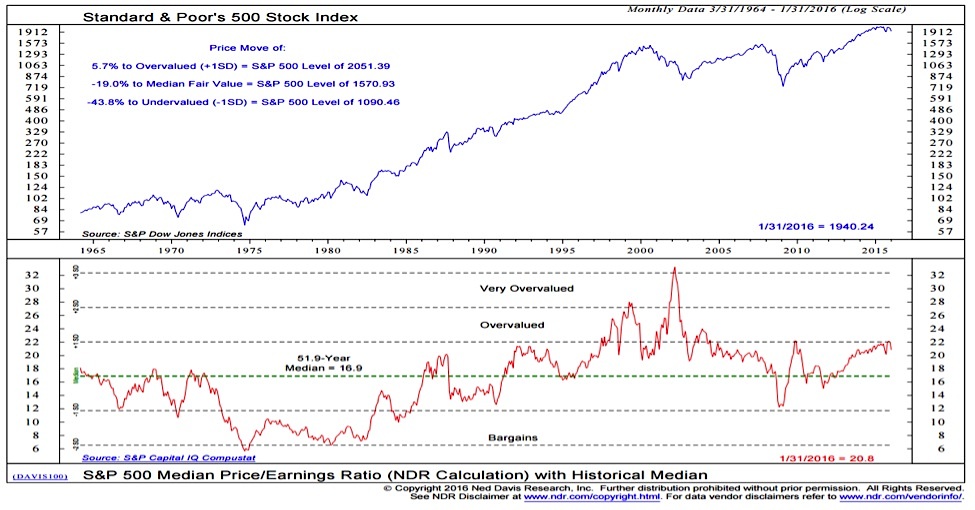

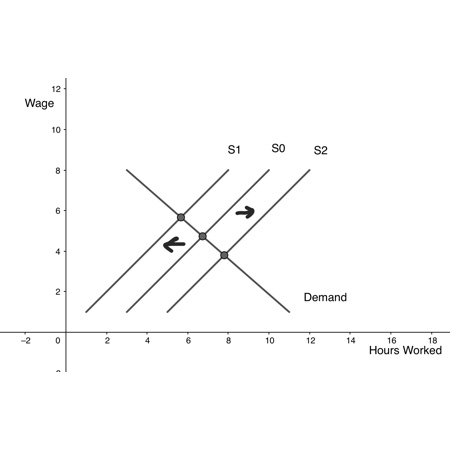

Low Interest Rates (Historically)

While interest rates have undeniably risen in recent months, BofA contextualizes these increases within the broader historical trend. Compared to previous interest rate cycles, current rates remain relatively low, particularly when considering the long-term perspective.

- Comparison to previous interest rate cycles: A historical comparison of interest rate cycles reveals that current rates are not exceptionally high, offering a degree of perspective to recent increases.

- Impact of low interest rates on future valuations: Low interest rates historically support higher equity valuations by reducing the cost of borrowing for businesses and increasing the attractiveness of equities relative to bonds.

- Discussion of the Federal Reserve's policy and its impact: The Federal Reserve's policy decisions and their anticipated impact on future interest rates are a crucial element in BofA's analysis. Their projections inform the long-term market valuation assessment.

Technological Innovation and Long-Term Growth

BofA highlights the transformative power of technological innovation as a significant driver of future economic growth and a key factor supporting their view on current stock market valuations.

- Impact of AI, automation, and other technological advancements: Rapid advancements in artificial intelligence, automation, and other technologies are poised to revolutionize multiple industries, creating exciting new investment opportunities.

- Growth potential in emerging tech sectors: Emerging technology sectors offer significant growth potential, creating attractive investment opportunities for investors with a long-term outlook.

- Attractive valuation opportunities in innovative companies: Many innovative companies, while potentially having higher valuations than more established firms, offer attractive long-term growth prospects.

Addressing the Concerns: Counterarguments to Market Valuation Worries

While BofA maintains a relatively positive outlook, they acknowledge the legitimate concerns surrounding current stock market valuations. Their analysis carefully considers these risks and offers mitigating factors.

Inflationary Pressures

BofA acknowledges the impact of inflation but suggests that current inflationary pressures are manageable and likely to moderate over time.

- Analysis of current inflation trends: BofA's economists closely monitor current inflation trends and their projected trajectory.

- Discussion of the Fed's strategies to combat inflation: The Federal Reserve's actions to combat inflation are a crucial element in BofA’s analysis.

- Projected impact of inflation on future earnings: BofA's analysis assesses the likely impact of inflation on corporate earnings, incorporating various scenarios into their projections.

Geopolitical Risks

Geopolitical uncertainties are undeniable, but BofA emphasizes the resilience of the global economy and the market's ability to absorb shocks.

- Assessment of key global risks: BofA carefully considers key global risks and assesses their potential impact on market valuations.

- BofA’s analysis of the market’s ability to absorb shocks: Their analysis incorporates historical precedent of market reactions to geopolitical events.

- Diversification strategies to mitigate risks: Diversification of investment portfolios is highlighted as a key strategy for mitigating risks associated with geopolitical uncertainty.

Market Volatility

BofA acknowledges short-term market fluctuations but emphasizes the importance of a long-term investment horizon.

- Historical context of market corrections: Market corrections are a normal part of the market cycle, and BofA offers historical context to put recent volatility into perspective.

- Importance of a long-term investment horizon: A long-term investment strategy is crucial for weathering short-term market fluctuations and realizing long-term growth potential.

- Opportunities arising from market corrections: Market corrections often create opportunities to acquire undervalued assets, providing strategic investment opportunities.

Conclusion

BofA's analysis suggests that while concerns about stock market valuations are understandable, a closer examination reveals several mitigating factors. Strong earnings growth, historically low interest rates (in context), and the potential for significant technological advancements all contribute to a more optimistic outlook on equity valuations. While acknowledging the challenges of inflation and geopolitical uncertainty, BofA maintains a relatively positive stance on the long-term prospects for equity markets. Don't let perceived threats to stock market valuations deter you. Understand the full picture by considering BofA's insightful analysis. Learn more about developing a sound investment strategy that considers both risks and the long-term potential of current stock market valuations. Contact us today to discuss your investment portfolio and how to navigate the current market landscape.

Featured Posts

-

Nhl Playoffs Oilers Vs Kings Game 1 Prediction And Betting Analysis

May 10, 2025

Nhl Playoffs Oilers Vs Kings Game 1 Prediction And Betting Analysis

May 10, 2025 -

Strengthening Regional Capital Markets The Pakistan Sri Lanka Bangladesh Initiative

May 10, 2025

Strengthening Regional Capital Markets The Pakistan Sri Lanka Bangladesh Initiative

May 10, 2025 -

Predicting The Top Storylines In The Nhls Remaining 2024 25 Season

May 10, 2025

Predicting The Top Storylines In The Nhls Remaining 2024 25 Season

May 10, 2025 -

Investing Made Easy Jazz Cash And K Trade Revolutionize Stock Trading

May 10, 2025

Investing Made Easy Jazz Cash And K Trade Revolutionize Stock Trading

May 10, 2025 -

The China Factor How Market Shifts Affect Bmw Porsche And Other Automakers

May 10, 2025

The China Factor How Market Shifts Affect Bmw Porsche And Other Automakers

May 10, 2025