US Debt Ceiling Crisis: August Deadline Approaches

Table of Contents

Understanding the US Debt Ceiling

The US debt ceiling, also known as the debt limit, is the total amount of money the US government is legally allowed to borrow to meet its existing obligations. This isn't a limit on spending; rather, it's a limit on the government's ability to finance its already-authorized spending through borrowing. The national debt, on the other hand, represents the total accumulation of past borrowing. The debt ceiling and the national debt are distinct concepts; exceeding the debt ceiling doesn't automatically increase the national debt, but rather prevents the government from paying its bills.

The debt ceiling has been raised numerous times throughout history, usually without major incident. However, recent political gridlock has transformed these routine procedures into high-stakes showdowns with potentially severe economic consequences. The difference between the debt ceiling and the budget deficit is also crucial. The budget deficit is the difference between government spending and revenue in a given year. A persistent budget deficit contributes to the growth of the national debt, making debt ceiling increases necessary.

- Brief history of debt ceiling increases: The debt ceiling has been raised or suspended numerous times since its inception in 1917. Historically, these increases have been relatively routine, but recent years have witnessed heightened political tension.

- Key players involved in the negotiations: The primary players involved are the US Congress (House of Representatives and Senate) and the White House. Both Republican and Democrat lawmakers play a significant role in the negotiations, often resulting in significant political battles.

- Potential economic consequences of not raising the debt ceiling: Failure to raise the debt ceiling could result in a government default, leading to a credit downgrade, higher interest rates, economic recession, and widespread market volatility.

The August Deadline and its Implications

The looming August deadline adds significant urgency to the situation. Failure to reach an agreement by this point could lead to the US defaulting on its debt obligations – a scenario with potentially catastrophic consequences. A default could trigger a government shutdown, halting essential government services and causing significant disruption. Beyond the immediate implications, the uncertainty surrounding the debt ceiling debate is already impacting investor confidence and negatively affecting economic growth.

The political dynamics are extremely complex, with Republicans and Democrats holding differing views on spending and budget priorities. This political gridlock is further exacerbating the urgency of the situation.

- Specific dates and events leading to the deadline: The Treasury Department provides regular updates on its cash balances and the projected date when extraordinary measures may be exhausted. This date, currently estimated for August, marks the critical deadline for raising the debt ceiling.

- Potential impact on the US economy and global markets: A US default would likely cause significant turmoil in global financial markets, leading to a sharp decline in the value of the US dollar, higher interest rates, and a potential global recession.

- Potential social impacts: Delayed or halted government payments could severely impact various social programs, including Social Security and Medicare, affecting millions of Americans.

Potential Solutions and Negotiations

Several potential solutions are currently being debated, ranging from a simple increase in the debt ceiling to a broader budget compromise that involves spending cuts or tax increases. Bipartisan negotiations are crucial to finding a sustainable solution that avoids a catastrophic default. However, significant disagreements remain on spending levels, tax policies, and the overall approach to fiscal responsibility.

The feasibility of each solution hinges on political will and compromise. A simple debt ceiling increase would address the immediate crisis but not tackle the underlying issues of long-term debt sustainability. A comprehensive budget compromise, while more desirable in the long run, requires significant political cooperation and compromise.

- Summary of proposed solutions from different parties: Republican proposals often focus on spending cuts and fiscal restraint, while Democratic proposals typically involve a combination of spending increases and tax reforms.

- Analysis of the feasibility of each solution: The success of any solution depends largely on the willingness of both parties to negotiate and compromise. The narrow margins in Congress further complicate reaching a bipartisan agreement.

- Potential impact of different solutions on the economy and various demographics: Different solutions will have varying impacts on economic growth, inflation, and the distribution of income and wealth among different demographics.

The Impact on the Global Economy

The potential consequences of a US debt default extend far beyond the US borders. As the world's largest economy, the US plays a significant role in the global financial system. A US default could trigger a global recession, impacting international markets, and jeopardizing global economic stability.

- Impact on US dollar value: A US default would significantly weaken the US dollar, potentially making imports more expensive and exports cheaper.

- Impact on foreign investment and trade: Foreign investors might lose confidence in the US economy, potentially leading to capital flight and disruptions to international trade.

- Potential ripple effects in other countries: The economic shockwaves from a US default would reverberate throughout the global economy, particularly affecting countries with close economic ties to the US.

Avoiding a US Debt Ceiling Crisis: Looking Ahead

The US debt ceiling crisis presents a serious threat to the American and global economies. The August deadline demands immediate action. Failure to find a solution will have severe and long-lasting consequences. It’s crucial to stay informed about the ongoing negotiations and to contact your elected officials to urge them to prioritize finding a responsible and sustainable solution. Understanding the debt ceiling crisis and its potential impact is paramount to informed civic engagement. Avoiding a debt ceiling crisis requires immediate action and a commitment to responsible fiscal policy. The looming debt ceiling crisis demands our attention; the stakes are simply too high to ignore. Learn more about the debt ceiling crisis, and contact your representatives to make your voice heard and help shape the future.

Featured Posts

-

The Evolving Landscape Of The Chinese Auto Market Case Studies Of Bmw And Porsche

May 10, 2025

The Evolving Landscape Of The Chinese Auto Market Case Studies Of Bmw And Porsche

May 10, 2025 -

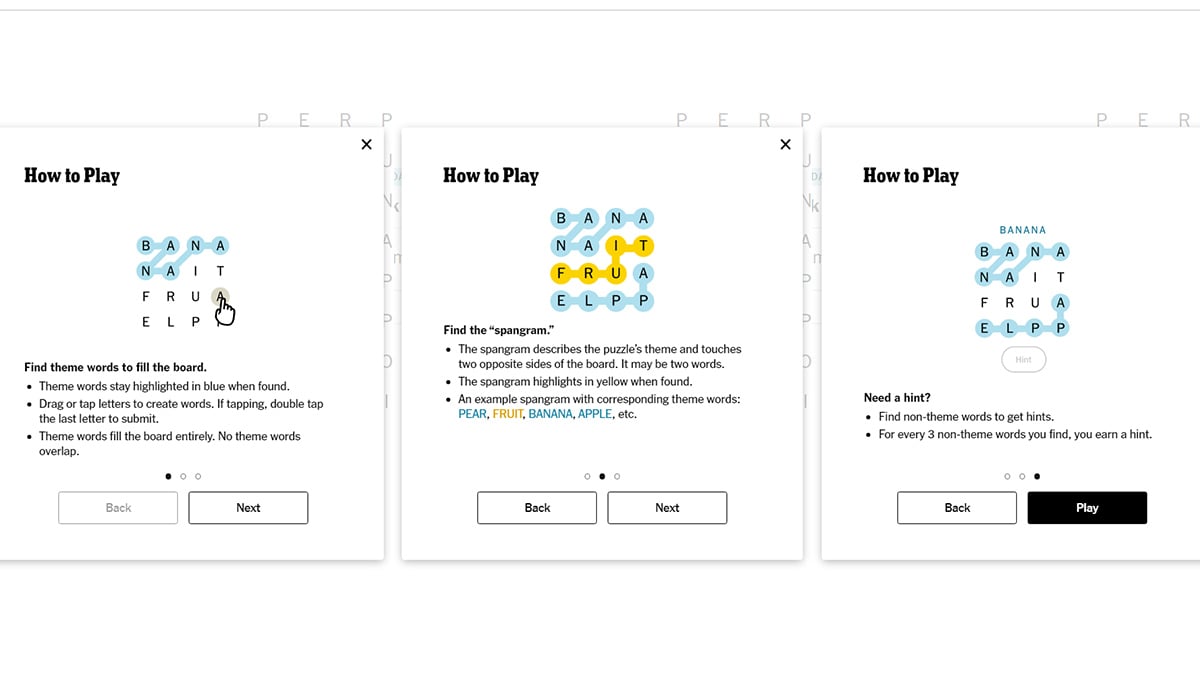

Strands Nyt April 12 2024 Complete Answers And Hints For Game 405

May 10, 2025

Strands Nyt April 12 2024 Complete Answers And Hints For Game 405

May 10, 2025 -

Regulatory Reform In Focus Indian Insurers And Bond Forwards

May 10, 2025

Regulatory Reform In Focus Indian Insurers And Bond Forwards

May 10, 2025 -

Complete Guide To Nyt Strands Game 349 February 15th

May 10, 2025

Complete Guide To Nyt Strands Game 349 February 15th

May 10, 2025 -

New Evidence Emerges In Wynne Evans Defence Following Strictly Allegations

May 10, 2025

New Evidence Emerges In Wynne Evans Defence Following Strictly Allegations

May 10, 2025