Should You Buy Palantir Stock Now? Investment Risks And Rewards

Table of Contents

Understanding Palantir's Business Model and Growth Potential

Palantir's success hinges on two core platforms: Gotham, catering primarily to government agencies, and Foundry, designed for commercial clients. These platforms provide sophisticated data integration and analytics capabilities, enabling organizations to extract actionable insights from vast datasets. Palantir's target markets are expansive, including government agencies focused on national security and intelligence, as well as large commercial enterprises across various sectors like finance, healthcare, and manufacturing.

Recent financial performance shows a trajectory of revenue growth, although profitability remains a key focus for the company. This growth is fueled by increasing demand for advanced data analytics solutions.

- Key Strengths of Palantir's Technology: Its platforms are renowned for their ability to handle complex, unstructured data, providing real-time insights and supporting critical decision-making.

- Potential for Expansion into New Markets: Palantir continues to explore new sectors and geographic regions, presenting significant growth opportunities.

- Competitive Advantages: Palantir’s proprietary technology, strong customer relationships, and deep expertise in data analytics provide a distinct competitive edge.

- Long-Term Growth Projections: While predictions vary, several reputable analysts foresee strong long-term growth for Palantir, driven by the ever-increasing importance of data analytics across industries. (Note: Always consult multiple reputable sources for financial projections.)

Assessing the Risks of Investing in Palantir Stock

Investing in Palantir stock, like any technology stock, carries inherent volatility. The company’s significant reliance on government contracts presents a key risk, as changes in government priorities or budget cuts could negatively impact revenue. Furthermore, the competitive landscape is fiercely competitive, with established players and emerging startups vying for market share.

Concerns around Palantir's valuation also exist. Some analysts argue that the current stock price may reflect overly optimistic growth expectations.

- Potential Risks Associated with Government Regulations: Changes in regulations could impact Palantir's ability to operate in certain markets.

- Risks Related to Data Security and Privacy: Handling sensitive data requires robust security measures, and any data breach could have severe consequences.

- Economic Factors: Economic downturns can reduce spending on data analytics solutions, impacting Palantir's growth.

- Potential for Decreased Profitability: Maintaining profitability while competing in a rapidly evolving market will be a constant challenge.

Evaluating the Rewards of Palantir Stock Investment

Despite the risks, investing in Palantir offers the potential for substantial long-term returns. The company's innovative technology has the potential to disrupt various industries, and its growing market share in the expanding data analytics sector is promising. Positive analyst ratings and predictions further support the potential for future growth.

- Potential for Significant Capital Appreciation: Successful execution of its business strategy could lead to significant increases in stock value.

- Opportunities for Dividend Payments: While not currently paying dividends, future profitability could lead to dividend distributions.

- Long-Term Growth Prospects: The increasing demand for data analytics across various sectors presents a significant growth catalyst for Palantir.

- Positive Industry Trends: The overall trend of digital transformation and increased data reliance fuels the growth of the data analytics market, benefiting Palantir.

Factors to Consider Before Buying Palantir Stock

Before making any investment decisions, remember to diversify your portfolio to mitigate risk. Conducting thorough due diligence is crucial. This involves researching Palantir's financial statements, understanding its business model, and evaluating its competitive landscape. Consulting a qualified financial advisor is strongly recommended. Your personal risk tolerance and investment timeline are critical factors.

- Steps Involved in Conducting Thorough Research: Analyze financial reports, read industry analyses, and assess competitive threats.

- Importance of Understanding Your Financial Goals: Ensure your investment aligns with your long-term financial objectives.

- Setting Realistic Expectations: Avoid chasing short-term gains; focus on long-term growth potential.

- Questions to Ask a Financial Advisor: Discuss your risk tolerance, investment goals, and suitability of Palantir stock within your overall portfolio.

Conclusion: Should You Buy Palantir Stock? A Final Verdict

The decision of whether to buy Palantir stock is complex, involving careful consideration of both its significant growth potential and substantial inherent risks. The company’s innovative technology and expanding market presence offer compelling reasons for investment, while its reliance on government contracts and competitive pressures pose considerable challenges. Ultimately, the decision of whether to buy Palantir stock, invest in Palantir, or make a Palantir stock purchase is a personal one. After carefully weighing the risks and rewards outlined above, and conducting your own thorough research, you can decide if a Palantir investment aligns with your financial goals. Remember to consult with a financial advisor before making any investment decisions.

Featured Posts

-

Elizabeth Arden Products Budget Friendly Options

May 09, 2025

Elizabeth Arden Products Budget Friendly Options

May 09, 2025 -

Whats App Privacy Concerns Examining Metas 168 Million Spyware Settlement

May 09, 2025

Whats App Privacy Concerns Examining Metas 168 Million Spyware Settlement

May 09, 2025 -

From Wolves To The Top Of Europe A Football Players Transformation

May 09, 2025

From Wolves To The Top Of Europe A Football Players Transformation

May 09, 2025 -

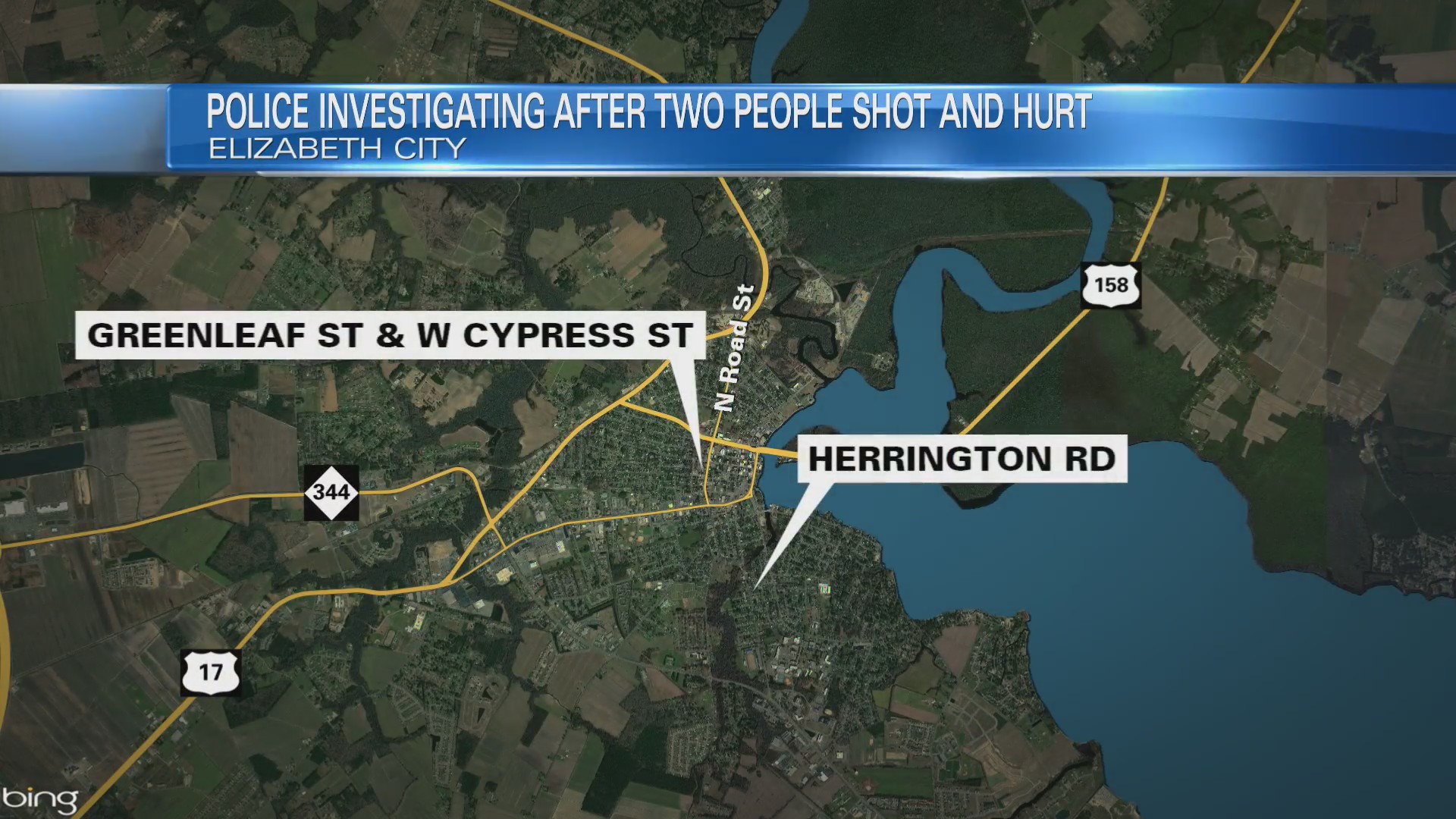

Police Make Arrest Following Weekend Shooting In Elizabeth City

May 09, 2025

Police Make Arrest Following Weekend Shooting In Elizabeth City

May 09, 2025 -

Should I Buy Palantir Stock Now A 2025 Growth Projection Analysis

May 09, 2025

Should I Buy Palantir Stock Now A 2025 Growth Projection Analysis

May 09, 2025