Should You Buy XRP (Ripple) Now? A Detailed Analysis Of Market Trends

Table of Contents

Current Market Conditions and XRP Price Analysis

Recent XRP Price Performance

XRP's price has shown considerable volatility in recent months. Analyzing its price history is crucial for understanding its current position.

- Price Trends: [Insert a chart showing XRP's price movement over the past year, highlighting highs, lows, and significant price changes]. For example, we can see a period of relative stability followed by a period of increased volatility. Specific data points should be included here (e.g., "XRP reached a high of $X on [Date] and a low of $Y on [Date]").

- News Impact: Significant news events, like court updates regarding the SEC lawsuit against Ripple, have historically impacted XRP's price dramatically. Positive news tends to lead to price increases, while negative news can trigger sharp declines. For instance, [mention specific news events and their impact on XRP price].

- Volatility: XRP's price volatility is higher than many other established cryptocurrencies. This high volatility presents both opportunities and risks for investors. Understanding this volatility is essential before investing in XRP.

Technical Analysis of XRP

Technical analysis uses chart patterns and indicators to predict future price movements. Analyzing XRP through this lens offers valuable insights.

- Moving Averages: [Insert a chart showing XRP's price with key moving averages, e.g., 50-day and 200-day]. The relationship between these moving averages can signal potential buying or selling opportunities. For example, a "golden cross" (50-day MA crossing above the 200-day MA) is often seen as a bullish signal.

- RSI (Relative Strength Index): The RSI helps gauge the momentum of price movements. [Insert a chart showing XRP's RSI]. An RSI above 70 suggests the asset might be overbought, while below 30 suggests it might be oversold.

- Chart Patterns: Identifying chart patterns like head and shoulders, double tops, or triangles can provide clues about potential future price direction. [Mention any relevant chart patterns observed in XRP's price chart].

Fundamental Analysis of Ripple

Fundamental analysis focuses on the underlying value of Ripple and its technology. This involves assessing:

- RippleNet: RippleNet is Ripple's global payment network, enabling fast and efficient cross-border transactions. Its adoption by financial institutions is a key factor influencing XRP's value.

- SEC Lawsuit: The ongoing SEC lawsuit against Ripple casts a shadow over XRP's future. A favorable ruling could significantly boost XRP's price, while an unfavorable one could have the opposite effect. The uncertainty surrounding this legal battle creates significant risk.

- Partnerships: Ripple has partnered with several financial institutions globally. The expansion of these partnerships enhances RippleNet's reach and could increase the demand for XRP.

Factors Influencing XRP's Future Price

Regulatory Landscape and its Impact on XRP

Regulatory clarity is paramount in the cryptocurrency market.

- SEC Lawsuit Outcome: The outcome of the SEC lawsuit is arguably the biggest factor affecting XRP's future. A positive outcome could remove much of the regulatory uncertainty currently weighing on the price.

- Global Regulation: The regulatory landscape for cryptocurrencies is evolving globally. Increased regulatory clarity in key markets could positively influence investor sentiment towards XRP.

- Investor Confidence: Regulatory uncertainty has a significant impact on investor confidence. Positive regulatory developments tend to improve investor confidence, while negative ones can lead to a sell-off.

Adoption and Use Cases of XRP

The adoption of XRP by financial institutions and its use in real-world applications are key determinants of its future value.

- Cross-Border Payments: XRP's speed and low transaction costs make it attractive for cross-border payments. Increased adoption by banks and payment processors could fuel significant demand.

- RippleNet Expansion: The expansion of RippleNet into new markets and the integration of new partners will directly impact XRP's adoption and its price.

- New Use Cases: The potential for XRP to be used in other applications beyond cross-border payments, such as decentralized finance (DeFi), could also influence its price.

Market Sentiment and Investor Confidence

Market sentiment plays a crucial role in shaping XRP's price.

- Social Media Sentiment: Analyzing social media sentiment towards XRP can provide insights into investor psychology.

- News Coverage: Positive news coverage tends to boost investor confidence, while negative news can lead to sell-offs.

- Expert Opinions: Opinions from prominent cryptocurrency analysts and investors can also influence market sentiment.

Risks Associated with Investing in XRP

Volatility and Market Risk

The cryptocurrency market is inherently volatile, and XRP is no exception.

- Price Swings: XRP's price can experience significant swings in short periods, potentially leading to substantial losses.

- Market Corrections: The cryptocurrency market is prone to corrections, where prices drop sharply. XRP is highly susceptible to these market corrections.

- Risk Tolerance: Investing in XRP requires a high-risk tolerance. Only invest what you can afford to lose.

Regulatory Uncertainty

The regulatory uncertainty surrounding XRP remains a major risk factor.

- SEC Lawsuit Uncertainty: The SEC lawsuit creates significant uncertainty about XRP's future regulatory status.

- Potential for Further Regulation: Future regulatory actions could negatively impact XRP's price and adoption.

Technological Risks

While Ripple's technology is generally considered robust, technological risks always exist.

- Security Vulnerabilities: Any security vulnerabilities within the Ripple network could negatively impact XRP's value.

- Technological Disruptions: Technological advancements could render Ripple's technology obsolete or less competitive.

Conclusion

This analysis has explored current market conditions, price trends, and factors influencing XRP's future price. We've also highlighted the significant risks associated with investing in XRP, particularly the regulatory uncertainty surrounding the SEC lawsuit. The outcome of this legal battle will likely be the single most important factor determining XRP's price in the coming months and years. Remember that thorough research and risk assessment are crucial before investing in any cryptocurrency.

Call to Action: Should you buy XRP now? The decision depends entirely on your individual risk tolerance and investment goals. This analysis provides a framework for your research, but you should conduct your own thorough investigation into XRP and the Ripple ecosystem before making any investment decisions related to XRP. Remember, only invest what you can afford to lose.

Featured Posts

-

Dwp Scrapping Two Benefits What You Need To Know

May 08, 2025

Dwp Scrapping Two Benefits What You Need To Know

May 08, 2025 -

Andor Season 2 A Guide To Everything You Need To Know Before Watching

May 08, 2025

Andor Season 2 A Guide To Everything You Need To Know Before Watching

May 08, 2025 -

Lahore Schools Adjust Timings For Psl Matches

May 08, 2025

Lahore Schools Adjust Timings For Psl Matches

May 08, 2025 -

The Long Walk Movie Stephen Kings Classic Brought To The Big Screen

May 08, 2025

The Long Walk Movie Stephen Kings Classic Brought To The Big Screen

May 08, 2025 -

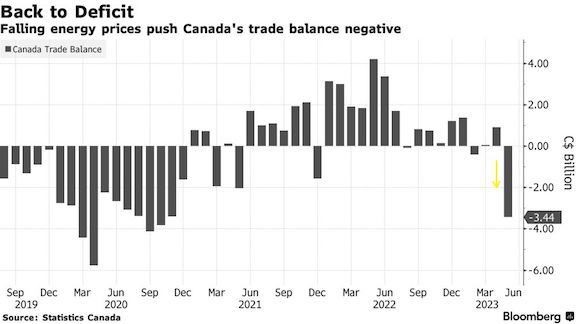

Canadas Trade Deficit A 506 Million Improvement With New Tariffs

May 08, 2025

Canadas Trade Deficit A 506 Million Improvement With New Tariffs

May 08, 2025