Should You Invest In D-Wave Quantum Inc. (QBTS) Now?

Table of Contents

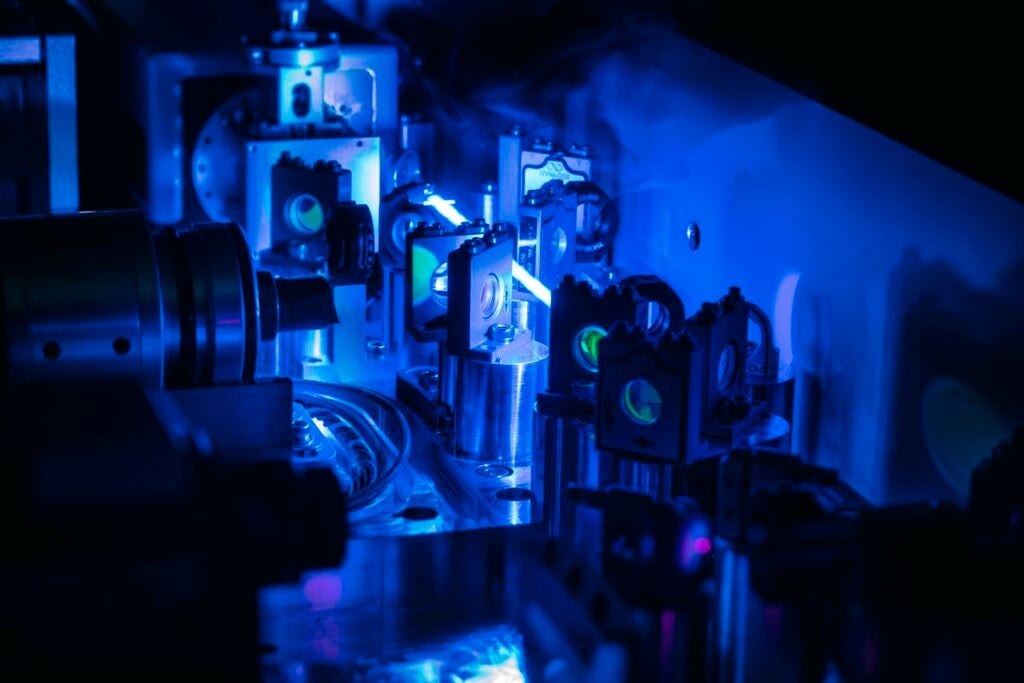

Understanding D-Wave Quantum Inc. (QBTS) and its Business Model

D-Wave Quantum Inc. (QBTS) is a publicly traded company specializing in quantum annealing, a unique approach to quantum computing. Unlike gate-based quantum computers pursued by companies like IBM and Google, D-Wave's systems are designed to solve specific optimization problems exceptionally quickly. Their target market includes organizations in fields like logistics, materials science, and finance, where complex optimization challenges abound. Current clients leverage D-Wave's quantum annealers via cloud access, generating revenue through subscription models and consulting services. While profitability remains a challenge for the company at this stage, revenue growth provides some indication of market traction. Key financial metrics, such as revenue growth rate, should be closely monitored by potential investors.

- Key partnerships and collaborations: D-Wave has established partnerships with leading research institutions and corporations, fostering innovation and market adoption.

- Recent technological advancements and breakthroughs: Ongoing developments in qubit count and system performance represent significant milestones for D-Wave's technology and its potential applications.

- Potential future applications of D-Wave's technology: The applications of D-Wave's quantum annealing technology extend far beyond current implementations, encompassing drug discovery, financial modeling, and artificial intelligence advancements.

Analyzing the Risks of Investing in QBTS

Investing in any quantum computing company, including D-Wave (QBTS), carries substantial risk. The technology is still nascent, and significant technological hurdles remain before widespread adoption. Market uncertainty is also a major concern; the quantum computing market is still developing, and the ultimate market size and adoption rate are unpredictable.

Financially, QBTS faces risks associated with its current stage of development. This includes potential for further dilution of existing shares through future funding rounds, as well as significant debt levels and the ongoing pursuit of profitability. The competitive landscape is fiercely contested. Established tech giants like IBM, Google, and Microsoft are aggressively pursuing their own quantum computing initiatives, posing a significant threat to D-Wave's market position.

- Specific financial risks for QBTS: Potential investors need to carefully analyze QBTS's financial statements, including revenue, expenses, and cash flow, to assess the company's financial health and sustainability.

- Competition from other quantum computing firms (e.g., IBM, Google): The intense competition from well-funded tech giants presents a major challenge for D-Wave's long-term success.

- Regulatory risks and potential government involvement: Government regulations and policies surrounding the development and deployment of quantum computing technologies could impact D-Wave's business.

Evaluating the Potential Rewards of Investing in QBTS

Despite the risks, the long-term potential of the quantum computing market is undeniable. Analysts project substantial growth, and D-Wave, as a pioneer in the field, is well-positioned to capture significant market share if it successfully overcomes technological and commercial challenges. Successful execution of its business strategy and technological breakthroughs could result in significant returns for investors. The potential market capitalization growth for QBTS could be substantial if the company achieves widespread adoption of its technology.

- Potential market capitalization growth for QBTS: This depends heavily on D-Wave's ability to deliver on its technological roadmap and capture market share.

- Projected future revenue growth based on industry forecasts: Analyzing industry projections and D-Wave's own forecasts will offer a perspective on its growth potential.

- Opportunities for disruptive innovation and market dominance: D-Wave’s unique approach to quantum computing offers the potential for significant market disruption.

Comparing QBTS to Other Quantum Computing Investments

Direct comparisons of QBTS to other publicly traded pure-play quantum computing companies are limited, as few exist. However, potential investors should consider comparing QBTS to other tech companies involved in related fields, such as those developing specialized hardware or software for quantum computing applications. This broader comparison allows for a more nuanced assessment of risk and reward.

- Key differentiators between QBTS and competitors: D-Wave's focus on quantum annealing distinguishes it from companies focusing on gate-based quantum computing.

- Risk/reward profiles of different quantum computing investments: A diversified portfolio approach may help mitigate risk.

- Diversification strategies for quantum computing portfolios: Investing in a range of quantum computing-related companies or broader tech indices can help spread risk.

Conclusion: Should You Invest in D-Wave Quantum Inc. (QBTS) Now? A Final Verdict

Investing in D-Wave Quantum (QBTS) presents a high-risk, high-reward proposition. While the potential for significant long-term returns is considerable, given the immense potential of quantum computing and D-Wave's pioneering role, the financial and technological risks are substantial. The competitive landscape is intense, and the company's financial performance needs to be carefully scrutinized.

While this article provides valuable insights into investing in D-Wave Quantum (QBTS), remember to perform your own comprehensive research and consult with a financial advisor before making any investment decisions related to D-Wave Quantum, QBTS, or the broader quantum computing market. Thorough due diligence is crucial before investing in any quantum computing stock, including D-Wave Quantum.

Featured Posts

-

Nyt Mini Crossword Answers March 13

May 20, 2025

Nyt Mini Crossword Answers March 13

May 20, 2025 -

Manchester United Transfer News World Class Striker Talks Intensify

May 20, 2025

Manchester United Transfer News World Class Striker Talks Intensify

May 20, 2025 -

Legal Action Big Bear Ai Bbai Investors Should Contact Gross Law Firm

May 20, 2025

Legal Action Big Bear Ai Bbai Investors Should Contact Gross Law Firm

May 20, 2025 -

Sharp Increase In V Mware Costs At And T On Broadcoms Acquisition

May 20, 2025

Sharp Increase In V Mware Costs At And T On Broadcoms Acquisition

May 20, 2025 -

Quantum Stocks Surge In 2025 Rigetti And Ion Q Lead The Charge

May 20, 2025

Quantum Stocks Surge In 2025 Rigetti And Ion Q Lead The Charge

May 20, 2025

Latest Posts

-

Sandylands U Tv Schedule Where And When To Watch

May 20, 2025

Sandylands U Tv Schedule Where And When To Watch

May 20, 2025 -

Watch Sandylands U Episode Guide And Air Dates

May 20, 2025

Watch Sandylands U Episode Guide And Air Dates

May 20, 2025 -

Find Sandylands U On Tv A Comprehensive Guide

May 20, 2025

Find Sandylands U On Tv A Comprehensive Guide

May 20, 2025 -

Matt Lucas And David Walliams Cliff Richard Musical The One Big Snag

May 20, 2025

Matt Lucas And David Walliams Cliff Richard Musical The One Big Snag

May 20, 2025 -

Sandylands U Tv Schedule Never Miss An Episode

May 20, 2025

Sandylands U Tv Schedule Never Miss An Episode

May 20, 2025