Should You Invest In Palantir Stock Before May 5th Earnings Report?

Table of Contents

Palantir's Recent Performance and Market Sentiment

Before considering a Palantir stock investment before the earnings report, it's crucial to understand the company's recent performance and the overall market sentiment. Recent stock price movements, trading volume, and analyst ratings all paint a picture of investor confidence (or lack thereof).

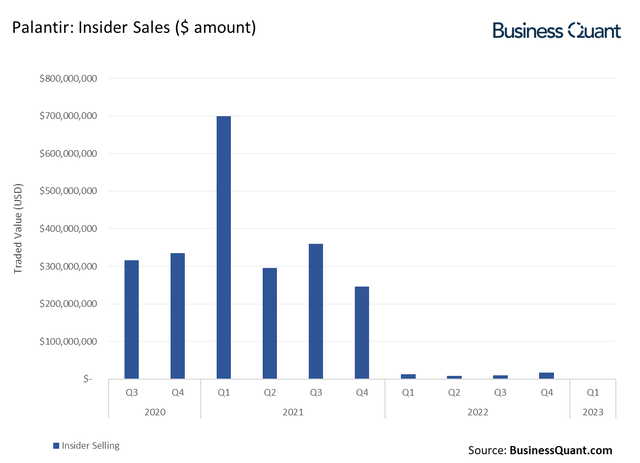

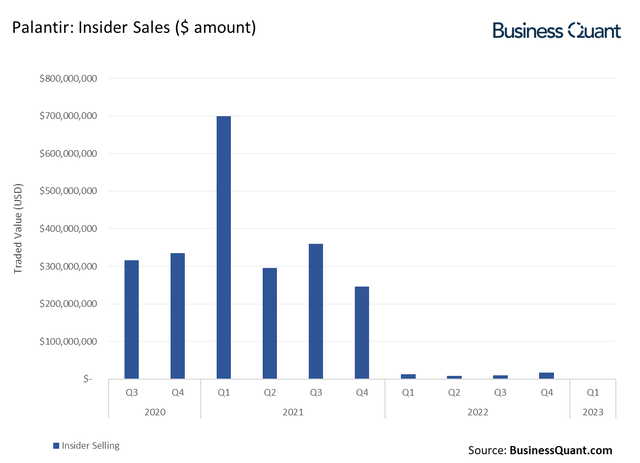

Analyzing the recent trading activity of PLTR reveals significant volatility. Large swings in daily price changes are common, indicating a stock sensitive to news and market sentiment. Examining the trading volume provides insight into the level of investor interest and potential for further price fluctuations.

Analyst ratings and price targets offer another perspective. While some analysts maintain bullish outlooks and high price targets for Palantir stock, predicting future price movements is speculative at best. Other analysts might express more cautious views, citing concerns about factors like competition and profitability.

The overall market sentiment toward Palantir and the broader tech sector is also a critical factor. Negative sentiment in the tech sector as a whole can negatively impact even well-performing stocks like Palantir.

- Recent contract wins and losses: Significant new contracts, especially with government agencies, can boost investor confidence and drive up the Palantir stock price. Conversely, contract losses can negatively affect the stock.

- Impact of geopolitical events: Palantir's business, particularly its government contracts, can be affected by geopolitical instability and international relations. Understanding these external factors is vital.

- Comparison to competitor stock performance: Comparing Palantir's performance to competitors like Snowflake (SNOW) and Datadog (DDOG) helps assess its relative strength and potential for future growth.

Analyzing Palantir's Expected Earnings Report (May 5th)

The May 5th earnings report will be a pivotal moment for Palantir investors. Investors will be keenly focused on several key performance indicators (KPIs) to gauge the company's financial health and future prospects.

Key Metrics to Watch:

- Revenue Growth: Sustained and accelerating revenue growth is crucial for justifying Palantir's valuation. A slowdown in revenue growth could lead to a sell-off.

- Profitability: Investors will be looking for signs of improving profitability, such as increasing margins and reduced operating expenses. Recurring revenue and improved margins are important indicators of long-term sustainability.

- Customer Acquisition: The rate at which Palantir acquires new customers, particularly in the commercial sector, is a key indicator of future growth potential.

Potential Surprises:

The earnings report could contain both upside and downside surprises. Positive surprises, such as exceeding revenue expectations or announcing significant new contracts, could send the Palantir stock price soaring. Conversely, disappointing results could trigger a sharp decline. The guidance provided for future quarters will be equally important, setting investor expectations for the coming months.

- Potential impact of new product launches: The success of any new product launches will significantly impact revenue growth and investor sentiment.

- Expected growth in government and commercial sectors: Analyzing the growth in both government and commercial sectors is crucial, as it provides a balanced view of Palantir’s overall market penetration and diversification.

- Analysis of operating expenses and margins: Efficient management of operating expenses and improvement in profit margins are key indicators of a financially healthy company.

Risks and Rewards of Investing in Palantir Stock Before Earnings

Investing in Palantir stock before the earnings report presents both significant risks and potential rewards. The high growth potential is tempting, but the associated volatility demands careful consideration.

Potential Risks:

- Volatility: Palantir stock is known for its volatility, meaning its price can fluctuate significantly in short periods. This can lead to significant losses if the market reacts negatively to the earnings report.

- Disappointing Earnings: A disappointing earnings report could trigger a sharp decline in the stock price, potentially wiping out significant investments.

- Market Sentiment: Negative overall market sentiment can amplify the impact of a negative earnings report.

Potential Rewards:

-

Positive Earnings Surprise: A positive earnings surprise could lead to a significant increase in the stock price, generating substantial gains for investors.

-

Long-Term Growth: Palantir operates in a rapidly growing market, offering the potential for long-term growth and returns, although not guaranteed.

-

Volatility associated with high-growth tech stocks: High-growth tech stocks are often more volatile than established companies.

-

Potential for significant price drops following a disappointing earnings report: Be prepared for potential losses if the earnings miss expectations.

-

Opportunities for significant gains if the earnings report is positive: A positive report could result in a considerable increase in stock price.

-

Diversification strategies to mitigate risk: Diversifying your portfolio can help reduce the overall risk associated with investing in a volatile stock like Palantir.

Alternative Investment Strategies

If the risk associated with investing in Palantir stock before earnings seems too high, several alternative investment strategies exist.

-

Similar Tech Stocks: Explore other tech stocks with similar growth potential but potentially lower volatility. A more established company in the data analytics sector may offer a less risky investment opportunity.

-

Diversification: Diversifying your investment portfolio across different sectors can help mitigate risk. Don't put all your eggs in one basket.

-

Index Funds and ETFs: Index funds and ETFs provide broader market exposure, reducing your reliance on a single stock’s performance. They offer diversification and typically lower volatility.

-

Comparison of similar tech stocks with less volatility: Research other companies in related fields offering similar growth prospects with potentially less risk.

-

Strategies for diversifying investments across different sectors: Spreading your investments reduces the impact of any single investment performing poorly.

-

Discussion of index funds and ETFs as a less risky alternative: Index funds and ETFs offer diversification and potentially lower volatility.

Conclusion: Making Informed Palantir Stock Investment Decisions

Deciding whether to invest in Palantir stock before the May 5th earnings report is a complex decision. The potential for substantial rewards exists, but so does the potential for equally substantial losses. Thoroughly analyze the information presented here, conduct your own research using reliable sources, and consider your individual risk tolerance before making any investment decisions regarding Palantir stock. Remember to only invest what you can afford to lose. Carefully assess your investment goals and risk tolerance before making a Palantir stock investment or any other investment decision.

Featured Posts

-

Discover The Elizabeth Stewart And Lilysilk Spring Capsule Collection

May 10, 2025

Discover The Elizabeth Stewart And Lilysilk Spring Capsule Collection

May 10, 2025 -

Implantation D Un Vignoble De 2500 M A Dijon Secteur Des Valendons

May 10, 2025

Implantation D Un Vignoble De 2500 M A Dijon Secteur Des Valendons

May 10, 2025 -

The Real Safe Bet Investing Strategies For Secure Returns

May 10, 2025

The Real Safe Bet Investing Strategies For Secure Returns

May 10, 2025 -

Us Debt Limit August Deadline And Potential Economic Consequences

May 10, 2025

Us Debt Limit August Deadline And Potential Economic Consequences

May 10, 2025 -

Palantir Stock Forecast 2025 Is A 40 Gain Realistic Investment Analysis

May 10, 2025

Palantir Stock Forecast 2025 Is A 40 Gain Realistic Investment Analysis

May 10, 2025