US Debt Limit: August Deadline And Potential Economic Consequences

Table of Contents

Understanding the US Debt Limit

What is the Debt Ceiling?

The debt ceiling, also known as the debt limit, is a legal limit on the total amount of money that the U.S. government can borrow to meet its existing legal obligations. It's not a limit on spending; rather, it's a limit on how the government finances its already-authorized spending. This limit was established to control government spending and debt, requiring Congress to approve any increase. Historically, Congress has routinely raised or suspended the debt ceiling to avoid default, but these debates have become increasingly contentious in recent years.

- Definition: The debt ceiling is a legislated limit on the amount of national debt the U.S. Treasury can incur.

- Role in Spending: It doesn't limit new spending, but it dictates how the government pays for spending that's already been authorized by Congress.

- Past Debates: Past debt ceiling debates have often resulted in brinkmanship and temporary solutions, highlighting the political challenges involved in managing the nation's finances.

The August Deadline and its Significance

While the exact date is subject to change based on political negotiations, the US is rapidly approaching a critical timeframe around August where the debt ceiling could be reached. This deadline is crucial because if Congress fails to act by then, the Treasury may run out of resources to pay all its obligations.

- Urgency: The situation is extremely urgent, leaving little room for delay. A failure to act could have catastrophic repercussions.

- Consequences of Missing the Deadline: Failing to raise the debt ceiling could lead to a default on US Treasury obligations, with far-reaching economic consequences.

- Political Implications: The debt ceiling debate is highly politicized, often mirroring broader disagreements on government spending and fiscal policy.

Potential Economic Consequences of Reaching the Debt Limit

Government Shutdown

Reaching the debt limit without Congressional action could result in a partial or even a complete government shutdown. This means that non-essential government services would be temporarily suspended.

- Affected Services: National parks could close, passport processing could be delayed, and some social security payments might be interrupted.

- Impact on Employees: Government employees might face furloughs or delayed paychecks.

- Ripple Effect: A shutdown would disrupt the economy, impacting businesses and consumers dependent on government services and contracts.

Credit Rating Downgrade

A failure to raise the debt ceiling could trigger a downgrade in the US credit rating. This would significantly impact the US's borrowing costs.

- Impact on Interest Rates: Higher interest rates would make it more expensive for the government to borrow money, increasing the national debt burden.

- Borrowing Costs: This would also increase borrowing costs for businesses and individuals, potentially slowing economic growth.

- Investor Uncertainty: A downgrade would create uncertainty in financial markets, potentially leading to increased volatility and decreased investment.

Market Volatility and Recessionary Risks

The uncertainty surrounding the debt ceiling could lead to significant market volatility and increase the risk of a recession.

- Market Instability: Investors may lose confidence in the US economy, leading to stock market declines and other forms of market instability.

- Decreased Consumer Confidence: Uncertainty about the future could lead to decreased consumer spending, further slowing economic growth.

- Increased Unemployment: A recession could result in job losses and increased unemployment.

- Global Repercussions: A US default would have severe global repercussions, impacting international trade and financial markets.

Potential Solutions and Political Implications

Raising the Debt Ceiling

The most straightforward solution is to raise the debt ceiling, allowing the government to continue meeting its financial obligations. However, this process is often fraught with political challenges.

- Bipartisan Cooperation: Raising the debt ceiling typically requires bipartisan cooperation in Congress, which can be difficult to achieve, especially in a politically divided climate.

- Role of Congress: Both the House and Senate must approve any legislation to raise the debt ceiling.

- Political Factions: Different political factions hold varying views on government spending and fiscal policy, making consensus difficult.

Short-Term vs. Long-Term Solutions

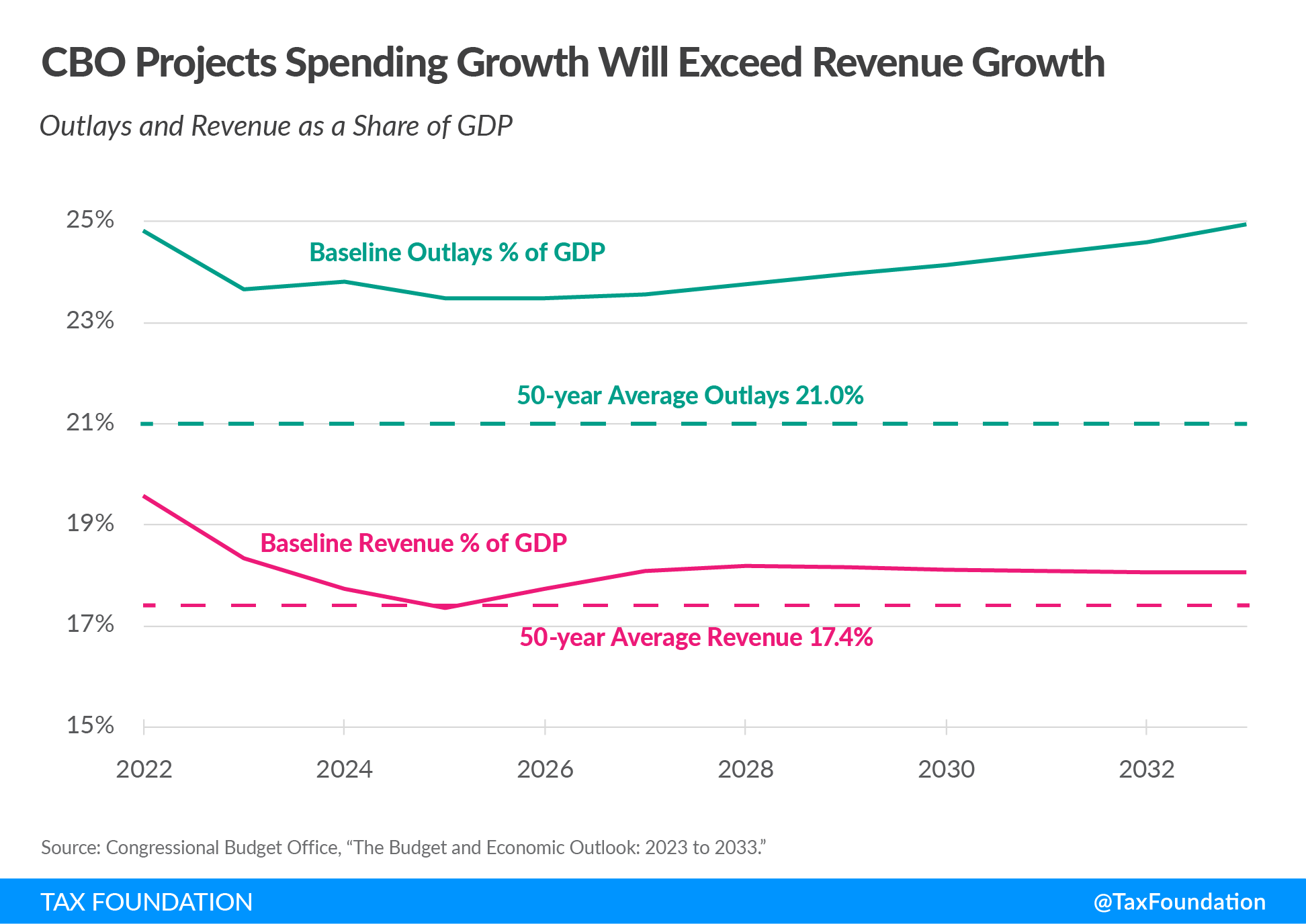

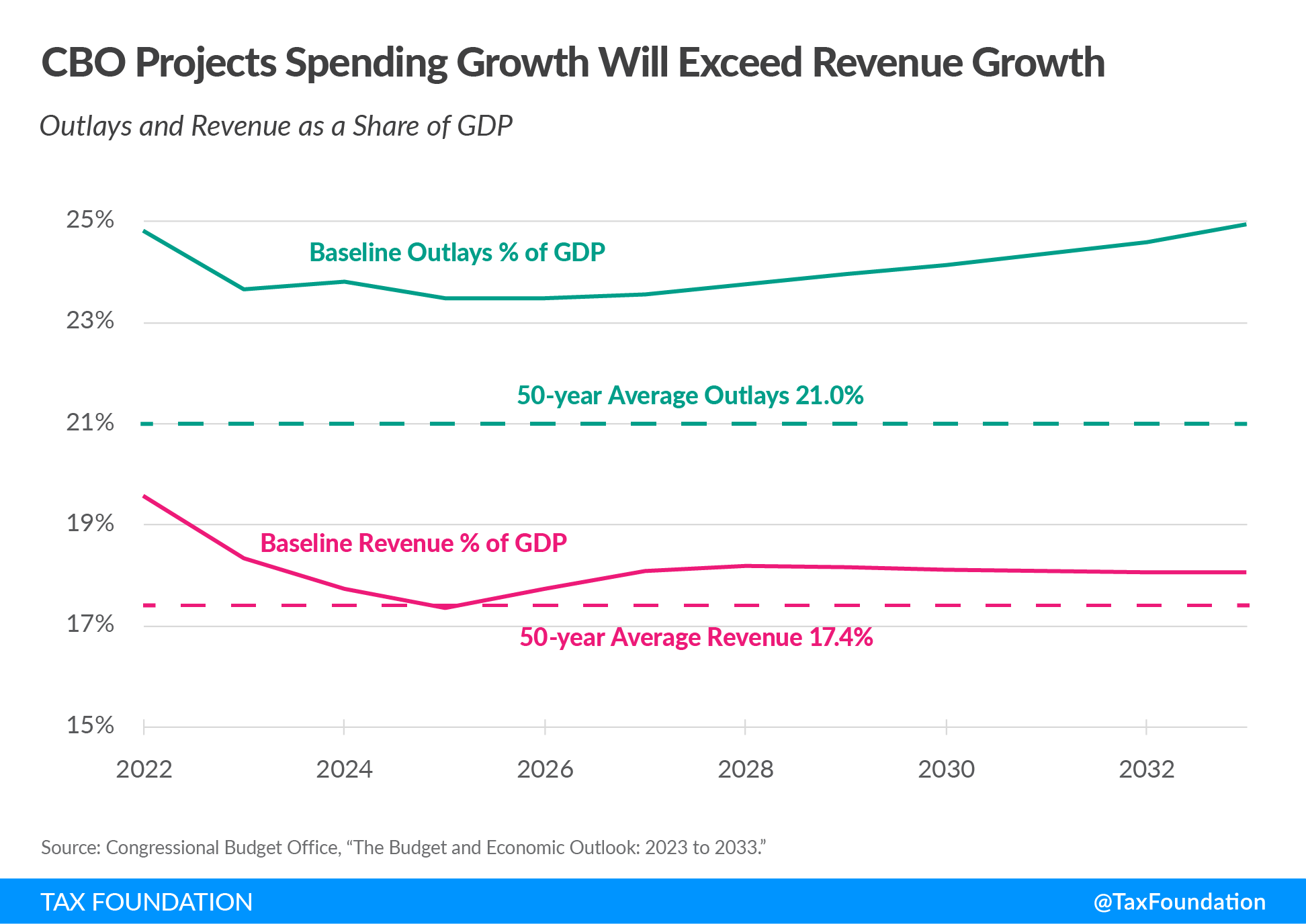

There are arguments for both short-term and long-term solutions. Short-term solutions might provide temporary relief, but they don't address the underlying issues of government spending and revenue. Long-term solutions require a more comprehensive approach to fiscal policy.

- Short-Term Fixes: These might involve temporarily suspending the debt ceiling or raising it by a smaller amount, delaying the problem but not resolving it.

- Long-Term Strategies: These involve implementing measures to control government spending, increase revenue, or both, promoting sustainable fiscal responsibility.

Conclusion

The looming August deadline for the US debt limit presents a serious threat to the US and global economies. Failure to act could lead to a government shutdown, credit rating downgrade, market volatility, and even a recession. Understanding the US debt limit crisis is crucial for every citizen. While raising the debt ceiling is the most immediate solution, long-term strategies for fiscal responsibility are equally vital. The political hurdles involved highlight the need for bipartisan cooperation and responsible fiscal planning.

Call to Action: Learn more about the US debt limit crisis, stay updated on the latest developments regarding the US debt ceiling, and urge your representatives to act responsibly on the US debt limit. Contact your elected officials to express your concerns and advocate for a responsible solution to this critical issue.

Featured Posts

-

Sea Level Rise Preparing Coastal Areas For A Changing Climate

May 10, 2025

Sea Level Rise Preparing Coastal Areas For A Changing Climate

May 10, 2025 -

Netflix Gotvi Rimeyk Na Kultov Roman Na Stivn King

May 10, 2025

Netflix Gotvi Rimeyk Na Kultov Roman Na Stivn King

May 10, 2025 -

The Evolution Of Psg Luis Enriques Winning Approach

May 10, 2025

The Evolution Of Psg Luis Enriques Winning Approach

May 10, 2025 -

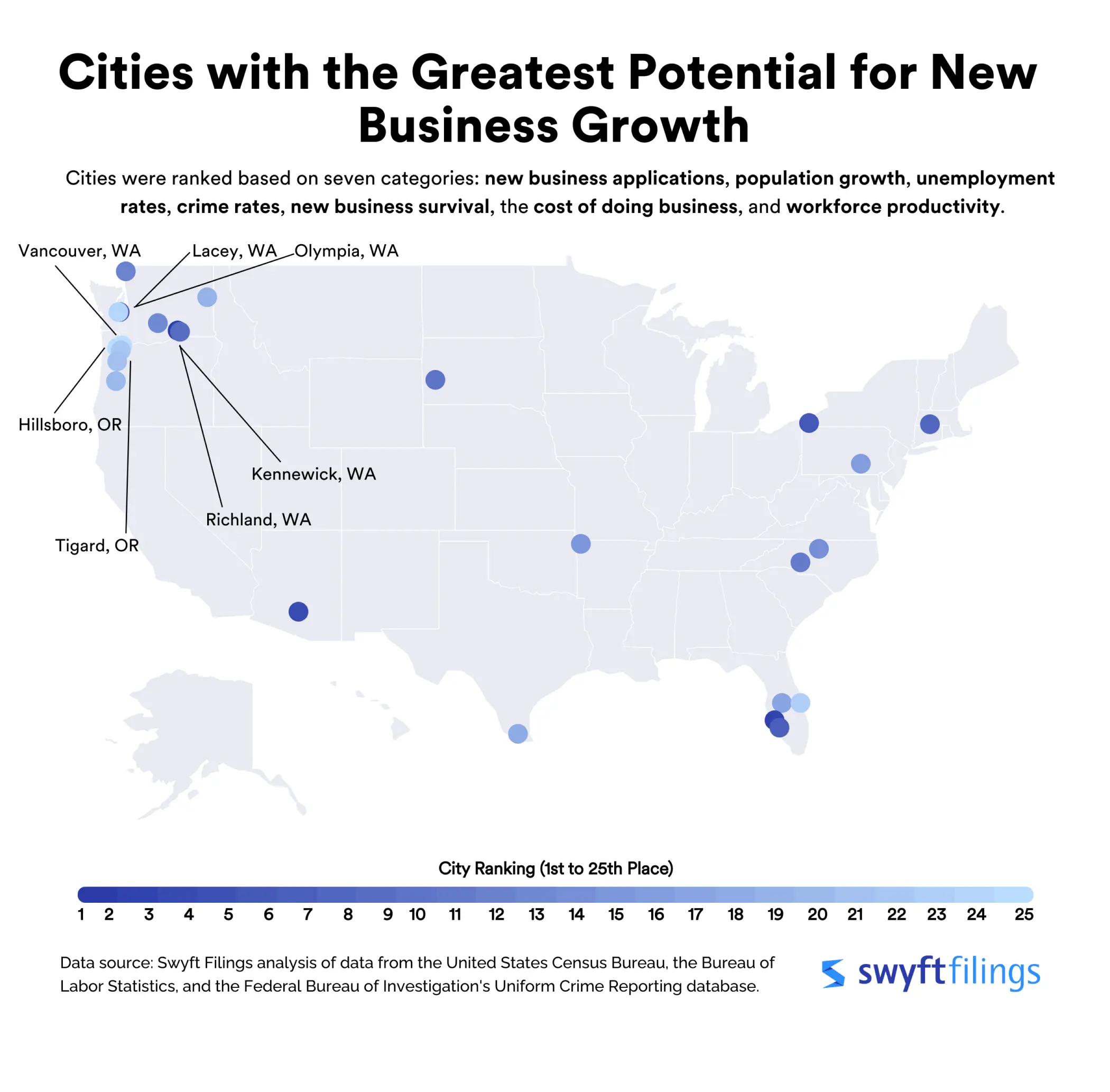

Understanding The Growth Of New Business Hot Spots Nationwide

May 10, 2025

Understanding The Growth Of New Business Hot Spots Nationwide

May 10, 2025 -

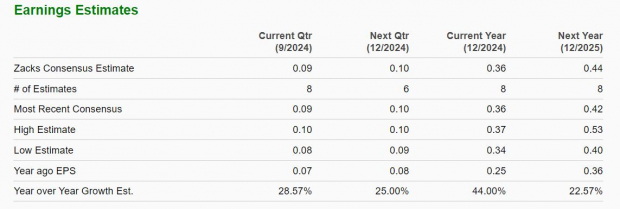

Should You Buy Palantir Stock Before May 5th A Prudent Investors Guide

May 10, 2025

Should You Buy Palantir Stock Before May 5th A Prudent Investors Guide

May 10, 2025