Significant Drop In Amsterdam Stock Exchange: AEX Index Below 4%

Table of Contents

Causes of the AEX Index Decline

Several intertwined factors have contributed to the recent decline of the AEX Index. Understanding these root causes is crucial for navigating the current market volatility.

Global Economic Uncertainty

The global economic landscape is currently characterized by significant uncertainty. High inflation rates in many developed nations, coupled with aggressive interest rate hikes by central banks to combat inflation, are dampening economic growth and impacting investor confidence worldwide. Geopolitical tensions, such as the ongoing war in Ukraine, further exacerbate this uncertainty, creating a ripple effect across global markets, including the AEX Index.

- Examples of global events impacting the Dutch market: The war in Ukraine, impacting energy prices and supply chains; rising interest rates in the US affecting global investment flows; persistent inflation in the Eurozone reducing consumer spending.

- Data points: Compared to the same period last year, the AEX Index has fallen by X%, while the S&P 500 has fallen by Y%. This highlights the significant impact of global economic headwinds on the Dutch market.

Performance of Specific Sectors

The decline in the AEX Index isn't uniform across all sectors. Certain industries are experiencing more pronounced downturns than others. This uneven performance reflects the unique vulnerabilities of specific sectors to the current economic climate.

- Examples of underperforming sectors: The technology sector, highly sensitive to interest rate hikes, has seen substantial declines; the energy sector, impacted by volatile energy prices and geopolitical uncertainty, also underperformed; the financial sector faces challenges related to credit risk and reduced economic activity.

- Data to support claims: Company X, a leading technology firm listed on the AEX, saw its stock price decline by Z% in the last month. This mirrors the broader trend of underperformance within the technology sector.

Investor Sentiment and Market Volatility

Negative investor sentiment and increased market volatility play a crucial role in the AEX Index's fall. Fear and uncertainty are driving investors to move away from riskier assets, leading to a sell-off in the stock market.

- Explain the psychological factors influencing investor decisions: Fear of further economic slowdown, uncertainty regarding future earnings, and the herd mentality contributing to panic selling are key psychological factors at play.

- Mention technical indicators or trading patterns: Increased trading volume alongside a sharp decline in the AEX Index suggests significant market nervousness. Technical indicators like the Relative Strength Index (RSI) may show the market is oversold, hinting at a potential bounce-back, but this is not guaranteed.

- Include data on trading volume and market volatility: Trading volume on the Amsterdam Stock Exchange has increased by W% in recent weeks, indicating elevated market activity driven by uncertainty.

Implications for Investors

The AEX Index's decline has significant implications for investors, both in the short-term and the long-term.

Short-Term Impact

The short-term impact for investors holding AEX-listed stocks is primarily characterized by potential losses. Portfolio diversification, while offering protection against significant downturns in specific sectors, hasn't completely insulated investors from the overall market decline.

- Discuss potential losses: Depending on the specific investments, investors may experience losses ranging from minor adjustments to significant reductions in portfolio value.

- The impact on portfolio diversification: While diversification helps to mitigate risk, it doesn't eliminate it. The current market downturn affects diverse portfolios to varying degrees.

- Hedging strategies: Investors may consider hedging strategies, such as options or short selling, to mitigate potential further losses. However, these strategies carry their own risks and should be employed cautiously.

- Advice for investors reacting to the short-term volatility: Avoid panic selling and instead focus on a long-term investment strategy. Reassess your risk tolerance and adjust your portfolio accordingly.

Long-Term Outlook

While the short-term outlook may be uncertain, the long-term implications for the AEX Index depend on several factors, including the overall recovery of the global economy and the performance of individual companies listed on the exchange.

- Discuss opportunities for long-term investors: The current decline presents buying opportunities for long-term investors willing to take calculated risks. Companies with strong fundamentals may see their stock prices recover once the global economic situation stabilizes.

- Potential recovery scenarios: The AEX Index's recovery depends on factors like inflation control, easing geopolitical tensions, and corporate earnings growth.

- Risk assessment: Long-term investors should carefully assess their risk tolerance and diversify their portfolios to minimize potential losses. Regularly review and adjust your investment strategy as needed.

- Consider factors influencing long-term growth prospects of the Dutch economy: The long-term outlook for the AEX Index is intricately linked to the overall health of the Dutch economy and its ability to adapt to global challenges.

Potential Recovery Strategies & Future Predictions

Several factors could influence the AEX Index's potential recovery.

Governmental and Central Bank Actions

Governmental interventions and central bank policies can play a crucial role in stimulating economic growth and stabilizing the AEX Index.

- Examples of policy changes: Fiscal stimulus packages, tax cuts, or infrastructure investments could boost economic activity and investor confidence.

- Monetary policy adjustments: Central banks may adjust interest rates or implement quantitative easing programs to manage inflation and stimulate economic growth.

- Mention the potential effectiveness of these strategies: The effectiveness of these strategies depends on several factors and their timely implementation.

Market Analysts' Predictions

Market analysts offer varied predictions about the future trajectory of the AEX Index, reflecting the inherent uncertainty of market forecasting.

- Present diverse opinions and provide sources for predictions: Some analysts predict a gradual recovery, while others foresee further short-term declines before a rebound. Always consult multiple reputable sources before making investment decisions.

- Emphasize the uncertainty inherent in market predictions: Market forecasts are not guarantees; they should be considered alongside your own due diligence and risk tolerance.

Conclusion

The significant drop in the AEX Index below 4% is a result of several interconnected factors, including global economic uncertainty, weak performance in specific sectors, and negative investor sentiment. This decline carries both short-term and long-term implications for investors, requiring careful consideration of risk and the implementation of appropriate strategies. Governmental actions and central bank policies will influence the potential recovery, and while market analysts offer varied predictions, navigating this volatility requires a robust understanding of the AEX Index and its underlying factors.

Call to Action: Stay informed about the fluctuations of the AEX Index and monitor the performance of your investments closely. Regularly review your portfolio and consider seeking professional financial advice to navigate the complexities of the market and effectively manage your investments during periods of AEX Index volatility. For more insights into the AEX Index and related market trends, continue following our updates.

Featured Posts

-

M6 Crash Live Updates And Traffic Delays

May 24, 2025

M6 Crash Live Updates And Traffic Delays

May 24, 2025 -

Mia Farrows Comeback Is Ronan Farrow The Key

May 24, 2025

Mia Farrows Comeback Is Ronan Farrow The Key

May 24, 2025 -

Nasledie Nashego Pokoleniya Chto My Ostavim Buduschim Pokoleniyam

May 24, 2025

Nasledie Nashego Pokoleniya Chto My Ostavim Buduschim Pokoleniyam

May 24, 2025 -

Escape To The Country Overcoming Challenges And Enjoying The Rewards

May 24, 2025

Escape To The Country Overcoming Challenges And Enjoying The Rewards

May 24, 2025 -

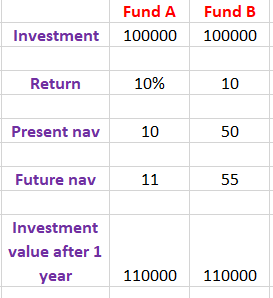

Tracking The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

Tracking The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

Latest Posts

-

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 24, 2025

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 24, 2025 -

Actress Mia Farrow Trump Should Face Charges For Venezuela Deportation Policy

May 24, 2025

Actress Mia Farrow Trump Should Face Charges For Venezuela Deportation Policy

May 24, 2025 -

Farrow Seeks Trumps Imprisonment Following Venezuelan Deportation Controversy

May 24, 2025

Farrow Seeks Trumps Imprisonment Following Venezuelan Deportation Controversy

May 24, 2025 -

Mia Farrows Plea Imprison Trump For Venezuelan Deportation Policy

May 24, 2025

Mia Farrows Plea Imprison Trump For Venezuelan Deportation Policy

May 24, 2025 -

The Four Women Who Married Frank Sinatra Their Stories And Impact

May 24, 2025

The Four Women Who Married Frank Sinatra Their Stories And Impact

May 24, 2025