Tracking The Net Asset Value (NAV) Of The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

Where to Find the Amundi Dow Jones Industrial Average UCITS ETF NAV

Accurate and up-to-date NAV information is vital. Here's where you can find the Amundi Dow Jones Industrial Average UCITS ETF NAV:

Official Sources

The most reliable source for the Amundi Dow Jones Industrial Average UCITS ETF NAV is the official Amundi website. Always prioritize official sources to avoid misinformation. Look for the NAV data within these sections of the Amundi website (specific locations may vary slightly depending on website updates):

- Fund Fact Sheet: These documents usually provide the most recent NAV, often updated daily.

- Fund Performance Page: Amundi's dedicated performance pages often display historical and current NAV data for their ETFs.

- Investor Relations Section: This section might contain more detailed financial information, including the NAV.

Brokerage Platforms and Trading Apps

Most brokerage accounts and trading platforms (where you likely purchased the ETF) will show the Amundi Dow Jones Industrial Average UCITS ETF NAV alongside its current market price. Popular platforms such as:

- Interactive Brokers: Displays NAV alongside market data within the trade ticket and portfolio view.

- Fidelity: Provides NAV information on the ETF's details page within your account.

- Schwab: Shows NAV and market price within your portfolio and research tools.

Remember that there might be minor discrepancies between the NAV reported on your brokerage platform and the official Amundi website due to reporting lags.

Financial News Websites and Data Providers

Reputable financial websites like Yahoo Finance, Google Finance, and Bloomberg often provide ETF NAV information, including data for the Amundi Dow Jones Industrial Average UCITS ETF. However, always double-check the data against official Amundi sources. Dedicated financial data providers such as Refinitiv and FactSet offer even more comprehensive data, but usually require subscriptions. Ensure consistency across sources to verify accuracy.

Understanding the Factors Affecting Amundi Dow Jones Industrial Average UCITS ETF NAV

Several factors influence the Amundi Dow Jones Industrial Average UCITS ETF NAV. Understanding these is key to interpreting its fluctuations:

Underlying Asset Performance

The Amundi Dow Jones Industrial Average UCITS ETF tracks the Dow Jones Industrial Average. Therefore, the performance of the 30 constituent companies directly affects the ETF's NAV. If the Dow Jones Industrial Average rises, so will the ETF's NAV, and vice-versa. This reflects the index tracking nature of the ETF.

Currency Fluctuations

If you're invested in the Amundi Dow Jones Industrial Average UCITS ETF in a currency different from the ETF's base currency (e.g., investing in a USD-denominated ETF while your base currency is EUR), currency exchange rates will influence the NAV you see in your local currency. A strengthening USD against the EUR would increase the NAV displayed in EUR.

Expenses and Fees

Management fees and other operational expenses associated with the ETF will gradually reduce the NAV over time. This is reflected in the expense ratio. A higher expense ratio will lead to a slightly lower NAV compared to an ETF with a lower expense ratio over the long term.

Strategies for Efficiently Tracking Amundi Dow Jones Industrial Average UCITS ETF NAV

Setting Up Automated Alerts

Many brokerage platforms and financial websites allow you to set up price alerts. Utilize this feature to receive notifications when the Amundi Dow Jones Industrial Average UCITS ETF NAV reaches specific thresholds (e.g., a significant increase or decrease).

Utilizing Spreadsheet Software or Financial Tracking Tools

Employ spreadsheet software like Microsoft Excel or dedicated portfolio tracking tools to monitor the Amundi Dow Jones Industrial Average UCITS ETF NAV over time. Some platforms offer automated data downloads, simplifying the tracking process.

Regularly Reviewing Performance Reports

Regularly review the Amundi Dow Jones Industrial Average UCITS ETF's periodic reports (annual reports, fact sheets, etc.) for detailed NAV information, performance analysis, and other valuable insights.

Conclusion: Mastering Amundi Dow Jones Industrial Average UCITS ETF NAV Tracking

Tracking the Amundi Dow Jones Industrial Average UCITS ETF NAV effectively involves utilizing official sources, understanding the influencing factors, and employing efficient tracking strategies. Remember to always prioritize reliable data sources like the official Amundi website and to be aware of potential discrepancies between sources. By mastering Amundi Dow Jones Industrial Average UCITS ETF NAV tracking and regularly monitoring its performance, you can make more informed decisions regarding your investment. Start tracking your Amundi ETF NAV today for a more confident investment strategy and monitor your Amundi Dow Jones Industrial Average UCITS ETF NAV for optimal portfolio management. Efficient NAV tracking is key to successful investing!

Featured Posts

-

Escape To The Country Weighing The Pros And Cons Of Rural Living

May 24, 2025

Escape To The Country Weighing The Pros And Cons Of Rural Living

May 24, 2025 -

Stock Market In Amsterdam Suffers 7 Drop Trade War Uncertainty Creates Panic

May 24, 2025

Stock Market In Amsterdam Suffers 7 Drop Trade War Uncertainty Creates Panic

May 24, 2025 -

One Womans Pandemic Journey The Importance Of Green Spaces In Seattle

May 24, 2025

One Womans Pandemic Journey The Importance Of Green Spaces In Seattle

May 24, 2025 -

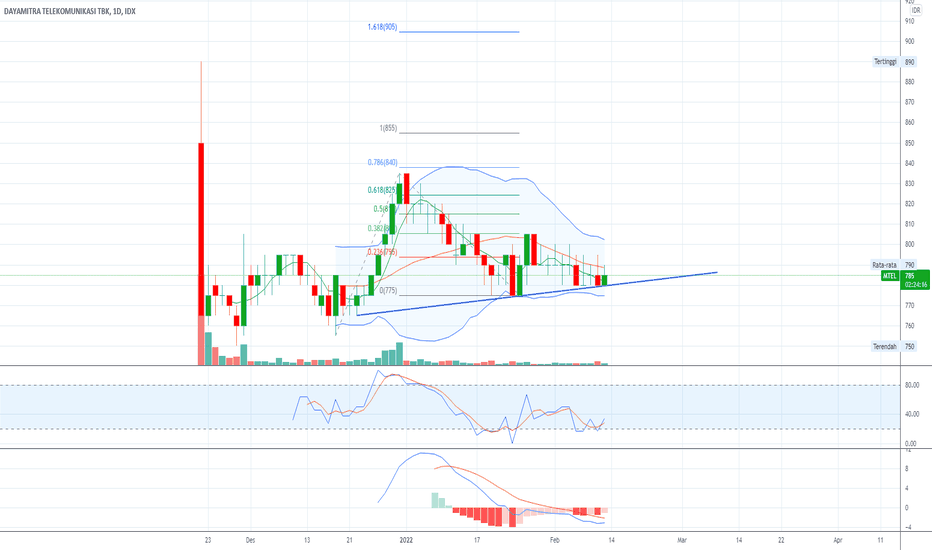

Analisis Investasi Mtel And Mbma Setelah Termasuk Dalam Msci Small Cap

May 24, 2025

Analisis Investasi Mtel And Mbma Setelah Termasuk Dalam Msci Small Cap

May 24, 2025 -

Top R And B Tracks Of The Week Featuring Leon Thomas And Flo

May 24, 2025

Top R And B Tracks Of The Week Featuring Leon Thomas And Flo

May 24, 2025

Latest Posts

-

Trade War Uncertainty Causes 7 Fall In Amsterdam Stock Market

May 24, 2025

Trade War Uncertainty Causes 7 Fall In Amsterdam Stock Market

May 24, 2025 -

Euro Sterker Dan 1 08 Analyse Van De Stijgende Rentes

May 24, 2025

Euro Sterker Dan 1 08 Analyse Van De Stijgende Rentes

May 24, 2025 -

Trumps Tariff Increase Sends Amsterdam Stock Exchange Down 2

May 24, 2025

Trumps Tariff Increase Sends Amsterdam Stock Exchange Down 2

May 24, 2025 -

Significant Drop In Amsterdam Stock Market Trade War Fallout

May 24, 2025

Significant Drop In Amsterdam Stock Market Trade War Fallout

May 24, 2025 -

Kapitaalmarktrentes Stijgen Verder Impact Op De Euro En De Markt

May 24, 2025

Kapitaalmarktrentes Stijgen Verder Impact Op De Euro En De Markt

May 24, 2025