Significant Stock Gains On BSE: Sensex's Positive Momentum

Table of Contents

Key Factors Driving Sensex's Positive Momentum

Several interconnected factors have contributed to the Sensex's impressive rise and the overall positive momentum in the BSE. Let's examine the key drivers:

Strong Corporate Earnings

Strong Q2 2023 results from various sectors have significantly boosted the Sensex. Many companies across sectors like IT, Pharma, and FMCG, have reported exceptional growth, exceeding market expectations.

- IT Sector: Leading IT companies showcased robust revenue growth, fueled by strong demand for digital transformation services globally. For example, Infosys reported a [insert percentage]% increase in quarterly profits, contributing significantly to the overall market surge.

- Pharma Sector: The pharmaceutical sector benefited from increased demand for both generic and specialty drugs, resulting in higher revenue and profit margins. [Insert company name] reported a [insert percentage]% jump in its Q2 earnings.

- FMCG Sector: Despite inflationary pressures, the FMCG sector demonstrated resilience, with companies effectively managing costs and maintaining strong sales volumes. [Insert company name]’s innovative product launches contributed to its robust Q2 performance.

This strong performance across key sectors reflects a healthy Indian economy and increased consumer spending.

Positive Global Economic Indicators

Positive global economic indicators have played a crucial role in the Sensex's positive momentum. Easing inflation in several major economies, improved consumer sentiment, and a potential slowdown in interest rate hikes by central banks have created a more optimistic global outlook.

- Easing Inflation: Lower inflation rates in the US and Europe reduced concerns about aggressive monetary tightening, boosting investor confidence globally, including in the Indian stock market.

- Improved Consumer Sentiment: Increased consumer spending in developed economies indicates a healthier global economic climate, positively impacting export-oriented Indian companies.

- Lower Interest Rate Hikes: The anticipation of a less aggressive approach to interest rate hikes by global central banks has reduced borrowing costs, fostering investment and driving stock market growth.

This global stability translates into increased foreign investment and a positive ripple effect on Indian markets.

Increased Foreign Institutional Investor (FII) Investment

Increased Foreign Institutional Investor (FII) investment has been a major catalyst for the Sensex's rise. FIIs have shown renewed confidence in the Indian market, injecting significant capital and pushing stock prices higher.

- FII Inflows: Data indicates a substantial increase in FII inflows into the Indian stock market during [mention specific period], contributing significantly to the Sensex's positive momentum. [Insert data on FII inflows].

- Reasons for Increased Interest: The improved macroeconomic fundamentals in India, coupled with a relatively stable political environment, have attracted greater FII interest. The long-term growth potential of the Indian economy remains a key draw for foreign investors.

This inflow of foreign capital boosts market liquidity and further strengthens the positive market sentiment.

Government Policies and Reforms

Supportive government policies and reforms have also played a crucial role in creating a conducive environment for stock market growth.

- Infrastructure Development: Government initiatives focused on infrastructure development are attracting investment and creating new opportunities for growth in related sectors.

- Tax Reforms: Recent tax reforms aim to simplify tax processes and boost ease of doing business, further enhancing investor confidence.

- Ease of Doing Business Initiatives: Efforts to improve the ease of doing business in India are attracting both domestic and foreign investments, fostering economic growth.

These initiatives contribute to a more stable and investor-friendly environment, attracting investment and driving economic growth.

Sectors Showing the Most Significant Gains

Several sectors have contributed significantly to the Sensex's rise, showcasing impressive growth.

Top Performing Sectors

The IT, Banking, and Financial sectors have been among the top performers, driving a substantial portion of the Sensex's gains.

- IT Sector: [Insert percentage gain]

- Banking Sector: [Insert percentage gain]

- Financial Sector: [Insert percentage gain]

The strong performance of these sectors reflects the broader economic strength and positive market sentiment.

Analyzing Sector-Specific Performance

Within these top-performing sectors, individual companies have demonstrated exceptional growth. [Insert examples of specific companies and their percentage gains]. This sector-specific analysis helps investors to identify opportunities for targeted investments.

Implications for Investors and Future Outlook

The significant stock gains on the BSE have important implications for investors and the future outlook.

Investment Strategies

The current market conditions call for a balanced approach to investment.

- Diversification: Diversifying investments across different sectors and asset classes remains crucial to mitigate risk.

- Long-term Perspective: A long-term investment horizon is recommended, allowing investors to ride out short-term market fluctuations.

- Thorough Research: Conducting thorough research before investing in any stock is crucial.

Investors should carefully assess their risk tolerance and invest accordingly.

Predicting Future Trends

While the Sensex's positive momentum is encouraging, it's crucial to maintain a cautious outlook. Several factors could influence future market movements.

- Global Economic Slowdown: A potential global economic slowdown could impact Indian markets.

- Geopolitical Risks: Geopolitical uncertainties and potential global conflicts could create volatility.

- Domestic Policy Changes: Changes in domestic policy could also impact market sentiment.

However, the long-term growth prospects for the Indian economy remain strong, presenting sustainable long-term growth opportunities for investors.

Conclusion

The significant stock gains on the BSE, driven by the Sensex's positive momentum, reflect a confluence of factors including strong corporate earnings, positive global economic indicators, increased FII investment, and supportive government policies. Understanding the nuances of this Sensex positive momentum is vital for making informed investment decisions. Stay informed about the latest developments in the Indian stock market and leverage this positive momentum by conducting thorough research and making well-informed investment decisions. Learn more about investing in the BSE and capitalizing on these significant stock gains to maximize your investment potential.

Featured Posts

-

The Future Of Cobalt Congos Quota Plan And Its Implications For The Global Market

May 15, 2025

The Future Of Cobalt Congos Quota Plan And Its Implications For The Global Market

May 15, 2025 -

Stock Market Valuation Concerns Bof As Perspective And Guidance For Investors

May 15, 2025

Stock Market Valuation Concerns Bof As Perspective And Guidance For Investors

May 15, 2025 -

Trump Tax Plan House Gop Unveils Specifics

May 15, 2025

Trump Tax Plan House Gop Unveils Specifics

May 15, 2025 -

R5 45 Crore Penalty Fiu Inds Action Against Paytm Payments Bank For Money Laundering

May 15, 2025

R5 45 Crore Penalty Fiu Inds Action Against Paytm Payments Bank For Money Laundering

May 15, 2025 -

Kibris Fatih Erbakandan Sehitlerimize Saygi Dolu Aciklama

May 15, 2025

Kibris Fatih Erbakandan Sehitlerimize Saygi Dolu Aciklama

May 15, 2025

Latest Posts

-

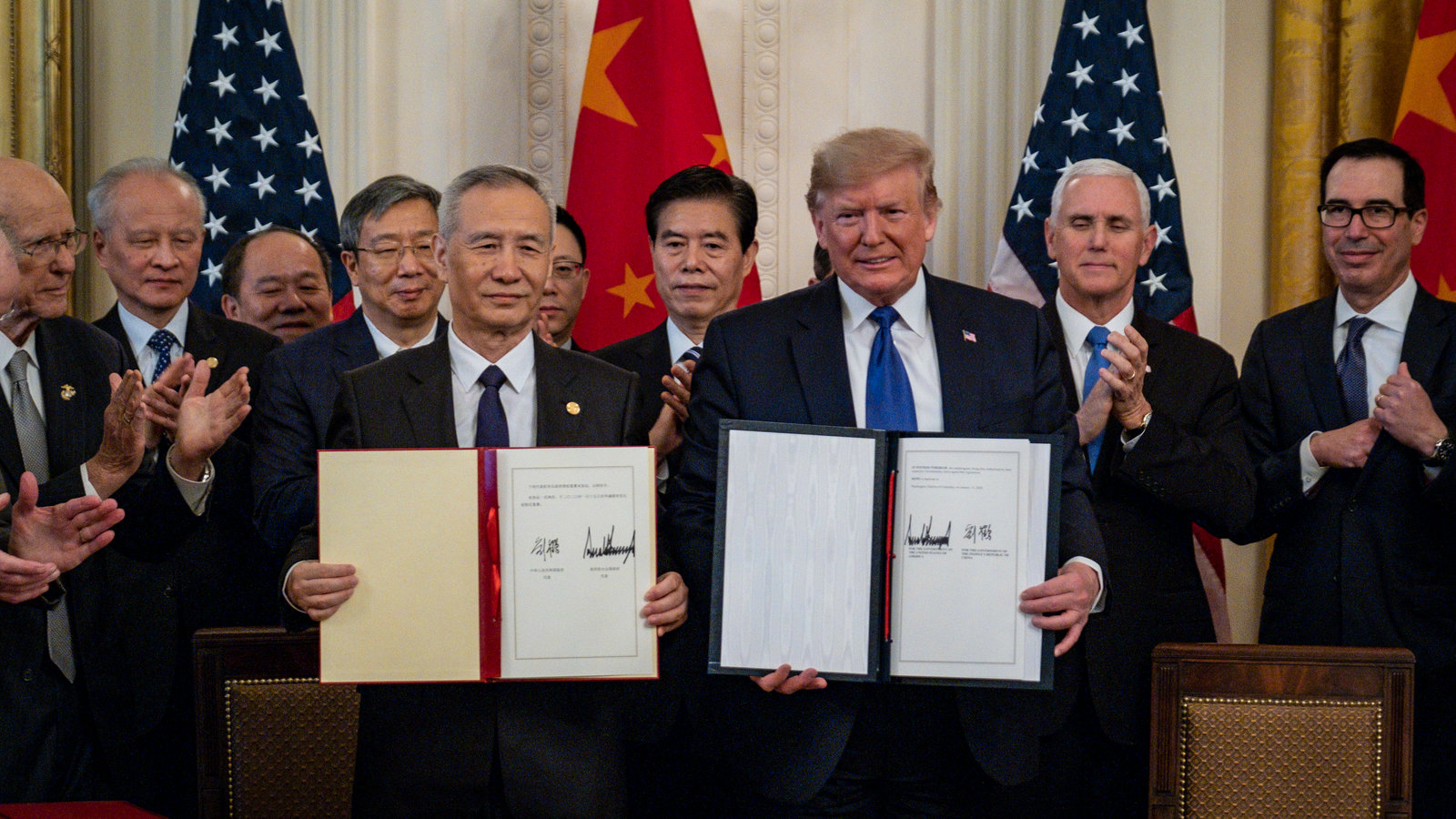

The Us And China Trade Deal Analyzing The Concessions And Compromises

May 15, 2025

The Us And China Trade Deal Analyzing The Concessions And Compromises

May 15, 2025 -

Hondas Ev Investment In Ontario Facing Challenges And Delays

May 15, 2025

Hondas Ev Investment In Ontario Facing Challenges And Delays

May 15, 2025 -

U S China Trade War A Look At The Breakthrough And What It Means

May 15, 2025

U S China Trade War A Look At The Breakthrough And What It Means

May 15, 2025 -

Ontarios Ev Future Uncertain As Honda Halts 15 Billion Project

May 15, 2025

Ontarios Ev Future Uncertain As Honda Halts 15 Billion Project

May 15, 2025 -

Record Egg Prices Fall Now 5 A Dozen In The United States

May 15, 2025

Record Egg Prices Fall Now 5 A Dozen In The United States

May 15, 2025