Trump Tax Plan: House GOP Unveils Specifics

Table of Contents

Individual Income Tax Changes

The proposed changes to individual income taxes under this revised Trump Tax Plan are substantial and will likely affect taxpayers across various income levels.

Proposed Changes to Tax Brackets

The plan proposes significant alterations to the existing tax brackets. While specific numbers may vary depending on final legislation, the proposed changes aim to adjust the brackets from the current system and the rates in place under the original Trump tax plan.

- Lower Bracket Expansion: A potential expansion of lower tax brackets could benefit lower-income individuals.

- Higher Bracket Adjustments: Conversely, higher-income earners might see adjustments to their tax brackets, potentially resulting in higher or lower tax liabilities.

- Standard Deduction Changes: The plan may include adjustments to the standard deduction, impacting how many individuals choose between itemizing or taking the standard deduction.

The net impact on the tax burden will vary considerably depending on individual circumstances, requiring careful analysis of income, deductions, and credits to fully assess.

Elimination or Modification of Tax Deductions

A key aspect of this revised Trump Tax Plan involves changes to several itemized deductions, potentially impacting taxpayers significantly.

- State and Local Taxes (SALT): The deductibility of SALT, a point of contention in previous tax legislation, might be further modified or limited.

- Mortgage Interest Deduction: The plan may propose alterations to the limits or phase-out of the mortgage interest deduction, affecting homeowners significantly.

- Charitable Contributions: Deductions for charitable contributions could also be subject to changes, impacting taxpayers who itemize due to significant charitable giving.

Taxpayers who heavily rely on itemized deductions should carefully evaluate the potential consequences and consider alternative strategies for minimizing their tax liability.

Child Tax Credit and Other Credits

The Trump Tax Plan also proposes modifications to various tax credits, including significant ones for families.

- Child Tax Credit (CTC): The proposed plan may alter the CTC amount, eligibility requirements, or the phase-out thresholds.

- Earned Income Tax Credit (EITC): Changes to the EITC are also anticipated, affecting low-to-moderate-income families.

- Other Credits: Other credits, such as those for education or healthcare expenses, may undergo adjustments.

These modifications will significantly affect families with children and those with low-to-moderate incomes, requiring a thorough review of individual situations to determine the full impact.

Corporate Tax Rate Changes

The proposed Trump Tax Plan also includes substantial changes to the corporate tax structure.

Proposed Corporate Tax Rate

The plan proposes a revised corporate tax rate that aims to improve economic competitiveness.

- Comparison to Current Rate: The proposed rate will be directly compared to both the current rate and that under the original Trump tax plan.

- Impact on Profitability: The changes are expected to influence corporate profitability and investment decisions.

- Impact on Economic Growth: Economists will assess the potential impacts on overall economic growth and job creation.

The implications of this proposed rate require comprehensive analysis, considering its potential impact on various sectors and their investment strategies.

Changes to Corporate Deductions

The plan also suggests adjustments to corporate deductions.

- Depreciation: Changes to depreciation rules will affect how companies deduct the cost of assets over time.

- Interest Expense: Modifications to the deductibility of interest expense are anticipated, affecting the financial strategies of businesses.

- Other Deductions: Several other deductions may also see changes, impacting corporate tax liabilities.

These changes necessitate a careful review of corporate tax implications and necessitate adjusting business planning and investment strategies accordingly.

Economic Impacts of the Trump Tax Plan

The proposed Trump Tax Plan carries significant implications for the overall economy.

Projected Revenue Effects

The plan will likely have a substantial impact on federal government revenue.

- Revenue Projections: Analysis will include projections from various economic modeling sources.

- Government Spending: Changes to government revenue will affect funding for various programs and initiatives.

- Long-Term Fiscal Impact: The plan's long-term effects on the national debt and budget deficits need thorough investigation.

The projected revenue impacts will necessitate careful evaluation of the trade-offs between tax cuts and potential increases in the national debt.

Impact on Economic Growth

The revised Trump Tax Plan’s effects on economic growth are central to its evaluation.

- Economic Models: Economists will utilize different economic models to predict the impact on growth, inflation, and job creation.

- Investment and Job Creation: The plan's proponents argue that it will stimulate investment and job creation.

- Potential Negative Consequences: Potential negative impacts, such as increased inflation, require thorough analysis.

The potential effects of this revised Trump Tax Plan on economic growth and stability necessitate careful study and consideration.

Conclusion

The House GOP's proposed Trump Tax Plan presents a complex array of changes to both individual and corporate taxation. Understanding the proposed alterations to tax brackets, deductions, credits, and their potential economic impact is crucial for individuals and businesses. This plan, with its potential shifts in revenue and economic growth, warrants thorough examination. Stay informed about ongoing developments and further analysis of the Trump Tax Plan to prepare for its potential effects. Learn more about the implications of this far-reaching Trump Tax Plan and take proactive steps to plan accordingly.

Featured Posts

-

Sensex Rally Which Stocks Gained Over 10 On Bse Today

May 15, 2025

Sensex Rally Which Stocks Gained Over 10 On Bse Today

May 15, 2025 -

Mlb Betting Padres Vs Pirates Predictions And Best Odds Today

May 15, 2025

Mlb Betting Padres Vs Pirates Predictions And Best Odds Today

May 15, 2025 -

Eppo Bruins Wil Snel Over Leeflang Met Npo Praten

May 15, 2025

Eppo Bruins Wil Snel Over Leeflang Met Npo Praten

May 15, 2025 -

Paddy Pimbletts Ufc 314 Callout Ilia Topuria And Two Others

May 15, 2025

Paddy Pimbletts Ufc 314 Callout Ilia Topuria And Two Others

May 15, 2025 -

Hudsons Bay Company Receives Court Approval To Extend Creditor Protection Until July 31st

May 15, 2025

Hudsons Bay Company Receives Court Approval To Extend Creditor Protection Until July 31st

May 15, 2025

Latest Posts

-

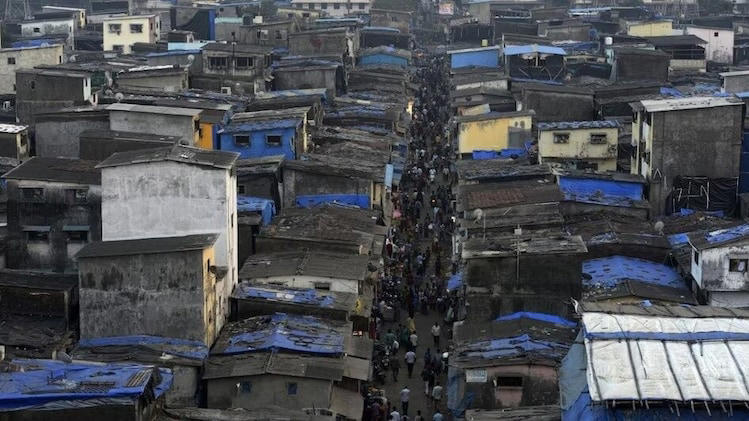

Dial 108 Ambulance Project Bombay High Court Upholds Contract

May 15, 2025

Dial 108 Ambulance Project Bombay High Court Upholds Contract

May 15, 2025 -

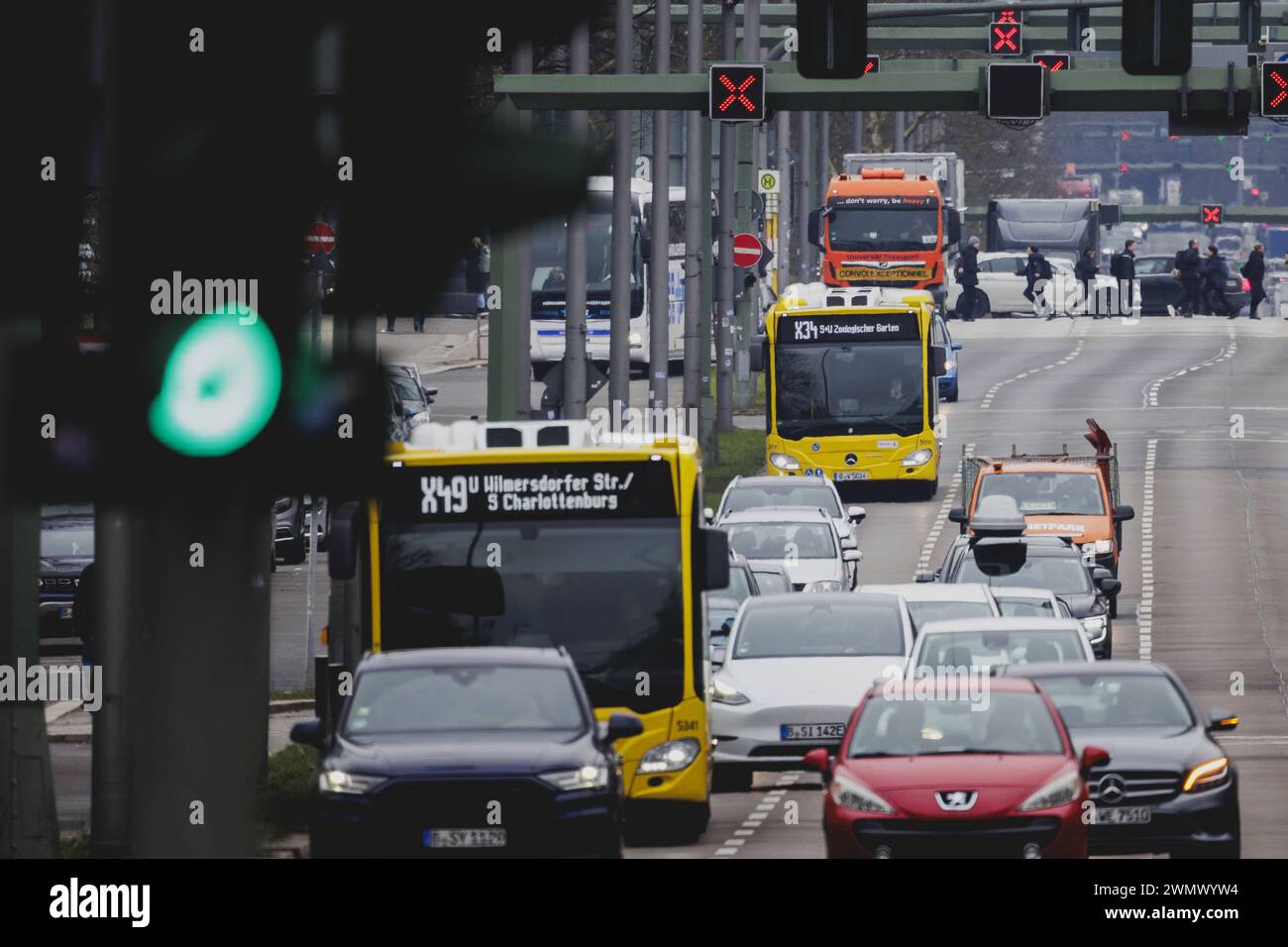

Schlichtung Gescheitert Was Bedeuten Streiks Und Entlassungen Beim Bvg

May 15, 2025

Schlichtung Gescheitert Was Bedeuten Streiks Und Entlassungen Beim Bvg

May 15, 2025 -

Mumbai Dial 108 Ambulance Contract Bombay Hc Ruling

May 15, 2025

Mumbai Dial 108 Ambulance Contract Bombay Hc Ruling

May 15, 2025 -

Bvg Streikgefahr Scheitern Der Verhandlungen Nach Schlichtung

May 15, 2025

Bvg Streikgefahr Scheitern Der Verhandlungen Nach Schlichtung

May 15, 2025 -

Kanadensiska Stjaernors Franvaro Vm Hockey 2024 Tre Kronor Och Tjeckien

May 15, 2025

Kanadensiska Stjaernors Franvaro Vm Hockey 2024 Tre Kronor Och Tjeckien

May 15, 2025