Slowing Growth Forces SSE To Cut Spending By £3 Billion

Table of Contents

Reasons Behind SSE's £3 Billion Spending Cut

The £3 billion reduction in SSE's spending reflects a confluence of factors impacting the energy sector. Understanding these reasons is crucial to grasping the full scope of the situation and its potential long-term effects.

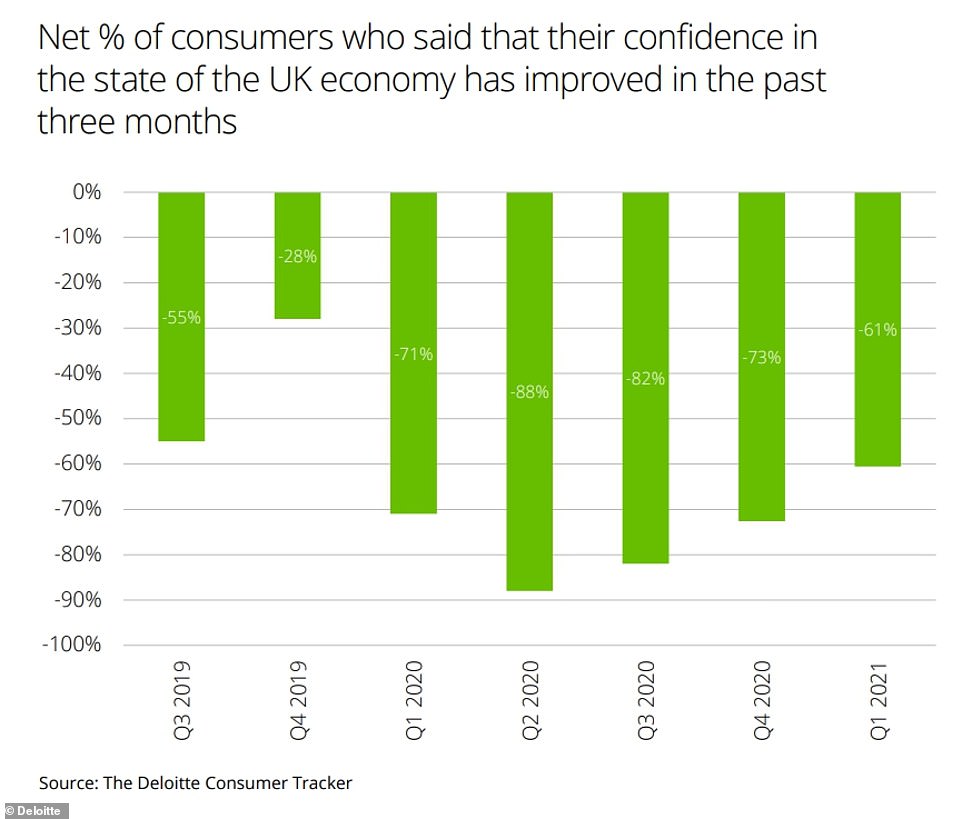

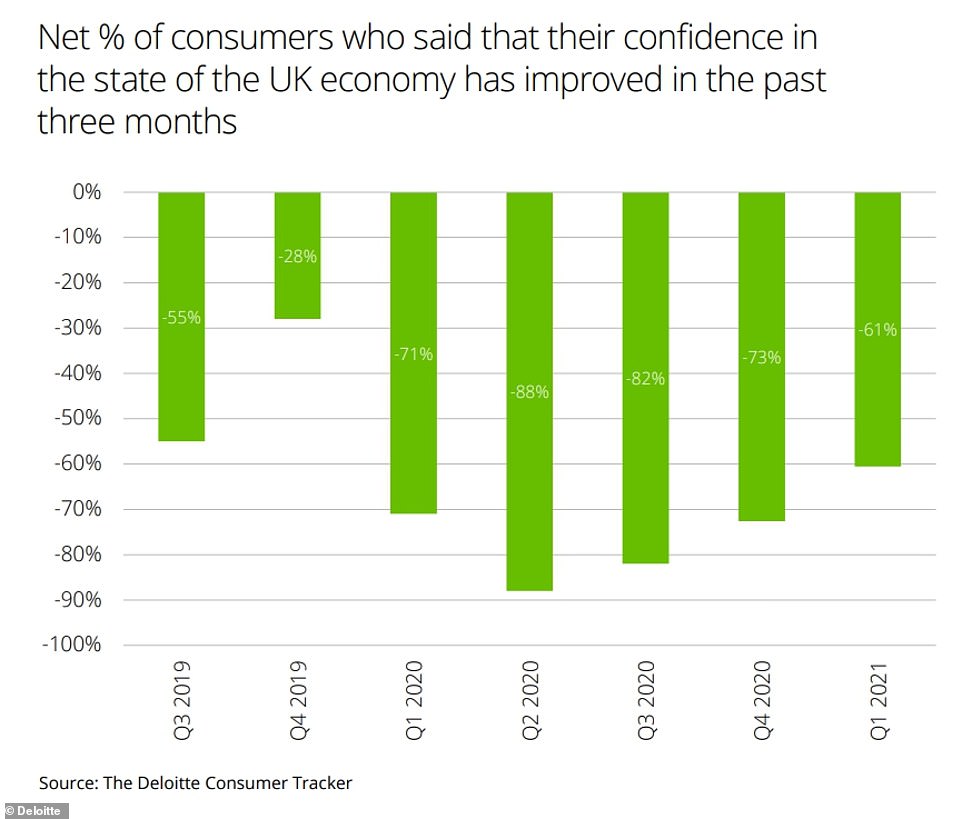

Impact of Slowing Economic Growth

Slowing economic growth directly impacts energy demand. As consumer spending decreases, so does the overall consumption of energy. Recent GDP growth forecasts, showing a slowdown in key markets, support this claim. For example, [cite source showing GDP slowdown]. This reduced demand places significant pressure on energy companies like SSE.

- Decreased energy consumption due to economic slowdown: Reduced industrial activity and household spending translate to lower energy usage.

- Reduced investment in new energy projects due to uncertainty: The economic uncertainty makes it riskier to invest in large-scale energy projects.

- Pressure on profit margins forcing cost-cutting measures: Lower demand and higher input costs squeeze profit margins, necessitating drastic cost-cutting measures like the announced £3 billion reduction.

Challenges in the Energy Market

The energy market is inherently volatile, and SSE is not immune to its challenges. Increased competition and rising inflation add to the pressure.

- Increased competition from renewable energy sources: The rise of renewable energy sources like solar and wind power intensifies competition in the energy market.

- Rising inflation impacting project budgets: Inflation increases the cost of materials and labor, significantly impacting project budgets and profitability.

- Regulatory changes and their effect on profitability: Changes in energy regulations and policies can heavily influence the profitability of energy projects and require companies to adapt quickly.

Strategic Re-evaluation and Prioritization

Facing these challenges, SSE is undertaking a strategic re-evaluation and prioritizing its investments. This means focusing resources on the most profitable areas while potentially delaying or canceling less lucrative projects.

- Focus shifting towards more profitable ventures: SSE is likely to concentrate its investments on projects with higher returns and lower risk.

- Delay or cancellation of less-profitable projects: Projects deemed less profitable or carrying higher risk are likely to be delayed or canceled entirely.

- Investment in renewable energy likely to be prioritized: Despite the overall spending cuts, investments in renewable energy sources, considered a long-term growth area, may be prioritized.

Impact of the Spending Cuts on SSE's Operations

The £3 billion spending cut will undoubtedly have significant implications for SSE's operations, impacting various aspects of the business.

Job Security and Employment

The reduction in spending raises concerns about job security. While SSE hasn't explicitly announced widespread job losses, restructuring and potential redundancies are likely possibilities.

- Potential for job losses or redundancies: Cost-cutting measures often involve workforce reductions to reduce overhead.

- Impact on employee morale and productivity: Uncertainty surrounding job security can negatively impact employee morale and productivity.

- Potential for outsourcing or offshoring: To further reduce costs, SSE might consider outsourcing or offshoring certain operations.

Future Investment Plans

The spending cuts will inevitably impact SSE's future growth and expansion plans. The company's long-term strategy will need to adapt to the new financial realities.

- Revised investment strategy focusing on core businesses: SSE will likely focus its investments on its core businesses to maximize returns.

- Impact on future renewable energy projects: While renewable energy might be prioritized, the overall cuts will likely affect the scale and speed of these projects.

- Potential for mergers or acquisitions to be affected: SSE's ability to pursue mergers or acquisitions might be constrained by the reduced financial capacity.

Shareholder Reaction and Market Response

The announcement of the £3 billion spending cut has undoubtedly impacted SSE's share price and investor sentiment.

- Share price fluctuations following the announcement: The share price is likely to experience volatility following the announcement, reflecting investor reactions.

- Analyst reactions and future price predictions: Financial analysts will provide their assessments and predictions for the future share price.

- Investor confidence and future investment outlook: The spending cuts might affect investor confidence, potentially influencing future investment decisions.

Conclusion

SSE's decision to cut £3 billion in spending underscores the challenging economic environment and the volatile nature of the energy market. The impact of slowing growth, heightened competition, and rising inflation has forced the company to re-evaluate its spending priorities. This could lead to job losses and alterations to future investment plans, including potential delays or cancellations of projects. The long-term effects of these SSE spending cuts remain to be seen, but the company's response clearly highlights the significant challenges faced by businesses in the current economic climate. Stay informed about further developments regarding SSE spending cuts and their implications for the future of the energy sector. Understanding the nuances of these SSE spending cuts is crucial for navigating the evolving energy landscape.

Featured Posts

-

Half Dome Wins Abn Group Victoria Media Account A New Partnership

May 22, 2025

Half Dome Wins Abn Group Victoria Media Account A New Partnership

May 22, 2025 -

Occasionmarkt Bloeit Abn Amro Ziet Sterke Toename Verkopen

May 22, 2025

Occasionmarkt Bloeit Abn Amro Ziet Sterke Toename Verkopen

May 22, 2025 -

Blake Lively And Taylor Swift Did A Subpoena Damage Their Friendship

May 22, 2025

Blake Lively And Taylor Swift Did A Subpoena Damage Their Friendship

May 22, 2025 -

Vstup Ukrayini Do Nato Poglyadi Yevrokomisara Ta Analiz Rizikiv

May 22, 2025

Vstup Ukrayini Do Nato Poglyadi Yevrokomisara Ta Analiz Rizikiv

May 22, 2025 -

Cartoon Network And Looney Tunes Unite In New 2025 Animated Short

May 22, 2025

Cartoon Network And Looney Tunes Unite In New 2025 Animated Short

May 22, 2025

Latest Posts

-

Thursdays Drop In Core Weave Inc Crwv Stock A Comprehensive Look

May 22, 2025

Thursdays Drop In Core Weave Inc Crwv Stock A Comprehensive Look

May 22, 2025 -

Core Weave Inc Crwv Stock Drop On Tuesday Reasons And Analysis

May 22, 2025

Core Weave Inc Crwv Stock Drop On Tuesday Reasons And Analysis

May 22, 2025 -

Understanding Core Weave Inc S Crwv Share Price Decrease On Thursday

May 22, 2025

Understanding Core Weave Inc S Crwv Share Price Decrease On Thursday

May 22, 2025 -

Core Weave Inc Crwv Stock Drop Thursdays Decline Explained

May 22, 2025

Core Weave Inc Crwv Stock Drop Thursdays Decline Explained

May 22, 2025 -

Understanding The Sharp Increase In Core Weave Crwv Stock On Thursday

May 22, 2025

Understanding The Sharp Increase In Core Weave Crwv Stock On Thursday

May 22, 2025