SPAC Stock Surge: Is This The Next Big Investment Opportunity?

Table of Contents

Understanding SPACs: A Deep Dive

What are SPACs?

SPACs, or Special Purpose Acquisition Companies, are essentially "blank check" companies. They raise capital through an initial public offering (IPO) with the sole purpose of merging with or acquiring a private company. This allows private companies to go public without undergoing a traditional IPO process, often considered a faster and less cumbersome route. The SPAC structure involves a trust that holds the capital raised, ready to be deployed once a suitable acquisition target is identified.

How SPACs Work?

The process begins with a SPAC raising capital through an IPO. Once the funds are secured, the SPAC management team actively searches for a target private company to acquire. This process is known as a SPAC merger or a de-SPAC transaction. If a suitable target is found and the merger is approved by the SPAC shareholders, the private company becomes a publicly traded entity. The entire process, from IPO to private company acquisition, can take anywhere from a few months to several years. Sponsors, typically experienced investment professionals, play a crucial role in identifying and evaluating potential acquisition targets.

- Initial Public Offering (IPO) process for SPACs: SPACs raise capital through an IPO, typically listing on a major stock exchange. Investors purchase shares anticipating the future value increase after a successful merger.

- Merger process with a target company: A detailed due diligence process precedes the merger, including financial audits and legal reviews of both the SPAC and the target company. Shareholder votes from both entities are required to finalize the merger.

- Redemption rights of SPAC investors: SPAC investors often have the right to redeem their shares at the initial investment price if they are not satisfied with the proposed merger target.

- Potential for high returns and associated risks: Successful SPAC mergers can lead to significant returns for investors, while unsuccessful ones can lead to substantial losses.

The Allure of SPAC Investments: Potential for High Returns

High Growth Potential

SPACs offer the potential for significant investment returns through stock appreciation. If a SPAC successfully merges with a high-growth company in a promising sector, the resulting publicly traded entity might experience rapid growth, driving up the stock price and generating substantial returns for investors. Investing in high-growth stocks through SPACs can be particularly attractive for those seeking potentially large gains.

Access to Pre-IPO Companies

One of the primary advantages of SPACs is that they provide investors with access to promising pre-IPO investment opportunities. This allows investors to participate in the growth of private companies before they go public, something typically reserved for venture capitalists and institutional investors. Gaining access to private company access through a SPAC can be a valuable way to diversify one's portfolio and potentially benefit from early-stage investing opportunities.

- Examples of successful SPAC mergers: Several successful SPAC mergers have resulted in considerable returns for investors, highlighting the potential upside of this investment strategy (examples should be provided here depending on current market trends).

- Potential for diversification: Investing in SPACs across different sectors can contribute to portfolio diversification.

- Role of experienced management teams: Experienced SPAC sponsors and management teams significantly increase the likelihood of a successful merger and subsequent returns for investors.

Navigating the Risks: Understanding the Downsides of SPAC Investments

Volatility and Risk

SPAC investments are inherently volatile. The success of a SPAC hinges on its ability to find and merge with a suitable target company. If the SPAC fails to identify a viable target or the merged company underperforms, investors could experience significant losses. Market volatility can also impact SPAC performance, making them a riskier investment than established publicly traded companies. Understanding the investment risk involved is crucial. SPAC failure rates are important to consider when assessing the risk profile.

Due Diligence is Crucial

Before investing in a SPAC, thorough due diligence is absolutely essential. Investors should carefully scrutinize the SPAC's sponsor track record, the financial health and future prospects of the target company (post-merger), and overall market conditions. Conducting proper SPAC research and performing a comprehensive investment analysis are crucial steps in mitigating risk.

- Examples of SPACs that have failed to generate returns: Highlighting examples of unsuccessful SPACs underscores the importance of thorough research.

- Risks associated with less-experienced management teams: Investing in SPACs with inexperienced or less-proven management teams significantly increases the risk of failure.

- Understanding the terms of the SPAC offering and merger agreement: Carefully reviewing the offering documents and understanding the terms of the merger agreement is crucial before investing.

Conclusion

Investing in SPACs presents a unique opportunity for potentially high returns, but it's crucial to carefully weigh the risks involved. Thorough due diligence, understanding the market trends, and diversification are essential for successful SPAC investing. The SPAC market is dynamic; therefore, continuous monitoring and adaptation are vital. Before diving into the exciting world of SPAC stock, conduct thorough research, understand the inherent risks, and only invest what you can afford to lose. Learn more about navigating the complexities of SPAC investments and discover if this is the right investment opportunity for your portfolio.

Featured Posts

-

Ra Soat Chat Che Co So Giu Tre Tu Nhan Xu Ly Nghiem Bao Hanh Tre Em

May 09, 2025

Ra Soat Chat Che Co So Giu Tre Tu Nhan Xu Ly Nghiem Bao Hanh Tre Em

May 09, 2025 -

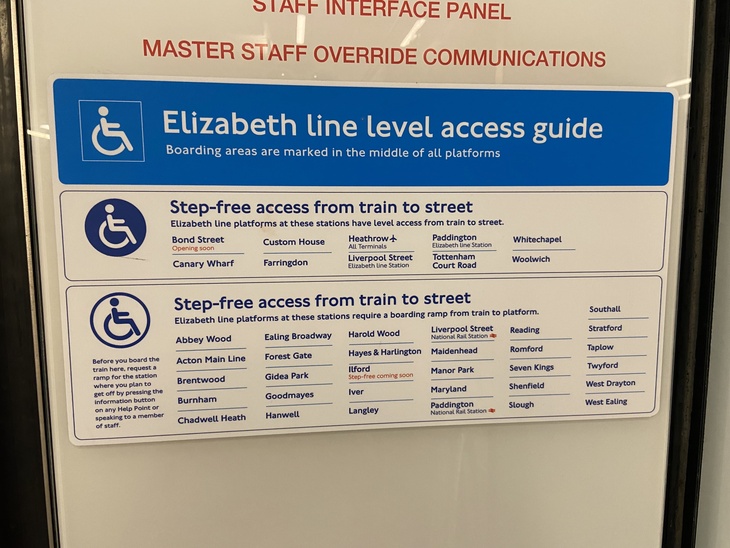

Mind The Gap Wheelchair Accessibility On The Elizabeth Line

May 09, 2025

Mind The Gap Wheelchair Accessibility On The Elizabeth Line

May 09, 2025 -

Stock Market Update Indias Sensex And Nifty 50 Remain Steady Despite Headwinds

May 09, 2025

Stock Market Update Indias Sensex And Nifty 50 Remain Steady Despite Headwinds

May 09, 2025 -

Federal Reserve Pauses Rate Hikes Inflation And Recession Risks

May 09, 2025

Federal Reserve Pauses Rate Hikes Inflation And Recession Risks

May 09, 2025 -

Arsenal Or Psg Rio Ferdinands Revised Champions League Final Prediction

May 09, 2025

Arsenal Or Psg Rio Ferdinands Revised Champions League Final Prediction

May 09, 2025