SPAC Stock Surge: Should You Invest In This MicroStrategy Competitor?

Table of Contents

Understanding the SPAC Market and its Risks

SPACs, also known as "blank check companies," raise capital through an initial public offering (IPO) with the intention of merging with a private company. Their recent popularity stems from a perceived ease of access to capital for private companies and a quicker route to public markets than a traditional IPO. However, SPAC investments carry significant risks.

- Lack of detailed due diligence before merger: Investors often commit to a SPAC before knowing the target company, relying heavily on the SPAC sponsor's due diligence. This lack of transparency can lead to disappointing outcomes.

- Potential for overvalued post-merger shares: The excitement surrounding a SPAC merger can lead to inflated share prices, creating a bubble that may burst after the merger is complete. Post-merger share dilution can also negatively impact returns for early investors.

- Higher volatility compared to established companies: SPACs are inherently more volatile than established companies due to their speculative nature and the uncertainty surrounding the target acquisition.

- Risk of the deal falling through: There's always the chance the proposed merger may fail to materialize, leaving investors with a diminished return or even a complete loss.

The regulatory environment surrounding SPACs is evolving, with increased scrutiny from the SEC aimed at protecting investors. Recent changes include stricter disclosure requirements and increased focus on the due diligence process. While some SPAC mergers in the business intelligence sector have been successful, others have resulted in significant losses for investors, highlighting the inherent risks involved.

Evaluating MicroStrategy Competitors Entering via SPACs

Several MicroStrategy competitors have recently leveraged SPACs to go public. Let's examine two hypothetical examples (replace with actual companies for a real-world analysis):

Example Competitor A: A Deep Dive

- Business model and competitive advantage against MicroStrategy: Example Competitor A offers a cloud-based analytics platform emphasizing ease of use and integration with existing business systems, targeting smaller to medium-sized enterprises (SMEs) underserved by MicroStrategy's enterprise solutions.

- Financial projections and growth potential: The company projects significant revenue growth driven by expanding market share in the SME segment. However, achieving these projections relies heavily on successful product adoption and market penetration.

- Valuation compared to MicroStrategy's valuation: Example Competitor A's valuation is considerably lower than MicroStrategy's, reflecting its smaller scale and less established market position. This could represent an opportunity for growth but also carries higher risk.

- Assessment of management team and expertise: The management team comprises seasoned professionals with experience in software development, sales, and marketing, bolstering confidence in their execution capabilities.

- Unique risks and opportunities: The primary risk is competition from larger players and the need to successfully execute their growth strategy. A key opportunity lies in their focus on the fast-growing SME market.

Example Competitor B: A Deep Dive

(Repeat the above bullet points, adapting the information to reflect the specifics of a second hypothetical competitor. Replace these with real companies and their data for accurate analysis)

The MicroStrategy Factor: Analyzing the Competition

MicroStrategy holds a strong position in the enterprise business intelligence market, known for its powerful analytics platform and large enterprise clientele. Their recent performance and high market capitalization reflect this established presence.

However, the market is dynamic. The SPAC competitors mentioned above aim to differentiate themselves by focusing on specific market segments, offering innovative features, or providing more cost-effective solutions. This competitive landscape analysis would best be represented in a table comparing key factors such as:

| Feature | MicroStrategy | Example Competitor A | Example Competitor B |

|---|---|---|---|

| Target Market | Large Enterprises | SMEs | Specific Industry Niche |

| Pricing Model | Premium | Subscription-based | Freemium/Tiered |

| Key Strengths | Established Brand, Robust Platform | Ease of Use, Cloud-Based | Specific Industry Expertise |

Developing Your Investment Strategy: SPACs vs. Direct Investment

Investing in SPACs presents a higher risk-reward profile compared to direct investment in established companies like MicroStrategy. While SPACs offer potential high returns, they also carry significant risks due to their speculative nature. Direct investment in MicroStrategy offers greater stability but potentially lower growth.

Diversification is key. Don't put all your eggs in one basket. A well-balanced portfolio might include established players like MicroStrategy alongside carefully vetted SPAC investments in promising competitors. Always perform thorough due diligence, including independent research beyond the SPAC's prospectus, before investing. Consulting with a financial advisor is highly recommended.

Conclusion

Investing in a MicroStrategy competitor via a SPAC presents both significant opportunities and substantial risks. Before jumping into the exciting but risky world of SPACs, carefully consider factors such as the SPAC's sponsor, the target company's financials and growth potential, the competitive landscape, and the inherent volatility of SPAC investments. Thorough research, careful consideration of your risk tolerance, and consultation with a financial advisor are essential steps before making any SPAC stock investments. Remember, informed decisions lead to better outcomes in this dynamic market.

Featured Posts

-

Erick Pulgar El Gesto Con El Corazon De La Hinchada Del Flamengo

May 08, 2025

Erick Pulgar El Gesto Con El Corazon De La Hinchada Del Flamengo

May 08, 2025 -

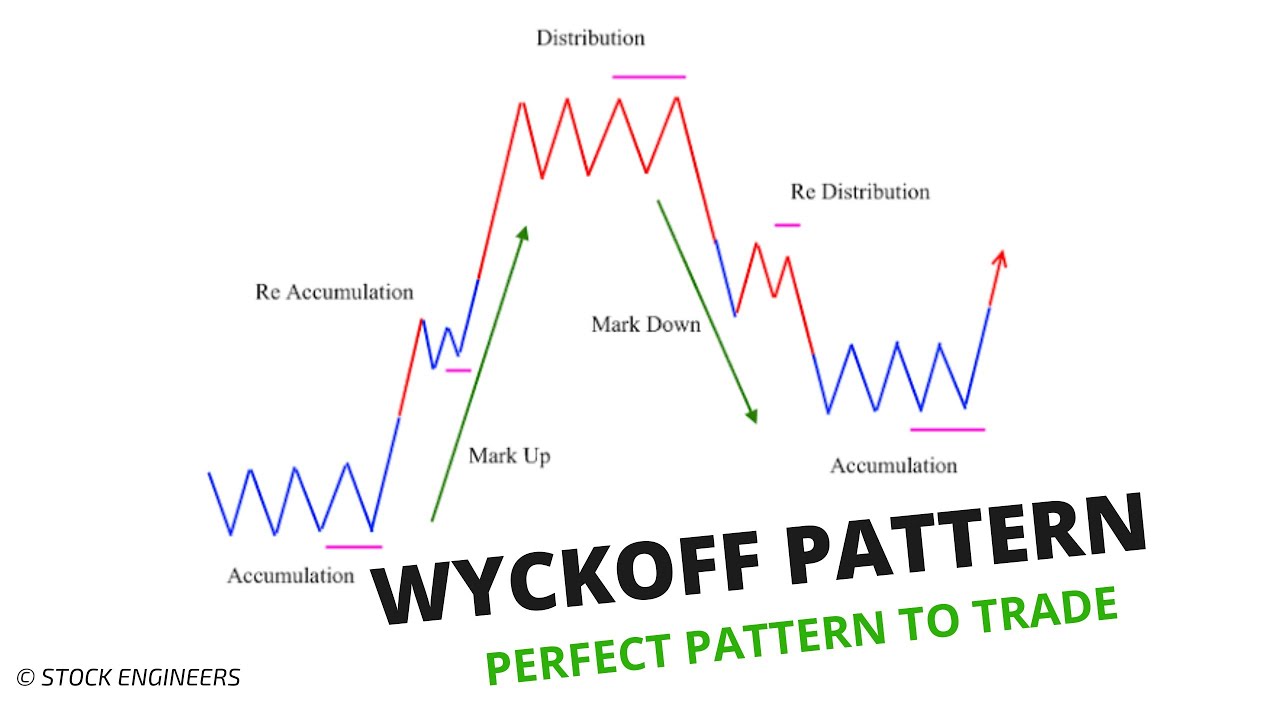

Ethereums Path To 2 700 A Wyckoff Accumulation Perspective

May 08, 2025

Ethereums Path To 2 700 A Wyckoff Accumulation Perspective

May 08, 2025 -

Recent Developments F4 Elden Ring Possum And Superman

May 08, 2025

Recent Developments F4 Elden Ring Possum And Superman

May 08, 2025 -

Gjranwalh Dyrynh Dshmny Fayrng Ka Waqeh 5 Afrad Jan Bhq Mlzm Hlak

May 08, 2025

Gjranwalh Dyrynh Dshmny Fayrng Ka Waqeh 5 Afrad Jan Bhq Mlzm Hlak

May 08, 2025 -

Psg Pjesa E Pare E Veshtire Por Fitorja E Sigurt

May 08, 2025

Psg Pjesa E Pare E Veshtire Por Fitorja E Sigurt

May 08, 2025