Understanding Bitcoin's Golden Cross: A Cyclical Indicator Explained

Table of Contents

What is a Golden Cross in Bitcoin Trading?

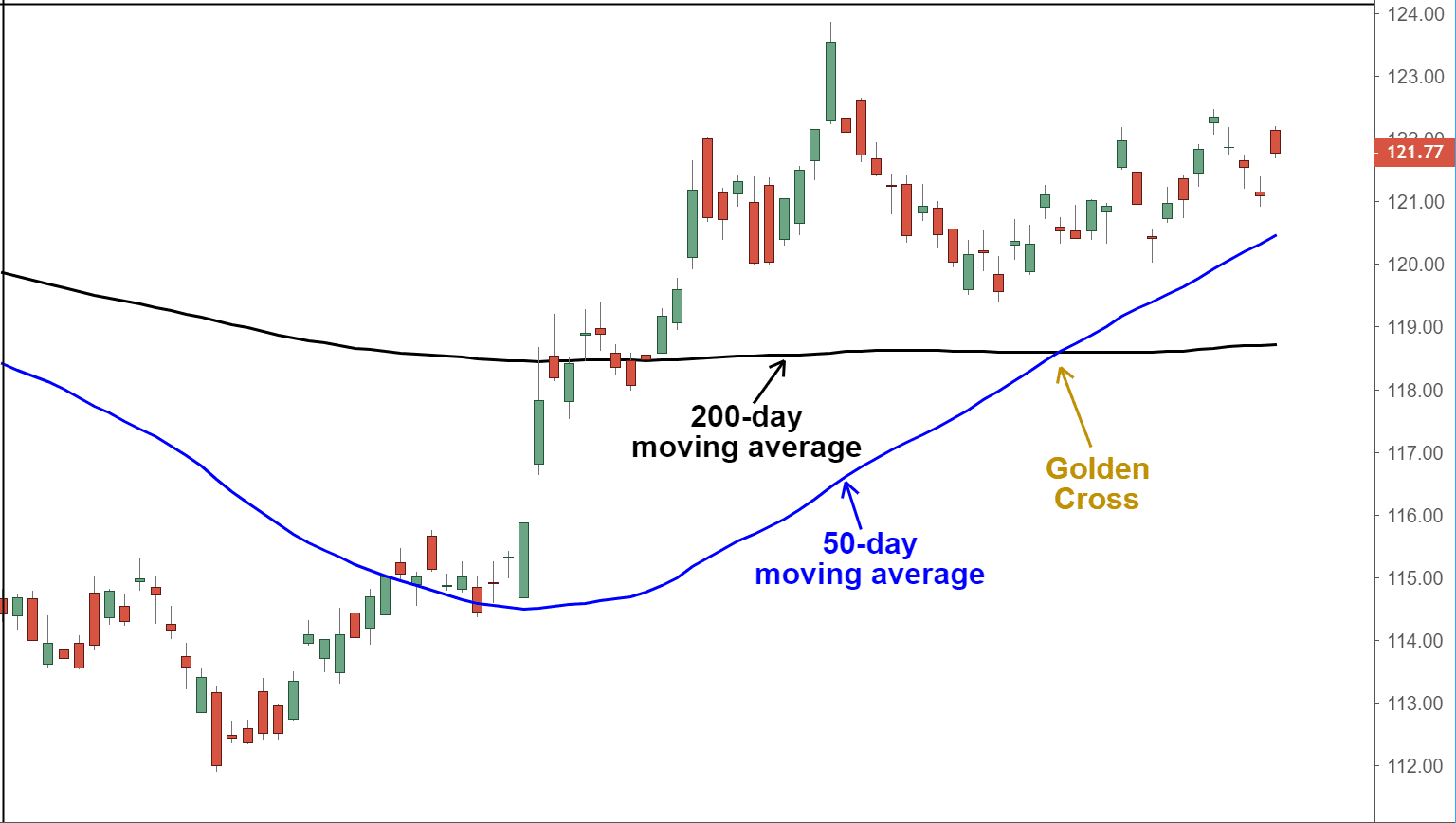

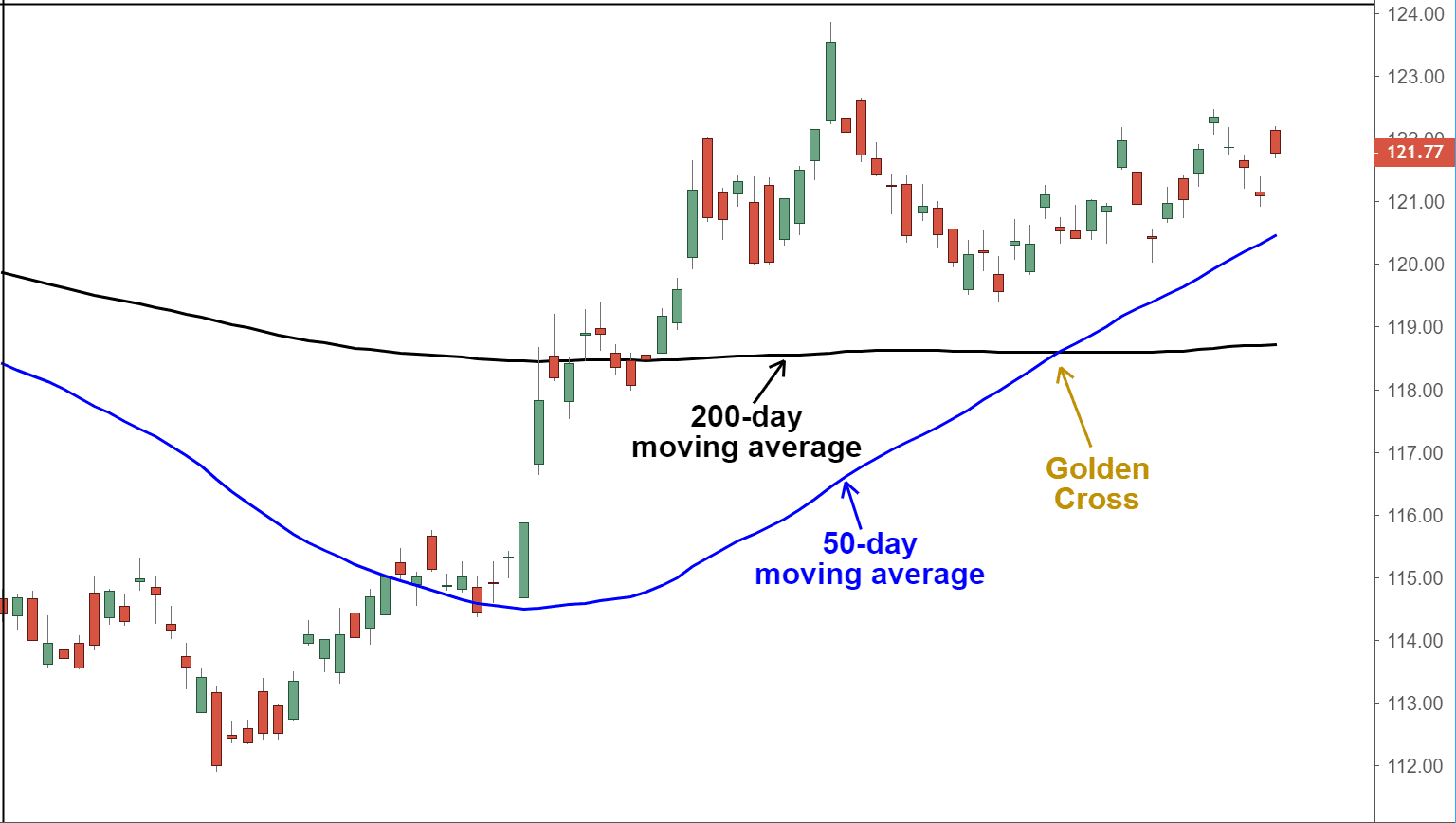

The Golden Cross is a bullish technical indicator formed when a shorter-term moving average crosses above a longer-term moving average. In Bitcoin trading, this typically involves the 50-day moving average (MA) crossing above the 200-day MA.

- Moving Averages Explained: Moving averages smooth out price fluctuations, providing a clearer trend picture. The 50-day MA represents short-term price momentum, while the 200-day MA reflects long-term price trends. A shorter-term MA crossing above a longer-term MA suggests a shift from bearish to bullish momentum.

- The Bullish Signal: The crossover itself signals a potential shift in market sentiment from bearish to bullish. It suggests that buying pressure is increasing and overcoming selling pressure, potentially leading to an upward price trend.

- Visual Representation: On a Bitcoin price chart, the Golden Cross is visually represented by the 50-day MA line crossing above the 200-day MA line.

- Identifying Buy Opportunities: Traders often view the Golden Cross as a potential buy signal, indicating a favorable entry point for long positions in Bitcoin.

Historical Performance of Bitcoin's Golden Cross

Analyzing past occurrences of the Golden Cross in Bitcoin's price history reveals mixed results. While some instances have accurately predicted significant price increases, others have produced false signals or less substantial rallies.

- Successful and Unsuccessful Predictions: [Insert Chart or Graph Here showing examples of both successful and unsuccessful Golden Cross occurrences in Bitcoin's price history. Clearly label each instance]. The chart will showcase instances where the Golden Cross preceded significant price increases, and instances where it did not result in substantial price movements.

- Reliability Based on Historical Data: The historical data suggests that the Golden Cross is not a foolproof predictor. While it offers valuable insights, it's essential to interpret it cautiously and in conjunction with other indicators.

- Considering Other Factors: Relying solely on the Golden Cross for trading decisions is risky. Factors such as overall market sentiment, macroeconomic conditions, regulatory changes, and news events significantly influence Bitcoin's price.

- Confirmation Bias: Traders should be aware of confirmation bias—the tendency to favor information confirming pre-existing beliefs. Objective analysis is vital to avoid misinterpreting the Golden Cross signal.

Limitations and Considerations of the Golden Cross

The Golden Cross, like any other technical indicator, has limitations. Using it as the sole basis for trading decisions can lead to inaccurate predictions and losses.

- False Signals and Whipsaws: The Golden Cross can generate false signals, leading to whipsaws (rapid price reversals) and potentially unprofitable trades. It's essential to confirm the signal with other indicators.

- Combining with Other Indicators: Integrating the Golden Cross with additional indicators, such as the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), or Bollinger Bands, enhances accuracy and reduces the risk of false signals.

- Market Sentiment and Fundamental Analysis: Analyzing market sentiment (through social media, news, etc.) and conducting fundamental analysis (examining Bitcoin's underlying technology and adoption rate) helps provide a more holistic perspective.

- Market Manipulation: Large-scale market manipulation can influence price movements, potentially causing inaccurate Golden Cross signals.

How to Identify Bitcoin's Golden Cross on Trading Charts

Identifying the Golden Cross involves using charting software or online platforms that display moving averages.

- Finding the 50-Day and 200-Day MAs: Most trading platforms allow you to customize chart indicators, enabling the selection and display of 50-day and 200-day moving averages.

- Chart Examples: [Include images of charts with clearly marked Golden Crosses on different timeframes (daily, weekly)]. These visual aids will demonstrate how to easily identify the pattern.

- Recommended Charting Software: Popular platforms like TradingView, Coinbase Pro, and Binance offer robust charting tools, including the ability to display multiple moving averages.

- Adjusting Timeframes: Analyze the Golden Cross on different timeframes (daily, weekly, monthly) to identify consistent patterns and avoid short-term noise.

Conclusion

This article explored the significance of Bitcoin's Golden Cross, a cyclical indicator used in technical analysis. While it can be a valuable tool for identifying potential bullish trends, it's crucial to remember its limitations and use it in conjunction with other forms of analysis. The Golden Cross is not a foolproof predictor, and relying solely on it could lead to poor investment decisions. Understanding Bitcoin's Golden Cross is a critical step in navigating the cryptocurrency market. By combining this indicator with other analytical methods, you can develop a more robust trading strategy. Continue learning about Bitcoin’s Golden Cross and other technical indicators to refine your understanding of Bitcoin's price movements.

Featured Posts

-

Us Navy Jet Lost At Sea Second Incident From Truman Aircraft Carrier

May 08, 2025

Us Navy Jet Lost At Sea Second Incident From Truman Aircraft Carrier

May 08, 2025 -

Resultados De La Ligue 1 Psg Gana Al Lyon

May 08, 2025

Resultados De La Ligue 1 Psg Gana Al Lyon

May 08, 2025 -

Iniciando Con Fuerza Los Dodgers Y Su Mejor Comienzo De Temporada

May 08, 2025

Iniciando Con Fuerza Los Dodgers Y Su Mejor Comienzo De Temporada

May 08, 2025 -

Is Another Canada Post Strike Imminent Key Dates And Impacts

May 08, 2025

Is Another Canada Post Strike Imminent Key Dates And Impacts

May 08, 2025 -

Lotto Jackpot Results Wednesday April 9th

May 08, 2025

Lotto Jackpot Results Wednesday April 9th

May 08, 2025