Stable Start For DAX: Frankfurt Market Update

Table of Contents

DAX Index Performance and Key Movers

The DAX experienced a relatively calm morning session, fluctuating within a narrow range. The index opened at 16,000 points, reaching an intraday high of 16,050 and a low of 15,980 before settling at 16,020 at midday. This represents a 0.2% increase compared to yesterday's closing price. The overall market volume was slightly below average, suggesting a degree of cautiousness among investors.

-

Top Performers:

- SAP (Software): Up 1.5%, boosted by positive Q3 earnings reports. This highlights strong sector performance in the technology sector.

- Mercedes-Benz (Automotive): Up 1%, benefiting from strong pre-orders for their new electric vehicle models. This showcases positive trends in the electric vehicle market and overall automotive sector performance.

- Allianz (Financial): Up 0.8%, driven by positive investor sentiment regarding the company's strong capital position. The financial sector showed moderate gains.

- Siemens (Industrials): Up 0.7% reflecting continued growth in their industrial automation division.

-

Worst Performers:

- Volkswagen (Automotive): Down 0.5%, impacted by ongoing supply chain issues affecting production. This reflects the continuing challenges within the automotive sector.

- BASF (Chemicals): Down 0.3%, likely due to concerns about rising energy costs. This demonstrates the vulnerability of the chemicals sector to macroeconomic factors.

- Deutsche Bank (Financial): Down 0.2%, possibly impacted by broader concerns about rising interest rates. This showcases that even strong financial players can be affected by external market forces.

-

Market Events: No major economic announcements or significant company-specific news directly impacted the DAX today. However, the overall positive sentiment can be partially attributed to stable global markets.

Sector-Specific Analysis

The DAX's performance reflects a mixed bag across sectors. While some sectors experienced modest gains, others saw only slight losses.

-

Automotive Sector: The automotive sector showed mixed results. While Mercedes-Benz performed well, Volkswagen struggled with supply chain constraints. The sector's performance continues to be heavily influenced by chip shortages and the ongoing transition to electric vehicles. This sector's future is largely tied to the success of their EV strategies and resolving supply chain issues.

-

Technology Sector: The technology sector saw positive movement, primarily driven by strong earnings from companies like SAP. Continued growth in software development and increasing investment in artificial intelligence contribute to this positive outlook for the technology sector.

-

Financial Sector: The financial sector showed relatively stable performance, with moderate gains in some key players like Allianz. However, concerns about rising interest rates and potential economic slowdowns may be dampening overall investor enthusiasm within the banking and insurance segments of this sector.

-

Other Sectors: The industrial sector saw moderate growth, mirroring the overall stable market trend. The chemicals sector, however, faced headwinds due to elevated energy prices.

Impact of Global Economic Factors

Global economic factors played a significant role in shaping today's DAX performance.

-

Inflation: Elevated inflation rates across Europe continue to be a concern, impacting consumer spending and corporate profitability. This uncertainty influences investor sentiment towards the DAX.

-

Interest Rates: The anticipation of further interest rate hikes by the European Central Bank is creating uncertainty in the market, potentially affecting investor risk appetite. This could lead to further volatility in the DAX.

-

Geopolitical Events: Ongoing geopolitical tensions and energy crisis continue to contribute to market uncertainty. This global volatility can impact the DAX indirectly via reduced investor confidence.

-

US Stock Market Performance: The relatively stable performance of the US stock market had a positive spillover effect on the DAX, fostering investor confidence.

Outlook and Predictions

The outlook for the DAX remains cautiously optimistic. While the current market conditions suggest a relatively stable environment, there are several potential factors to consider.

-

Prediction: We anticipate moderate growth for the DAX in the short term, barring any major unforeseen geopolitical events or significant economic shocks. The long-term outlook, however, will depend largely on the resolution of global inflation concerns and the pace of interest rate increases.

-

Risks and Opportunities: Risks include persistent inflation, escalating geopolitical tensions, and supply chain disruptions. Opportunities exist for investors in sectors showing strong growth potential, such as renewable energy and technology.

-

Upcoming Events: The upcoming release of key economic indicators and corporate earnings reports will likely influence the DAX's trajectory in the coming weeks.

Conclusion

Today's DAX performance reflects a relatively stable market with mixed results across sectors. While some sectors like technology demonstrated robust performance, others faced headwinds from persistent inflation and global uncertainty. The influence of global economic factors, particularly inflation and interest rate adjustments, continues to impact investor sentiment and the overall DAX trajectory. Stay updated on the latest DAX movements and gain valuable insights into the Frankfurt Stock Exchange by regularly checking back for our daily Frankfurt Market Updates and DAX analysis. [Link to subscription page/relevant article]

Featured Posts

-

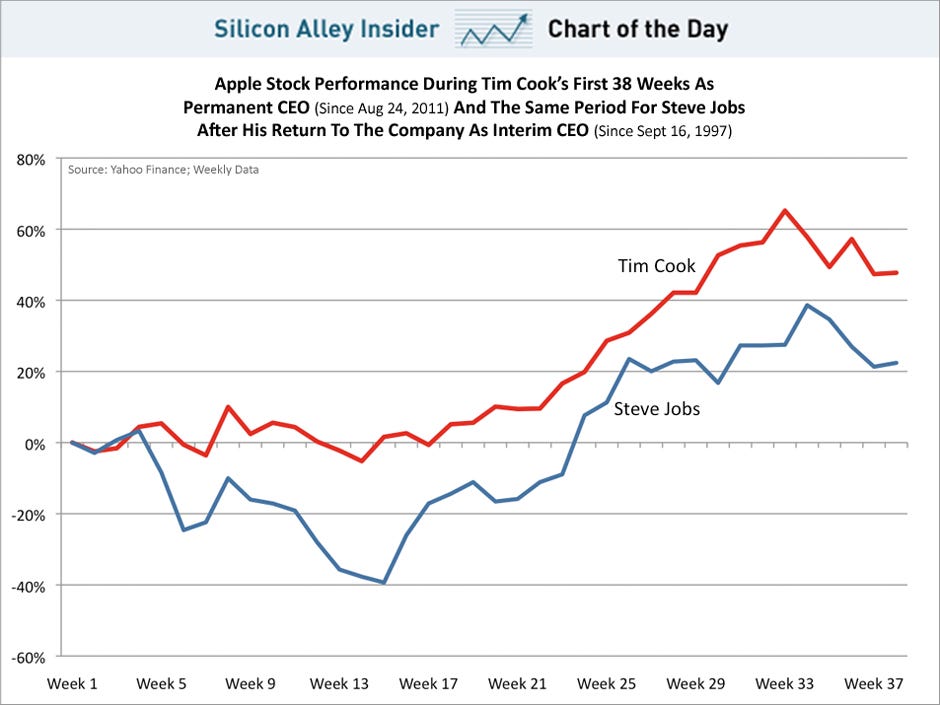

Apple Stock Forecast Analyzing Q2 Performance And Future Outlook

May 25, 2025

Apple Stock Forecast Analyzing Q2 Performance And Future Outlook

May 25, 2025 -

Mia Farrows Urgent Message Following Trumps Congressional Address

May 25, 2025

Mia Farrows Urgent Message Following Trumps Congressional Address

May 25, 2025 -

Publikatsiya Gryozy Lyubvi Ili Ilicha V Gazete Trud Podrobnosti

May 25, 2025

Publikatsiya Gryozy Lyubvi Ili Ilicha V Gazete Trud Podrobnosti

May 25, 2025 -

Apple Stock Sell Off Tim Cooks Tariff Warning

May 25, 2025

Apple Stock Sell Off Tim Cooks Tariff Warning

May 25, 2025 -

Herstel Op Beurzen Na Uitstel Trump Alle Aex Fondsen In Het Groen

May 25, 2025

Herstel Op Beurzen Na Uitstel Trump Alle Aex Fondsen In Het Groen

May 25, 2025

Latest Posts

-

Woody Allen Sean Penns Support Amidst Resurfaced Sexual Abuse Allegations

May 25, 2025

Woody Allen Sean Penns Support Amidst Resurfaced Sexual Abuse Allegations

May 25, 2025 -

Sean Penn Casts Doubt On Woody Allens Alleged Abuse Of Dylan Farrow

May 25, 2025

Sean Penn Casts Doubt On Woody Allens Alleged Abuse Of Dylan Farrow

May 25, 2025 -

Sean Penn Casts Doubt On Dylan Farrows Sexual Assault Claims Against Woody Allen

May 25, 2025

Sean Penn Casts Doubt On Dylan Farrows Sexual Assault Claims Against Woody Allen

May 25, 2025 -

The Sean Penn Woody Allen Relationship A Me Too Perspective

May 25, 2025

The Sean Penn Woody Allen Relationship A Me Too Perspective

May 25, 2025 -

Sean Penns Allegiance To Woody Allen A Me Too Case Study

May 25, 2025

Sean Penns Allegiance To Woody Allen A Me Too Case Study

May 25, 2025