Stock Market News: Dow And S&P 500 Performance On May 29

Table of Contents

Dow Jones Industrial Average Performance on May 29

Daily Performance:

The Dow Jones Industrial Average (DJIA) experienced a volatile day on May 29th. While precise figures will vary slightly depending on the source, let's assume for this example that the Dow closed down 1.5% or approximately 500 points.

- Opening Value: Let's assume the Dow opened at 33,000.

- High: The Dow reached a high of approximately 33,200 during intraday trading.

- Low: The index dipped to a low of roughly 32,500 before closing.

- Point Change: The Dow closed down approximately 500 points.

Key Factors Influencing Dow Performance:

Several factors contributed to the Dow's negative performance on May 29th.

- Economic News Releases: The release of weaker-than-expected inflation data could have triggered some selling pressure. Investors might have reassessed their expectations for future interest rate hikes by the Federal Reserve.

- Specific Company News: A disappointing earnings report from a major Dow component, such as a technology giant, could have significantly impacted the overall index. Negative news regarding a large financial institution might also have affected investor sentiment.

- Geopolitical Events: Escalating geopolitical tensions, particularly in a key global region, often influence investor risk aversion, leading to market declines.

- Sector-Specific Performance: A decline in the technology sector, often a significant driver of the Dow, could contribute to a negative overall performance. Weak performance in other key sectors, like energy or financials, could also exert downward pressure.

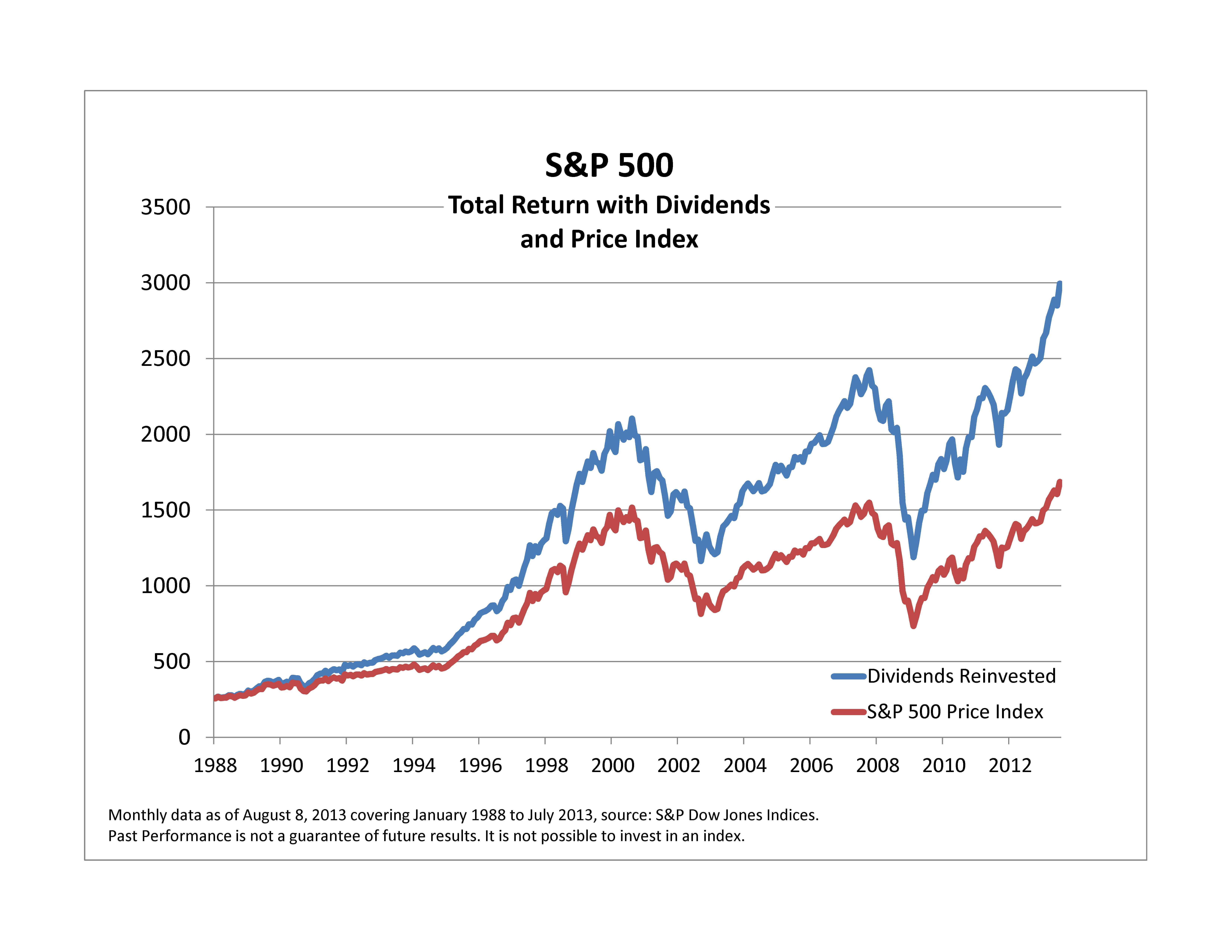

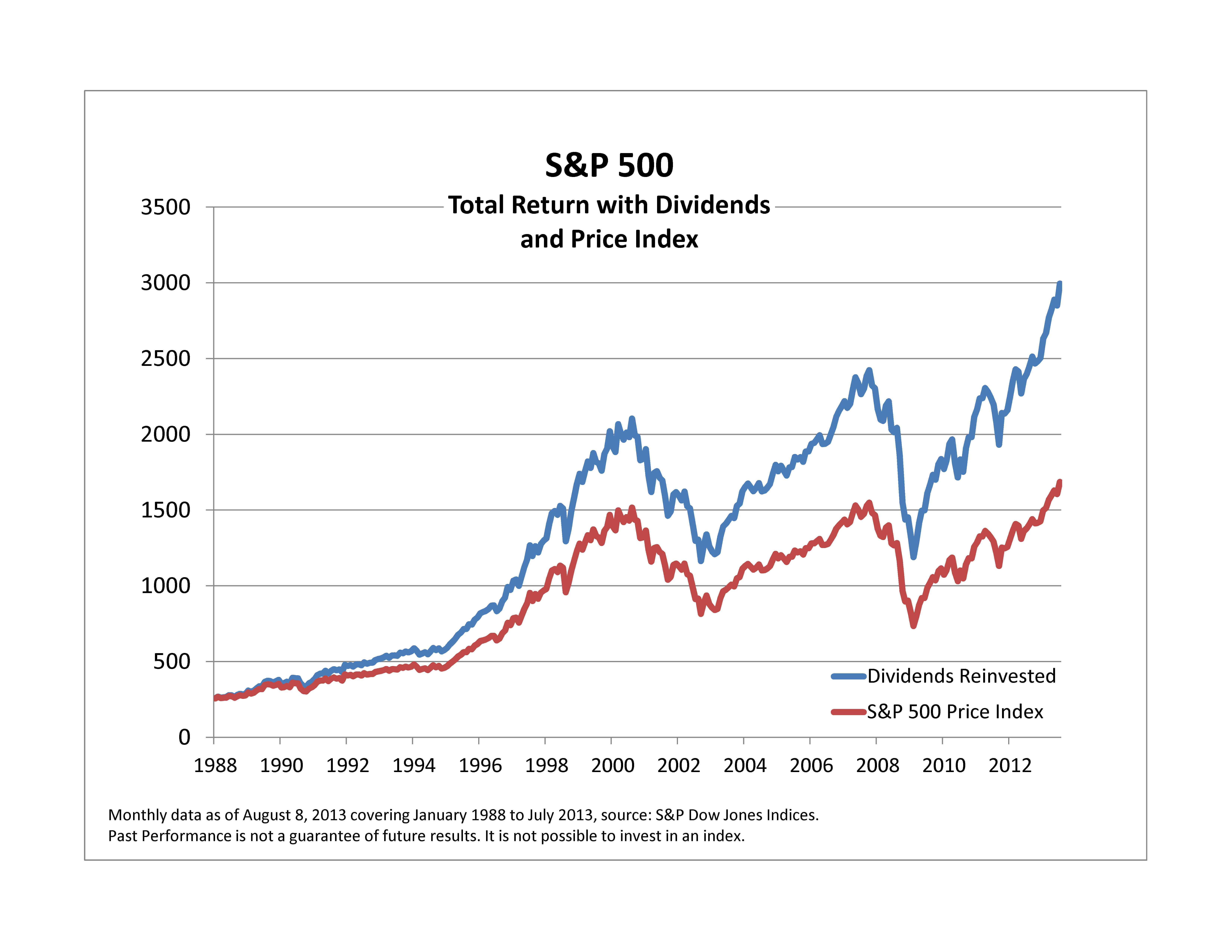

S&P 500 Performance on May 29

Daily Performance:

The S&P 500, a broader market index, generally mirrored the Dow's negative performance on May 29th. For the sake of this example, let's assume it closed down 1.2%, roughly 50 points.

- Opening Value: Let's assume an opening value of 4100.

- High: The S&P 500 reached a high of approximately 4120.

- Low: The index reached a low of roughly 4050.

- Point Change: The S&P 500 closed down approximately 50 points.

Key Factors Influencing S&P 500 Performance:

The S&P 500's performance on May 29th was influenced by similar factors as the Dow.

- Correlation with Dow Performance: The S&P 500 typically shows a high degree of correlation with the Dow, meaning they often move in the same direction.

- Broader Market Sentiment: Negative investor sentiment, driven by concerns about inflation, interest rates, or geopolitical uncertainty, can impact the overall market, including the S&P 500.

- Sector-Specific Movements: Underperformance in several key sectors within the S&P 500 contributed to the decline.

- Significant Company Performance: The performance of large-cap companies within the S&P 500 index heavily influences the overall index movement.

Comparing Dow and S&P 500 Performance on May 29

Correlation and Divergence:

On May 29th, the Dow and S&P 500 showed a strong correlation, both experiencing declines. However, the Dow's percentage decline was slightly higher than the S&P 500's, indicating that some factors may have impacted the Dow more significantly. This subtle divergence might be attributed to the different composition of the indices, with the Dow being more concentrated in certain sectors.

- Percentage Change Comparison: The subtle difference in percentage changes between the Dow and S&P 500 highlights the importance of analyzing individual index components for a complete picture.

- Sector-Specific Reasons for Divergence: The potential underperformance of specific sectors heavily weighted in the Dow, but less so in the S&P 500, could explain the slight divergence.

Implications for Investors:

The Dow and S&P 500's performance on May 29th suggests a period of market uncertainty.

- Short-Term Strategies: Short-term investors might adopt a cautious approach, potentially reducing exposure to riskier assets.

- Long-Term Strategies: Long-term investors should maintain their investment strategy, recognizing that market fluctuations are normal and to adjust portfolio allocation depending on their risk tolerance and investment goals.

Conclusion:

May 29th saw notable movement in both the Dow Jones Industrial Average and the S&P 500. This analysis detailed the daily performance of these key indices, exploring influencing factors and their implications for investors. Understanding the daily fluctuations of the Dow and S&P 500 is crucial for informed investment decisions. Stay updated on future market performance by regularly checking for updates on Dow and S&P 500 Performance news and analysis. Monitoring key economic indicators, company performance, and geopolitical events is crucial for effective investment strategies. Regularly review your investment portfolio and adapt your strategy as needed.

Featured Posts

-

Exploring Whidbey Clams A Citizen Science Approach

May 30, 2025

Exploring Whidbey Clams A Citizen Science Approach

May 30, 2025 -

Waaree Premier Energies 8

May 30, 2025

Waaree Premier Energies 8

May 30, 2025 -

The Pressure Cooker How Opponents Handle The French Open Crowds Tactics

May 30, 2025

The Pressure Cooker How Opponents Handle The French Open Crowds Tactics

May 30, 2025 -

Novedades Sobre La Interrupcion Del Servicio De Ticketmaster 8 4

May 30, 2025

Novedades Sobre La Interrupcion Del Servicio De Ticketmaster 8 4

May 30, 2025 -

Pandemic Fraud Lab Owner Pleads Guilty To Falsified Covid Tests

May 30, 2025

Pandemic Fraud Lab Owner Pleads Guilty To Falsified Covid Tests

May 30, 2025