Stock Market Prediction: Outperforming Palantir In 3 Years – Two Top Picks

Table of Contents

Palantir Technologies has seen its share price fluctuate significantly, capturing the attention of investors worldwide. While it holds potential, many are seeking alternatives with higher predicted growth over the next three years. This article explores two compelling stock market predictions and presents two top stock picks poised to potentially outperform Palantir. We'll analyze their market position, growth potential, and risk factors to help you make informed investment decisions.

Understanding Palantir's Current Market Position and Challenges

Palantir's Strengths and Weaknesses:

Palantir boasts several strengths, contributing to its current market position:

- Strong Government Contracts: A significant portion of Palantir's revenue stems from lucrative government contracts, providing a stable revenue stream.

- Innovative Technology: Palantir's data analytics and software platforms are considered cutting-edge, offering unique capabilities in data integration and analysis.

- Data Security Expertise: The company is renowned for its expertise in securing sensitive data, a crucial factor in government and enterprise contracts.

However, Palantir also faces challenges:

- High Valuation: Palantir's stock price has been subject to volatility and its valuation remains a concern for some investors.

- Dependence on Government Contracts: Over-reliance on government contracts exposes the company to potential shifts in government spending and policy.

- Intense Competition: The data analytics market is highly competitive, with established players and emerging startups vying for market share.

Recent performance has shown fluctuating growth, with analysts offering mixed predictions for the future. The long-term growth prospects of Palantir depend heavily on its ability to diversify its client base and expand its product offerings beyond government contracts. Its current market share, while significant in certain niche markets, faces challenges from larger, more diversified competitors. The valuation remains a key factor to consider when assessing its future performance.

Identifying Potential Risks in Investing in Palantir:

Investing in Palantir, like any stock, carries inherent risks:

- Volatility: Palantir's stock price has exhibited significant volatility, making it a higher-risk investment.

- Market Risk: Broader market downturns can negatively impact Palantir's share price regardless of its individual performance.

- Investment Risk: There's always a risk of losing some or all of your investment in Palantir.

- Geopolitical Risk: Changes in geopolitical conditions, particularly those impacting government spending, can significantly affect Palantir's revenue.

- Economic Downturns: A recession or significant economic slowdown could reduce government spending and private sector investment, impacting Palantir's growth.

Top Stock Pick #1: CrowdStrike Holdings, Inc. (CRWD) – A Detailed Analysis

CrowdStrike's Business Model and Competitive Advantage:

CrowdStrike is a leading cybersecurity company offering a cloud-native endpoint protection platform. Its subscription-based model provides recurring revenue, a significant advantage over traditional software licensing models. CrowdStrike's competitive advantage lies in its:

- Market Leadership in Endpoint Detection and Response (EDR): CrowdStrike holds a significant market share in the EDR market, a rapidly growing segment of the cybersecurity industry.

- AI-Powered Threat Detection: The company leverages artificial intelligence and machine learning for proactive threat detection and prevention, providing superior protection compared to traditional signature-based solutions.

- Strong Customer Acquisition and Retention: CrowdStrike boasts high customer satisfaction and a strong track record of customer acquisition and retention.

Growth Projections and Financial Performance of CrowdStrike:

CrowdStrike has demonstrated impressive revenue growth and profitability. Analyst predictions suggest continued strong growth over the next three years, potentially outpacing Palantir's projected growth. [Insert chart/graph showing CrowdStrike's revenue growth and earnings per share (EPS) projections, citing sources like financial reports and analyst estimates from reputable firms]. This growth is driven by increasing demand for cloud-based security solutions and CrowdStrike's strong market position. The return on investment (ROI) for CrowdStrike, based on current projections, is expected to be favorable compared to Palantir.

Risk Assessment for CrowdStrike:

While CrowdStrike's outlook is positive, some risks exist:

- Market Competition: The cybersecurity market is competitive, with established players and emerging startups constantly innovating.

- Regulatory Risk: Changes in data privacy regulations could impact CrowdStrike's operations and growth.

- Financial Risk: Like any growth stock, CrowdStrike's valuation is subject to market fluctuations.

Top Stock Pick #2: Datadog (DDOG) – A Detailed Analysis

Datadog's Business Model and Competitive Advantage:

Datadog provides a monitoring and analytics platform for cloud-scale applications. Its SaaS (Software as a Service) model provides recurring revenue and scalability. Datadog's competitive advantages include:

- Unified Monitoring Platform: Datadog offers a single platform for monitoring various aspects of cloud infrastructure and applications, simplifying operations and reducing complexity.

- Extensive Integrations: Its platform integrates with a wide range of cloud services and technologies, making it adaptable to diverse environments.

- Strong Developer Community: Datadog benefits from a large and active developer community, contributing to continuous improvement and innovation.

Growth Projections and Financial Performance of Datadog:

Datadog has consistently demonstrated strong revenue growth fueled by the increasing adoption of cloud computing. Analyst projections suggest continued robust growth over the next three years, surpassing Palantir's projected performance. [Insert chart/graph showing Datadog's revenue growth and EPS projections, citing sources]. The projected profit margin and ROI for Datadog are positive indicators for potential outperformance compared to Palantir.

Risk Assessment for Datadog:

Investing in Datadog carries some risks:

- Market Competition: The cloud monitoring market is competitive, with several established players and emerging competitors.

- Customer Concentration: Dependence on a relatively small number of large customers could expose Datadog to significant revenue volatility.

- Economic Downturn: A significant economic slowdown could impact customer spending on cloud infrastructure and monitoring tools.

Conclusion

This analysis suggests that CrowdStrike and Datadog, based on their current market positions, growth trajectories, and financial performance, hold the potential to outperform Palantir over the next three years. However, it's crucial to remember that these are predictions based on current data and analysis. All investments carry risk. CrowdStrike and Datadog, while promising, are not without their challenges.

Call to Action: While this article provides insightful stock market predictions and analysis of potential alternatives to Palantir, remember that all investments carry risk. Conduct thorough research and consider seeking advice from a qualified financial advisor before investing in any stock. Start your informed stock market prediction journey today and explore the potential of CrowdStrike and Datadog as strong contenders to outperform Palantir.

Featured Posts

-

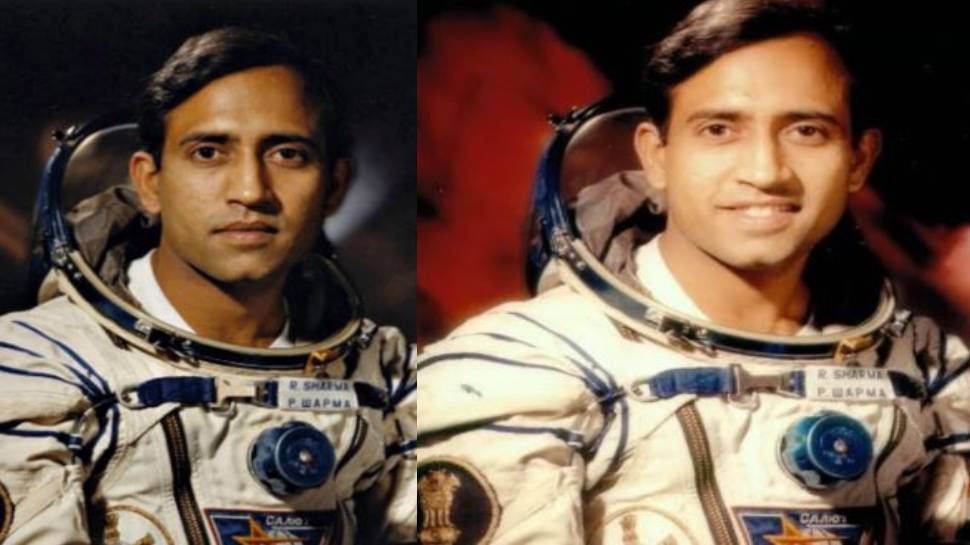

Indias First Astronaut Rakesh Sharmas Journey And Present Endeavors

May 09, 2025

Indias First Astronaut Rakesh Sharmas Journey And Present Endeavors

May 09, 2025 -

Save On Elizabeth Arden Skincare Walmart Alternatives

May 09, 2025

Save On Elizabeth Arden Skincare Walmart Alternatives

May 09, 2025 -

Family Support For Dakota Johnson At Materialist Los Angeles Premiere

May 09, 2025

Family Support For Dakota Johnson At Materialist Los Angeles Premiere

May 09, 2025 -

Indonesias Foreign Exchange Reserves Plunge Rupiah Weakness Takes Toll

May 09, 2025

Indonesias Foreign Exchange Reserves Plunge Rupiah Weakness Takes Toll

May 09, 2025 -

R5 1078 2025

May 09, 2025

R5 1078 2025

May 09, 2025