Strengthening Regional Capital Markets: The Pakistan-Sri Lanka-Bangladesh Initiative

Table of Contents

The Current State of Capital Markets in Pakistan, Sri Lanka, and Bangladesh

Each of the three countries – Pakistan, Sri Lanka, and Bangladesh – possesses unique strengths and weaknesses in its capital market infrastructure. Analyzing these is crucial to understanding the scope and challenges of the PSB initiative.

-

Pakistan: While boasting a relatively developed stock exchange, Pakistan faces challenges related to market depth and liquidity, particularly in the bond market. Investor confidence, impacted by macroeconomic factors, also needs improvement. Strengthening the regulatory framework and addressing issues of transparency are key priorities. Keywords: Pakistan Stock Exchange, market depth, liquidity, regulatory framework, investor confidence, bond market, financial regulations.

-

Sri Lanka: Sri Lanka's capital market is smaller compared to Pakistan's, but it exhibits relatively higher liquidity. Regulatory frameworks are generally considered sound, but enhancing investor education and attracting foreign investment remain important goals. Keywords: Colombo Stock Exchange, liquidity, regulatory framework, investor education, foreign direct investment (FDI).

-

Bangladesh: Bangladesh's capital market is characterized by relatively low market capitalization and trading volumes. Improving market infrastructure, enhancing transparency, and attracting both domestic and foreign investment are critical for growth. Keywords: Dhaka Stock Exchange, market capitalization, trading volumes, transparency, foreign investment.

Similarities across the three markets include a need for improved technology, better investor protection mechanisms, and increased transparency to attract foreign capital and build investor confidence. Differences exist in market size, depth, and regulatory approaches, necessitating a carefully planned and phased integration process.

Key Pillars of the Pakistan-Sri Lanka-Bangladesh Initiative

The PSB initiative rests on three main pillars: enhanced regulatory cooperation, infrastructure development, and investor education and awareness.

Enhanced Regulatory Cooperation

Harmonizing regulations and standards is paramount. This includes:

- Cross-border listing and trading: Facilitating the listing of companies from one country on the stock exchanges of others.

- Information asymmetry reduction: Improving data transparency and access to information for investors across borders.

- Regulatory harmonization: Developing common standards for listing requirements, corporate governance, and investor protection. Keywords: regulatory harmonization, cross-border listing, information asymmetry, transparency, market regulation.

Infrastructure Development

Modernizing and integrating trading platforms and clearing systems is essential. This involves:

- Integrated trading platforms: Creating a unified system that allows for seamless trading across the three countries.

- Efficient clearing systems: Establishing reliable and efficient mechanisms for settling transactions.

- Fintech adoption: Utilizing technology to enhance market efficiency, reduce costs, and improve access for investors. Keywords: trading platforms, clearing systems, fintech, technology, infrastructure development.

Investor Education and Awareness

Building investor confidence requires focused efforts on:

- Financial literacy programs: Educating investors about the benefits of regional market integration and cross-border investment.

- Risk management awareness: Helping investors understand and manage the risks associated with cross-border investment.

- Promoting cross-border investment: Creating incentives and reducing barriers to encourage investment across the PSB region. Keywords: investor education, cross-border investment, risk management, financial literacy.

Potential Benefits of the Initiative

The PSB initiative promises significant benefits for the region:

Economic Growth and Development

Regional capital market integration can stimulate economic activity through:

- Increased capital flows: Facilitating the movement of capital across borders, leading to more efficient allocation of resources.

- Attracting FDI: Creating a more attractive investment climate, leading to increased foreign direct investment.

- Portfolio diversification: Providing investors with opportunities to diversify their investment portfolios across the region. Keywords: economic growth, foreign direct investment (FDI), portfolio diversification, capital flows.

Enhanced Regional Cooperation

The initiative can strengthen economic ties by:

- Promoting regional cooperation: Facilitating joint ventures and collaborative projects.

- Deepening economic integration: Creating a more integrated and interconnected regional economy. Keywords: regional cooperation, economic integration, South Asian cooperation.

Building a Stronger Future Through Regional Capital Market Integration: The Pakistan-Sri Lanka-Bangladesh Initiative

The Pakistan-Sri Lanka-Bangladesh initiative offers a transformative opportunity to strengthen regional capital markets and unlock significant economic growth. The success of this initiative hinges on effective regulatory cooperation, the development of robust market infrastructure, and targeted investor education programs. By addressing the specific challenges and capitalizing on the unique strengths of each country's capital market, the PSB region can create a vibrant and integrated financial ecosystem that benefits all participants. Investing in the success of the Pakistan-Sri Lanka-Bangladesh initiative is crucial for unlocking the immense economic potential of the region. Let's continue to explore ways to strengthen regional capital markets for mutual benefit.

Featured Posts

-

Singer Wynne Evans Relaxed Day With Liz Following Bbc Scheduling Change

May 10, 2025

Singer Wynne Evans Relaxed Day With Liz Following Bbc Scheduling Change

May 10, 2025 -

Ryujinx Emulator Development Ceases Following Nintendo Contact

May 10, 2025

Ryujinx Emulator Development Ceases Following Nintendo Contact

May 10, 2025 -

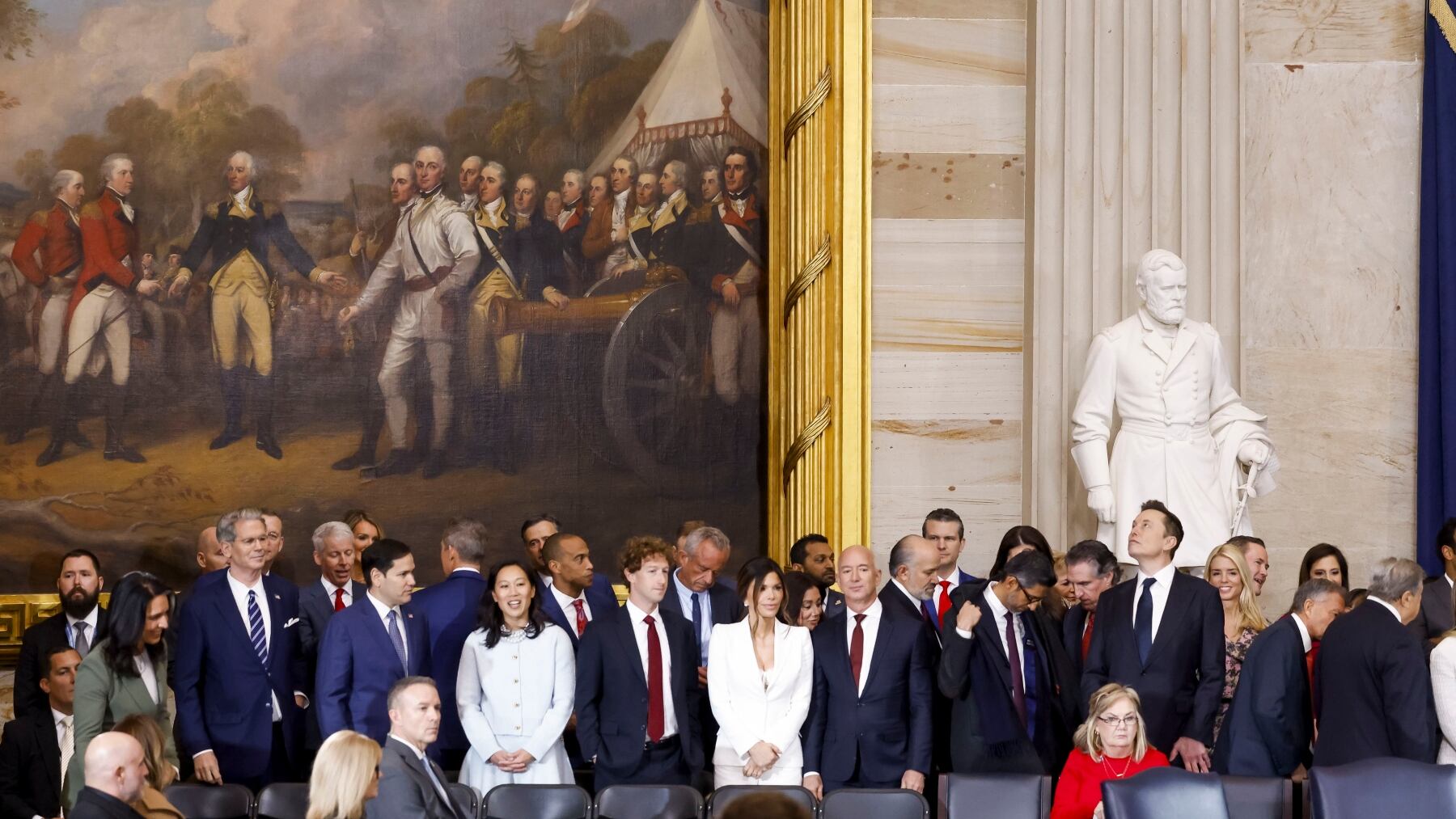

Analyzing The Net Worth Losses Of Elon Musk Jeff Bezos And Mark Zuckerberg After Trumps Inauguration

May 10, 2025

Analyzing The Net Worth Losses Of Elon Musk Jeff Bezos And Mark Zuckerberg After Trumps Inauguration

May 10, 2025 -

Community Activist Proposes Live Womb Transplants For Transgender Mothers

May 10, 2025

Community Activist Proposes Live Womb Transplants For Transgender Mothers

May 10, 2025 -

Actors And Writers Strike A Complete Hollywood Shutdown

May 10, 2025

Actors And Writers Strike A Complete Hollywood Shutdown

May 10, 2025