Success In Private Credit: 5 Essential Do's And Don'ts

Table of Contents

Do: Conduct Thorough Due Diligence

Before investing in any private credit opportunity, comprehensive due diligence is paramount. This involves a meticulous examination of various factors to ensure the investment aligns with your risk tolerance and investment goals.

Analyze the Borrower's Financial Health

A deep dive into the borrower's financial health is crucial. This goes beyond simply reviewing the summary figures; you need a granular understanding of their financial stability.

- Scrutinize cash flow statements for consistent profitability: Look for trends, seasonality, and any red flags that might indicate financial instability. A strong and consistent cash flow is the lifeblood of any successful borrower.

- Evaluate debt-to-equity ratios and leverage levels: Understand the borrower's capital structure and its ability to service its debt obligations. High leverage can be a significant risk factor.

- Assess the borrower's management team experience and track record: A competent and experienced management team is crucial for successful business operations and loan repayment. Investigate their past successes and failures.

- Understand the underlying collateral and its valuation: Thoroughly assess the value of the collateral securing the loan. Independent appraisals are often necessary to ensure accurate valuation.

Assess the Market and Competitive Landscape

Don't solely focus on the borrower; analyze the broader market context. This provides a crucial perspective on the investment's potential for success.

- Research industry trends and potential disruptions: Understanding industry dynamics helps assess the borrower's long-term viability and potential challenges.

- Analyze competing investment opportunities: Compare the potential returns and risks of this private credit opportunity against others in the market.

- Consider the exit strategy and potential liquidity: Plan for how you will eventually exit the investment. Understanding liquidity options is crucial, especially for illiquid assets.

Don't: Neglect Legal and Regulatory Compliance

Navigating the legal and regulatory landscape of private credit is critical. Non-compliance can lead to significant financial and reputational damage.

Understand the Regulatory Framework

Private credit investments are subject to various state and federal regulations. Staying informed is crucial to avoid legal pitfalls.

- Be aware of state and federal lending regulations: Regulations vary significantly depending on the type of loan and the jurisdiction. Engage legal counsel specializing in private credit to ensure compliance.

- Ensure compliance with all disclosure requirements: Transparency is vital in private credit transactions. Failure to comply with disclosure requirements can lead to severe penalties.

- Consult with legal counsel to mitigate legal risks: Legal expertise is indispensable throughout the entire investment process, from structuring the loan to managing potential defaults.

Overlook Contractual Obligations

Meticulously review and understand all loan agreements before committing to an investment.

- Clearly define loan terms, interest rates, and repayment schedules: Ambiguity in loan agreements can lead to disputes and financial losses.

- Establish robust default provisions and remedies: Outline clear procedures for handling defaults, including remedies such as collateral liquidation.

- Secure appropriate collateral and guarantees: Adequate collateral and guarantees are vital to protect your investment in case of default.

Do: Diversify Your Portfolio

Diversification is a cornerstone of successful investing, and private credit is no exception.

Spread Investments Across Different Borrowers and Sectors

Don't concentrate your investments in a single borrower or sector. This minimizes your exposure to sector-specific risks.

- Diversify across industries, geographies, and borrower types (e.g., real estate, energy, technology): Spreading investments across various sectors reduces the impact of any single sector's underperformance.

- Consider the correlation between investments to minimize overall risk: Avoid over-concentrating in highly correlated assets, which can amplify losses during market downturns.

Employ a Strategic Allocation Approach

Develop a well-defined investment strategy that aligns with your risk tolerance and investment objectives.

- Establish a clear investment strategy aligned with your risk appetite: Your investment strategy should outline your risk tolerance, investment goals, and preferred asset allocation.

- Regularly rebalance your portfolio to maintain the desired asset allocation: Market fluctuations can disrupt your desired allocation; regular rebalancing helps maintain your intended risk profile.

Don't: Underestimate Risk Management

Private credit investments carry inherent risks. Proactive risk management is crucial for mitigating potential losses.

Develop a Robust Risk Assessment Process

Implement a comprehensive risk assessment process that identifies and evaluates potential risks at each stage of the investment.

- Employ stress testing and scenario analysis to evaluate the impact of adverse events: This helps assess the investment's resilience under various adverse economic conditions.

- Regularly monitor borrower performance and market conditions: Continuous monitoring allows for early identification of potential problems and prompt corrective action.

- Establish clear risk thresholds and limits: Setting clear limits helps control exposure to specific risks and prevents excessive concentration in any single area.

Fail to Monitor Loan Performance

Consistent monitoring of loan performance is essential to ensure timely repayment and identify potential issues early on.

- Implement a system for tracking loan repayments, interest accruals, and other key performance indicators: Regular tracking provides a clear picture of loan performance and identifies any deviations from expectations.

- Maintain regular communication with borrowers: Open communication helps build trust and allows for early detection of potential problems.

- Be prepared to take corrective action if necessary: Having a plan in place for addressing potential problems, such as loan restructuring or default management, is crucial.

Do: Build Strong Relationships

Networking and relationship building are essential for success in private credit.

Network with Key Players

Building relationships within the private credit industry provides access to valuable information and investment opportunities.

- Attend industry events and conferences: These events offer opportunities to meet potential borrowers, lenders, and other key players in the industry.

- Connect with potential borrowers, lenders, and service providers: Developing a strong network increases access to deal flow and expertise.

Foster Long-Term Partnerships

Cultivating long-term relationships with borrowers and other stakeholders enhances trust and facilitates future collaboration.

- Communicate transparently and maintain open lines of communication: Open communication helps foster trust and build strong relationships.

- Seek mutually beneficial arrangements: Focusing on mutually beneficial partnerships fosters collaboration and long-term success.

Conclusion

Success in private credit requires a combination of meticulous due diligence, effective risk management, and strategic decision-making. By following these do's and don'ts, you can significantly improve your chances of achieving your investment goals. Remember to prioritize thorough due diligence, comply with all regulations, diversify your portfolio, and actively manage risk. Don't hesitate to seek expert advice to navigate the complexities of private credit. Start building your success in private credit today!

Featured Posts

-

Mlb Home Run Prop Bets May 8th Predictions And Best Odds

May 18, 2025

Mlb Home Run Prop Bets May 8th Predictions And Best Odds

May 18, 2025 -

How Kenley Jansen Is Mentoring Top Prospect Ben Joyce La Angels

May 18, 2025

How Kenley Jansen Is Mentoring Top Prospect Ben Joyce La Angels

May 18, 2025 -

Kanye Vest Prokomentuvav Rozstavannya Z Byankoyu Tsenzori

May 18, 2025

Kanye Vest Prokomentuvav Rozstavannya Z Byankoyu Tsenzori

May 18, 2025 -

Trumps Middle East Engagement Winners And Losers

May 18, 2025

Trumps Middle East Engagement Winners And Losers

May 18, 2025 -

House Gop Tax Bill Encounters Resistance Over Medicaid Clean Energy Provisions

May 18, 2025

House Gop Tax Bill Encounters Resistance Over Medicaid Clean Energy Provisions

May 18, 2025

Latest Posts

-

Find Easy A On Bbc Three Hd Your Complete Tv Guide

May 18, 2025

Find Easy A On Bbc Three Hd Your Complete Tv Guide

May 18, 2025 -

Taran Killam Discusses His Friendship With Amanda Bynes

May 18, 2025

Taran Killam Discusses His Friendship With Amanda Bynes

May 18, 2025 -

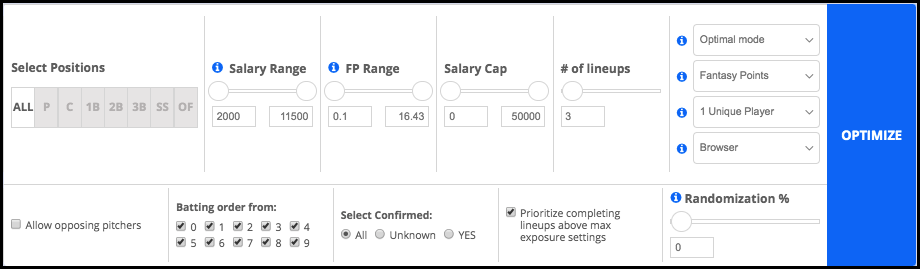

May 8th Mlb Dfs Lineup Optimizer Sleeper Picks And Value Plays

May 18, 2025

May 8th Mlb Dfs Lineup Optimizer Sleeper Picks And Value Plays

May 18, 2025 -

Mlb Dfs May 8th Sleeper Picks And Hitter To Target

May 18, 2025

Mlb Dfs May 8th Sleeper Picks And Hitter To Target

May 18, 2025 -

Amanda Bynes And Rachel Green The Unexpected Comparison Made By Drake Bell

May 18, 2025

Amanda Bynes And Rachel Green The Unexpected Comparison Made By Drake Bell

May 18, 2025