Tesla Fights Back Against Shareholder Lawsuits Following Musk's Controversial Pay Package

Table of Contents

The Structure of Musk's Compensation Package and its Controversies

Elon Musk's compensation package is structured around a complex system of stock options, performance metrics, and vesting schedules designed to incentivize him to achieve ambitious company goals. The sheer scale of the potential payout, however, has drawn significant criticism. Critics argue it’s far beyond what's typical for CEOs of comparable companies and potentially dilutes the value of existing shareholder stock.

- Stock Options: The package primarily consists of stock options, allowing Musk to purchase Tesla shares at a predetermined price. The number of options granted is contingent on Tesla achieving specific, pre-defined performance targets over a 10-year period.

- Performance Metrics: These targets are exceptionally ambitious, covering a range of criteria including market capitalization, revenue growth, and operational milestones. Reaching all goals would result in a payout worth tens of billions of dollars.

- Vesting Schedules: The vesting of these options is tied to the achievement of these performance targets, ensuring Musk benefits only if Tesla achieves exceptional growth. However, even partial achievement of these targets translates into significant financial gains for Musk.

The potential cost to Tesla if all performance goals are met is staggering, potentially exceeding $55 billion. Critics argue that some performance metrics are overly ambitious and may not be realistically achievable, potentially benefiting Musk even if Tesla falls short of its intended goals. This raises concerns about potential conflicts of interest and the fair allocation of company resources.

Key Arguments Presented in the Shareholder Lawsuits

Several shareholder lawsuits have been filed against Tesla, alleging various breaches of fiduciary duty and corporate waste. These Tesla shareholder lawsuits represent a concerted effort by shareholders to challenge the legitimacy of Musk's compensation package and the board's oversight.

- Breach of Fiduciary Duty: Shareholders argue that the Tesla board failed in its duty to act in the best interests of all shareholders, approving a compensation package that disproportionately benefits Musk at the expense of other investors.

- Corporate Waste: The lawsuits allege that the compensation package constitutes corporate waste, as its potential cost significantly outweighs any potential benefit to Tesla's overall performance.

- Inadequate Oversight: The plaintiffs claim that the board failed to exercise proper oversight and engage in adequate due diligence before approving such an exorbitant compensation package.

These lawsuits cite relevant sections of Delaware corporate law, where Tesla is incorporated, arguing that the compensation package violates established norms for executive compensation and breaches the directors' fiduciary duties. The plaintiffs and their legal representatives are pursuing remedies including monetary damages and potential board reforms to prevent similar excessive compensation packages in the future.

Tesla's Defense Strategy Against the Lawsuits

Tesla and its legal team have robustly defended the compensation package, arguing that it is justified by Musk's unique contributions and the significant value he brings to the company.

- Tesla's Rationale: The company argues that the compensation package is essential to retain Musk’s expertise and leadership, emphasizing his pivotal role in Tesla’s success and continued innovation in the electric vehicle and clean energy sectors.

- Evidence Presented: Tesla's defense likely relies on demonstrating the extraordinary growth achieved under Musk's leadership and the exceptional difficulty of achieving the performance targets set within the compensation plan. They will present financial data and expert testimony to support their position.

- Expert Witnesses: Tesla is expected to utilize expert witnesses specializing in executive compensation, corporate governance, and financial valuation to bolster their arguments and counter the claims made by the plaintiffs.

Tesla's defense will hinge on proving the fairness and reasonableness of the compensation package given the high risk and exceptional achievements that Tesla has realised under Musk's guidance.

Potential Outcomes and Implications for Tesla and its Stock

The potential outcomes of these Tesla shareholder lawsuits remain uncertain. Several scenarios could unfold, each carrying significant implications for Tesla and its stock price.

- Settlements: Tesla might choose to settle some or all of the lawsuits to avoid protracted and costly litigation. The terms of any settlements could impact Tesla's financial performance.

- Court Judgments: If the cases proceed to trial, the court's decision could significantly impact the future structure of executive compensation at Tesla. An unfavorable ruling could result in substantial financial penalties.

- Impact on Tesla's Stock: The negative publicity surrounding these lawsuits, regardless of the ultimate legal outcome, could negatively affect investor sentiment and Tesla's stock price. Uncertainty surrounding the future of Musk’s leadership could also impact the company's stock performance, both short-term and long-term.

Conclusion

The Tesla shareholder lawsuits represent a significant challenge to the company and to Elon Musk's leadership. The core issue remains the controversial compensation package, its immense potential cost, and whether it constitutes a breach of fiduciary duty by the board. The arguments presented by shareholders highlight concerns about corporate governance and excessive executive pay. Tesla’s defense emphasizes the extraordinary value Musk has brought to the company and the difficulty in achieving the compensation targets. The ultimate outcomes of these lawsuits will significantly impact Tesla’s financial performance, reputation, and the future trajectory of the company. Stay tuned for further updates on these crucial Tesla shareholder lawsuits and the ongoing debate surrounding executive compensation in the tech industry. Understanding the various aspects of these Tesla shareholder lawsuits is vital for navigating the complexities of investing in the electric vehicle sector and for ensuring accountability in corporate governance.

Featured Posts

-

White House Rejects Moodys Us Credit Downgrade Analysis And Response

May 18, 2025

White House Rejects Moodys Us Credit Downgrade Analysis And Response

May 18, 2025 -

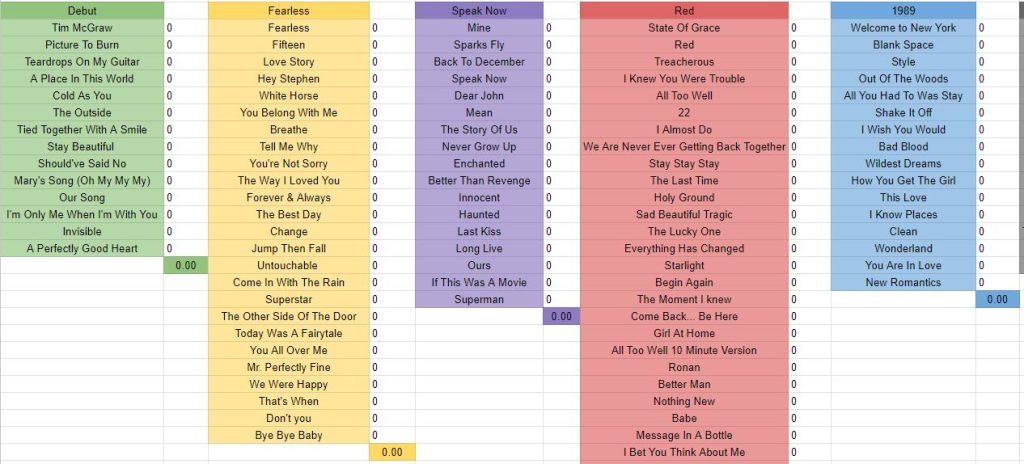

The Ultimate Taylor Swift Album Ranking 11 Albums Reviewed

May 18, 2025

The Ultimate Taylor Swift Album Ranking 11 Albums Reviewed

May 18, 2025 -

Vuurwerkverbod Een Op De Zes Blijft Kopen

May 18, 2025

Vuurwerkverbod Een Op De Zes Blijft Kopen

May 18, 2025 -

Kanye West Bianca Censori A Spanish Reunion

May 18, 2025

Kanye West Bianca Censori A Spanish Reunion

May 18, 2025 -

The Us Army And Right To Repair Benefits Challenges And The Future Of Military Technology

May 18, 2025

The Us Army And Right To Repair Benefits Challenges And The Future Of Military Technology

May 18, 2025

Latest Posts

-

Angels Pari Post Rain Game Winning Homer Against White Sox

May 18, 2025

Angels Pari Post Rain Game Winning Homer Against White Sox

May 18, 2025 -

Pete Crow Reports Cubs Clinch Series Win Thanks To Armstrongs Performance

May 18, 2025

Pete Crow Reports Cubs Clinch Series Win Thanks To Armstrongs Performance

May 18, 2025 -

Todays Mlb Home Run Props May 8th Predictions And Betting Odds

May 18, 2025

Todays Mlb Home Run Props May 8th Predictions And Betting Odds

May 18, 2025 -

Dodgers Bet On Conforto Can He Match Hernandezs Production

May 18, 2025

Dodgers Bet On Conforto Can He Match Hernandezs Production

May 18, 2025 -

Kyren Paris Clutch Homer Leads Angels To Victory Over White Sox

May 18, 2025

Kyren Paris Clutch Homer Leads Angels To Victory Over White Sox

May 18, 2025