Tesla Stock Plunge: Is Elon Musk's Time Running Out?

Table of Contents

Analyzing the Tesla Stock Plunge

Factors Contributing to the Decline

Several interconnected factors have contributed to the decline in Tesla stock. These include:

- Increased Competition: The EV market is rapidly expanding, with established automakers and new entrants aggressively challenging Tesla's dominance. Companies like BYD, Volkswagen, and Rivian are rapidly gaining market share, putting pressure on Tesla's sales and profitability.

- Rising Interest Rates: The Federal Reserve's interest rate hikes have dampened investor sentiment across the board, impacting growth stocks like Tesla particularly hard. Higher interest rates increase borrowing costs, making expansion and investment more expensive.

- Macroeconomic Headwinds: Global economic uncertainty, including inflation and recessionary fears, has further negatively impacted investor confidence in riskier assets, such as Tesla stock. The overall market volatility has undoubtedly contributed to the plunge.

- Elon Musk's Controversial Actions: Elon Musk's controversial actions, particularly his $44 billion acquisition of Twitter and subsequent management of the platform, have significantly distracted from Tesla's operations and eroded investor confidence. The time and resources diverted to Twitter have raised concerns about his focus on Tesla.

- Production Challenges and Delays: Tesla has experienced several production challenges and delays, impacting its ability to meet growing demand and potentially affecting its financial performance. Supply chain disruptions have also played a role.

For instance, Tesla's stock price plummeted by over X% on [Date] following the announcement of [Specific Event that impacted the stock price]. [Link to relevant news article]. This demonstrates the significant impact of negative news on investor sentiment.

Elon Musk's Leadership and its Impact

The Twitter Acquisition and its Fallout

The Twitter acquisition represents a massive financial burden for Musk, raising concerns about his ability to effectively manage both companies simultaneously. The substantial debt incurred to finance the deal has undoubtedly impacted Tesla's financial health and investor perception. The distraction caused by Twitter's operational challenges has also raised questions about Musk's focus on Tesla's long-term strategy.

Musk's Public Image and its Influence on Stock Price

Musk's often controversial tweets and public statements have repeatedly influenced Tesla's stock price. His impulsive pronouncements and occasional disregard for conventional corporate communication have created market uncertainty and volatility. Examples include [Cite specific examples of controversial tweets or statements].

Leadership Style and Long-Term Vision

Musk's visionary leadership has undeniably been instrumental in Tesla's success. However, his often autocratic style and penchant for impulsive decision-making raise concerns about the company's long-term sustainability. Balancing innovation with responsible management will be critical for Tesla's continued growth.

The Competitive Landscape and Future Outlook for Tesla

Rising Competition in the Electric Vehicle Market

The EV market is no longer Tesla's exclusive domain. Established automakers are investing heavily in EVs, while new players are entering the market with innovative technologies and competitive pricing. This intense competition is squeezing Tesla's market share and profit margins. Companies like [mention specific competitors with their market strategies] pose a significant threat.

Tesla's Innovation and Future Product Roadmap

Tesla's continued success hinges on its ability to innovate and introduce new products to maintain its competitive edge. The development of new models, advancements in battery technology, and expansion into new markets (like autonomous driving) are crucial for Tesla's future growth.

Market Predictions and Analyst Opinions

Analyst opinions on Tesla's future stock performance are divided. Some analysts remain bullish, citing Tesla's strong brand recognition and technological advancements. Others express concerns about the intense competition and macroeconomic headwinds. [Cite examples of analyst opinions and their predictions, including sources].

Investor Sentiment and Strategies

Should Investors Buy the Dip?

The question of whether to "buy the dip" in Tesla stock is a complex one. While the current valuation might present an attractive entry point for some investors, it's crucial to acknowledge the significant risks involved. Thorough due diligence and a careful assessment of one's risk tolerance are essential before making any investment decisions.

Alternative Investment Options

Investors seeking exposure to the EV sector might consider diversifying their portfolio by investing in other EV companies or ETFs focused on the broader clean energy sector. This can help mitigate the risk associated with investing heavily in a single stock.

Conclusion

The recent Tesla stock plunge is a complex phenomenon resulting from a combination of factors: increased competition in the EV market, macroeconomic headwinds, rising interest rates, and Elon Musk's controversial actions and leadership style. The question of whether Elon Musk's time is running out remains open to interpretation; his visionary leadership has built Tesla into a global giant, but his leadership style and recent decisions have undeniably created significant uncertainty.

Monitor Tesla stock closely, stay updated on Tesla's future product roadmap, and learn more about the evolving EV market. Consider your investment strategy for Tesla stock carefully, and remember to consult with a financial advisor before making any investment decisions.

Featured Posts

-

Is Figmas Ai The Future Of Design A Comparison With Competitors

May 09, 2025

Is Figmas Ai The Future Of Design A Comparison With Competitors

May 09, 2025 -

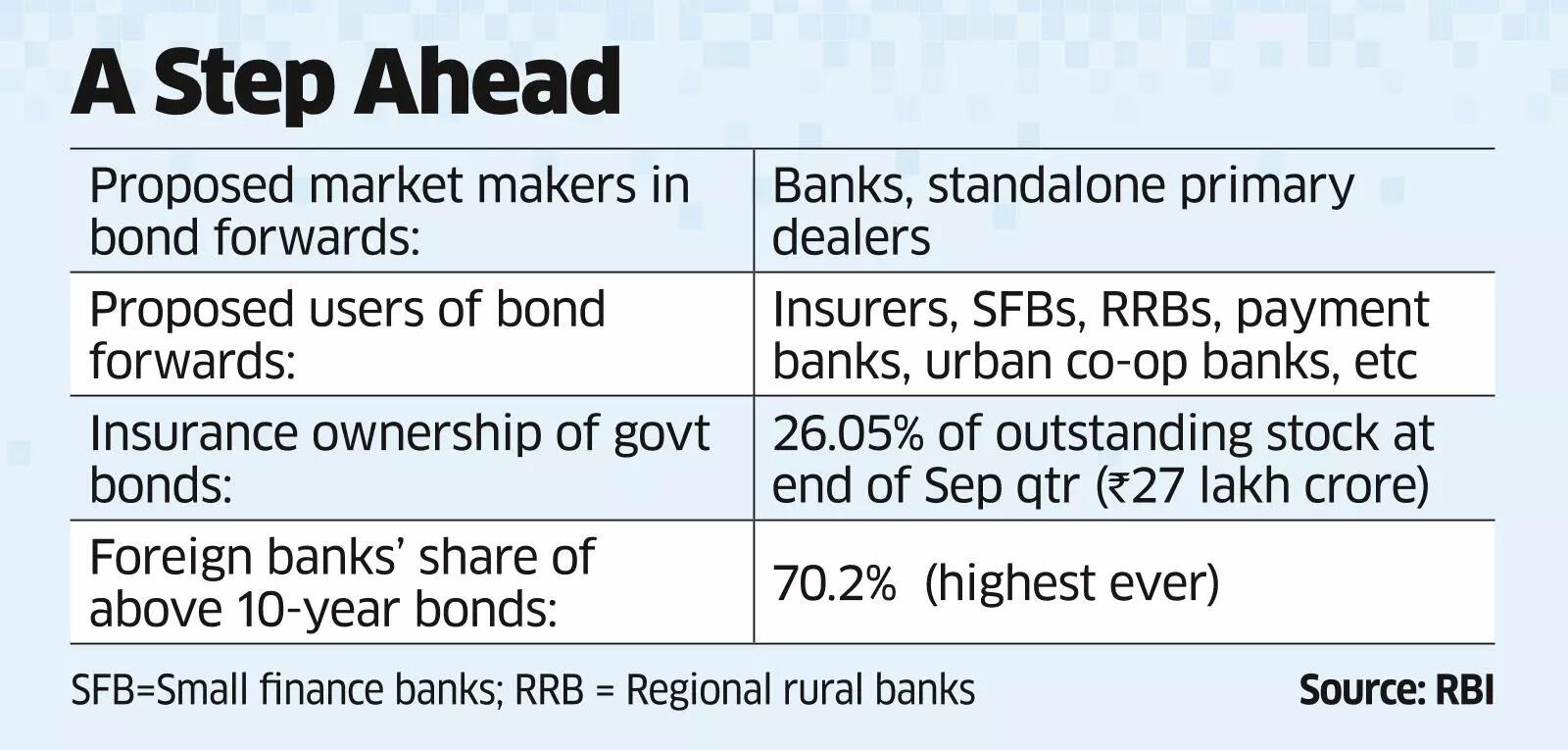

Easing Regulations For Bond Forwards A Boon For Indian Insurers

May 09, 2025

Easing Regulations For Bond Forwards A Boon For Indian Insurers

May 09, 2025 -

Watch Pam Bondis Statements On Eliminating American Citizens Spark Outrage

May 09, 2025

Watch Pam Bondis Statements On Eliminating American Citizens Spark Outrage

May 09, 2025 -

Easter Weekend In Lake Charles Top Live Music And Events

May 09, 2025

Easter Weekend In Lake Charles Top Live Music And Events

May 09, 2025 -

De Relatie Brekelmans India Uitdagingen En Kansen Voor Samenwerking

May 09, 2025

De Relatie Brekelmans India Uitdagingen En Kansen Voor Samenwerking

May 09, 2025