The 2025 BigBear.ai (BBAI) Stock Crash: Causes And Implications

Table of Contents

Potential Economic Factors Contributing to a BBAI Stock Decline

Macroeconomic instability significantly impacts tech valuations. A downturn in 2025 could severely affect BigBear.ai (BBAI) stock price.

- Macroeconomic Instability: A global recession, triggered by factors like persistent inflation, rapidly rising interest rates, or geopolitical instability, would likely reduce investor appetite for riskier assets, including AI stocks like BBAI. Reduced consumer spending further exacerbates the problem, decreasing demand for AI-powered services.

- AI Market Saturation and Competition: The AI market is rapidly evolving. Increased competition from established tech giants and innovative startups could lead to market saturation. This could result in price wars, squeezing profit margins for BigBear.ai and ultimately impacting its BBAI stock price.

- The emergence of new, disruptive technologies could render BigBear.ai's offerings obsolete.

- Decreased demand for AI services due to market saturation would negatively impact BBAI's revenue streams.

- Industry-Specific Challenges: BigBear.ai operates in a heavily regulated sector. Changes in government regulations, cybersecurity breaches, or failure to meet ambitious growth targets could all contribute to a decline in BBAI stock value.

- Stringent data privacy regulations could hinder BigBear.ai's ability to operate effectively.

- A major cybersecurity incident could damage the company's reputation and investor confidence.

Company-Specific Risks Contributing to a BBAI Stock Crash

Beyond macroeconomic factors, company-specific risks can significantly influence BBAI stock performance.

- Financial Performance: Missed earnings expectations, declining revenue, or a substantial increase in debt could severely impact investor confidence.

- A failure to successfully monetize its AI solutions could result in decreased profitability.

- High operating costs, especially in research and development, could strain the company's finances.

- Unsuccessful product launches could damage the company's reputation and investor confidence.

- Management and Leadership: Changes in leadership, internal conflicts, or poor strategic decision-making can shake investor confidence in BigBear.ai.

- The departure of key executives could disrupt operations and negatively impact BBAI stock price.

- Internal conflicts and power struggles could lead to inefficient resource allocation.

- Poor strategic decisions, such as misjudging market trends or pursuing unprofitable ventures, could significantly harm the company.

- Technological Limitations: Failure to innovate and adapt to rapid technological advancements could leave BigBear.ai behind its competitors.

- A lack of investment in research and development could lead to technological obsolescence.

- An inability to adapt to changing market demands could render BigBear.ai's offerings irrelevant.

Implications of a BigBear.ai (BBAI) Stock Crash

A hypothetical BigBear.ai stock crash would have far-reaching implications.

- Investor Losses: Investors holding BBAI stock would face significant capital losses, potentially impacting their portfolio diversification and overall investment strategy. The resulting decreased investor confidence could lead to a broader sell-off in the AI sector.

- Impact on the AI Industry: A BBAI crash could trigger a ripple effect across the AI industry. It could decrease investment in AI startups, creating a negative perception of the sector and leading to a market correction. This could hinder the overall growth of the AI industry.

- Long-Term Recovery: BigBear.ai’s long-term recovery would depend on several factors, including its ability to restructure, form strategic partnerships, successfully launch new products, and regain investor trust. A swift and decisive response to the crisis would be crucial.

Conclusion: Navigating the Uncertainties of BigBear.ai (BBAI) Stock

A potential BigBear.ai (BBAI) stock crash in 2025 could be triggered by a combination of macroeconomic headwinds, intense competition, and company-specific risks. The consequences could be severe, impacting investors, the broader AI industry, and BigBear.ai's long-term prospects. Before investing in BBAI, conduct thorough research and due diligence. Analyze BigBear.ai's financial performance, competitive landscape, and strategic direction. Understand the inherent risks involved in investing in AI stocks. Conduct a comprehensive BigBear.ai stock analysis to inform your investment strategy and understand BBAI investment risks. Informed decisions are crucial for navigating the volatile world of technology stocks. Remember, understanding BBAI risks is key to responsible investing.

Featured Posts

-

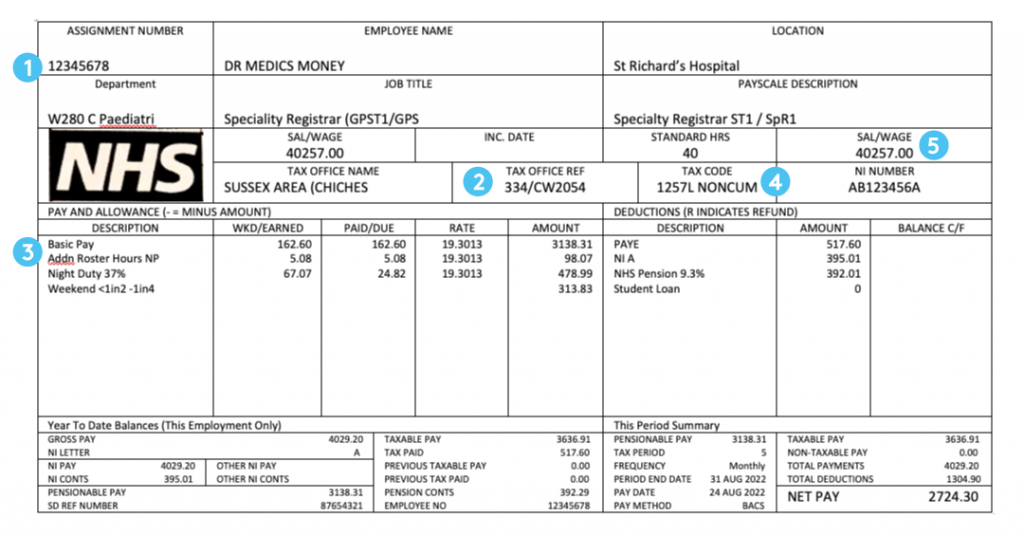

Unclaimed Hmrc Refunds How To Check Your Payslip And Claim

May 20, 2025

Unclaimed Hmrc Refunds How To Check Your Payslip And Claim

May 20, 2025 -

Talisca Tadic Transferi Fenerbahce De Gerilim Ve Yeni Bir Doenem

May 20, 2025

Talisca Tadic Transferi Fenerbahce De Gerilim Ve Yeni Bir Doenem

May 20, 2025 -

The Richard Mille Rm 72 01 A Closer Look At Leclercs Timepiece

May 20, 2025

The Richard Mille Rm 72 01 A Closer Look At Leclercs Timepiece

May 20, 2025 -

Update 49 Dogs Removed From Washington County Breeding Facility

May 20, 2025

Update 49 Dogs Removed From Washington County Breeding Facility

May 20, 2025 -

Reaktsi A Tadi A Na Nasilni Napad Na Detsu Shmitova Odgovornost

May 20, 2025

Reaktsi A Tadi A Na Nasilni Napad Na Detsu Shmitova Odgovornost

May 20, 2025

Latest Posts

-

Brasserie Hell City L Adresse Incontournable Pres Du Hellfest

May 21, 2025

Brasserie Hell City L Adresse Incontournable Pres Du Hellfest

May 21, 2025 -

Hell City Nouvelle Brasserie Pres Du Hellfest A Clisson

May 21, 2025

Hell City Nouvelle Brasserie Pres Du Hellfest A Clisson

May 21, 2025 -

Festival Le Bouillon A Clisson Retour Sur Des Spectacles Engages

May 21, 2025

Festival Le Bouillon A Clisson Retour Sur Des Spectacles Engages

May 21, 2025 -

Clisson Le Festival Le Bouillon Et Ses Spectacles Engages

May 21, 2025

Clisson Le Festival Le Bouillon Et Ses Spectacles Engages

May 21, 2025 -

Le Festival Le Bouillon Engagement Et Spectacles A Clisson

May 21, 2025

Le Festival Le Bouillon Engagement Et Spectacles A Clisson

May 21, 2025