Unclaimed HMRC Refunds: How To Check Your Payslip And Claim

Table of Contents

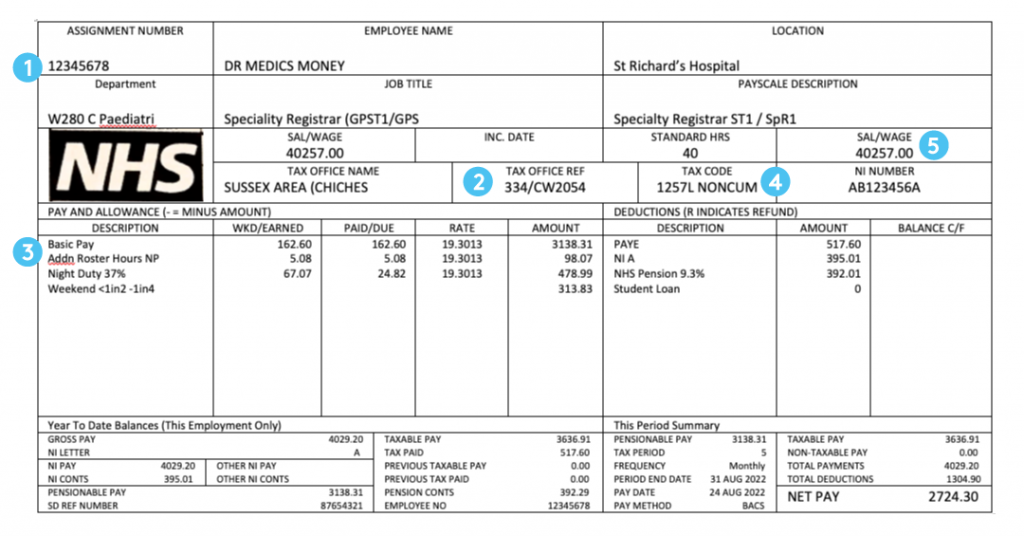

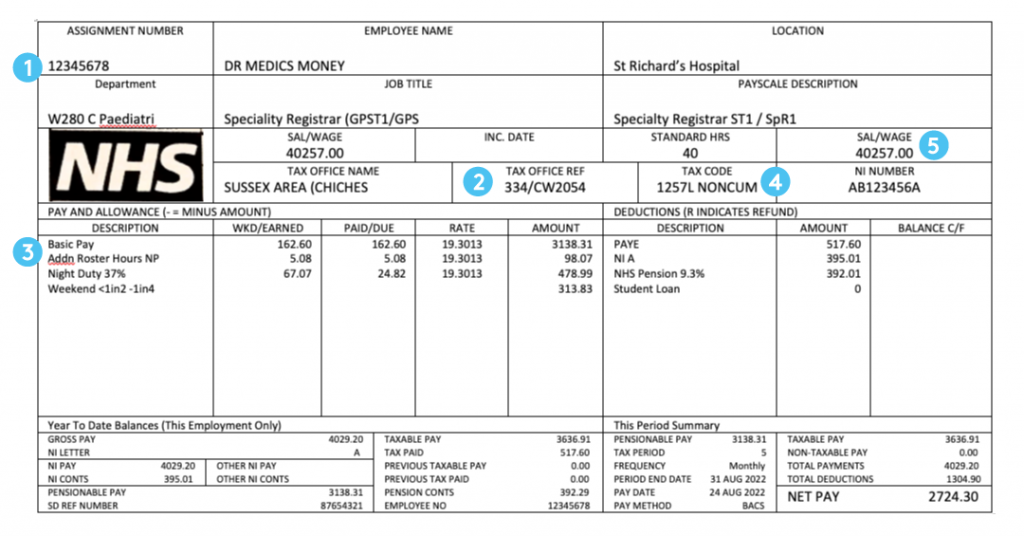

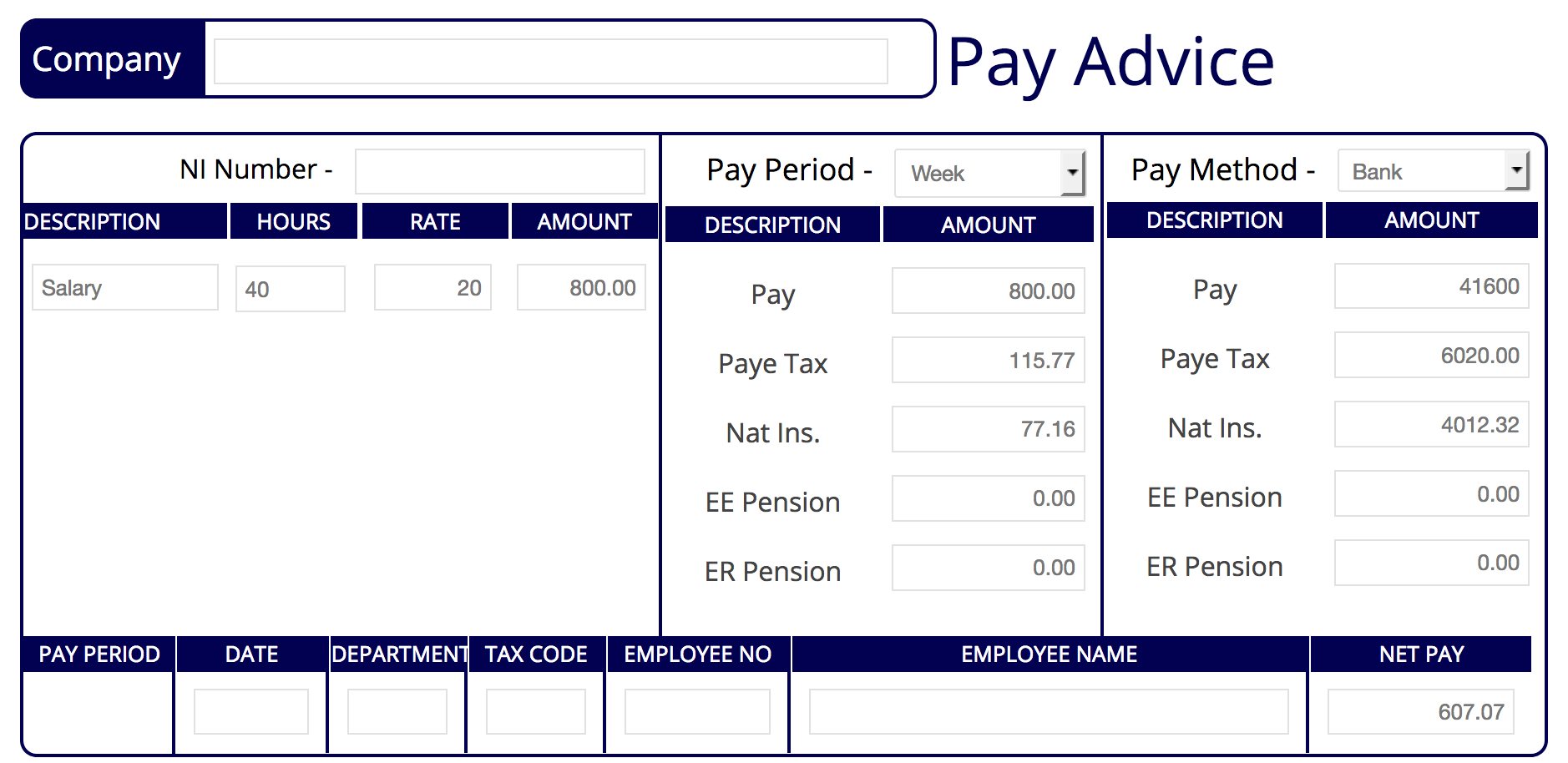

Understanding Your Payslip: Key Information for HMRC Refund Claims

Your payslip is a crucial document for identifying potential unclaimed HMRC refunds. Understanding its details is the first step towards reclaiming your money. Knowing how to read your payslip effectively can save you significant money and time. Keywords: payslip, tax code, tax deducted, HMRC payslip, understand payslip.

Here's what to look for:

- Tax Code: This code determines how much tax is deducted from your salary. An incorrect tax code can lead to overpayment. Check it against the HMRC guidelines for your personal circumstances.

- Tax Paid: This shows the total amount of tax deducted from your pay during the pay period. Compare this to your expected tax liability based on your earnings and tax code.

- National Insurance Contributions: Ensure these are calculated correctly based on your earnings.

- Gross Pay vs. Net Pay: Understanding the difference between your gross (before tax deductions) and net (after tax deductions) pay is crucial for spotting anomalies.

Example: (Insert image of a sample payslip with key areas highlighted, like tax code, tax paid, national insurance)

- Check your tax code for accuracy.

- Verify the amount of tax deducted each pay period. Look for inconsistencies or unusually high deductions.

- Look for any discrepancies or unusual entries. If anything seems off, investigate it further.

- Compare payslips over several months to identify patterns. This helps to highlight any persistent overpayments.

- Keep all payslips for at least 3 years, as HMRC may require them for verification of your claim.

Common Reasons for Unclaimed HMRC Refunds

Several factors can lead to unclaimed HMRC refunds. Understanding these reasons is vital in identifying if you're owed money. Keywords: HMRC tax relief, tax overpayment, marriage allowance, pension contribution relief, charitable donations tax relief.

- Changes in employment status: A change in job, or a change to your working hours, could affect your tax code and potentially lead to overpayment.

- Marriage Allowance: If you're married or in a civil partnership and one partner earns less than the personal allowance, you might be entitled to transfer some of that allowance to the higher earner, reducing your overall tax liability.

- Pension contributions relief: Contributions to a registered pension scheme can reduce your taxable income, potentially leading to a refund if too much tax was deducted.

- Gift Aid donations to charities: If you've donated to a registered charity and opted into Gift Aid, you might be entitled to tax relief on your donations.

- Working from home expenses: If you worked from home during the pandemic or regularly work from home, you may be able to claim tax relief on additional expenses.

- Student loan repayments: There are specific rules governing student loan repayments and how they interact with tax. An incorrect calculation might lead to overpayment.

How to Check for and Claim Your Unclaimed HMRC Refund

Claiming your unclaimed HMRC refund is straightforward if you follow these steps. Keywords: HMRC online portal, claim HMRC refund, HMRC tax refund claim, HMRC online services, submit HMRC claim.

- Access the HMRC website: Go to the official HMRC website.

- Login securely with your Government Gateway credentials. You'll need your Government Gateway User ID and password.

- Navigate to the 'Tax account' section. This section provides an overview of your tax affairs.

- Check for any outstanding repayments or adjustments. The system will highlight any potential refunds you're entitled to.

- Complete the online refund claim form accurately. Ensure all information is correct and complete.

- Provide all necessary supporting documentation. This might include payslips, P60s, and other relevant documents.

- Submit your claim and keep a record of your submission. You should receive confirmation of your claim.

What to Do if Your Claim is Rejected

If your HMRC refund claim is rejected, don't despair. Understand the reasons for rejection and take the necessary steps to appeal. Keywords: HMRC claim rejected, appeal HMRC decision, HMRC tax appeal, HMRC contact.

- Review the rejection notice carefully. Identify the reason for the rejection.

- Gather any missing or corrected documentation. Address any issues highlighted in the rejection notice.

- Contact HMRC directly to discuss the reasons for rejection. Explain your situation and provide any further information.

- Submit a formal appeal if necessary. Follow HMRC's appeal procedure carefully.

- Keep a detailed record of all communications. This is crucial if you need to escalate the issue further.

Conclusion: Don't Miss Out – Claim Your Unclaimed HMRC Refund Today!

Checking your payslips for potential overpayments and claiming unclaimed HMRC refunds is a simple process that could put extra money back in your pocket. Don't delay – take action today! Keywords: Unclaimed HMRC Refunds, claim your refund, HMRC refund claim, check your payslip now. Review your payslips, gather your documents, and claim what's rightfully yours. Start checking your payslips now and claim your unclaimed HMRC refund today!

Featured Posts

-

Boulevard Fhb Ex Vge Restrictions De Circulation Pour Les Deux Roues Et Trois Roues A Partir Du 15 Avril

May 20, 2025

Boulevard Fhb Ex Vge Restrictions De Circulation Pour Les Deux Roues Et Trois Roues A Partir Du 15 Avril

May 20, 2025 -

Hedge Fund Executives Us Ban Accusations Of Lying To Immigration Officials

May 20, 2025

Hedge Fund Executives Us Ban Accusations Of Lying To Immigration Officials

May 20, 2025 -

Millions Could Be Owed Hmrc Refunds Check Your Payslip Now

May 20, 2025

Millions Could Be Owed Hmrc Refunds Check Your Payslip Now

May 20, 2025 -

Ferraris Response To Leclerc Speculation Before Imola

May 20, 2025

Ferraris Response To Leclerc Speculation Before Imola

May 20, 2025 -

Shmitova Utnja Nakon Napada Tadi Trazhi Ob Ashnjenje

May 20, 2025

Shmitova Utnja Nakon Napada Tadi Trazhi Ob Ashnjenje

May 20, 2025

Latest Posts

-

Novo Dijete Jennifer Lawrence Objavljeni Detalji

May 20, 2025

Novo Dijete Jennifer Lawrence Objavljeni Detalji

May 20, 2025 -

Jennifer Lawrence Majka Dva Djeteta

May 20, 2025

Jennifer Lawrence Majka Dva Djeteta

May 20, 2025 -

Iznenadenje Jennifer Lawrence Dobila Drugo Dijete

May 20, 2025

Iznenadenje Jennifer Lawrence Dobila Drugo Dijete

May 20, 2025 -

Potvrda Jennifer Lawrence Dobila Drugo Dijete

May 20, 2025

Potvrda Jennifer Lawrence Dobila Drugo Dijete

May 20, 2025 -

Vijesti Jennifer Lawrence Rodila Drugo Dijete

May 20, 2025

Vijesti Jennifer Lawrence Rodila Drugo Dijete

May 20, 2025