The Case For News Corp: Why It's More Valuable Than The Market Suggests

Table of Contents

News Corp's Diversified Portfolio: A Key Strength

News Corp's strength lies in its remarkably diversified portfolio, mitigating risk and offering multiple avenues for growth. This isn't just a single-sector bet; it's a strategic investment across several key media and publishing areas.

Dominance in News and Information

News Corp holds a leading position in the global news and information market, boasting iconic publications with unparalleled reach and influence.

- High Subscription Numbers: The Wall Street Journal, for example, maintains a substantial subscriber base, both print and digital, demonstrating consistent demand for its high-quality financial news.

- Digital Readership Growth: News Corp's publications are actively adapting to the digital landscape, showing significant growth in online readership and engagement across platforms like websites and apps. This indicates a successful transition to new media consumption habits.

- Unmatched Brand Recognition: Brands like The Wall Street Journal, The Times, and The Sun enjoy exceptional brand recognition and trust, providing a strong foundation for future growth and expansion. This brand equity is a significant undervalued asset.

Robust Book Publishing Division

HarperCollins, a key part of the News Corp portfolio, is a major player in the book publishing industry, consistently delivering successful titles and best-selling authors.

- Successful Imprints: HarperCollins houses numerous successful imprints catering to various genres, ensuring a diversified revenue stream and resilience to market fluctuations.

- Significant Market Share: The imprint holds a considerable market share across several key segments of the book publishing market, indicating a strong competitive position.

- Growth Potential in Specific Genres: The company continues to identify and invest in emerging genres and authors, showing a proactive approach to maintaining growth and profitability.

Strategic Investments in Digital Media

News Corp is not merely clinging to traditional media; it's strategically investing in digital platforms and technologies to drive future growth.

- Innovative Digital Initiatives: The company is actively developing and investing in new digital products and platforms designed to engage audiences in the evolving media landscape.

- Potential for Revenue Growth: These digital initiatives are expected to generate significant revenue growth in the coming years, supplementing the existing strong revenue streams from print and traditional media.

- Data-Driven Digital Strategy: News Corp's digital strategy is informed by data analysis, enabling more targeted content creation and enhanced user experience, driving engagement and monetization.

Undervalued Assets and Hidden Potential

Beyond its core publishing and media businesses, News Corp possesses significant undervalued assets and untapped potential.

Real Estate Holdings

News Corp owns substantial real estate holdings, which are often overlooked in market valuations.

- Prime Locations: These properties are strategically located, often in prime urban centers, significantly adding to their potential value.

- Redevelopment or Sale Potential: Some properties may offer potential for redevelopment or sale, unlocking significant hidden value for the company.

- Significant Asset Value: A detailed appraisal of the real estate holdings could reveal a significantly higher value than currently reflected in the market capitalization.

Strong Brand Equity

The intangible value of established News Corp brands is substantial and contributes significantly to the company's long-term earning potential.

- High Brand Recognition and Trust: Decades of consistent quality have built strong brand recognition and consumer trust, translating into significant competitive advantages.

- Customer Loyalty: Established brands foster customer loyalty, making it easier to maintain subscriptions and sales.

- Licensing and Merchandising Opportunities: The strong brand equity opens doors for licensing and merchandising opportunities, creating additional revenue streams.

Strategic Acquisitions and Partnerships

News Corp's history of strategic acquisitions and partnerships demonstrates its ability to identify and integrate promising ventures, further enhancing its market position and growth trajectory.

- Successful Acquisitions: Past acquisitions have proven beneficial to the company's performance, showcasing a shrewd approach to expanding market reach and capabilities.

- Synergistic Partnerships: Strategic partnerships have leveraged synergies, creating opportunities for growth and innovation within the media industry.

- Future Acquisition Opportunities: News Corp remains positioned to capitalize on future acquisition opportunities, further strengthening its portfolio and enhancing its market share.

Financial Performance and Future Outlook

News Corp's recent financial results showcase positive trends, including revenue growth in key segments and robust profit margins, pointing towards a promising future.

- Revenue Growth: Consistent revenue growth across different sectors demonstrates the diversified nature of News Corp's portfolio and its resilience against market downturns.

- Strong Profit Margins: Healthy profit margins indicate efficient operations and strong pricing power in several market segments.

- Positive Growth Projections: Analysts are projecting continued growth for News Corp, underpinned by its strategic initiatives and strong market positions.

Conclusion

The evidence overwhelmingly suggests that News Corp is a significantly undervalued asset with considerable growth potential. Its diversified portfolio, strong brand equity, undervalued assets, and strategic acquisitions paint a picture of a company poised for continued growth. Don't miss out on this opportunity. Consider adding News Corp to your investment portfolio today. Investing in News Corp offers exposure to a dynamic media landscape and a company with a clear path to long-term value creation. The News Corp opportunity is one that savvy investors shouldn't overlook.

Featured Posts

-

Net Asset Value Nav Of Amundi Msci World Catholic Principles Ucits Etf Acc What You Need To Know

May 24, 2025

Net Asset Value Nav Of Amundi Msci World Catholic Principles Ucits Etf Acc What You Need To Know

May 24, 2025 -

Kyle Walkers Milan Party Details Emerge After Wifes Return

May 24, 2025

Kyle Walkers Milan Party Details Emerge After Wifes Return

May 24, 2025 -

Major Losses Continue Amsterdam Stock Exchange Down 11

May 24, 2025

Major Losses Continue Amsterdam Stock Exchange Down 11

May 24, 2025 -

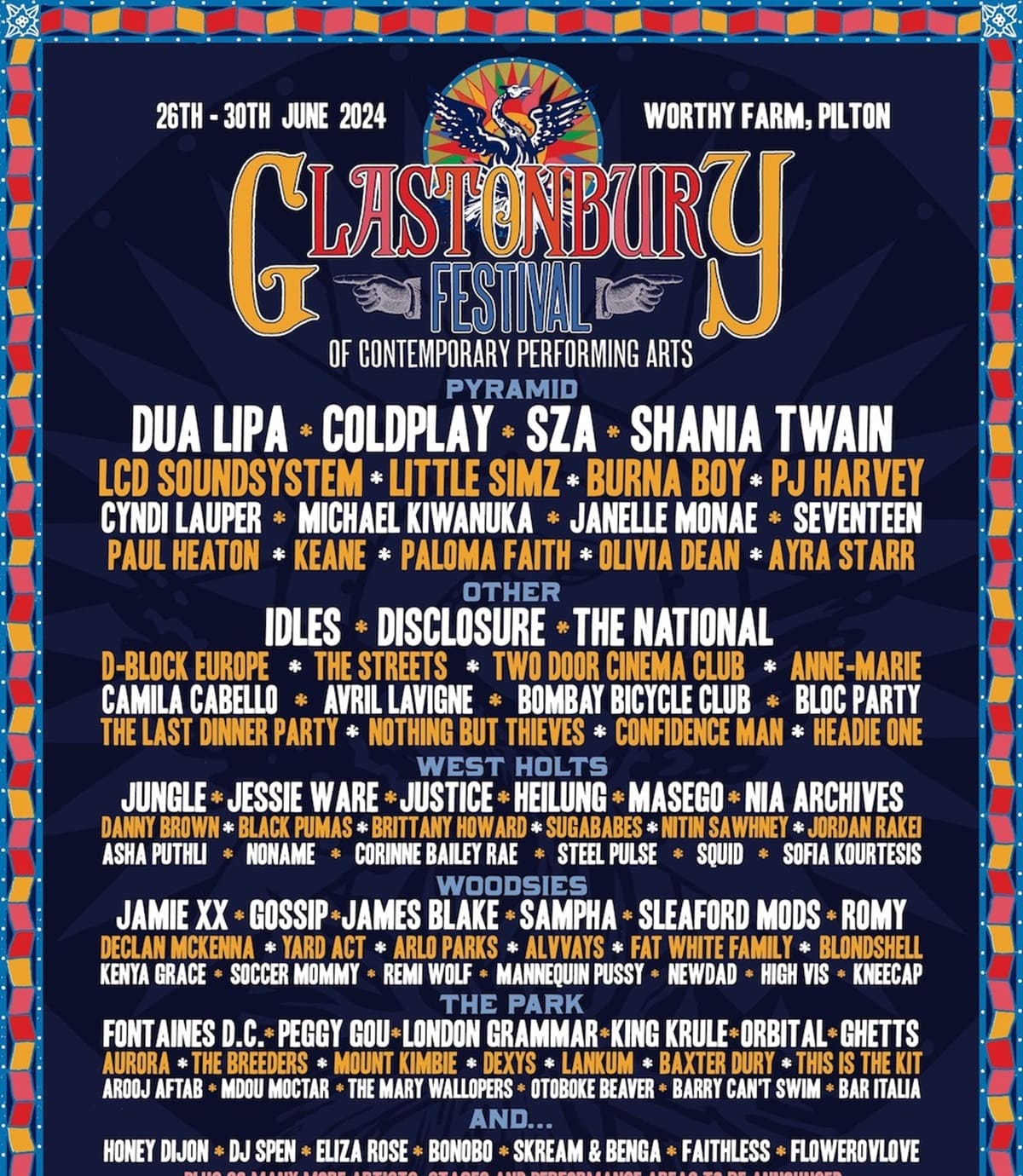

Glastonbury 2025 Lineup Announcement A Controversial Choice

May 24, 2025

Glastonbury 2025 Lineup Announcement A Controversial Choice

May 24, 2025 -

Significant Drop In Amsterdam Stock Market Trade War Fallout

May 24, 2025

Significant Drop In Amsterdam Stock Market Trade War Fallout

May 24, 2025

Latest Posts

-

Brest Urban Trail L Importance Des Benevoles Artistes Et Partenaires

May 24, 2025

Brest Urban Trail L Importance Des Benevoles Artistes Et Partenaires

May 24, 2025 -

Rebuilding Bridges Bangladesh And Europe Collaborate For Mutual Growth

May 24, 2025

Rebuilding Bridges Bangladesh And Europe Collaborate For Mutual Growth

May 24, 2025 -

Les Visages Du Brest Urban Trail Benevoles Artistes Et Partenaires

May 24, 2025

Les Visages Du Brest Urban Trail Benevoles Artistes Et Partenaires

May 24, 2025 -

Mathieu Avanzi Le Francais Une Langue Vivante Et Dynamique

May 24, 2025

Mathieu Avanzi Le Francais Une Langue Vivante Et Dynamique

May 24, 2025 -

Best Of Bangladesh In Europe 2nd Edition Collaboration And Growth

May 24, 2025

Best Of Bangladesh In Europe 2nd Edition Collaboration And Growth

May 24, 2025