Top 3 Financial Errors Women Make & How To Fix Them

Table of Contents

Women face unique financial challenges throughout their lives. From the gender pay gap to caregiving responsibilities, navigating the financial world can feel overwhelming. This article will highlight the top three financial errors women often make and provide actionable steps to correct them, empowering you to achieve your financial goals. Let's address these common stumbling blocks and pave the way for a brighter financial future.

Underestimating the Importance of Retirement Planning

The pursuit of financial security is a journey, and retirement planning is a crucial milestone. Unfortunately, women often face a significant disadvantage when it comes to retirement savings. This disparity, known as the gender retirement gap, needs immediate attention and proactive measures to bridge.

The Gender Retirement Gap: A Stark Reality

The gender retirement gap is a persistent issue, with women consistently accumulating less in retirement savings than their male counterparts. This gap is not due to a lack of ambition but rather a complex interplay of societal and economic factors.

- Statistics on the Gender Retirement Gap: Studies consistently show women having significantly smaller retirement nest eggs compared to men. This difference can translate into thousands, even millions, of dollars less in retirement income.

- Reasons for the Gap: Several factors contribute to this disparity:

- Career Interruptions: Women are more likely to take career breaks for childcare or elder care, resulting in lost income and reduced contributions to retirement accounts.

- Lower Salaries: The persistent gender pay gap means women often earn less than men for doing the same job, leading to smaller contributions to retirement savings throughout their careers.

- Longer Life Expectancy: Women generally live longer than men, requiring larger retirement nest eggs to cover their expenses for a longer period.

The long-term consequences of this gap can be severe, potentially leading to financial insecurity and a lower quality of life in retirement.

Strategies for Closing the Gap: Taking Control of Your Future

Fortunately, there are proactive steps women can take to mitigate this gap and secure a comfortable retirement.

- Start Saving Early: Even small, regular contributions to a retirement account can make a significant difference over time, thanks to the power of compound interest.

- Tax-Advantaged Retirement Accounts: Utilize tax-advantaged accounts like 401(k)s and IRAs to maximize your savings and minimize your tax burden. Understand the contribution limits and the differences between traditional and Roth accounts.

- Employer Matching Contributions: Take full advantage of any employer matching contributions offered through your workplace retirement plan. It's essentially free money!

- Automate Savings: Set up automatic transfers from your checking account to your retirement account each month. This makes saving consistent and effortless.

- Seek Professional Financial Advice: Consider consulting a financial advisor who can help you create a personalized retirement plan tailored to your specific needs and goals.

Ignoring or Under-prioritizing Debt Management

High levels of debt can significantly hinder a woman's financial well-being, impacting everything from retirement savings to future financial opportunities.

The High Cost of High-Interest Debt: A Crushing Burden

High-interest debt, such as credit card debt and payday loans, can quickly spiral out of control due to compounding interest. This can lead to a cycle of debt that's difficult to escape.

- Compound Interest Calculations: A simple example can illustrate the devastating impact. A $5,000 credit card balance at 18% APR can accumulate substantial interest over time, significantly increasing the total amount owed.

- Impact on Credit Scores: High debt significantly lowers credit scores, making it harder to qualify for loans, mortgages, and even some rental agreements.

- Emotional Toll of Debt: The stress and anxiety associated with overwhelming debt can negatively impact mental and physical health.

Effective Debt Management Techniques: Reclaiming Financial Control

Taking proactive steps to manage and eliminate debt is crucial for long-term financial health.

- Create a Debt Repayment Plan: Employ methods like the debt snowball (paying off smallest debts first for motivation) or the debt avalanche (paying off highest-interest debts first for cost savings).

- Negotiate Lower Interest Rates: Contact your creditors to discuss lowering your interest rates. Many are willing to work with you to avoid defaults.

- Consolidate Debt: Consider consolidating high-interest debts into a lower-interest loan to simplify payments and reduce overall interest costs.

- Budget Effectively: Track your income and expenses to identify areas where you can cut back and allocate more funds towards debt repayment.

- Seek Debt Counseling: If you're struggling to manage your debt on your own, consider seeking professional help from a reputable credit counseling agency.

Lack of Financial Literacy and Planning: Empowering Yourself

A strong foundation in financial literacy is essential for making informed financial decisions throughout life. Many women lack the knowledge and confidence to navigate the complexities of personal finance effectively.

The Importance of Financial Education: Building Your Knowledge

Understanding basic financial concepts is critical for achieving financial security. This includes:

- Budgeting: Creating and sticking to a budget is the cornerstone of sound financial management.

- Investing: Learning about different investment options, such as stocks, bonds, and mutual funds, can help you grow your wealth over time.

- Understanding Credit Scores: Knowing how credit scores work and how to improve them is crucial for obtaining favorable loan terms.

- Insurance: Understanding different types of insurance, such as health, life, and auto insurance, is essential for protecting yourself and your family.

- Estate Planning: Planning for the distribution of your assets after death is an important part of financial planning.

Resources for Financial Learning: Expanding Your Horizons

Numerous resources are available to help women improve their financial literacy:

- Financial Literacy Websites: Websites like the National Endowment for Financial Education (NEFE) and the Consumer Financial Protection Bureau (CFPB) offer valuable information and educational materials.

- Books: Many excellent books on personal finance are geared toward women and their specific financial challenges.

- Courses and Workshops: Community colleges, universities, and online platforms offer courses and workshops on various aspects of personal finance.

- Financial Advisors: A financial advisor can provide personalized guidance and support to help you achieve your financial goals.

- Community Resources: Many local organizations offer free or low-cost financial education programs.

Conclusion: Taking Charge of Your Financial Future

This article highlighted three common financial errors women make: underestimating the importance of retirement planning, ignoring or under-prioritizing debt management, and lacking financial literacy and planning. Addressing these issues proactively can significantly improve your financial well-being and help you achieve long-term financial security. Remember, financial success isn't about luck; it's about knowledge, planning, and consistent action.

Call to Action: Take control of your financial future! Start addressing these common financial errors today. Learn more about effective strategies for retirement planning and build a secure financial future tailored to your needs. Don't delay – start planning your financial success now. Avoid these top 3 financial errors and empower yourself financially!

Featured Posts

-

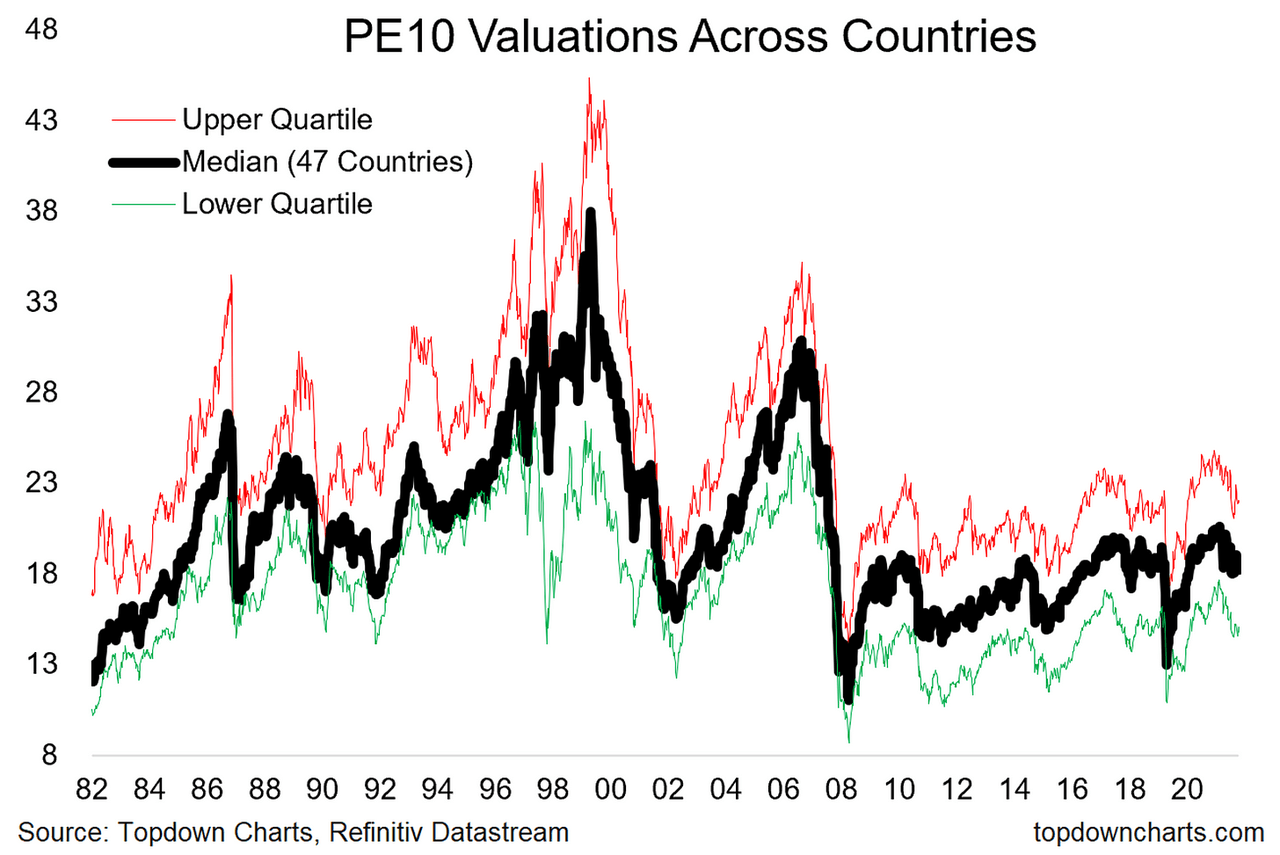

Stock Market Valuations Bof As Analysis And Investor Reassurance

May 22, 2025

Stock Market Valuations Bof As Analysis And Investor Reassurance

May 22, 2025 -

Thames Water Executive Bonuses A Closer Look At The Controversy

May 22, 2025

Thames Water Executive Bonuses A Closer Look At The Controversy

May 22, 2025 -

Antiques Roadshow Appraisal Exposes Theft Results In Arrest

May 22, 2025

Antiques Roadshow Appraisal Exposes Theft Results In Arrest

May 22, 2025 -

Aimscaps Wild Ride A Deep Dive Into The World Trading Tournament Wtt

May 22, 2025

Aimscaps Wild Ride A Deep Dive Into The World Trading Tournament Wtt

May 22, 2025 -

Analyzing The Love Monster A Critical Look At The Storys Impact

May 22, 2025

Analyzing The Love Monster A Critical Look At The Storys Impact

May 22, 2025

Latest Posts

-

Did Taylor Swifts Legal Troubles Damage Her Bond With Blake Lively

May 22, 2025

Did Taylor Swifts Legal Troubles Damage Her Bond With Blake Lively

May 22, 2025 -

The Strain On Taylor Swift And Blake Livelys Friendship A Legal Battles Aftermath

May 22, 2025

The Strain On Taylor Swift And Blake Livelys Friendship A Legal Battles Aftermath

May 22, 2025 -

Blake Lively Justin Baldoni And Taylor Swift An Exclusive Report On The Ongoing Legal Dispute

May 22, 2025

Blake Lively Justin Baldoni And Taylor Swift An Exclusive Report On The Ongoing Legal Dispute

May 22, 2025 -

Taylor Swift And Blake Lively A Friendship On The Rocks Due To Legal Issues

May 22, 2025

Taylor Swift And Blake Lively A Friendship On The Rocks Due To Legal Issues

May 22, 2025 -

Exclusive How Taylor Swift Is Navigating The Blake Lively And Justin Baldoni Legal Battle

May 22, 2025

Exclusive How Taylor Swift Is Navigating The Blake Lively And Justin Baldoni Legal Battle

May 22, 2025