The Future Of CoreWeave Stock: Predictions And Analysis

Table of Contents

CoreWeave's Competitive Advantage and Market Position

CoreWeave is a prominent player in the burgeoning GPU cloud computing market. Its business model focuses on providing high-performance computing power through a scalable and sustainable infrastructure, attracting a diverse client base ranging from AI researchers to video game developers.

Dominating the GPU Cloud Computing Market:

CoreWeave boasts several unique selling propositions (USPs) that set it apart from competitors:

- Unmatched Scalability: CoreWeave's infrastructure allows for rapid scaling to meet fluctuating demand, a critical advantage in the dynamic cloud computing market.

- Sustainable Infrastructure: A commitment to environmentally friendly practices, using renewable energy sources, gives CoreWeave a competitive edge in an increasingly conscious market.

- Strategic Partnerships: Collaborations with leading technology companies provide access to cutting-edge technology and expanded market reach.

Compared to giants like AWS, Google Cloud, and Azure, CoreWeave often offers a more specialized and cost-effective solution for high-performance computing needs, focusing on a niche market. While precise market share figures remain elusive for a privately held company like CoreWeave, industry analysts predict significant growth potential within the rapidly expanding GPU cloud computing sector. This potential is further fueled by the increasing demand for AI and machine learning applications that rely heavily on GPU processing power.

Addressing Key Challenges and Risks:

Despite its advantages, CoreWeave faces challenges:

- Intense Competition: Established cloud providers represent a significant threat, continuously improving their GPU offerings and investing heavily in the market.

- Regulatory Hurdles: Navigating evolving data privacy regulations and compliance requirements across various jurisdictions presents ongoing challenges.

- Economic Downturns: A potential economic recession could impact customer spending on cloud services, affecting CoreWeave's revenue growth.

However, CoreWeave's strategic focus on a specific niche, combined with its innovative technology and sustainable practices, could mitigate these risks. Furthermore, strong financial management and a flexible business model can help the company weather economic fluctuations.

Financial Performance and Valuation

While detailed financial data for CoreWeave is limited due to its private status, publicly available information and industry analysis provide some insights.

Analyzing CoreWeave's Financials:

Although precise revenue figures aren't publicly available, reports suggest strong revenue growth fueled by increasing demand for its services. Key performance indicators (KPIs) like EBITDA and operating margin, once publicly available, will be crucial for assessing profitability and financial health. Comparing these metrics to competitors will provide a clearer understanding of CoreWeave's financial performance and position within the market.

Stock Valuation and Potential Returns:

Once CoreWeave goes public, traditional valuation metrics like the Price-to-Sales (P/S) ratio and, eventually, the Price-to-Earnings (P/E) ratio will become available for analysis. These ratios, when compared to similar companies in the cloud computing sector, will help determine the stock's valuation and potential returns. Positive catalysts such as successful new product launches, strategic acquisitions, or expansion into new markets could significantly impact future price appreciation. Conversely, factors like slower-than-expected growth, increased competition, or unfavorable macroeconomic conditions could lead to price depreciation.

Predictions for the Future of CoreWeave Stock

Predicting the future performance of any stock is inherently speculative, but analyzing potential scenarios offers valuable insight.

Bullish Case for CoreWeave:

- Continued Market Growth: The ongoing expansion of the GPU cloud computing market presents significant growth opportunities for CoreWeave.

- Successful Product Launches: Innovative new products and services could attract new customers and enhance revenue streams.

- Strategic Acquisitions: Acquiring complementary companies could expand CoreWeave's capabilities and market reach.

- Technological Advancements: Staying ahead of the curve in terms of technological innovation will ensure CoreWeave remains competitive and attractive to clients.

Bearish Case for CoreWeave:

- Increased Competition: Intensified competition from established players could erode CoreWeave's market share.

- Economic Downturn: A significant economic downturn could negatively impact demand for cloud services.

- Failure to Meet Growth Expectations: Falling short of projected growth targets could disappoint investors and lead to a decline in stock price.

- Regulatory Setbacks: Adverse regulatory decisions or changes could hinder CoreWeave's operations and growth.

Conclusion

CoreWeave occupies a promising position within the rapidly expanding GPU cloud computing market. While its innovative technology and strategic positioning offer significant potential for growth, investors should acknowledge the inherent risks associated with investing in a high-growth technology company. The availability of detailed financial data following a public offering will be crucial for a more comprehensive analysis. Based on current projections and the analysis above, a cautious "hold" or "buy" rating might be considered, pending further financial disclosures and market developments. However, thorough due diligence is paramount before any investment decision. To stay informed on CoreWeave stock and its future trajectory, continue your research into CoreWeave stock by monitoring financial news sources and CoreWeave’s investor relations (once available). Remember, this analysis should not be considered financial advice.

Featured Posts

-

Arne Slot Vs Liverpool A Tactical Comparison And Alissons World Class Goalkeeping

May 22, 2025

Arne Slot Vs Liverpool A Tactical Comparison And Alissons World Class Goalkeeping

May 22, 2025 -

Appeal Pending Ex Tory Councillors Wife Faces Decision On Racial Hatred Tweet

May 22, 2025

Appeal Pending Ex Tory Councillors Wife Faces Decision On Racial Hatred Tweet

May 22, 2025 -

Ftcs Appeal Against Microsoft Activision Merger Green Light

May 22, 2025

Ftcs Appeal Against Microsoft Activision Merger Green Light

May 22, 2025 -

Wednesdays Core Weave Crwv Stock Rally Analysis And Potential Drivers

May 22, 2025

Wednesdays Core Weave Crwv Stock Rally Analysis And Potential Drivers

May 22, 2025 -

Where To Stream Peppa Pig Online For Free A Parents Guide

May 22, 2025

Where To Stream Peppa Pig Online For Free A Parents Guide

May 22, 2025

Latest Posts

-

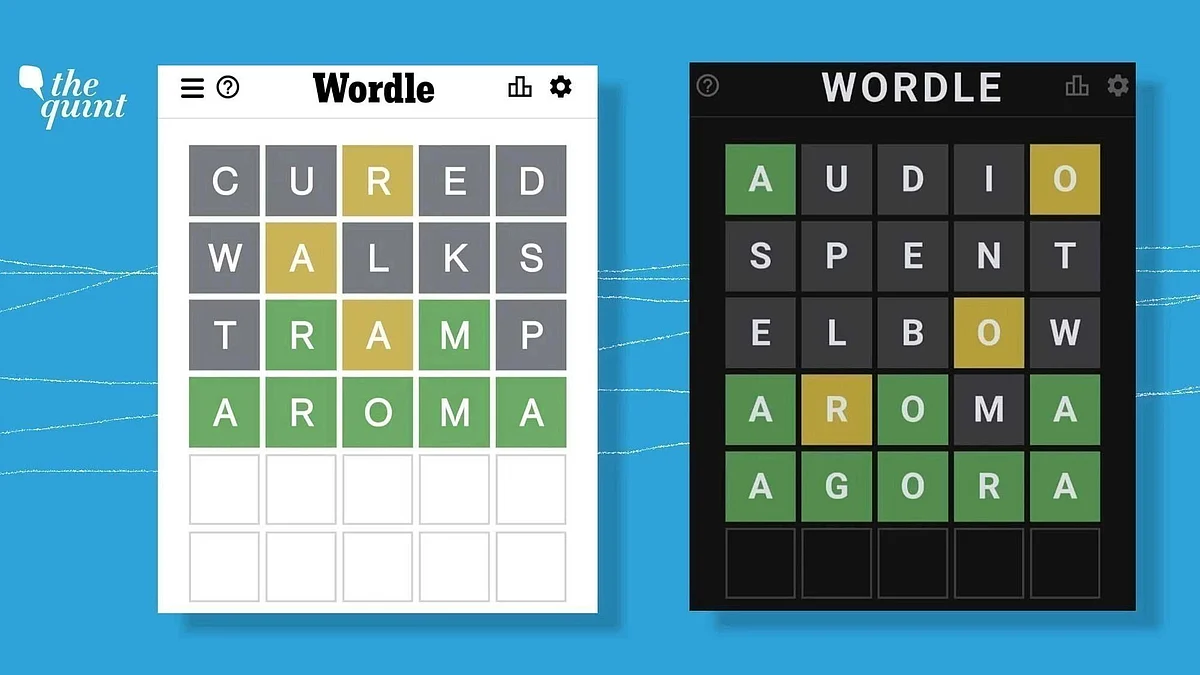

Solve Wordle 1358 Hints For Saturday March 8th

May 22, 2025

Solve Wordle 1358 Hints For Saturday March 8th

May 22, 2025 -

Wordle March 8th 1358 Clues And Solution

May 22, 2025

Wordle March 8th 1358 Clues And Solution

May 22, 2025 -

Wordle 1358 Hints And Answer For March 8th

May 22, 2025

Wordle 1358 Hints And Answer For March 8th

May 22, 2025 -

Wordle March 17th 2024 Hints Clues And Solution For Puzzle 367

May 22, 2025

Wordle March 17th 2024 Hints Clues And Solution For Puzzle 367

May 22, 2025 -

Wordle Puzzle Solution Wordle 1366 March 16th Hints And Answer

May 22, 2025

Wordle Puzzle Solution Wordle 1366 March 16th Hints And Answer

May 22, 2025