The GOP Tax Plan And The National Deficit: A Fact-Based Assessment

Table of Contents

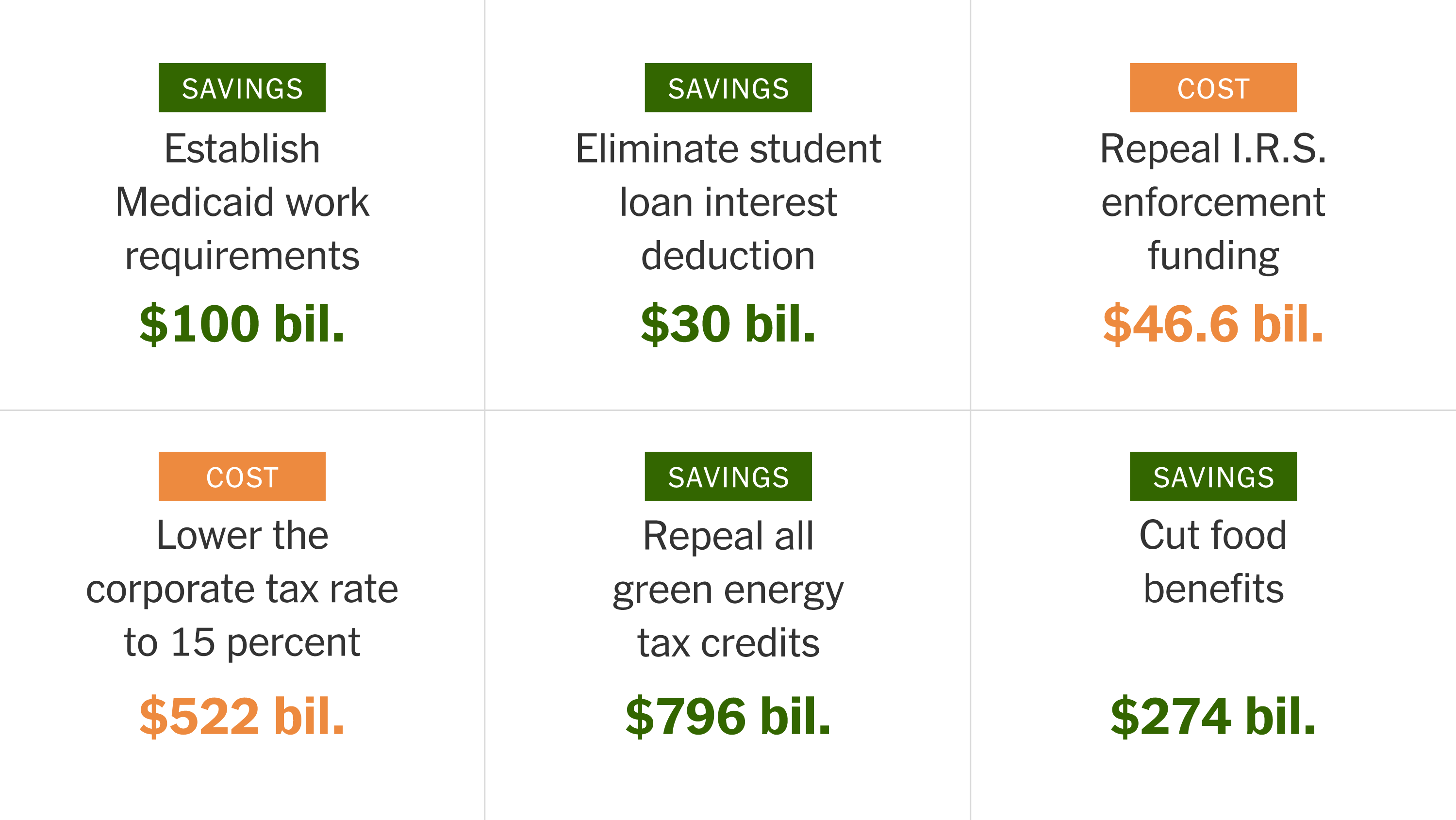

The GOP Tax Plan's Provisions and Their Projected Fiscal Impact

The Tax Cuts and Jobs Act of 2017, commonly referred to as the GOP tax plan, significantly altered the US tax code. Core provisions included substantial cuts to corporate and individual income tax rates, changes to deductions (including the standard deduction and state and local tax (SALT) deduction), and modifications to the international tax system.

These changes had significant projected fiscal impacts, largely based on static and dynamic scoring methodologies employed by organizations such as the Congressional Budget Office (CBO) and the Tax Policy Center. The differences in these methods are crucial to understanding the projections. Static scoring assumes no change in economic behavior in response to tax changes, while dynamic scoring attempts to incorporate the anticipated effects of the tax plan on economic activity.

- Corporate tax rate reduction from 35% to 21%: Projected to decrease federal revenue by trillions of dollars over 10 years (Source: CBO). This substantial reduction was a cornerstone of the plan, aiming to boost business investment and economic growth.

- Individual income tax rate reductions: Lowered tax rates across various income brackets, resulting in decreased individual tax liabilities. The CBO projected this to significantly reduce revenue collected.

- Changes to the standard deduction: Increased standard deduction amounts, leading to fewer individuals itemizing deductions and a further reduction in tax revenue.

- Limitation on the State and Local Tax (SALT) deduction: This cap significantly impacted taxpayers in high-tax states, leading to increased tax burdens for some and reduced federal revenue for others.

The debate over static versus dynamic scoring heavily influenced the projected deficit impact. Proponents of the GOP tax plan frequently cited dynamic scoring models suggesting that economic growth spurred by the tax cuts would offset the revenue losses. Critics, however, pointed to the inherent uncertainties and potential biases in dynamic scoring, preferring the more conservative estimates provided by static scoring.

Arguments in Favor of the GOP Tax Plan and its Impact on the Deficit

Supporters of the GOP tax plan argued that its provisions would stimulate economic growth through supply-side economics. They posited that lower tax rates would incentivize businesses to invest more, hire more workers, and increase productivity, ultimately leading to a larger tax base and increased tax revenue. This "trickle-down" effect, they contended, would offset the initial revenue loss from the tax cuts.

- Increased investment and job creation: Supporters believed the lower corporate tax rate would lead to increased capital investment, creating jobs and boosting economic activity.

- Stimulated economic growth: The overall effect, according to proponents, would be a faster-growing economy, generating sufficient tax revenue to compensate for the initial revenue reduction.

- Improved international competitiveness: Changes to the international tax system were intended to make American businesses more competitive globally.

However, counterarguments exist. Historical data on the efficacy of supply-side economics is mixed, with some studies showing limited impact and others highlighting potential negative consequences, such as increased income inequality. Moreover, economic models projecting alternative outcomes exist, often suggesting a less optimistic scenario regarding revenue generation. The effectiveness of the supply-side effects remains a point of ongoing debate.

Criticisms of the GOP Tax Plan and its Impact on the National Debt

Critics of the GOP tax plan argued that the tax cuts disproportionately benefited corporations and high-income earners, exacerbating income inequality and failing to generate sufficient revenue to offset the cost of the cuts. They highlighted the substantial increase in the national debt under the plan and warned of potential long-term consequences, such as:

- Increased national debt: The CBO and other organizations projected a substantial increase in the national debt due to the tax cuts.

- Higher interest payments: A larger national debt leads to increased interest payments, further straining the federal budget.

- Reduced government spending: The increased debt could necessitate cuts in other essential government programs, such as education, infrastructure, and healthcare.

- Increased income inequality: Critics argue that the tax cuts primarily benefitted the wealthy, widening the gap between rich and poor.

These criticisms underscore the potential for long-term fiscal instability and the need for careful consideration of the distributional effects of tax policy. The plan's impact on social security and medicare funding, crucial social safety net programs, is another major area of concern.

Long-Term Economic Effects and the National Deficit

The long-term implications of the GOP tax plan on the national debt are complex and depend on several factors, including economic growth rates, interest rates, and potential future tax reforms. Higher-than-projected economic growth could partially mitigate the debt increase, while slower growth or rising interest rates could exacerbate it.

- Impact on interest rates: Increased borrowing to finance the debt could lead to higher interest rates, increasing the cost of government borrowing.

- Future tax reforms: Future administrations may need to implement tax increases to address the growing debt, potentially impacting future economic growth and fiscal policy.

- Impact on social security and medicare: The increased national debt could strain funding for these vital programs, necessitating difficult choices about benefit levels and funding mechanisms.

Different economic growth scenarios paint varying pictures. A robust, sustained period of economic expansion might lessen the long-term impact, while stagnation or recession could significantly worsen the situation. Analyzing these scenarios and understanding their probabilities is crucial to assessing the full consequences of the GOP tax plan.

Conclusion: Assessing the GOP Tax Plan's Legacy on the National Deficit

The GOP tax plan's impact on the national deficit remains a complex and contested issue. While proponents argued that supply-side economics would offset revenue losses through increased economic growth, critics pointed to the disproportionate benefits to the wealthy and the substantial increase in the national debt. The uncertainties inherent in economic forecasting make definitive conclusions challenging. However, the substantial increase in the national debt and the potential long-term consequences for crucial government programs cannot be ignored.

Understanding the complexities of the GOP tax plan and its impact on the national deficit requires continued vigilance and critical analysis. Stay informed about the latest economic data and participate in the national conversation surrounding fiscal policy. Further research and informed debate are essential for developing sound and sustainable fiscal policies to address the challenges posed by the growing national debt. Keywords: GOP tax plan, national deficit, fiscal policy, economic impact.

Featured Posts

-

Aldhkae Alastnaey Wmyrath Ajatha Krysty Drast Fy Ieadt Alintaj Aladby

May 20, 2025

Aldhkae Alastnaey Wmyrath Ajatha Krysty Drast Fy Ieadt Alintaj Aladby

May 20, 2025 -

Incendio De Escola Na Tijuca Memorias E Amizades Em Cinzas

May 20, 2025

Incendio De Escola Na Tijuca Memorias E Amizades Em Cinzas

May 20, 2025 -

March 18th Nyt Mini Crossword Answers And Clues

May 20, 2025

March 18th Nyt Mini Crossword Answers And Clues

May 20, 2025 -

Affaire Jaminet Accord Trouve Pour Le Remboursement Des 450 000 E

May 20, 2025

Affaire Jaminet Accord Trouve Pour Le Remboursement Des 450 000 E

May 20, 2025 -

Trumps Trade Policies And The Wayne Gretzky Loyalty Question

May 20, 2025

Trumps Trade Policies And The Wayne Gretzky Loyalty Question

May 20, 2025

Latest Posts

-

12 Leading Ai Stocks Insights From The Reddit Community

May 20, 2025

12 Leading Ai Stocks Insights From The Reddit Community

May 20, 2025 -

Exploring Reddits Top 12 Ai Stock Suggestions

May 20, 2025

Exploring Reddits Top 12 Ai Stock Suggestions

May 20, 2025 -

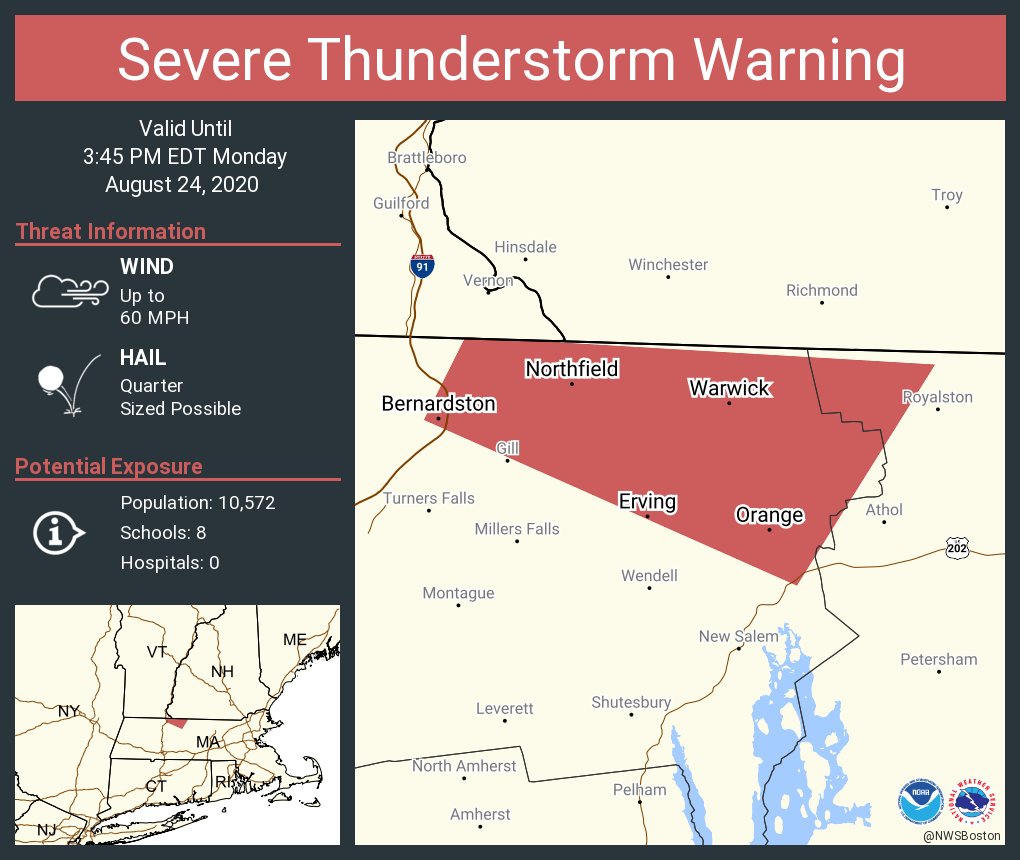

Stay Safe Strong Wind And Severe Storm Warning Issued

May 20, 2025

Stay Safe Strong Wind And Severe Storm Warning Issued

May 20, 2025 -

Reddits Choice 12 Top Performing Ai Stocks

May 20, 2025

Reddits Choice 12 Top Performing Ai Stocks

May 20, 2025 -

Big Bear Ai Stock Performance And Buy Recommendations

May 20, 2025

Big Bear Ai Stock Performance And Buy Recommendations

May 20, 2025