The Impact Of Climate Change On Your Home's Value And Creditworthiness

Table of Contents

Rising sea levels, extreme weather events – climate change is no longer a distant threat; it's directly impacting the value of your home and, increasingly, your creditworthiness. This article explores the crucial connection between climate change and your financial well-being. We'll examine how environmental risks translate into tangible financial consequences for homeowners, offering strategies to protect your investment.

<h2>Diminishing Property Values Due to Climate Change Risks</h2>

Climate change significantly affects property values through increased natural disaster risks and environmental degradation. Understanding these impacts is vital for making informed financial decisions.

<h3>Increased Risk of Natural Disasters</h3>

The frequency and intensity of hurricanes, floods, wildfires, and droughts are escalating due to climate change. This increased risk directly impacts property values in several ways:

- Devaluation of High-Risk Areas: Properties located in floodplains, coastal zones prone to erosion, or wildfire-prone areas experience significant devaluation. This makes selling or refinancing exceptionally challenging.

- Skyrocketing Insurance Premiums: Insurance companies assess risk based on location and climate data. High-risk areas face dramatically increased premiums, making homeownership more expensive and impacting the perceived value. In some cases, insurance becomes unaffordable, rendering the property virtually worthless.

- Direct Property Damage: The actual damage from extreme weather events further diminishes property value. Repair costs can be substantial, exceeding the property's worth in severe cases. For example, homes repeatedly flooded or partially destroyed by wildfires lose a significant portion of their market value.

<h3>Environmental Degradation and its Impact</h3>

Beyond extreme weather, broader environmental degradation influences property values:

- Air and Water Pollution: Homes located near polluted sites, industrial areas, or areas with declining air quality suffer a decrease in desirability and market value. Buyers are increasingly discerning about environmental factors.

- Proximity to Damaged Areas: Properties near areas experiencing significant environmental damage (e.g., deforestation, land subsidence) also see decreased values due to the perception of risk and reduced desirability.

- Increased Infrastructure Costs: Mitigation efforts, such as building seawalls or upgrading drainage systems, often result in increased taxes and infrastructure costs for homeowners, indirectly impacting property value.

<h2>Creditworthiness and Climate Change Exposure</h2>

The financial repercussions of climate change extend beyond property value to impact creditworthiness directly.

<h3>Increased Insurance Premiums and Denials</h3>

Climate change significantly increases insurance risk, leading to:

- Higher Premiums: Insurance companies pass increased risk onto homeowners through higher premiums. This can strain household budgets and even make insurance unaffordable.

- Policy Denials: In high-risk areas, securing insurance can become nearly impossible, leaving homeowners exposed to significant financial liabilities in the event of a disaster.

- Negative Credit Impact: Missed or unpaid insurance premiums can severely damage credit scores, making it difficult to secure future loans or credit.

<h3>Difficulty in Securing Mortgages and Loans</h3>

Lenders are increasingly incorporating climate risk into their lending decisions:

- Higher Interest Rates or Loan Denials: Properties in high-risk zones may face higher interest rates or even loan denials due to perceived increased risk. This limits borrowing power and increases the cost of homeownership.

- Lower Appraisal Values: Appraisals may reflect the diminished value due to climate-related risks, reducing the loan amount available.

- Tightened Lending Standards: More stringent lending standards reflect the increasing awareness of climate-related financial risks.

<h3>Forced Sales and Foreclosures</h3>

Severe weather events can result in:

- Forced Sales: Significant damage may force homeowners to sell their properties at a loss to cover repair costs or avoid foreclosure.

- Foreclosures: Inability to afford repairs, increased insurance premiums, or mortgage payments due to climate-related events can lead to foreclosure, severely damaging credit scores.

- Cumulative Financial Stress: The cumulative impact of climate-related financial pressures can lead to significant credit score decline, affecting future financial opportunities.

<h2>Mitigating the Impact: Protecting Your Home and Credit</h2>

Proactive measures can significantly mitigate the impact of climate change on your home and creditworthiness.

<h3>Home Improvement and Risk Mitigation</h3>

Investing in climate-resilient improvements can help maintain property value:

- Climate-Resilient Upgrades: Install flood barriers, fire-resistant roofing materials, and drought-tolerant landscaping.

- Regular Maintenance: Regular maintenance and proactive repairs minimize the damage from extreme weather events, reducing repair costs and preserving value.

- Energy Efficiency Improvements: Improving energy efficiency reduces utility costs, enhances property appeal, and contributes to environmental sustainability.

<h3>Financial Planning and Insurance</h3>

Careful financial planning and adequate insurance coverage are crucial:

- Comprehensive Insurance: Secure comprehensive insurance coverage, including flood and wildfire insurance, where applicable.

- Emergency Fund: Create a robust emergency fund to cover unexpected repairs, replacement costs, or temporary displacement.

- Financial Planning: Develop a financial plan that accounts for potential climate-related expenses and emergencies.

<h3>Staying Informed and Engaging in Community Efforts</h3>

Staying informed and participating in community initiatives is essential:

- Local Climate Risk Assessment: Understand the specific climate risks in your area.

- Community Engagement: Participate in local initiatives focused on climate resilience and community preparedness.

<h2>Conclusion</h2>

Climate change presents a significant threat to home values and creditworthiness. Understanding these risks and taking proactive steps to mitigate them is crucial for protecting your financial future. By investing in home improvements, securing adequate insurance, and engaging in responsible financial planning, you can minimize the impact of climate change on your home's value and your credit score. Don't wait for disaster to strike – take action today to protect your investment and your financial well-being against the effects of climate change on your home's value and creditworthiness.

Featured Posts

-

Flavio Cobollis Triumph Bucharest Tiriac Open Win

May 20, 2025

Flavio Cobollis Triumph Bucharest Tiriac Open Win

May 20, 2025 -

Trumps Aerospace Deals A Deep Dive Into The Numbers And Missing Details

May 20, 2025

Trumps Aerospace Deals A Deep Dive Into The Numbers And Missing Details

May 20, 2025 -

Chinas Ambitious Project A Supercomputer In Orbit

May 20, 2025

Chinas Ambitious Project A Supercomputer In Orbit

May 20, 2025 -

Nyt Mini Crossword Answers March 5 2025 Complete Solution

May 20, 2025

Nyt Mini Crossword Answers March 5 2025 Complete Solution

May 20, 2025 -

Valentino Haute Couture Suki Waterhouses Unexpectedly Chic Look

May 20, 2025

Valentino Haute Couture Suki Waterhouses Unexpectedly Chic Look

May 20, 2025

Latest Posts

-

Ai Stock Market 12 Top Picks From Reddit

May 20, 2025

Ai Stock Market 12 Top Picks From Reddit

May 20, 2025 -

Is Big Bear Ai Stock A Good Investment In 2024

May 20, 2025

Is Big Bear Ai Stock A Good Investment In 2024

May 20, 2025 -

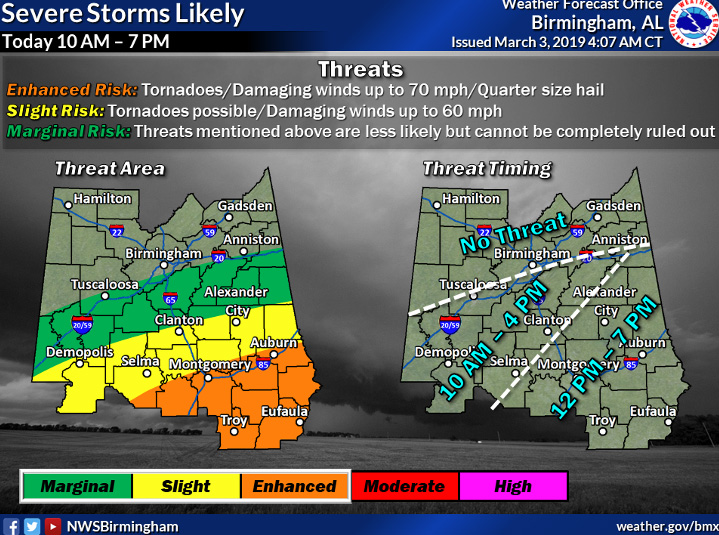

Your First Alert Strong Wind And Severe Storms Expected

May 20, 2025

Your First Alert Strong Wind And Severe Storms Expected

May 20, 2025 -

Top 12 Ai Stocks To Watch Reddits Hottest Picks

May 20, 2025

Top 12 Ai Stocks To Watch Reddits Hottest Picks

May 20, 2025 -

Should You Buy Big Bear Ai Stock Now Investing Considerations

May 20, 2025

Should You Buy Big Bear Ai Stock Now Investing Considerations

May 20, 2025