The Importance Of Net Asset Value (NAV) In Amundi Dow Jones Industrial Average UCITS ETF Investing

Table of Contents

What is Net Asset Value (NAV) and How is it Calculated for the Amundi DJIA UCITS ETF?

Net Asset Value (NAV) represents the net value of an ETF's assets minus its liabilities, per share. For the Amundi Dow Jones Industrial Average UCITS ETF, this means the NAV reflects the collective value of the 30 constituent companies of the Dow Jones Industrial Average, held within the ETF, after deducting expenses. Understanding this value is crucial for assessing your investment's growth.

- Definition of NAV: NAV is calculated by taking the total market value of all the ETF's holdings (the 30 Dow Jones Industrial Average stocks), adding any cash and subtracting liabilities such as management fees and expenses.

- Formula for calculating NAV (simplified explanation): (Total Asset Value - Total Liabilities) / Number of Outstanding Shares = NAV per share. The precise calculation is more complex, considering factors like accrued income and currency exchange rates.

- Factors affecting the daily NAV calculation: Daily market fluctuations in the prices of the Dow Jones components are the primary driver of NAV changes. Dividends received from the underlying stocks and the ETF's operating expenses also influence the daily NAV.

- Where to find the daily NAV: The daily NAV for the Amundi DJIA UCITS ETF is readily available on the Amundi website, major financial news websites (like Yahoo Finance or Google Finance), and through your brokerage account.

Using NAV to Track Amundi DJIA UCITS ETF Performance

The daily changes in the Amundi DJIA UCITS ETF's NAV directly reflect its performance. By tracking these changes, you gain valuable insight into the growth or decline of your investment. While the market price of the ETF might fluctuate slightly throughout the trading day, the NAV provides a more accurate picture of the underlying asset value.

- NAV as a measure of investment growth: Comparing the NAV over time (daily, weekly, monthly, or annually) allows you to clearly see your investment growth. A rising NAV indicates positive performance.

- Comparing NAV to previous periods: Regularly monitoring NAV changes helps you understand the ETF's performance relative to market benchmarks and your investment goals.

- Interpreting NAV fluctuations in relation to market trends: Analyzing NAV fluctuations in conjunction with broader market trends (e.g., economic news, interest rate changes) allows for a better understanding of the ETF's performance in different market conditions.

- Using NAV to evaluate the effectiveness of your investment strategy: Tracking NAV helps assess whether your investment strategy is aligning with your long-term financial objectives.

NAV and Amundi DJIA UCITS ETF Investment Decisions

The NAV is a vital tool for making informed buy and sell decisions regarding your Amundi DJIA UCITS ETF investment. It allows you to identify potential entry and exit points, optimizing your investment strategy.

- Using NAV to identify potential buying opportunities: A lower-than-expected NAV (relative to historical trends or comparable ETFs) might signal a potential buying opportunity, assuming no fundamental reasons for the decline.

- Using NAV to determine appropriate selling points: Conversely, a consistently high NAV may indicate it's time to consider selling or rebalancing your portfolio.

- Comparing NAV with other similar ETFs: Comparing the NAV of the Amundi DJIA UCITS ETF with similar ETFs tracking the Dow Jones Industrial Average helps you make informed choices based on performance and expense ratios.

- Considering NAV in relation to your overall investment portfolio: Your Amundi DJIA UCITS ETF’s NAV should be evaluated in the context of your broader portfolio to ensure appropriate diversification and risk management.

Understanding Potential Discrepancies between NAV and Market Price

While the NAV is a key indicator, it's important to note that the ETF's market price might sometimes deviate slightly from its NAV. This is primarily due to supply and demand dynamics in the market.

- Supply and demand influencing market price: High demand for the ETF can temporarily push its market price above the NAV, while low demand might push it below.

- Bid-ask spread explanation: The bid-ask spread (the difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept) contributes to price discrepancies.

- Minor discrepancies are normal, significant deviations should be investigated: While minor differences are typically normal, significant deviations between the market price and NAV warrant further investigation to understand the underlying market factors.

Conclusion

Mastering your Amundi Dow Jones Industrial Average UCITS ETF investment starts with understanding its Net Asset Value (NAV). This article highlighted the importance of regularly monitoring the NAV to track performance, make informed buy/sell decisions, and manage risk effectively. By actively utilizing this crucial metric and understanding its relationship to market trends, you can optimize your investment strategy and achieve your financial goals. Remember to regularly check the NAV of your Amundi Dow Jones Industrial Average UCITS ETF and use it as a key indicator for sound investment management.

Featured Posts

-

Prezzi Abbigliamento Usa Impatto Dei Dazi Sulla Moda

May 24, 2025

Prezzi Abbigliamento Usa Impatto Dei Dazi Sulla Moda

May 24, 2025 -

Escape To The Country Securing Your Dream Home On A 1m Budget

May 24, 2025

Escape To The Country Securing Your Dream Home On A 1m Budget

May 24, 2025 -

Royal Philips 2025 Annual General Meeting Of Shareholders Update

May 24, 2025

Royal Philips 2025 Annual General Meeting Of Shareholders Update

May 24, 2025 -

Herstel Op Beurzen Na Uitstel Trump Alle Aex Fondsen In De Plus

May 24, 2025

Herstel Op Beurzen Na Uitstel Trump Alle Aex Fondsen In De Plus

May 24, 2025 -

Dax Rise Frankfurt Equities Open Higher Record High Nears

May 24, 2025

Dax Rise Frankfurt Equities Open Higher Record High Nears

May 24, 2025

Latest Posts

-

Royal Philips 2025 Annual General Meeting Of Shareholders Update

May 24, 2025

Royal Philips 2025 Annual General Meeting Of Shareholders Update

May 24, 2025 -

Significant Drop In Amsterdam Stock Exchange Aex Index Below 4

May 24, 2025

Significant Drop In Amsterdam Stock Exchange Aex Index Below 4

May 24, 2025 -

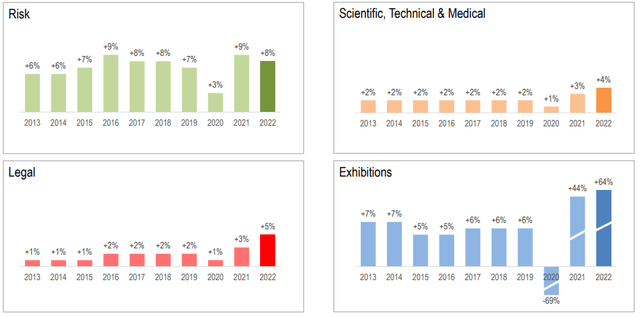

Economische Recessie Niet Voor Relx Ai Drijft Groei En Winstgevendheid

May 24, 2025

Economische Recessie Niet Voor Relx Ai Drijft Groei En Winstgevendheid

May 24, 2025 -

Uitstel Trump Leidt Tot Herstel Op De Beurzen Aex In Positief Gebied

May 24, 2025

Uitstel Trump Leidt Tot Herstel Op De Beurzen Aex In Positief Gebied

May 24, 2025 -

Aex Index Crumbles More Than 4 Loss Lowest Point In 12 Months

May 24, 2025

Aex Index Crumbles More Than 4 Loss Lowest Point In 12 Months

May 24, 2025