The Overvalued Canadian Dollar: Economic Implications And Solutions

Table of Contents

Factors Contributing to an Overvalued Canadian Dollar

Several key factors contribute to the perception of an overvalued Canadian dollar. Understanding these is crucial to addressing the issue effectively.

High Commodity Prices

Canada's economy is heavily reliant on resource-based exports, particularly oil and gas.

- Strong global demand for these commodities significantly increases the demand for the Canadian dollar (CAD), driving up its value.

- A direct correlation exists between commodity prices and the CAD's exchange rate. When oil prices rise, so does the CAD, and vice-versa. For instance, the surge in oil prices in 2022 led to a strengthening of the CAD. This relationship, however, can be volatile and unpredictable.

- Fluctuations in global energy markets can significantly impact the CAD's valuation, creating both opportunities and challenges for the Canadian economy.

Interest Rate Differentials

The Bank of Canada's monetary policy plays a significant role in determining the CAD's value.

- Higher interest rates in Canada compared to other major economies attract foreign investment, increasing demand for the CAD. Investors seek higher returns, leading to capital inflows.

- Global interest rate trends also significantly influence the CAD. When global interest rates rise, the CAD may appreciate, but if they fall, the opposite could be true. This requires careful monitoring of global economic conditions.

- The Bank of Canada's ability to manage interest rates strategically is crucial in mitigating the effects of an overvalued Canadian dollar.

Safe-Haven Status

Canada's reputation for political and economic stability makes its currency a safe haven during times of global uncertainty.

- During periods of geopolitical instability or economic crises, investors often flock to the perceived safety of the Canadian economy, increasing demand for the CAD.

- Events such as global financial crises or regional conflicts can lead to significant capital inflows into Canada, boosting the CAD's value.

- While this safe-haven status can be beneficial in some situations, it also contributes to the potential overvaluation of the CAD during periods of global instability.

Economic Implications of an Overvalued Canadian Dollar

An overvalued Canadian dollar presents a mixed bag of economic consequences.

Impact on Exports

A strong CAD negatively impacts Canadian export competitiveness.

- Canadian goods become more expensive for foreign buyers, leading to reduced export volumes and impacting industries like manufacturing and agriculture.

- Sectors heavily reliant on exports, such as forestry and automotive manufacturing, are particularly vulnerable to the effects of an overvalued CAD.

- This can lead to job losses and reduced economic growth in export-oriented industries.

Impact on Imports

Conversely, a strong CAD makes imported goods cheaper for Canadian consumers.

- Lower import costs can lead to reduced inflation and increased consumer spending on imported goods.

- However, this can also lead to increased reliance on imports, potentially harming domestic industries and impacting Canada's trade balance.

- The benefit of cheaper imports needs to be carefully weighed against the negative consequences for domestic production.

Impact on Tourism

An overvalued CAD makes Canada a more expensive destination for international tourists.

- This can lead to reduced tourism revenue, impacting businesses in the hospitality and tourism sectors.

- A stronger CAD can make Canada less attractive to international travelers compared to other destinations.

- Tourism-dependent regions and businesses are especially susceptible to this effect.

Impact on Foreign Investment

A strong CAD can make Canadian assets more expensive for foreign investors, potentially reducing foreign direct investment (FDI).

- This can hinder economic growth and limit the availability of capital for Canadian businesses.

- A less attractive investment climate can discourage foreign companies from setting up operations in Canada.

- Maintaining a competitive exchange rate is vital for attracting FDI and sustaining economic growth.

Potential Solutions to Address an Overvalued Canadian Dollar

Addressing an overvalued Canadian dollar requires a multi-pronged approach.

Diversification of the Economy

Reducing reliance on commodity exports is crucial for long-term economic stability.

- Investing in other sectors like technology, innovation, and advanced manufacturing can create a more resilient and diverse economy.

- Government initiatives supporting research and development, education, and entrepreneurship are crucial for diversification.

- A diversified economy is less vulnerable to fluctuations in commodity prices and global market conditions.

Monetary Policy Adjustments

The Bank of Canada plays a vital role in managing the exchange rate through monetary policy.

- Adjustments to interest rates can influence the CAD's value, although this requires careful consideration of potential trade-offs with other economic goals.

- Lowering interest rates can potentially weaken the CAD, making exports more competitive. However, this could also increase inflation.

- Balancing economic growth, inflation control, and exchange rate stability requires careful and strategic management by the Bank of Canada.

Fiscal Policy Interventions

Government spending and taxation policies can also indirectly influence the exchange rate.

- Targeted government spending on infrastructure projects or tax incentives for specific industries could stimulate economic activity and indirectly affect the CAD's value.

- However, fiscal policy interventions should be carefully planned and implemented to avoid unintended consequences.

- The effectiveness of fiscal policy in managing the exchange rate is often debated and requires careful consideration of potential risks and benefits.

Conclusion

The overvalued Canadian dollar is a complex issue with significant economic consequences. Factors such as high commodity prices, interest rate differentials, and Canada's safe-haven status all contribute to its current valuation. The implications are far-reaching, affecting exports, imports, tourism, and foreign investment. To address this, a diversified economy, strategic monetary policy adjustments by the Bank of Canada, and carefully considered fiscal policy interventions are necessary. Staying informed about the fluctuating value of the overvalued Canadian dollar and its impact is crucial. Follow economic news and engage in informed discussions to contribute to finding effective and sustainable solutions for maintaining a healthy and stable Canadian currency.

Featured Posts

-

Unlocking Potential The Crucial Role Of Middle Managers In Organizations

May 08, 2025

Unlocking Potential The Crucial Role Of Middle Managers In Organizations

May 08, 2025 -

Krachy Pwlys Ky Naahly Jawyd Ealm Awdhw Ka Armghan Kys Myn Byan

May 08, 2025

Krachy Pwlys Ky Naahly Jawyd Ealm Awdhw Ka Armghan Kys Myn Byan

May 08, 2025 -

Carney Defends Canadas Sovereignty In Trump Meeting

May 08, 2025

Carney Defends Canadas Sovereignty In Trump Meeting

May 08, 2025 -

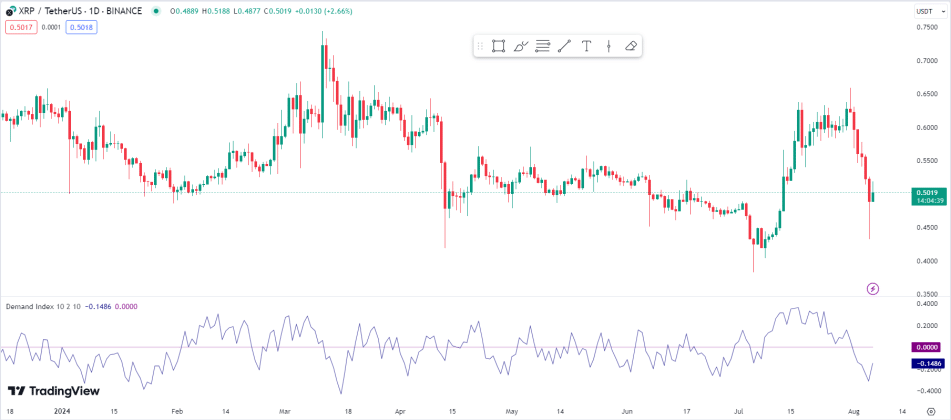

Will Xrp Etfs Disappoint Assessing Supply And Institutional Demand

May 08, 2025

Will Xrp Etfs Disappoint Assessing Supply And Institutional Demand

May 08, 2025 -

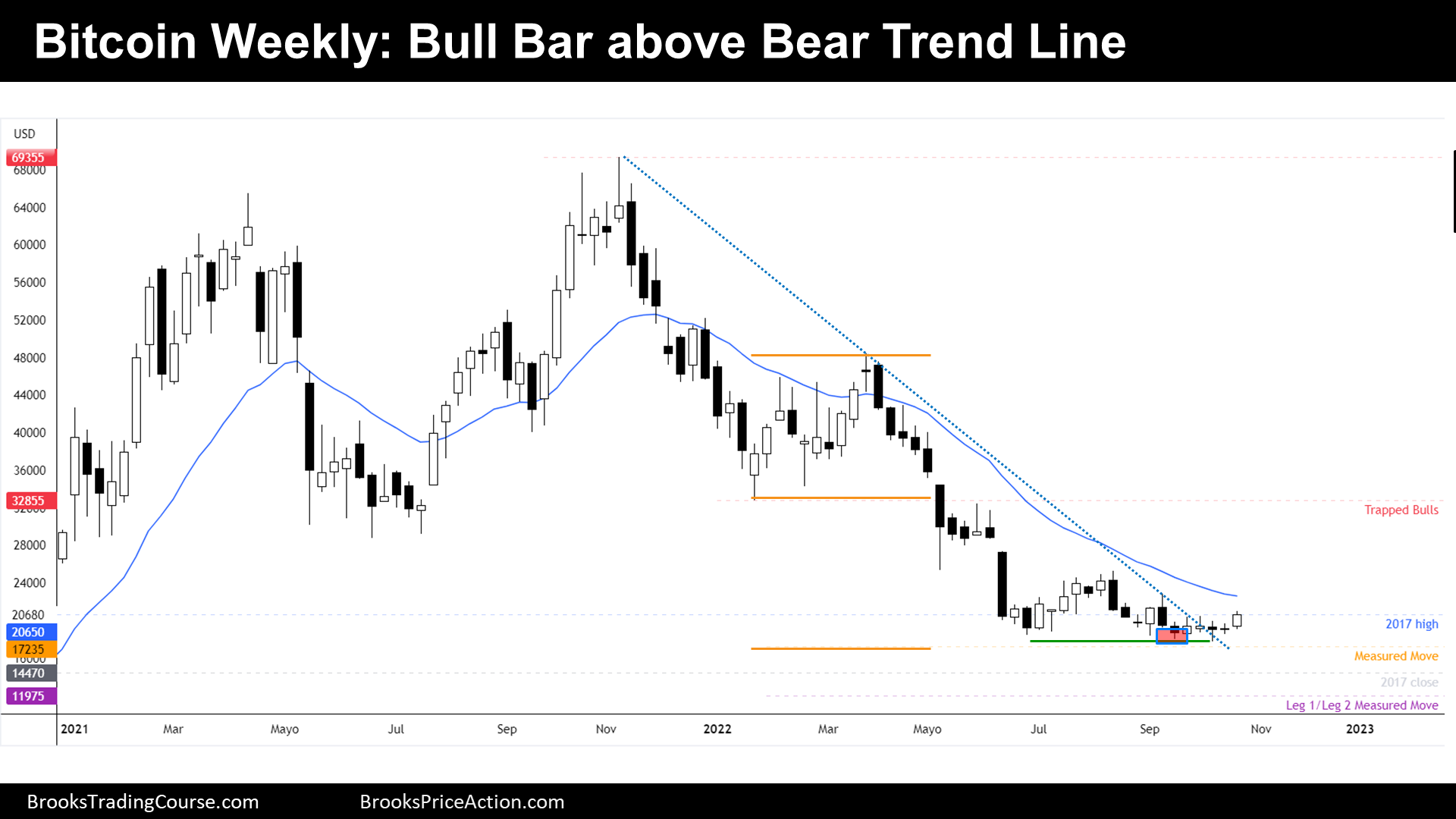

Analyzing The Bitcoin Rebound Signs Of A Long Term Trend

May 08, 2025

Analyzing The Bitcoin Rebound Signs Of A Long Term Trend

May 08, 2025