The Rise Of Succession Planning In High-Net-Worth Families

Table of Contents

The Complexities of High-Net-Worth Succession Planning

Succession planning for high-net-worth families extends far beyond simply dividing financial assets. It encompasses a multifaceted approach requiring careful consideration of various intricate elements.

Beyond Financial Assets

High-net-worth individuals often possess a diverse portfolio of assets that complicate the succession process. The complexities go beyond simple bank accounts and stocks.

- Navigating differing family member interests and expectations: Family members may have vastly different aspirations and expectations regarding the distribution of wealth, leading to potential conflicts. Open communication and clear guidelines are crucial to mitigate these issues.

- Managing complex asset structures and tax implications: High-net-worth estates often include complex structures like trusts, partnerships, and privately held companies, each with unique tax implications that require specialized expertise to navigate. Proper estate planning is critical here.

- Balancing charitable giving with family wealth preservation: Many high-net-worth families are deeply committed to philanthropy. Integrating charitable giving into the succession plan requires careful consideration to balance philanthropic goals with the long-term preservation of family wealth.

- Succession planning for family businesses and privately held companies: Transferring ownership and control of a family business requires a strategic approach that considers the business's long-term viability and the capabilities of the next generation. This often involves professional business succession planning.

- Considering generational differences in values and financial literacy: Different generations may have varying levels of financial literacy and differing values regarding wealth management and investment strategies. Bridging this gap through education and open communication is essential.

The Growing Need for Professional Expertise

Successfully navigating the intricacies of high-net-worth succession planning requires a team of specialized professionals. Attempting this alone is often inadequate and potentially disastrous.

- Estate attorneys specializing in high-net-worth families: Experienced estate attorneys are crucial in drafting legally sound and tax-efficient estate plans, including wills, trusts, and other legal documents.

- Certified Financial Planners (CFPs) with experience in wealth transfer: CFPs provide expertise in financial planning, investment management, and wealth transfer strategies tailored to the unique needs of high-net-worth families.

- Family business consultants: These consultants provide guidance on succession planning for family-owned businesses, including strategies for transferring ownership, managing transitions, and ensuring the long-term success of the enterprise.

- Tax advisors specializing in estate and gift taxes: Understanding and minimizing tax liabilities is paramount in high-net-worth succession planning. Expert tax advice is essential to optimize wealth transfer and minimize tax burdens.

- Therapists or mediators for family conflict resolution: Family dynamics can significantly impact the success of succession planning. Mediators or therapists can help facilitate open communication and resolve potential conflicts among family members.

Key Strategies for Effective Succession Planning

A successful succession plan is a comprehensive document that addresses all aspects of wealth transfer and family legacy. It is not a simple will, but a strategic plan that encompasses many areas.

Developing a Comprehensive Plan

Creating a robust plan requires a structured approach encompassing various key elements.

- Defining clear family goals and objectives: The plan should clearly define the family's goals, both financial and non-financial, to guide decision-making and ensure alignment among family members.

- Inventorying all assets and liabilities: A complete inventory of all assets (including real estate, investments, and intellectual property) and liabilities is crucial for accurate financial planning and efficient wealth transfer.

- Creating a detailed estate plan including wills, trusts, and power of attorney documents: Proper legal documentation is essential to ensure the smooth transfer of assets according to the family's wishes and to minimize potential legal disputes.

- Implementing tax-efficient wealth transfer strategies: Strategic tax planning is critical to minimize tax liabilities associated with the transfer of wealth across generations. This may involve utilizing trusts, gifting strategies, or other tax-efficient techniques.

- Establishing clear governance structures for family businesses: For family-owned businesses, establishing clear governance structures ensures the long-term success and stability of the business after the transition of ownership.

- Planning for philanthropic activities: If the family engages in philanthropy, integrating charitable giving into the succession plan ensures that the family's philanthropic goals are aligned with their overall wealth management strategy.

Open Communication and Family Governance

Open communication and establishing clear governance structures are critical for successful intergenerational wealth transfer.

- Regular family meetings to discuss plans and address concerns: Regular meetings provide opportunities to discuss the succession plan, address concerns, and foster open communication among family members.

- Establishing family constitutions or governance documents: Formal documents outlining family values, decision-making processes, and guidelines for wealth management provide structure and clarity.

- Creating a neutral third-party facilitator for family discussions: A neutral third party can help facilitate difficult conversations, mediate disputes, and ensure that all family members' voices are heard.

- Educating younger generations about financial literacy and family wealth: Providing education and training to younger generations on financial literacy and responsible wealth management prepares them for their future roles in managing family wealth.

- Fostering open and honest communication between generations: Open and honest communication builds trust and understanding among family members, which is crucial for a successful transition of wealth.

Addressing Potential Challenges and Risks

Even the most carefully crafted succession plan may encounter unforeseen challenges. Proactive planning and preparation are vital.

Family Conflict and Disputes

Disagreements amongst family members are common during wealth transfers.

- Preemptive mediation and conflict resolution: Proactive mediation can help prevent conflicts from escalating and ensure a smoother transition of wealth.

- Clear guidelines and decision-making processes: Establishing clear guidelines for decision-making and conflict resolution can help minimize disputes and maintain family harmony.

- Engaging independent advisors to mediate disputes: An independent advisor can provide neutral advice and mediate disputes between family members.

- Using legally binding agreements to prevent future conflicts: Legally binding agreements can help prevent future conflicts by clearly defining the terms of the wealth transfer and establishing clear expectations.

Tax Implications and Regulatory Compliance

Navigating tax laws and regulations is a critical aspect of high-net-worth succession planning.

- Understanding estate tax laws and implications: Thorough understanding of estate tax laws and implications is essential to minimize tax liabilities.

- Utilizing tax-efficient wealth transfer strategies: Employing tax-efficient strategies, such as trusts and gifting, can significantly reduce the tax burden associated with wealth transfer.

- Ensuring compliance with all relevant regulations: Adherence to all relevant laws and regulations is critical to avoid penalties and legal issues.

- Seeking expert advice on international tax implications: For families with international assets, expert advice on international tax implications is crucial.

Conclusion

Succession planning for high-net-worth families is a complex process demanding careful consideration of family dynamics, asset structures, and legal and tax implications. By implementing a comprehensive strategy, utilizing professional expertise, and fostering open communication within the family, high-net-worth families can effectively preserve their wealth, protect their legacy, and ensure a smooth transfer of assets across generations. Don't delay – begin your high-net-worth family's succession planning today. Contact a qualified professional to discuss your specific needs and create a customized plan that secures your family's future and legacy.

Featured Posts

-

Global Forest Loss Surges To New High The Impact Of Wildfires

May 22, 2025

Global Forest Loss Surges To New High The Impact Of Wildfires

May 22, 2025 -

The Greatest Hot Weather Drink You Ve Never Tried

May 22, 2025

The Greatest Hot Weather Drink You Ve Never Tried

May 22, 2025 -

Arne Slot Admits Liverpool Fortune Enrique Weighs In On Alisson

May 22, 2025

Arne Slot Admits Liverpool Fortune Enrique Weighs In On Alisson

May 22, 2025 -

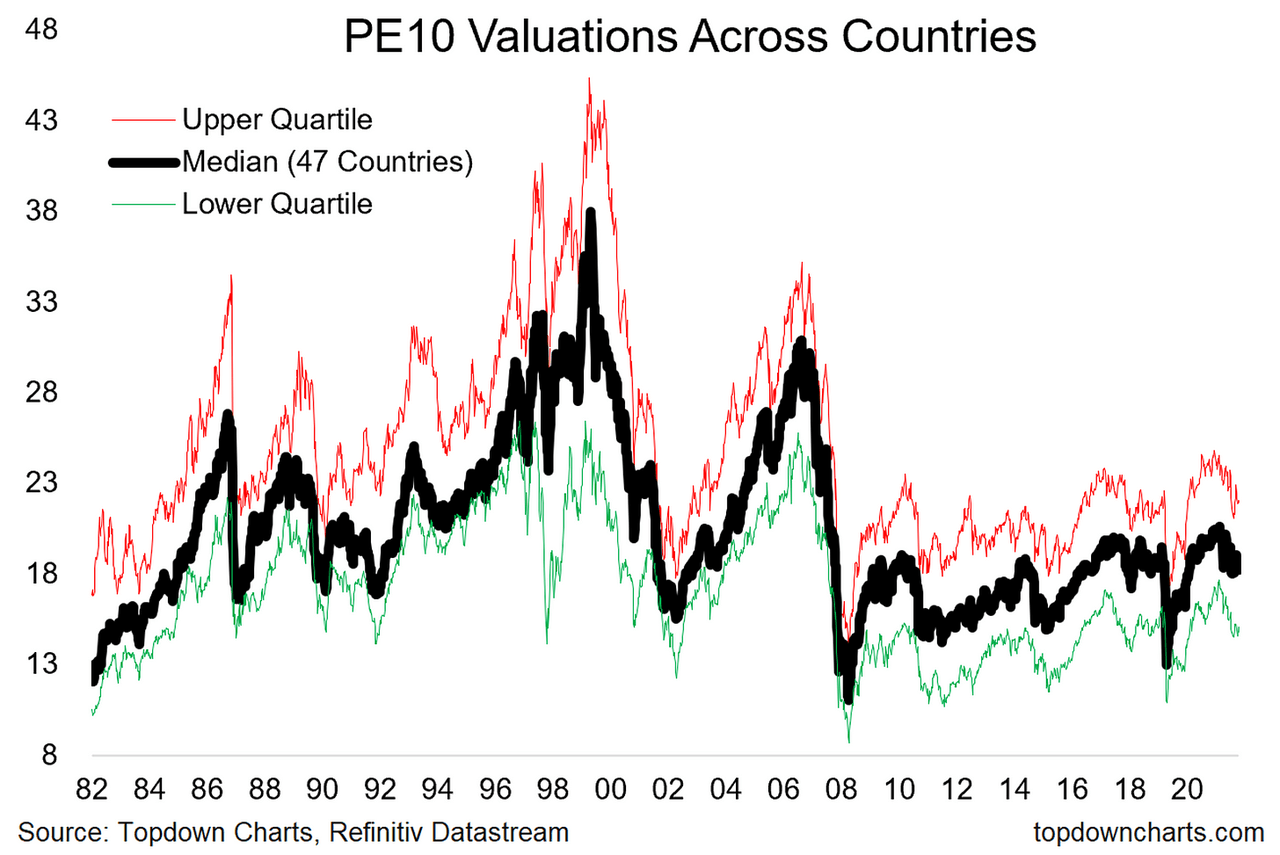

Stock Market Valuations Bof As Analysis And Investor Reassurance

May 22, 2025

Stock Market Valuations Bof As Analysis And Investor Reassurance

May 22, 2025 -

Analyzing Fan Reaction To Dexter Resurrections Villain

May 22, 2025

Analyzing Fan Reaction To Dexter Resurrections Villain

May 22, 2025

Latest Posts

-

Taylor Swift Text Leak Allegation Blake Livelys Lawyer In The Spotlight

May 22, 2025

Taylor Swift Text Leak Allegation Blake Livelys Lawyer In The Spotlight

May 22, 2025 -

Dissecting The Blake Lively Allegation What We Know

May 22, 2025

Dissecting The Blake Lively Allegation What We Know

May 22, 2025 -

The Blake Lively Allegation Fact Checking The Latest Reports

May 22, 2025

The Blake Lively Allegation Fact Checking The Latest Reports

May 22, 2025 -

Blake Livelys Lawyer Accused Of Threatening Taylor Swift Text Leak

May 22, 2025

Blake Livelys Lawyer Accused Of Threatening Taylor Swift Text Leak

May 22, 2025 -

Is Blake Lively Involved In This Alleged Incident A Look At The Controversy

May 22, 2025

Is Blake Lively Involved In This Alleged Incident A Look At The Controversy

May 22, 2025