Stock Market Valuations: BofA's Analysis And Investor Reassurance

Table of Contents

BofA's Key Findings on Current Stock Market Valuations

Bank of America's recent reports on stock market valuations offer a nuanced perspective. While specific data points fluctuate, BofA typically employs a multi-faceted approach, considering various valuation metrics to avoid relying on any single indicator. Their assessment often involves a blend of quantitative analysis and qualitative factors.

-

Summary of BofA's Overall Assessment: (Note: This section requires real-time data. Replace the bracketed information with the most current findings from BofA reports. For example:) [BofA's latest report suggests that the market is currently fairly valued, but with specific sectors showing signs of overvaluation, while others are considered undervalued. Their analysis emphasizes the need for a sector-specific approach, rather than a blanket judgment on overall market valuation.]

-

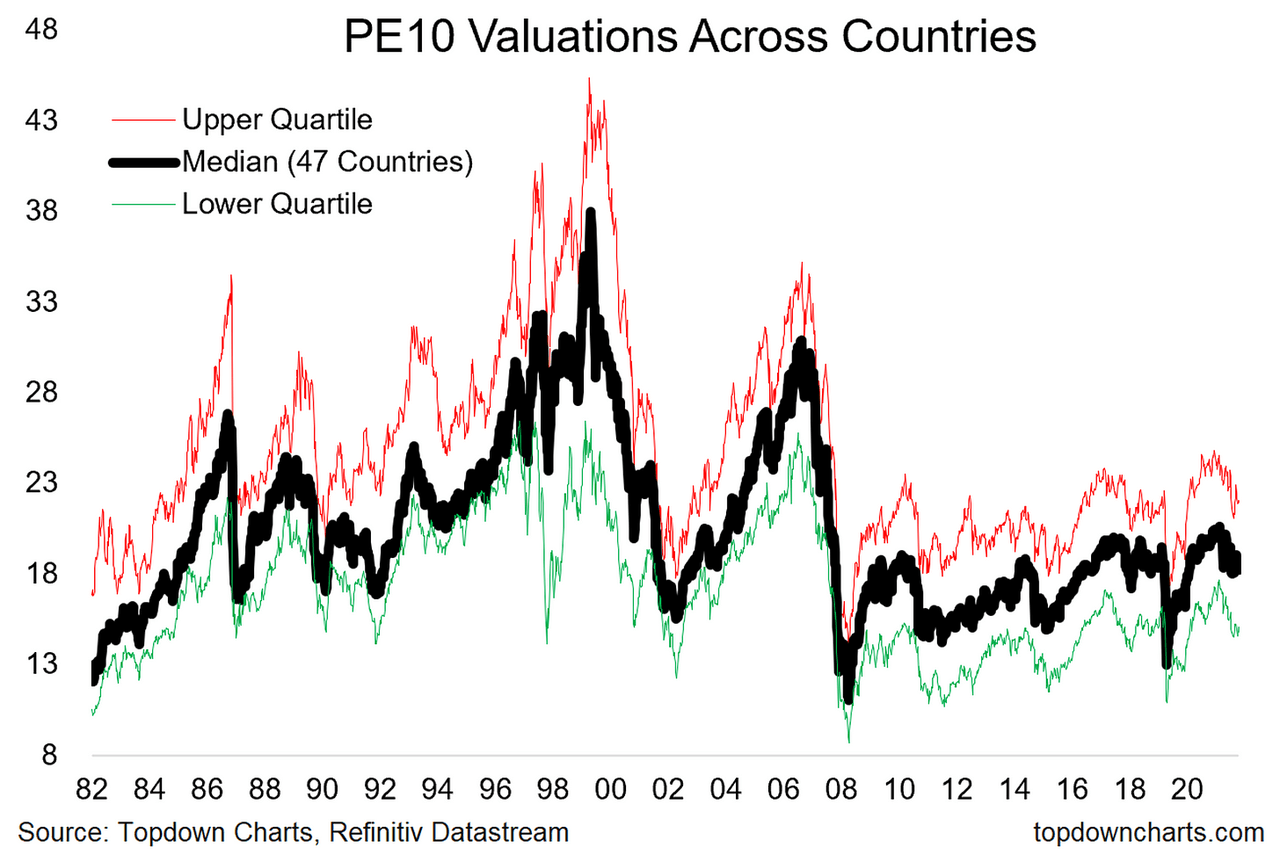

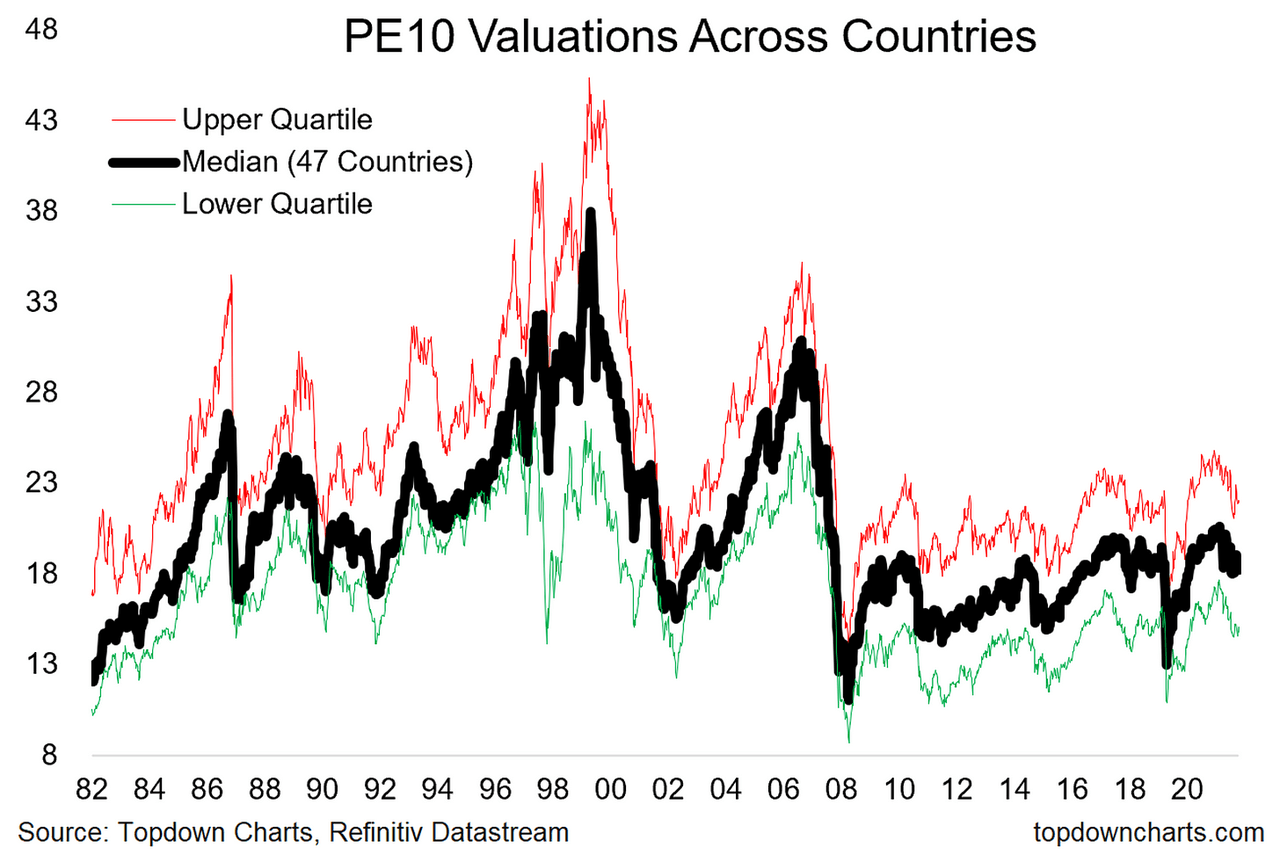

Specific Valuation Metrics: BofA's analysis typically incorporates several key valuation metrics:

- Price-to-Earnings Ratio (P/E): This compares a company's stock price to its earnings per share. A high P/E ratio suggests investors are willing to pay more for each dollar of earnings, potentially indicating higher growth expectations or overvaluation.

- Price-to-Sales Ratio (P/S): This ratio compares a company's market capitalization to its revenue. It's often used for companies with negative earnings. A high P/S ratio might suggest overvaluation, particularly if revenue growth is slow.

- Price-to-Book Ratio (P/B): This compares a company's market value to its book value (assets minus liabilities). A high P/B ratio could indicate that the market is placing a premium on the company's intangible assets or future growth potential, but it could also signify overvaluation.

-

Sector-Specific Analysis: BofA often highlights specific sectors or stocks that deviate significantly from the overall market valuation. [For example, BofA may point to the technology sector exhibiting higher P/E ratios compared to other sectors, warranting closer examination.]

-

Discrepancies Between Valuation Methods: It's crucial to acknowledge that different valuation methods can yield different results. BofA likely addresses these discrepancies and explains the nuances of interpreting conflicting signals from various metrics.

-

Changes Compared to Previous Reports: Monitoring the evolution of BofA's assessment over time is essential. [For example, has BofA shifted from a more cautious outlook to a more optimistic one? Has their valuation of particular sectors changed significantly?]

Understanding the Factors Influencing Stock Market Valuations

Several macroeconomic and microeconomic factors significantly influence stock market valuations. Understanding these forces is crucial for informed investment decisions.

- Interest Rates: Higher interest rates generally increase borrowing costs for companies, reducing profitability and potentially lowering stock valuations. Conversely, lower rates can stimulate borrowing and investment, boosting valuations.

- Inflation: High inflation erodes purchasing power and can impact company profits, affecting stock prices. BofA's analysis likely considers inflation expectations and their potential impact on earnings growth.

- Economic Growth: Strong economic growth typically leads to higher corporate earnings and increased investor confidence, driving up stock valuations. Conversely, weak economic growth can dampen market performance.

- Earnings Growth: The rate at which companies' earnings grow directly impacts stock prices. High earnings growth typically supports higher valuations, while slower or negative growth can lead to lower valuations.

- Geopolitical Risks: Geopolitical events and global uncertainty can create market volatility and influence investor sentiment, impacting valuations. BofA's analysis likely incorporates an assessment of significant geopolitical risks.

- Investor Sentiment: Market psychology and investor sentiment play a significant role in driving valuations. Periods of optimism can lead to higher valuations, while pessimism can push them down.

BofA's Recommendations for Investors

BofA's recommendations to investors are directly tied to their valuation analysis. While specific recommendations may change based on current market conditions, some general principles often prevail.

-

Investment Strategy: [For example, BofA might recommend a balanced approach, combining growth and value stocks, based on their valuation assessment of different sectors. They may suggest focusing on companies with strong fundamentals and sustainable growth prospects.]

-

Diversification and Risk Management: BofA invariably stresses the importance of a diversified portfolio to mitigate risk. This involves spreading investments across different asset classes, sectors, and geographies.

-

Long-Term Investing: BofA often advocates for a long-term investment horizon, emphasizing that short-term market fluctuations should not dictate long-term investment strategies.

-

Sector Focus: Based on their valuation analysis, BofA might suggest focusing on specific sectors showing better value or growth potential while avoiding sectors deemed overvalued. [For example, they might suggest a shift towards undervalued sectors like energy or consumer staples if growth stocks appear overvalued.]

-

Reasoning Behind Recommendations: BofA's recommendations should be clearly justified by their analysis of market valuations, macroeconomic factors, and sector-specific insights.

Addressing Investor Concerns and Reassurance

Market volatility is inherent, and investors often experience anxiety. Addressing these concerns is crucial for building confidence.

-

Common Investor Anxieties: Many investors worry about losing their investments, especially during periods of market uncertainty. BofA's reports aim to provide clarity and context to ease these anxieties.

-

Long-Term Perspective: Maintaining a long-term perspective is critical. Short-term market fluctuations are normal and should not derail a well-defined investment strategy.

-

Managing Emotional Responses: Emotional decision-making can lead to poor investment outcomes. Investors should aim to base decisions on rational analysis, rather than reacting to market swings driven by fear or greed.

-

Professional Financial Advice: Seeking advice from a qualified financial advisor can be invaluable, particularly for those lacking the expertise to navigate complex market conditions.

-

Reliable Resources: Numerous reliable sources offer valuable insights into stock market valuations. Staying informed is crucial, and resources like Bank of America's reports are important tools.

Conclusion

BofA's analysis provides valuable insight into current stock market valuations, highlighting key factors influencing market performance and offering guidance for investors. While market volatility is inevitable, understanding these valuations and applying sound investment strategies can help mitigate risk and maximize returns. Regularly reviewing reports from reputable sources and considering professional financial advice are important aspects of successful long-term investing. Stay informed about stock market valuations by regularly reviewing reports from reputable sources like Bank of America and adjusting your investment strategy accordingly. Understanding stock market valuations is key to informed investment decisions.

Featured Posts

-

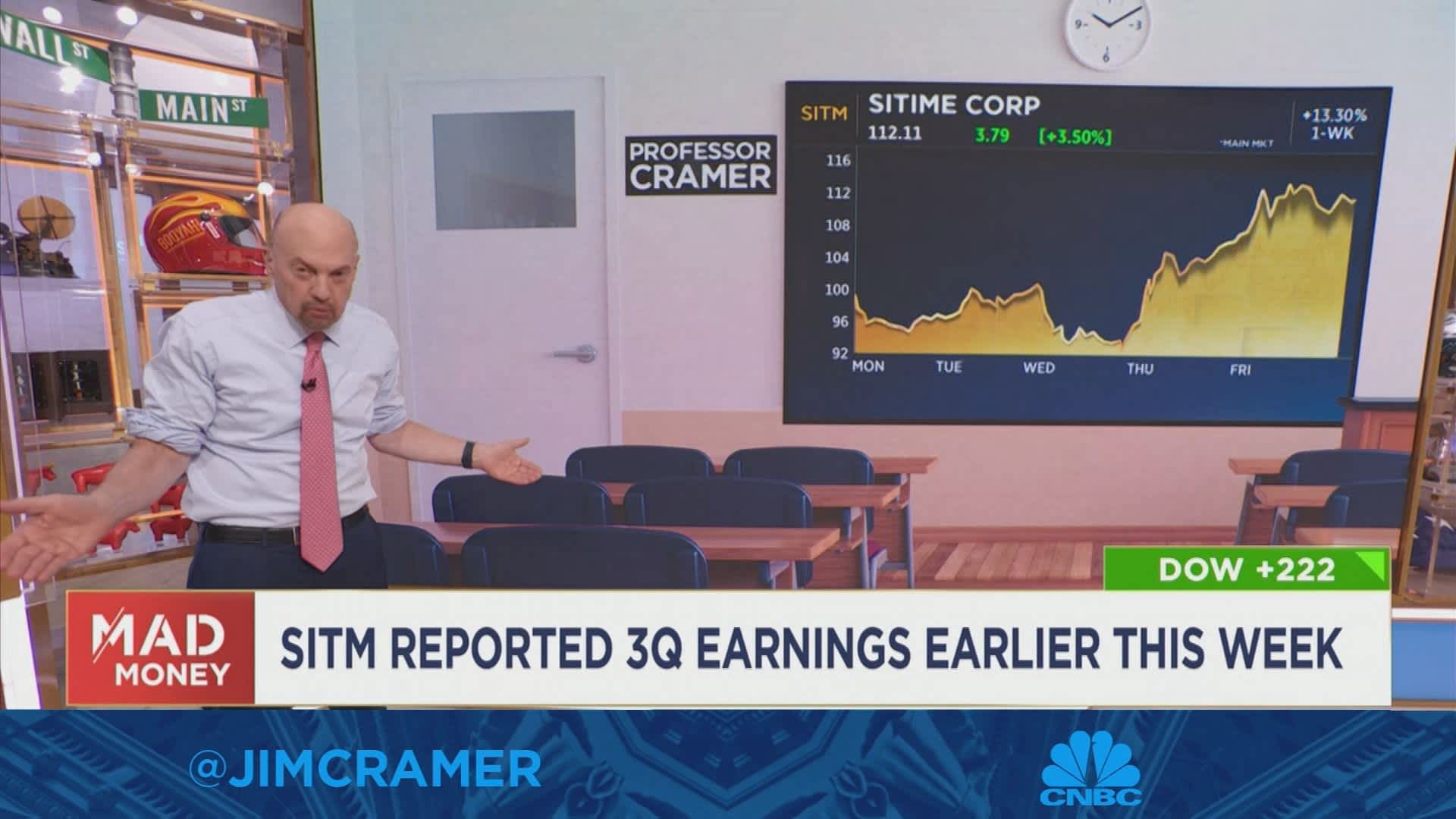

Is Jim Cramer Right About Core Weave Crwv Analyzing Its Position In Ai Infrastructure

May 22, 2025

Is Jim Cramer Right About Core Weave Crwv Analyzing Its Position In Ai Infrastructure

May 22, 2025 -

Moncoutant Sur Sevre Pres D Un Siecle De Diversification Chez Clisson

May 22, 2025

Moncoutant Sur Sevre Pres D Un Siecle De Diversification Chez Clisson

May 22, 2025 -

Love Monster Activities For Kids Fun And Educational Games

May 22, 2025

Love Monster Activities For Kids Fun And Educational Games

May 22, 2025 -

Grand Gender Reveal Mummy Pig Celebrates At A London Landmark

May 22, 2025

Grand Gender Reveal Mummy Pig Celebrates At A London Landmark

May 22, 2025 -

The Growing Trend Of Betting On California Wildfires A Concerning Reality

May 22, 2025

The Growing Trend Of Betting On California Wildfires A Concerning Reality

May 22, 2025

Latest Posts

-

Core Weave Inc Crwv Stock Performance On Tuesday A Detailed Look

May 22, 2025

Core Weave Inc Crwv Stock Performance On Tuesday A Detailed Look

May 22, 2025 -

The Core Weave Crwv Investment Case A Look Through Jim Cramers Lens

May 22, 2025

The Core Weave Crwv Investment Case A Look Through Jim Cramers Lens

May 22, 2025 -

Understanding Core Weaves Stock Performance

May 22, 2025

Understanding Core Weaves Stock Performance

May 22, 2025 -

Core Weave Crwv Stock Market Movement Explaining Last Weeks Performance

May 22, 2025

Core Weave Crwv Stock Market Movement Explaining Last Weeks Performance

May 22, 2025 -

Why Did Core Weave Crwv Stock Increase On Tuesday

May 22, 2025

Why Did Core Weave Crwv Stock Increase On Tuesday

May 22, 2025