Thursday's Fall In CoreWeave (CRWV) Stock: A Comprehensive Overview

Table of Contents

Analyzing the Market Conditions on Thursday

Thursday's downturn in CRWV wasn't an isolated event; it occurred within a broader context of market fluctuations. Understanding the prevailing market conditions is crucial to fully grasping the stock's decline. Several factors contributed to the overall negative sentiment:

-

Broader Market Trends: The tech sector, as a whole, experienced a period of consolidation on Thursday. Indices like the Nasdaq Composite and the S&P 500 showed moderate declines, reflecting a general sense of caution among investors. Rising interest rates continued to weigh on growth stocks, impacting companies like CoreWeave.

-

Macroeconomic Factors: Concerns about inflation and potential future interest rate hikes contributed to the overall market nervousness. This macroeconomic uncertainty often translates into decreased investor confidence in high-growth, high-valuation stocks like CRWV.

-

Relevant News and Events: No single major catastrophic event directly triggered the CRWV drop on Thursday; however, ongoing concerns about the overall economic climate and potential future regulatory changes within the cloud computing industry likely played a role in influencing investor sentiment.

CoreWeave's (CRWV) Recent Performance and News

Prior to Thursday's fall, CoreWeave had shown a period of growth, although this growth had possibly become overextended in the eyes of some investors. Examining CRWV's recent performance is key to understanding the context of the sudden decline.

-

Recent Company Announcements: Any recent announcements from CoreWeave regarding financial performance, partnerships, or product releases should be carefully considered. Were there any hints of slowing growth or potential challenges that may have contributed to investor apprehension?

-

Analyst Downgrades and Short-Selling: A closer look at analyst reports and short-selling activity around Thursday's drop is warranted. Were there any significant analyst downgrades or an increase in short positions that might have exacerbated the price decline?

-

Leadership and Strategy: While unlikely to be the sole reason for such a sudden drop, any recent significant changes within CoreWeave's leadership or a shift in its overall strategic direction could have influenced investor confidence.

Potential Reasons Behind Thursday's CRWV Stock Decline

Multiple factors likely converged to cause Thursday's sharp decline in CRWV stock. Pinpointing the exact cause is complex, but several possibilities warrant consideration:

-

Profit-Taking: After a period of significant growth, some investors may have decided to take profits, leading to a surge in selling pressure.

-

Negative News (Specific to CRWV): While no major negative news was immediately apparent, there may have been subtle negative indicators or rumors circulating within the market that triggered a sell-off.

-

Competitor Activity: Increased competition within the cloud computing industry could have impacted investor confidence in CoreWeave's long-term prospects, prompting some to sell.

-

Unforeseen Circumstances: It's also possible that unexpected and unforeseen events, not yet publicly known, contributed to the decline. This is something to be monitored closely in the days to come.

Investor Reactions and Future Outlook for CRWV Stock

Thursday's CRWV stock drop generated considerable investor reaction, as evidenced by the increased trading volume and volatility.

-

Trading Volume and Volatility: High trading volume on Thursday indicated significant investor activity, both buying and selling. Analyzing the precise ratio of buying to selling will offer a clearer picture.

-

Valuation Changes: The stock's valuation underwent a significant adjustment, reflecting the market's reassessment of CoreWeave's prospects.

-

Expert Opinions and Analyst Predictions: Following the drop, analysts' opinions and predictions regarding CRWV's future performance will become critical. These outlooks will help shape future investor decisions.

-

Recovery Strategies: Investors currently holding CRWV stock should consider their risk tolerance and diversification strategies. Depending on their long-term outlook, they might choose to hold, buy more at the lower price, or divest.

Conclusion: Understanding and Navigating Thursday's Fall in CoreWeave (CRWV) Stock

Thursday's decline in CoreWeave (CRWV) stock was likely a confluence of factors, including broader market conditions, recent company performance, and possibly some unforeseen circumstances. Understanding market dynamics and conducting thorough due diligence before investing is crucial. To navigate the complexities of the stock market, consistently monitoring CRWV stock and staying abreast of all developments is essential. Continue following relevant financial news sources, the CRWV investor relations page, and conducting your own research on Thursday's fall in CoreWeave (CRWV) stock and its ongoing implications. Remember, informed investment decisions are key to mitigating risk and potentially maximizing returns.

Featured Posts

-

Last Weeks Core Weave Crwv Stock Rally Causes And Implications

May 22, 2025

Last Weeks Core Weave Crwv Stock Rally Causes And Implications

May 22, 2025 -

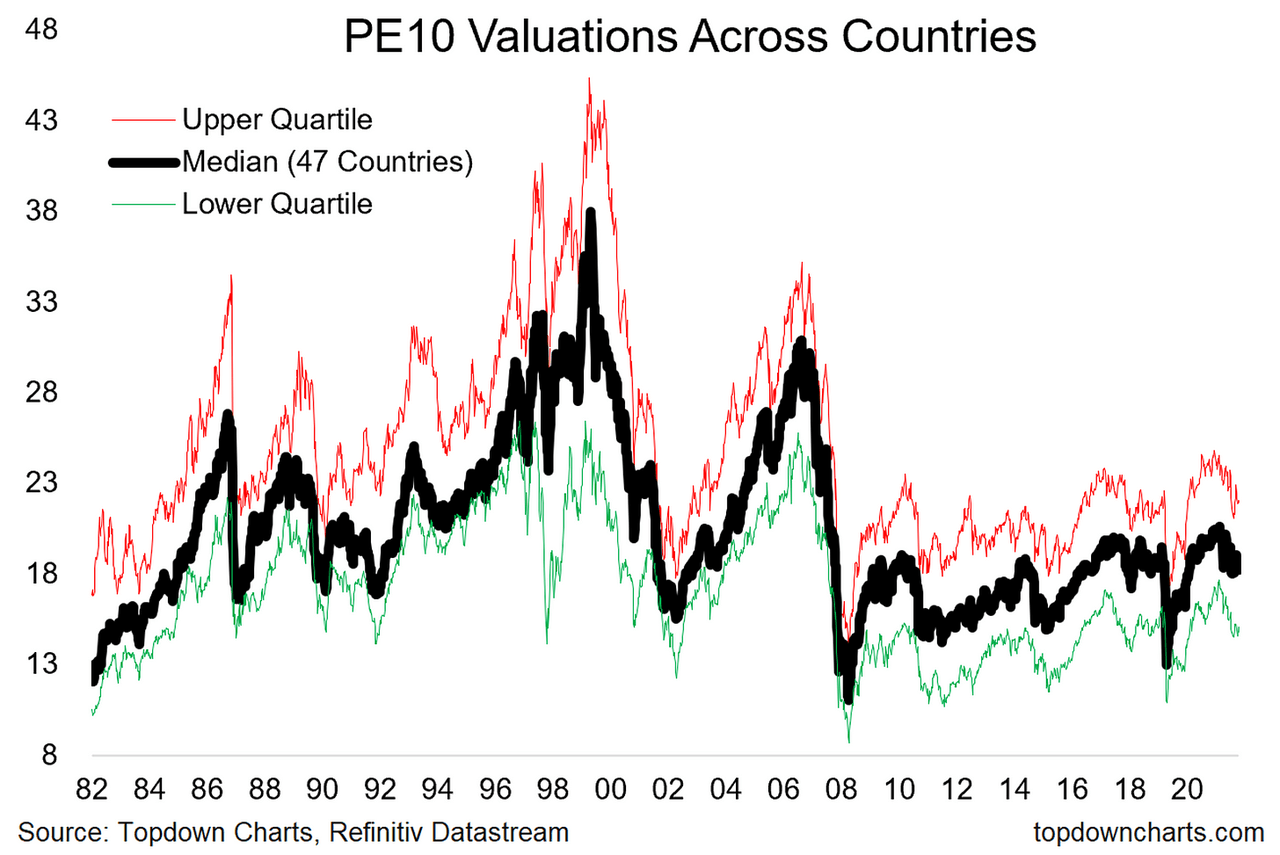

Stock Market Valuations Bof As Analysis And Investor Reassurance

May 22, 2025

Stock Market Valuations Bof As Analysis And Investor Reassurance

May 22, 2025 -

The Blake Lively Controversy Selena Gomezs Warning To Taylor Swift

May 22, 2025

The Blake Lively Controversy Selena Gomezs Warning To Taylor Swift

May 22, 2025 -

Used Car Dealer Fire Extensive Damage Reported

May 22, 2025

Used Car Dealer Fire Extensive Damage Reported

May 22, 2025 -

The Blake Lively Allegedly Situation Examining The Evidence And Implications

May 22, 2025

The Blake Lively Allegedly Situation Examining The Evidence And Implications

May 22, 2025

Latest Posts

-

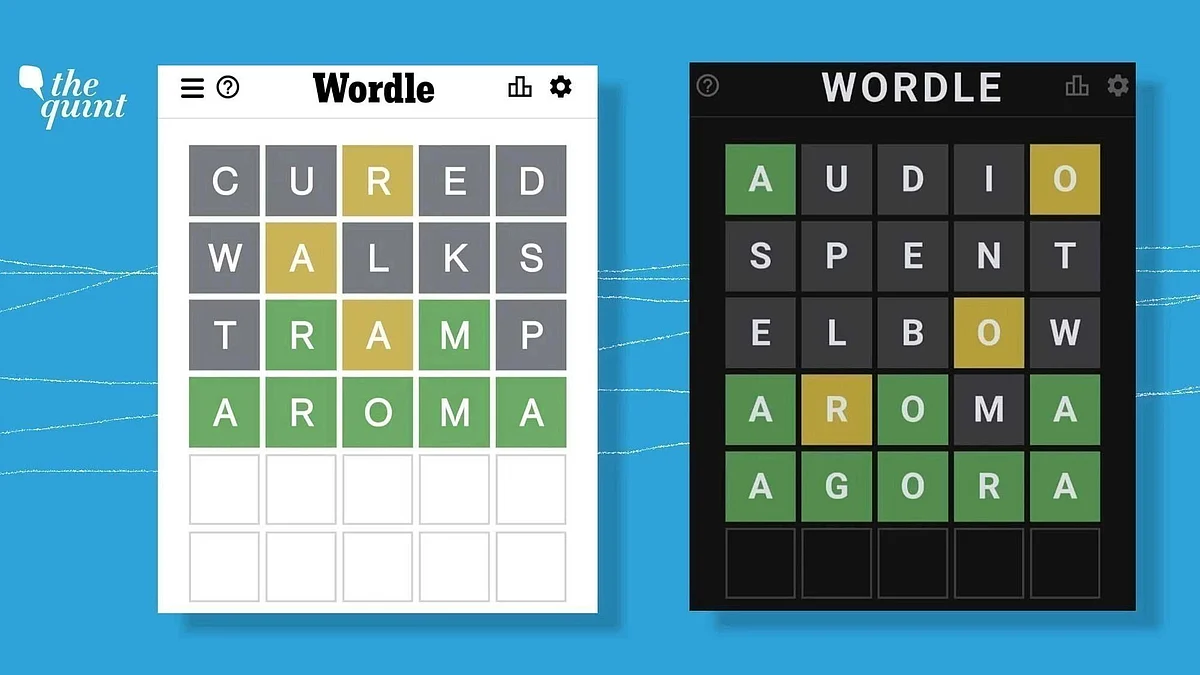

Solve Wordle 1358 Hints For Saturday March 8th

May 22, 2025

Solve Wordle 1358 Hints For Saturday March 8th

May 22, 2025 -

Wordle March 8th 1358 Clues And Solution

May 22, 2025

Wordle March 8th 1358 Clues And Solution

May 22, 2025 -

Wordle 1358 Hints And Answer For March 8th

May 22, 2025

Wordle 1358 Hints And Answer For March 8th

May 22, 2025 -

Wordle March 17th 2024 Hints Clues And Solution For Puzzle 367

May 22, 2025

Wordle March 17th 2024 Hints Clues And Solution For Puzzle 367

May 22, 2025 -

Wordle Puzzle Solution Wordle 1366 March 16th Hints And Answer

May 22, 2025

Wordle Puzzle Solution Wordle 1366 March 16th Hints And Answer

May 22, 2025