Tim Cook's Tariff Announcement Triggers Apple Stock Decline

Table of Contents

The Tariff Announcement and its Implications

Tim Cook's (or Apple's) announcement detailed significant tariff increases on several key Apple products. These new tariffs, impacting the import of crucial components and finished goods, directly affected Apple's bottom line and triggered the initial Apple stock decline.

- Specific products impacted: iPhones, iPads, MacBooks, Apple Watches, and various accessories.

- Percentage increase in tariffs: A reported increase of X% (replace X with the actual percentage).

- Target countries: Primarily originating from country Y (replace Y with the country of origin).

- Date of the announcement: [Insert Date]

The immediate market reaction was swift and dramatic. Following the announcement, Apple's stock price plummeted by [Insert Percentage]%, reflecting a significant loss in market capitalization and showcasing the gravity of the situation for investors already concerned about slowing iPhone sales. Data from [Source, e.g., Bloomberg, Yahoo Finance] confirms this sharp decrease.

Analysis of the Apple Stock Decline

Increased Production Costs

The increased tariffs directly translate to higher production costs for Apple. The company's extensive global supply chain, reliant on manufacturing in specific regions, now faces substantial added expenses.

- Global Supply Chain: Apple's intricate network of suppliers spans the globe, with many components sourced from [mention specific countries/regions].

- Increased Costs: Tariffs increase the cost of everything from individual components like processors and screens to the finished product itself.

- Impact on Profit Margins: These increased costs directly eat into Apple's already pressured profit margins, potentially forcing a reduction in profitability.

Consumer Impact and Reduced Demand

Higher production costs almost inevitably lead to higher prices for consumers. Will this cause a reduction in demand for Apple products?

- Price Increases: Apple is likely to pass some or all of the increased costs onto consumers, resulting in more expensive iPhones, iPads, and other products.

- Consumer Behavior: Consumer sensitivity to price increases varies, but a significant price hike could deter some potential buyers, particularly in price-sensitive markets.

- Analyst Predictions: Several analysts have already predicted a decrease in Apple sales due to the potential price increases caused by the new tariffs. [Cite specific analyst reports if available].

Investor Sentiment and Market Uncertainty

The tariff announcement significantly impacted investor confidence and fueled market uncertainty.

- Sell-offs: The news triggered significant sell-offs, as investors reacted to the increased risk and uncertainty surrounding Apple's future performance.

- Investor Statements: Many investor statements reflected concerns about the long-term effects of the tariffs on Apple's revenue and profitability. [Cite specific examples if available].

- Rating Agency Downgrades: Some rating agencies may downgrade Apple's outlook, further impacting investor sentiment and contributing to the Apple stock decline.

Potential Long-Term Effects on Apple

The long-term implications of these tariffs are significant and could reshape Apple's strategies.

- Mitigation Strategies: Apple might respond by shifting some production to other countries, adjusting pricing strategies, or engaging in intensive lobbying efforts to influence tariff policies.

- Innovation and Competitiveness: The added costs could hinder Apple's innovation and competitiveness, potentially slowing down product development and release cycles.

- Long-Term Stock Price: The long-term effect on the Apple stock decline will depend on Apple's ability to successfully navigate these challenges and maintain its market dominance. Current market forecasts are [mention if any predictions are available].

Conclusion

The Apple stock decline following Tim Cook's tariff announcement is a result of a confluence of factors: increased production costs, potential reduced consumer demand due to higher prices, and a general decline in investor confidence. The extent of the long-term impact remains to be seen, but it's clear that Apple faces significant challenges in mitigating the negative consequences of these new tariffs. The Apple stock decline serves as a stark reminder of the complexities of global trade and its impact on even the most successful companies. Keep a close eye on further developments affecting the Apple stock decline and its long-term consequences. Stay informed by following reputable financial news sources for updates on Apple's performance and the evolving tariff situation.

Featured Posts

-

Decouvrez Les Personnes Derriere Le Brest Urban Trail

May 25, 2025

Decouvrez Les Personnes Derriere Le Brest Urban Trail

May 25, 2025 -

Philips Announces Updated Agenda For 2025 Agm

May 25, 2025

Philips Announces Updated Agenda For 2025 Agm

May 25, 2025 -

The Thames Water Executive Bonus Scandal An Examination Of The Facts

May 25, 2025

The Thames Water Executive Bonus Scandal An Examination Of The Facts

May 25, 2025 -

Live Updates Pedestrian Struck By Vehicle On Princess Road

May 25, 2025

Live Updates Pedestrian Struck By Vehicle On Princess Road

May 25, 2025 -

Prepustanie V Nemecku Analyza Situacie A Jej Dosledkov Pre Zamestnancov

May 25, 2025

Prepustanie V Nemecku Analyza Situacie A Jej Dosledkov Pre Zamestnancov

May 25, 2025

Latest Posts

-

Canada Post Strike Will Customers Abandon A Struggling Crown Corporation

May 25, 2025

Canada Post Strike Will Customers Abandon A Struggling Crown Corporation

May 25, 2025 -

Canada Post Struggles Fuel Growth In Alternative Delivery Services

May 25, 2025

Canada Post Struggles Fuel Growth In Alternative Delivery Services

May 25, 2025 -

Media Company Sues Cohere For Copyright Infringement The Case Details

May 25, 2025

Media Company Sues Cohere For Copyright Infringement The Case Details

May 25, 2025 -

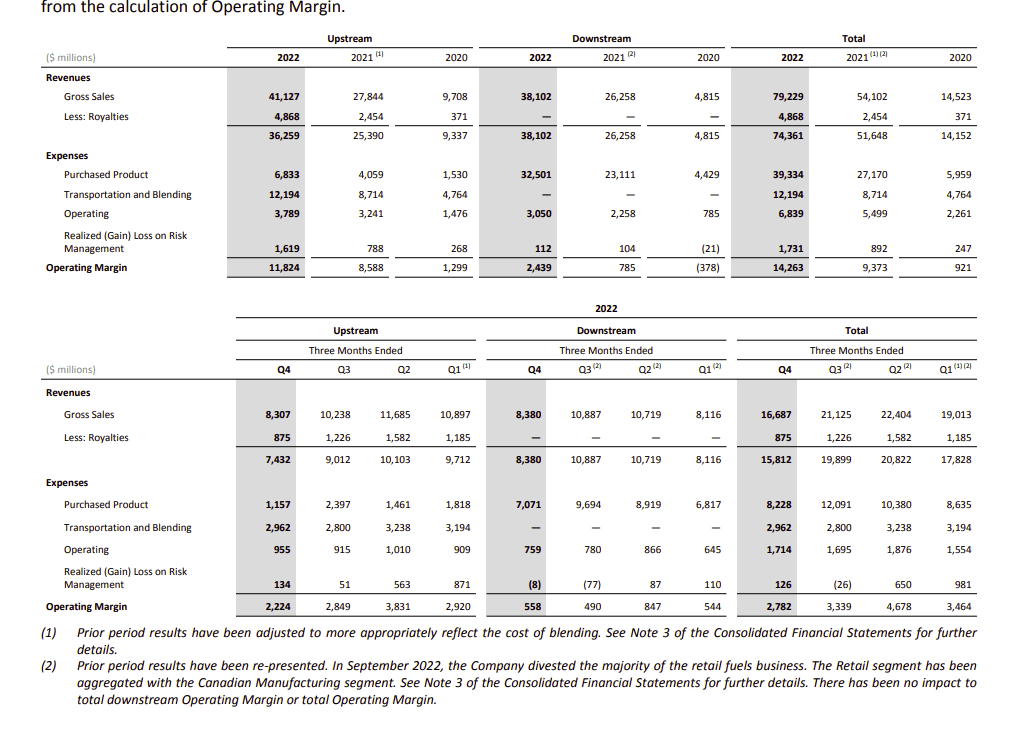

Cenovus Prioritizes Organic Growth Dimming Prospects Of Meg Buyout

May 25, 2025

Cenovus Prioritizes Organic Growth Dimming Prospects Of Meg Buyout

May 25, 2025 -

Cohere Asks Us Court To Dismiss Media Copyright Claim

May 25, 2025

Cohere Asks Us Court To Dismiss Media Copyright Claim

May 25, 2025