To Buy Or Not To Buy Palantir Stock Before May 5th: A Wall Street Perspective

Table of Contents

Palantir's Recent Performance and Future Projections

Palantir's stock performance leading up to May 5th will heavily depend on its Q4 2022 earnings report and its overall trajectory. Understanding these factors is crucial for any potential investor.

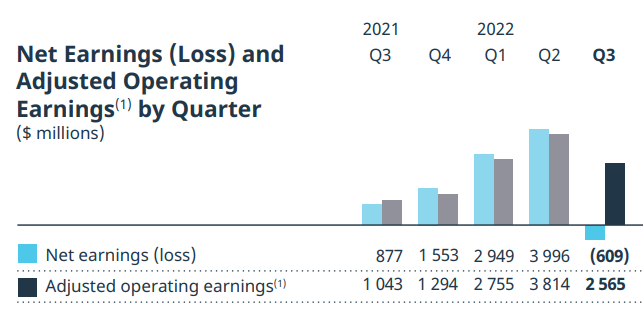

Q4 2022 Earnings and Revenue Growth

Palantir's Q4 2022 earnings will be a key indicator of its short-term health. Investors will scrutinize revenue growth, profitability, and overall financial performance compared to previous quarters. A strong showing could boost the Palantir stock price, while a disappointing report could lead to a decline.

- Revenue growth percentage: Analysts will be keenly watching the percentage increase (or decrease) in revenue compared to the same period last year. Significant acceleration in revenue growth would be a positive sign for investors.

- Net income (or loss): Profitability is paramount. A move towards profitability, or a significant increase in net income, would suggest a healthy financial state for Palantir.

- Key performance indicators (KPIs): Beyond simple revenue and income, investors will look at other KPIs such as customer acquisition costs, retention rates, and average revenue per user (ARPU) to gauge the long-term health of the business. Positive trends in these areas would be viewed favorably. Keywords: Palantir Q4 earnings, Palantir revenue growth, Palantir profitability

Government Contracts and Commercial Growth

Palantir's revenue is significantly influenced by its government contracts, particularly in the US. However, the company is actively diversifying into commercial markets, aiming for sustainable long-term growth.

- Percentage of revenue from government vs. commercial clients: The balance between government and commercial revenue streams is an important metric. A successful transition towards a more balanced revenue model would strengthen investor confidence.

- Significant new contracts secured: Announcements of major new contracts, both government and commercial, can significantly impact the Palantir stock price. New deals demonstrate the continued demand for Palantir's products and services.

- Growth potential in specific commercial sectors: Palantir's success in expanding into key sectors like healthcare and finance will be under close observation. Demonstrating significant traction in these areas will solidify its long-term growth prospects. Keywords: Palantir government contracts, Palantir commercial clients, Palantir market expansion

Market Sentiment and Analyst Ratings

Understanding the overall market sentiment and analyst ratings for Palantir is crucial for any investment decision. These insights offer a broader perspective on potential risks and rewards.

Wall Street's Outlook on Palantir

Before making any decisions about buying Palantir stock, it's vital to examine Wall Street's assessment of the company. This includes reviewing analyst ratings and price targets.

- Average price target: The average price target set by analysts gives an indication of the expected future stock price. A higher average price target suggests a more optimistic outlook.

- Range of price targets: The range of price targets reflects the variation in analyst opinions. A wide range suggests uncertainty about the future direction of the stock.

- Percentage of analysts with buy/hold/sell ratings: The distribution of buy, hold, and sell ratings among analysts provides a summary of overall sentiment. A high percentage of "buy" ratings would indicate positive sentiment. Keywords: Palantir analyst ratings, Palantir stock price target, Palantir stock forecast

Risk Factors to Consider

Investing in Palantir stock, like any investment, carries inherent risks. These must be carefully considered before making any investment decision.

- Key competitors: Palantir faces competition from established players in the data analytics and software markets. Increased competition could impact Palantir's market share and revenue growth.

- Potential geopolitical risks: Geopolitical events and shifts in government spending can significantly affect Palantir's government contracts and overall business.

- Economic factors affecting Palantir's business: Economic downturns or changes in government spending priorities could impact demand for Palantir's products and services. Keywords: Palantir risks, Palantir competition, Palantir investment risks

Conclusion

Deciding whether to buy Palantir stock before May 5th requires a careful analysis of its recent performance, future projections, market sentiment, and inherent risks. While Palantir shows promise with its expansion into the commercial sector, potential risks associated with government contracts and competition need thorough evaluation. Remember that past performance is not indicative of future results.

Before making any investment in Palantir stock, conduct your own thorough research and consider seeking professional financial advice. The information provided in this article is for informational purposes only and should not be construed as financial advice. Make informed decisions about your Palantir stock investment strategy. Keywords: Palantir stock decision, Palantir stock buy or sell, Palantir investment strategy.

Featured Posts

-

F1 75 Launch Doohans Direct Reply To Colapintos Question

May 09, 2025

F1 75 Launch Doohans Direct Reply To Colapintos Question

May 09, 2025 -

Jeanine Pirros Stock Market Warning Ignore For Weeks

May 09, 2025

Jeanine Pirros Stock Market Warning Ignore For Weeks

May 09, 2025 -

Record Production At Suncor But Sales Growth Lags Behind

May 09, 2025

Record Production At Suncor But Sales Growth Lags Behind

May 09, 2025 -

Wireless Mesh Networks Market A 9 8 Cagr Expansion

May 09, 2025

Wireless Mesh Networks Market A 9 8 Cagr Expansion

May 09, 2025 -

Largest Fentanyl Seizure In Us History Pam Bondis Announcement

May 09, 2025

Largest Fentanyl Seizure In Us History Pam Bondis Announcement

May 09, 2025