Tracking The Net Asset Value (NAV) Of Amundi MSCI World II UCITS ETF Dist

Table of Contents

What is Net Asset Value (NAV) and Why is it Important for Amundi MSCI World II UCITS ETF Dist?

Net Asset Value (NAV) represents the total value of an ETF's underlying assets minus its liabilities, divided by the number of outstanding shares. For the Amundi MSCI World II UCITS ETF Dist, the NAV reflects the collective value of its holdings in a diverse range of global companies, as represented by the MSCI World Index. This value is calculated daily, providing a snapshot of the ETF's net worth per share.

The NAV is a critical indicator of the ETF's performance. It provides a clear picture of the underlying asset value and allows you to track growth or decline over time. Comparing the Amundi MSCI World II UCITS ETF Dist NAV to other ETFs in the same sector helps you assess relative performance and make informed comparisons.

- NAV represents the value of the ETF's holdings per share. It's a fundamental measure of your investment's worth.

- Daily NAV fluctuations reflect market movements of the underlying assets. A rising NAV typically indicates positive market performance, while a falling NAV may suggest a downturn.

- Tracking NAV helps investors assess the ETF's growth and potential returns. Long-term NAV trends reveal the ETF's overall performance.

- Understanding NAV is crucial for making informed buy/sell decisions. It provides essential data to support your investment strategies.

Where to Find the Amundi MSCI World II UCITS ETF Dist NAV?

Accessing the Amundi MSCI World II UCITS ETF Dist NAV is straightforward. Several reliable sources provide real-time and historical data:

- Amundi's official website: [Insert Amundi Website Link Here] – The official source for accurate and up-to-date information.

- Major financial data providers: Bloomberg, Yahoo Finance, Google Finance, and others [Insert Links to Relevant Pages if Possible] offer comprehensive financial data, including ETF NAVs.

- Your brokerage account platform: Most brokerage platforms (e.g., Interactive Brokers, Fidelity, Schwab) display the NAV of your held ETFs directly within your account.

- Financial news websites: Reputable financial news sources often publish ETF NAV data, though it may not always be real-time.

Interpreting the Amundi MSCI World II UCITS ETF Dist NAV and its Implications

Changes in the Amundi MSCI World II UCITS ETF Dist NAV directly impact investor returns. A rising NAV indicates potential capital growth, while a falling NAV suggests a decrease in value. Several factors influence these fluctuations:

-

Market trends: Overall market performance significantly affects the NAV, as the ETF holds assets whose prices rise and fall with the market.

-

Currency exchange rates: Since the Amundi MSCI World II UCITS ETF Dist invests globally, fluctuations in currency exchange rates can impact the NAV, particularly for investors holding the ETF in a different currency.

-

The difference between NAV and market price: While the NAV represents the intrinsic value, the market price can fluctuate slightly throughout the trading day. This difference is usually minimal, especially for liquid ETFs.

-

Rising NAV indicates potential growth and increased investment value. This is a positive sign for your investment.

-

Falling NAV suggests potential losses or market downturns. This warrants careful consideration and monitoring.

-

Currency fluctuations can impact the NAV for international ETFs. Be aware of this factor, especially with global funds.

-

Compare NAV with historical data to understand long-term performance. This provides context and helps avoid short-term emotional reactions.

Using NAV for Investment Strategies with Amundi MSCI World II UCITS ETF Dist

The Amundi MSCI World II UCITS ETF Dist NAV is a valuable tool for informing investment decisions. Regularly monitoring the NAV allows you to track performance and adjust your strategy accordingly. Dollar-cost averaging, for example, involves investing a fixed amount at regular intervals, regardless of NAV fluctuations. This strategy mitigates the risk associated with market volatility.

- Regularly monitor NAV for informed investment decisions. Consistent monitoring provides valuable insights into your investment's performance.

- Consider using NAV in conjunction with other investment indicators. Don't rely solely on NAV; also consider factors like market trends and your overall financial goals.

- Avoid emotional investment decisions based solely on short-term NAV fluctuations. Long-term trends are generally more reliable indicators of success.

Conclusion

Tracking the Amundi MSCI World II UCITS ETF Dist NAV is essential for making informed investment decisions. By understanding its meaning, accessing reliable data sources (such as the Amundi website and major financial platforms), and interpreting its implications, you can actively manage your portfolio and optimize your investment strategy. Start monitoring the Amundi MSCI World II UCITS ETF Dist NAV today to make smarter investment choices. Regularly checking the Amundi MSCI World II UCITS ETF Dist NAV will help you optimize your investment strategy and achieve your financial goals. Remember to consider the NAV alongside other investment indicators for a comprehensive approach to managing your portfolio.

Featured Posts

-

Jymypaukku Tuukka Taponen F1 Sarjaan

May 24, 2025

Jymypaukku Tuukka Taponen F1 Sarjaan

May 24, 2025 -

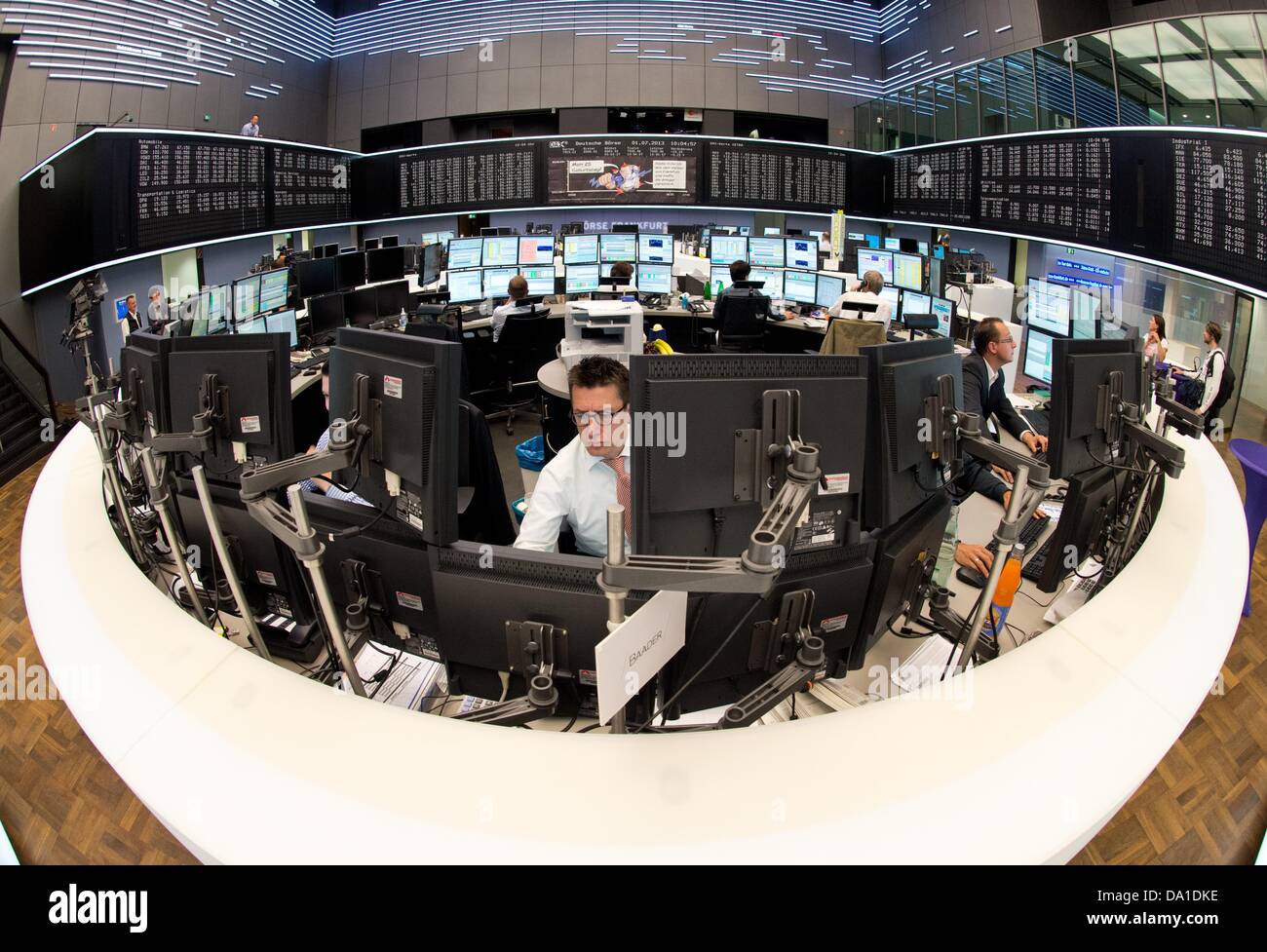

Frankfurt Stock Exchange Dax Ends Day Below 24 000 Points

May 24, 2025

Frankfurt Stock Exchange Dax Ends Day Below 24 000 Points

May 24, 2025 -

The Busiest Days To Fly Around Memorial Day 2025 A Travelers Guide

May 24, 2025

The Busiest Days To Fly Around Memorial Day 2025 A Travelers Guide

May 24, 2025 -

Ranking The 10 Fastest Standard Production Ferraris Track Performance

May 24, 2025

Ranking The 10 Fastest Standard Production Ferraris Track Performance

May 24, 2025 -

Daxs Rise A Wall Street Recoverys Potential Impact

May 24, 2025

Daxs Rise A Wall Street Recoverys Potential Impact

May 24, 2025

Latest Posts

-

The Kyle And Teddi Dog Walker Incident A Heated Confrontation

May 24, 2025

The Kyle And Teddi Dog Walker Incident A Heated Confrontation

May 24, 2025 -

Dog Walker Dispute Kyle And Teddis Fiery Exchange

May 24, 2025

Dog Walker Dispute Kyle And Teddis Fiery Exchange

May 24, 2025 -

Kyle And Teddis Heated Confrontation A Dog Walker Dispute

May 24, 2025

Kyle And Teddis Heated Confrontation A Dog Walker Dispute

May 24, 2025 -

New Diamond Ring Sparks Engagement Speculation For Annie Kilner And Kyle Walker

May 24, 2025

New Diamond Ring Sparks Engagement Speculation For Annie Kilner And Kyle Walker

May 24, 2025 -

Annie Kilner Shows Off Huge Diamond Ring After Walker Sighting

May 24, 2025

Annie Kilner Shows Off Huge Diamond Ring After Walker Sighting

May 24, 2025