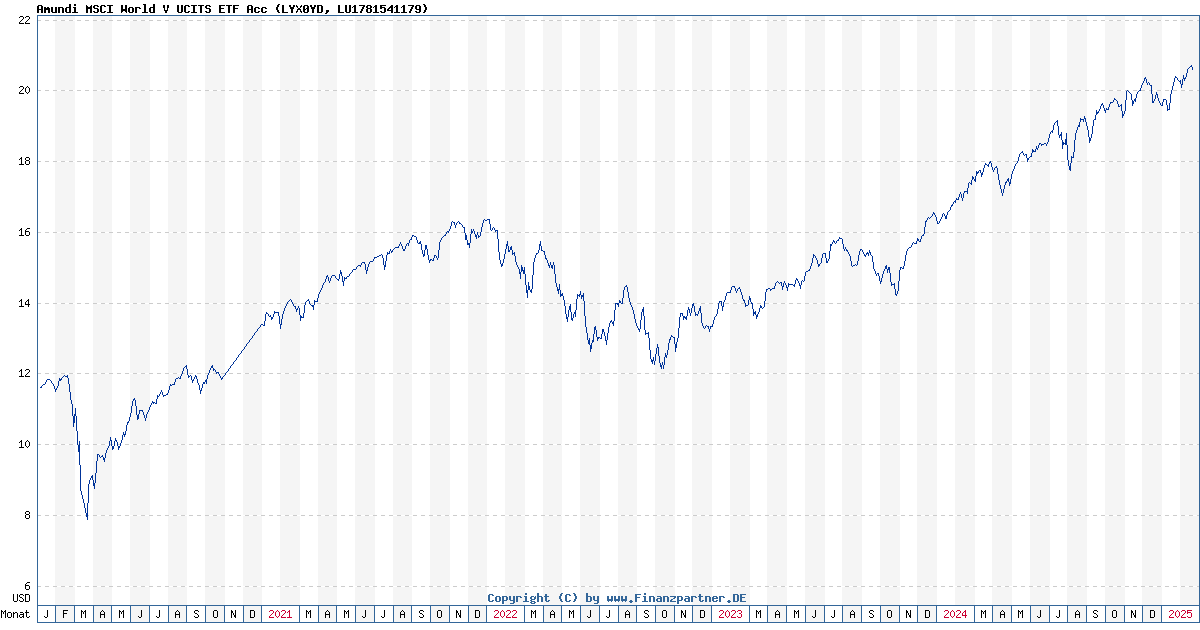

Tracking The Net Asset Value (NAV) Of The Amundi MSCI World Ex-US UCITS ETF

Table of Contents

What is Net Asset Value (NAV) and Why is it Important?

Net Asset Value (NAV) represents the value of an ETF's underlying assets per share. For the Amundi MSCI World ex-US UCITS ETF, the NAV calculation considers the total market value of all the stocks, bonds, or other assets held within the ETF, minus any liabilities. This figure is then divided by the total number of outstanding ETF shares. Understanding the Amundi MSCI World ex-US UCITS ETF valuation through its NAV is critical because it reflects the true worth of your investment. It provides a benchmark against which you can compare the market price of the ETF.

- NAV reflects the true value of the ETF's holdings. It's a snapshot of the intrinsic worth of the assets within the fund.

- NAV is calculated daily, usually at the end of trading. This provides a daily measure of the ETF's performance.

- Understanding NAV helps investors make informed decisions. By comparing the NAV to the market price, investors can identify potential buying or selling opportunities.

- Discrepancies between NAV and market price can signal trading opportunities (though risk should be considered). However, it is important to note that these discrepancies are often temporary and involve inherent market risks.

How to Track the NAV of the Amundi MSCI World ex-US UCITS ETF

Tracking the NAV of the Amundi MSCI World ex-US UCITS ETF is relatively straightforward. Several reliable methods exist, each with its advantages and potential limitations regarding data reporting time:

- Amundi's official website: The most accurate and authoritative source for the Amundi MSCI World ex-US UCITS ETF NAV is usually the fund manager's official website. Look for dedicated investor relations sections or fund fact sheets.

- Financial news websites: Reputable financial news sources like Bloomberg, Yahoo Finance, Google Finance, and others often provide real-time or near real-time NAV data for popular ETFs. However, always verify the accuracy of the data against the official source.

- Brokerage platforms: Most brokerage and investment platforms will display the NAV of the ETFs held in your portfolio. The convenience of this method makes it popular among investors. However, the timeliness of updates can vary among brokers.

- Dedicated ETF data providers: Specialized financial data providers offer comprehensive ETF information, including historical and real-time NAV data. These services often come at a subscription cost, but they may provide more detailed analytical tools.

Factors Affecting the NAV of the Amundi MSCI World ex-US UCITS ETF

The NAV of the Amundi MSCI World ex-US UCITS ETF is influenced by several internal and external factors:

- Currency exchange rates: Since the ETF invests in non-US companies, fluctuations in exchange rates between the relevant currencies and the investor's base currency (e.g., USD, EUR) directly impact the NAV. A strengthening of the investor's base currency against the currencies of the holdings will usually decrease the NAV (and vice versa).

- Global market performance: The overall performance of international stock markets significantly influences the NAV. Positive market movements generally lead to NAV increases, while negative movements result in decreases.

- Economic indicators: Macroeconomic factors such as interest rates, inflation, and GDP growth in various countries comprising the ETF's holdings have a considerable impact on the NAV.

- Company performance within the ETF: The individual performance of the companies held within the Amundi MSCI World ex-US UCITS ETF influences the overall NAV. Strong performance by constituent companies contributes to a higher NAV.

Interpreting NAV Changes in Your Investment Strategy

Understanding NAV changes is vital for effective investment management. However, it's crucial to approach NAV data with a long-term perspective:

- Long-term perspective: Short-term fluctuations in the NAV are normal and often reflect short-term market sentiment. Avoid making impulsive trading decisions based on minor daily changes.

- Diversification: The Amundi MSCI World ex-US UCITS ETF itself is designed for diversification, but it's still important to ensure appropriate diversification within your overall investment portfolio.

- Regular monitoring: Regularly review the NAV to track the long-term performance of your investment, but avoid overreacting to short-term market volatility.

- Professional advice: For significant investment decisions or if you're unsure how to interpret NAV data, seeking advice from a qualified financial advisor is strongly recommended.

Conclusion

Tracking the Net Asset Value (NAV) of the Amundi MSCI World ex-US UCITS ETF is a fundamental aspect of responsible investment management. By understanding how NAV is calculated, how to access accurate data, and the factors that influence it, you can make more informed investment choices. Remember to adopt a long-term perspective and manage your risk appropriately. Stay informed about the Net Asset Value (NAV) of the Amundi MSCI World ex-US UCITS ETF to optimize your investment strategy. Learn more about managing your Amundi MSCI World ex-US UCITS ETF investments today!

Featured Posts

-

Luxus Porsche 911 80 Millio Forint Az Extrak Ara

May 25, 2025

Luxus Porsche 911 80 Millio Forint Az Extrak Ara

May 25, 2025 -

Eurovision Village 2025 Conchita Wurst And Jj Live On Stage

May 25, 2025

Eurovision Village 2025 Conchita Wurst And Jj Live On Stage

May 25, 2025 -

Dax Rally Can It Withstand A Resurgent Wall Street

May 25, 2025

Dax Rally Can It Withstand A Resurgent Wall Street

May 25, 2025 -

Escape To The Country Living Sustainably In A Rural Environment

May 25, 2025

Escape To The Country Living Sustainably In A Rural Environment

May 25, 2025 -

Porsche Macan Ev Fyrsta Rafmagnsutgafan Kynnt

May 25, 2025

Porsche Macan Ev Fyrsta Rafmagnsutgafan Kynnt

May 25, 2025

Latest Posts

-

Kyle Vs Teddi Dog Walker Conflict Explodes

May 25, 2025

Kyle Vs Teddi Dog Walker Conflict Explodes

May 25, 2025 -

Kyle Walker Milan Night Out With Models After Wifes Return

May 25, 2025

Kyle Walker Milan Night Out With Models After Wifes Return

May 25, 2025 -

Dog Walker Drama Kyle And Teddis Fiery Argument

May 25, 2025

Dog Walker Drama Kyle And Teddis Fiery Argument

May 25, 2025 -

Annie Kilners Engagement Ring A Public Display After Walker Reunion

May 25, 2025

Annie Kilners Engagement Ring A Public Display After Walker Reunion

May 25, 2025 -

Kyle And Teddis Heated Confrontation A Dog Walker Showdown

May 25, 2025

Kyle And Teddis Heated Confrontation A Dog Walker Showdown

May 25, 2025