Trump Tariffs Weigh On Infineon (IFX) Sales Outlook

Table of Contents

The Impact of Trump Tariffs on the Semiconductor Industry

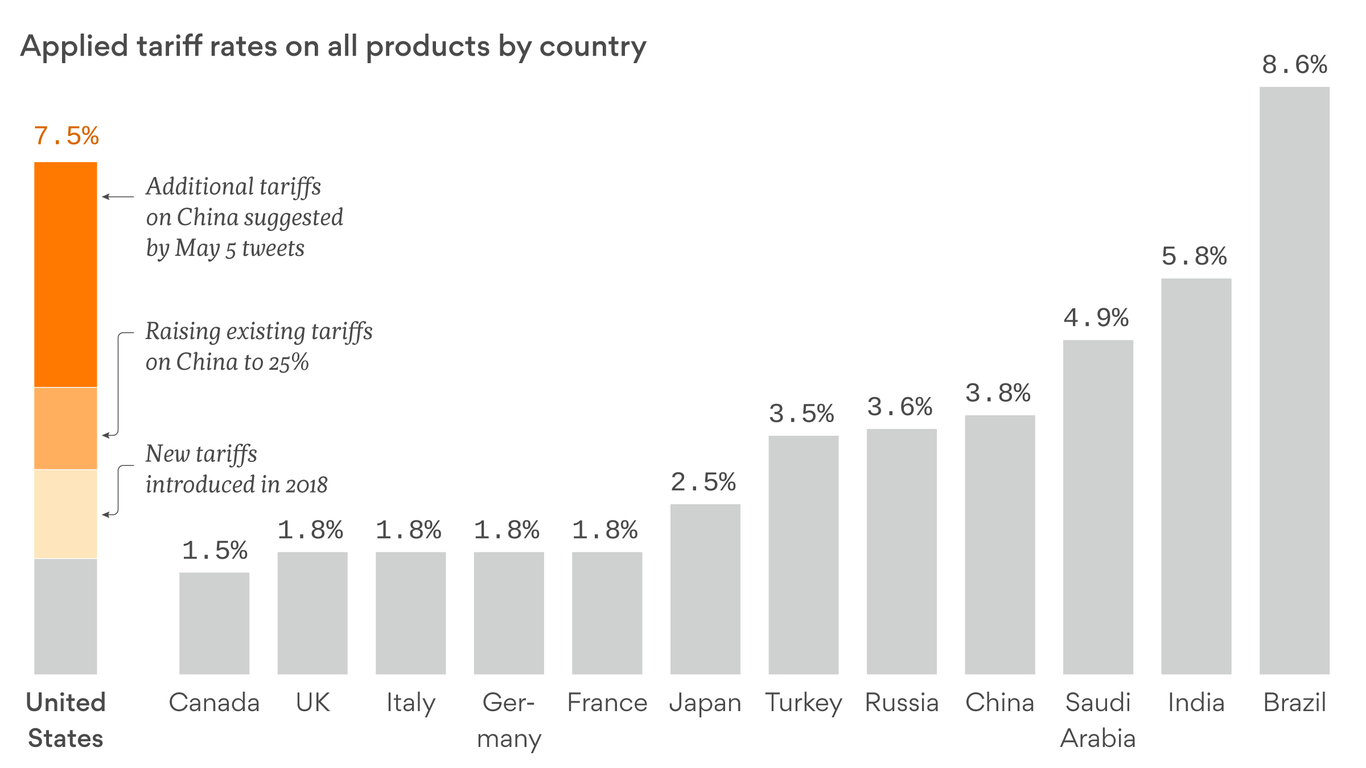

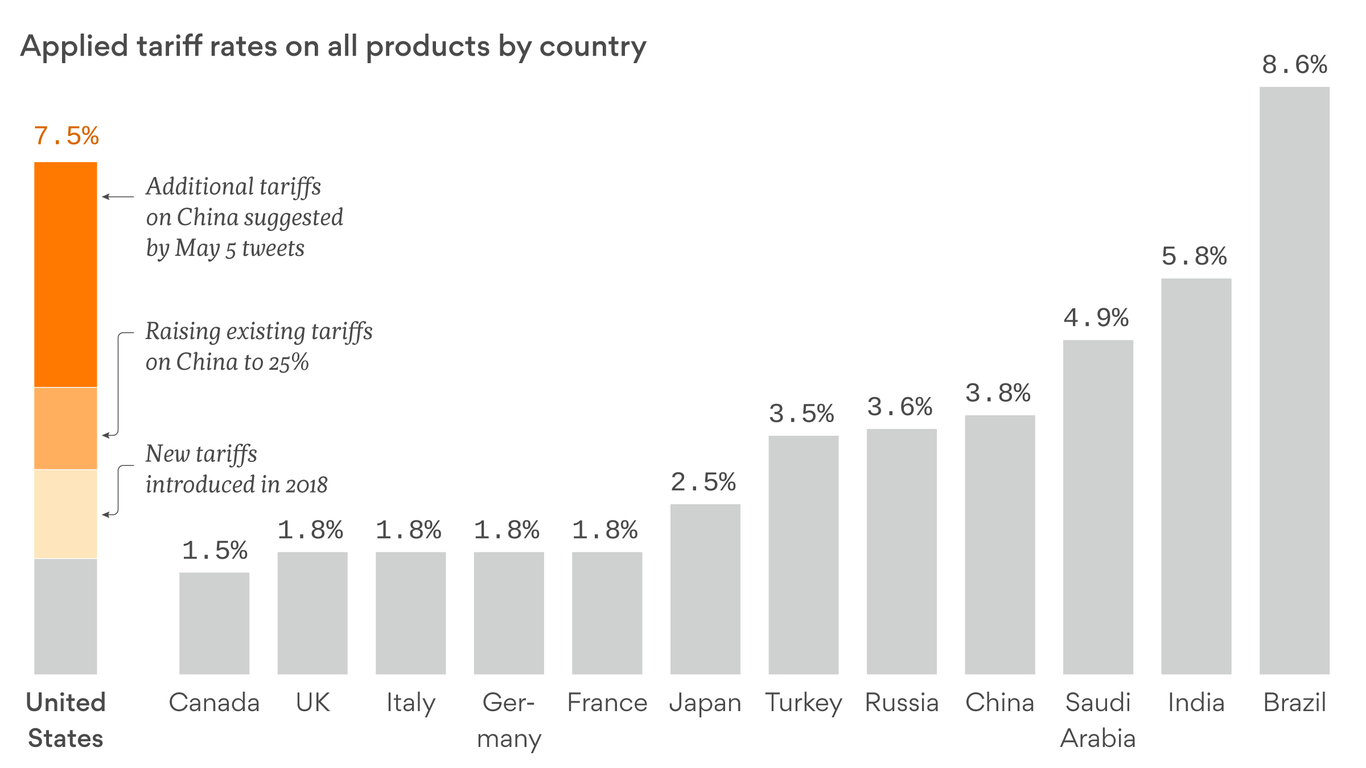

The Trump administration's tariffs, implemented primarily against China, created significant ripples throughout the global semiconductor industry. These tariffs didn't just affect finished goods; they disrupted intricate supply chains and increased costs across the board. The imposition of tariffs led to:

- Increased Prices for Raw Materials and Components: Many components and raw materials used in semiconductor manufacturing are sourced internationally. Tariffs on these inputs directly increased the cost of production for semiconductor manufacturers worldwide.

- Disrupted Supply Chains: The global nature of semiconductor production means that components often traverse multiple countries before assembly. Tariffs added complexities and delays to these established supply chains, leading to production bottlenecks.

Bullet Points Summarizing the Broad Impact:

- Increased production costs for semiconductor manufacturers, squeezing profit margins.

- Reduced global trade volume in semiconductors due to higher prices and logistical hurdles.

- Price increases passed on to consumers, impacting the affordability and demand for electronic devices.

Infineon's (IFX) Specific Vulnerabilities to Trump Tariffs

Infineon, with its extensive global operations and reliance on intricate supply chains, proved particularly vulnerable to the impact of Trump tariffs. The company's exposure stemmed from:

- Global Supply Chain Dependence: Infineon sources components and materials from numerous countries, making it susceptible to tariff-related price increases and supply chain disruptions.

- Specific Product Segment Impacts: Certain product segments within Infineon's portfolio, such as power semiconductors used in industrial applications and automotive electronics, were disproportionately affected by the tariffs due to their reliance on imported materials.

Bullet Points Highlighting Infineon's Specific Challenges:

- Specific product lines, including power semiconductors and automotive electronics, experienced higher costs due to tariffs on imported components.

- Geographic regions with strong ties to China and other targeted countries saw the most pronounced tariff impacts on Infineon's operations.

- Infineon implemented various strategies to mitigate the tariff effects, including diversification of suppliers and negotiations with customers to absorb some of the increased costs.

Analysis of Infineon's (IFX) Revised Sales Projections

Infineon's official reports and financial statements clearly reflected the negative impact of the Trump tariffs on its sales projections. While precise figures quantifying the tariff's direct impact are difficult to isolate, a comparison between pre-tariff estimations and post-tariff revisions reveals a notable downturn.

Bullet Points Showing the Quantifiable Impact (Illustrative – Replace with actual data from Infineon's reports):

- Revised sales projections showed a decrease of X% compared to pre-tariff estimates.

- Market share analysis indicated a Y% reduction in certain key segments due to increased pricing pressures.

- Infineon's response involved cost-cutting measures, streamlining operations, and focusing on higher-margin product lines.

Future Outlook and Potential Mitigation Strategies for Infineon (IFX)

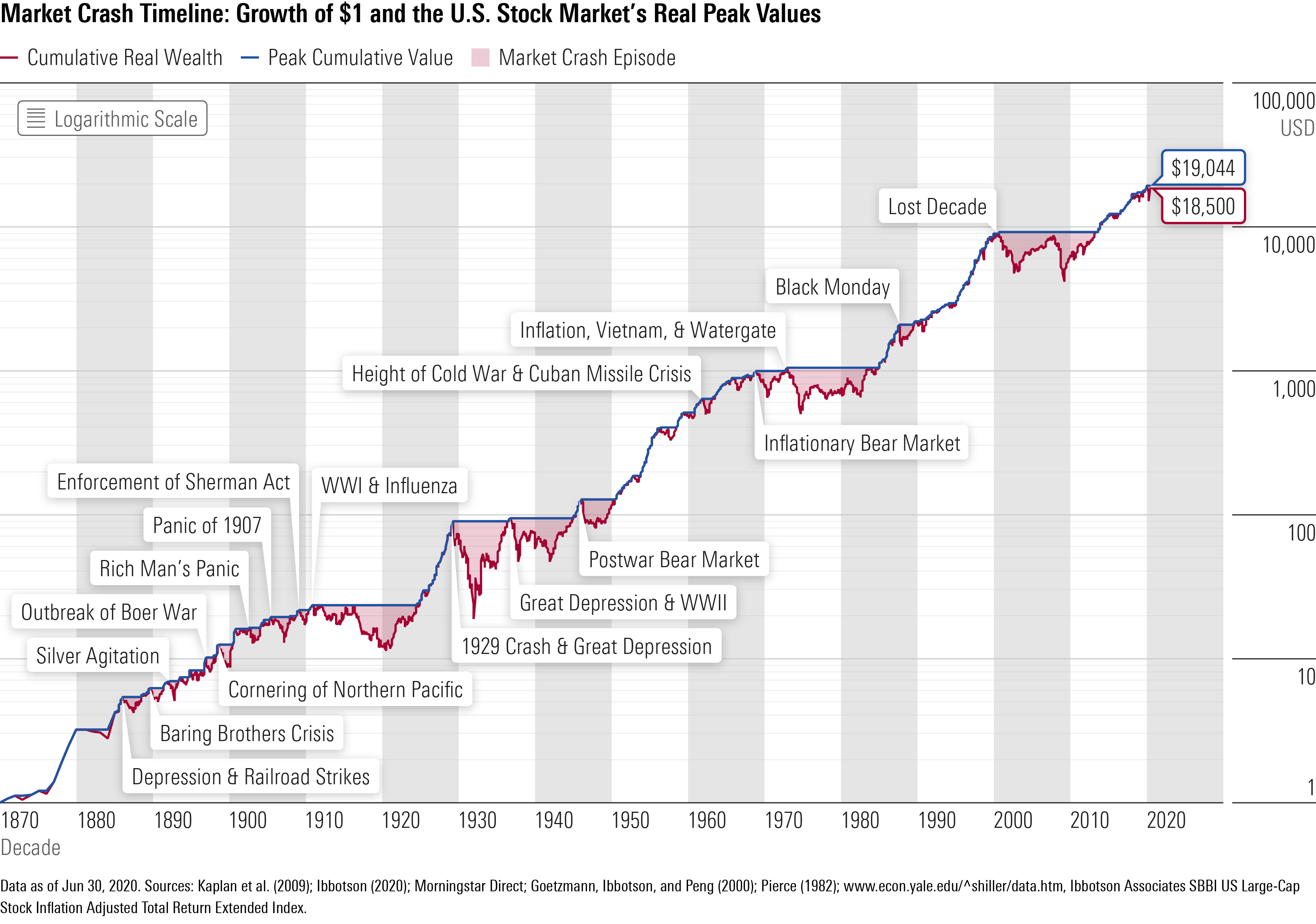

The long-term effects of the Trump tariffs on Infineon and the broader semiconductor industry remain a subject of ongoing analysis. Future scenarios will depend on various factors, including global trade relations and the evolution of geopolitical dynamics. However, Infineon can employ several mitigation strategies:

Bullet Points Outlining Potential Strategies:

- Exploring alternative supply chains and manufacturing locations to reduce reliance on tariff-affected regions.

- Investing in research and development of tariff-resistant technologies and processes, potentially through domestic sourcing or innovative manufacturing techniques.

- Engaging in lobbying efforts to influence trade policy and advocate for more favorable conditions for the semiconductor industry.

Investor Implications and Considerations

The impact of Trump tariffs presents both risks and opportunities for investors in Infineon (IFX) stock.

Bullet Points for Investors:

- Potential risks include lower-than-expected earnings and reduced profitability due to persistent tariff-related challenges. Opportunities may arise through the company's strategic adaptation and market share gains as competitors struggle.

- Recommendations for investors include thorough due diligence, focusing on Infineon's long-term strategic response, and diversification within the semiconductor sector or broader technology market.

- Diversification strategies should be considered to mitigate the risk associated with reliance on a single company or sector vulnerable to trade policy fluctuations.

Conclusion: Trump Tariffs and the Future of Infineon (IFX) Sales

The Trump-era tariffs undeniably weighed heavily on Infineon's sales outlook, impacting its supply chains, production costs, and overall financial performance. The analysis reveals a clear link between these tariffs and revised sales projections, highlighting the vulnerability of globalized industries to trade policy shifts. While Infineon is actively implementing mitigation strategies, the long-term consequences for the company and the broader semiconductor industry remain uncertain. Staying informed about ongoing trade policy developments is crucial for understanding the future trajectory of Infineon (IFX) and the wider market. Therefore, continue to follow updates and conduct thorough research on Trump tariffs and their effects on Infineon's sales outlook to make informed decisions.

Featured Posts

-

Pakistan Students Face Uk Visa Restrictions Potential Rise In Asylum Applications

May 09, 2025

Pakistan Students Face Uk Visa Restrictions Potential Rise In Asylum Applications

May 09, 2025 -

Bitcoin Conference Seoul 2025 A Key Event For The Asian Market

May 09, 2025

Bitcoin Conference Seoul 2025 A Key Event For The Asian Market

May 09, 2025 -

700 Point Sensex Rally Detailed Stock Market Analysis And News

May 09, 2025

700 Point Sensex Rally Detailed Stock Market Analysis And News

May 09, 2025 -

Solve Nyt Strands Game 349 Hints And Answers For February 15th Saturday

May 09, 2025

Solve Nyt Strands Game 349 Hints And Answers For February 15th Saturday

May 09, 2025 -

Is Bitcoins Rebound Just The Beginning A Market Analysis

May 09, 2025

Is Bitcoins Rebound Just The Beginning A Market Analysis

May 09, 2025