Trump's Trade War: $174 Billion Loss For World's Richest

Table of Contents

The Impact on Global Trade and Investment

Trump's trade war significantly disrupted global supply chains. The imposition of tariffs on various goods led to increased production costs and uncertainty, deterring both foreign direct investment (FDI) and domestic investment. Industries heavily reliant on international trade, such as technology and agriculture, faced severe challenges. For example, the tech sector witnessed delays in product launches and increased costs due to tariff hikes on components sourced from China. Similarly, American farmers suffered from retaliatory tariffs imposed by China on agricultural products.

Key consequences of this disruption include:

- Reduced international trade volume: The imposition of tariffs directly reduced the volume of goods traded internationally, impacting businesses and investors alike.

- Increased production costs: Tariffs increased the cost of imported goods, leading to higher prices for consumers and reduced profitability for businesses.

- Loss of market share for some companies: Companies reliant on exports to the US or China lost market share due to increased competition and reduced demand.

- Decreased foreign direct investment (FDI): The uncertainty created by the trade war discouraged foreign investors from committing capital, slowing economic growth.

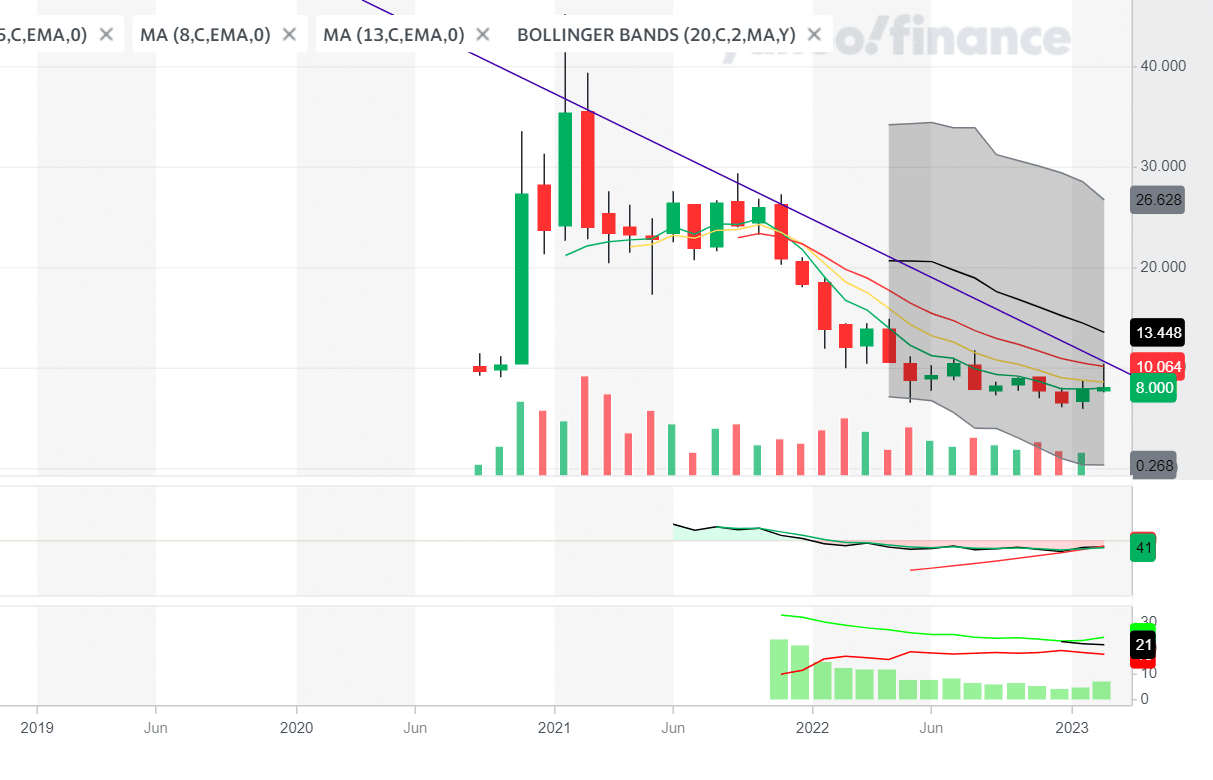

The Decline in Stock Market Value and Wealth

The escalating trade tensions during the Trump trade war created significant stock market volatility. The uncertainty surrounding trade policies led to decreased investor confidence, resulting in sharp declines in the stock values of many companies, particularly those heavily involved in international trade. This directly impacted the portfolios of high-net-worth individuals, who experienced substantial losses in their investments.

Key consequences for the world's wealthiest included:

- Stock market downturns: The trade war contributed to periods of significant stock market declines, eroding investor wealth.

- Reduced portfolio value for high-net-worth individuals: The drop in stock prices directly translated to a decrease in the net worth of billionaires and other high-net-worth individuals.

- Decreased dividend payouts: Companies facing reduced profitability cut back on dividend payouts, impacting the income of investors.

- Loss of capital for investors: Many investors suffered substantial capital losses as a result of the market volatility and decline in stock prices.

The Ripple Effect on Related Industries and Economies

The Trump trade war's effects rippled through various industries and economies. The manufacturing sector, heavily reliant on international trade, experienced job losses and reduced output. Consumers faced higher prices for imported goods due to increased tariffs, contributing to inflation. Countries heavily reliant on trade with the US or China suffered economic slowdowns as a result of reduced demand and disrupted supply chains.

Key consequences included:

- Job losses in affected industries: Thousands of jobs were lost in sectors impacted by the trade war, such as manufacturing and agriculture.

- Increased consumer prices: Tariffs and trade disruptions led to higher prices for consumers, reducing purchasing power.

- Economic slowdown in dependent nations: Countries heavily reliant on trade with the US or China experienced significant economic slowdowns.

- Increased inequality: The economic consequences of the trade war disproportionately affected low and middle-income workers, exacerbating existing inequalities.

Long-Term Consequences and Economic Uncertainty

The Trump trade war left a lasting impact on global economic growth and stability. The increased protectionist sentiment fostered during this period damaged international cooperation and trust. The uncertainty surrounding future trade policies continues to deter investment and hinder economic recovery. The potential for further escalation of trade conflicts remains a significant concern.

Lingering consequences include:

- Increased protectionist sentiment: The trade war reinforced protectionist tendencies globally, potentially hindering future trade liberalization efforts.

- Damage to international cooperation: The strained relationships between major economic powers continue to negatively impact international collaboration.

- Increased geopolitical tensions: The trade war exacerbated existing geopolitical tensions, adding further complexity to the international landscape.

- Slowed global economic recovery: The economic disruptions caused by the trade war have hampered global economic growth and recovery.

Conclusion: Understanding the Lasting Impact of Trump's Trade War

Trump's trade war resulted in a significant $174 billion loss for the world's wealthiest, underscoring its devastating consequences for global economic stability and international cooperation. The negative impacts on global trade, investment, and economic growth are undeniable. Understanding the long-term effects of these protectionist policies is crucial for preventing future economic crises. Learn more about the devastating consequences of protectionist trade policies and how to mitigate their impact on global wealth through further research and engagement with relevant resources.

Featured Posts

-

The Real Safe Bet Your Guide To Secure Investments

May 09, 2025

The Real Safe Bet Your Guide To Secure Investments

May 09, 2025 -

Dakota Johnson Ma Dvojnicku Na Slovensku Neuveritelna Podobnost

May 09, 2025

Dakota Johnson Ma Dvojnicku Na Slovensku Neuveritelna Podobnost

May 09, 2025 -

Palantir Stock Down 30 Is This A Buying Opportunity

May 09, 2025

Palantir Stock Down 30 Is This A Buying Opportunity

May 09, 2025 -

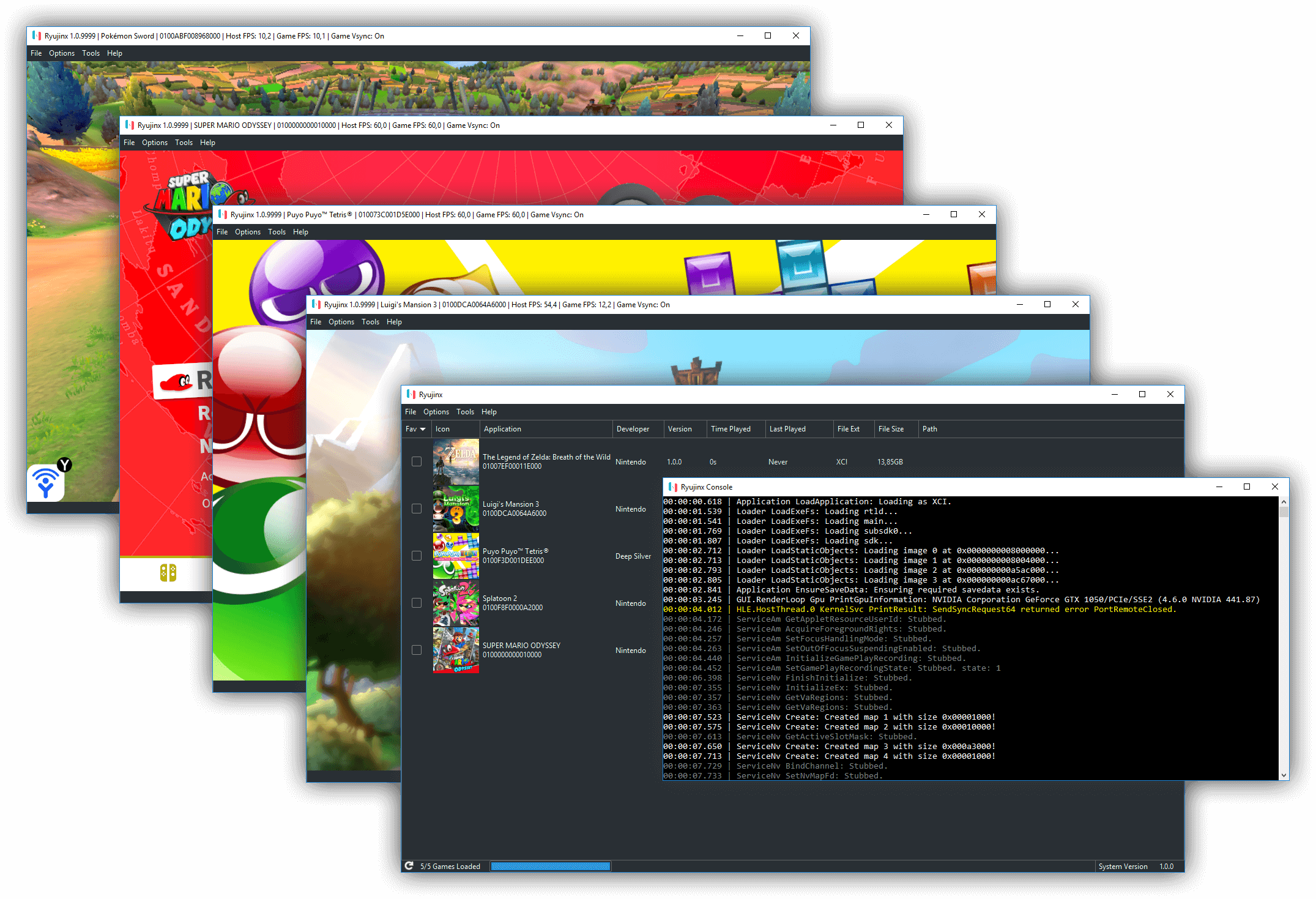

End Of An Era Ryujinx Emulator Development Stops Due To Nintendo

May 09, 2025

End Of An Era Ryujinx Emulator Development Stops Due To Nintendo

May 09, 2025 -

Doohans F1 Prospects Montoya Leaks Decision Details

May 09, 2025

Doohans F1 Prospects Montoya Leaks Decision Details

May 09, 2025